Steemit CryptoAcademy Contest/S1W2 - Reviewing Centralized Exchanges by @iamchukwudi

.png)

In the world of crypto exchanges, there are two main players, namely, the centralized exchanges and the decentralized exchanges. Crypto currency traders and HODLers usually have between both options to choose from. Each has their pros and cons, but in this edition of the Steemit engagement challenge, we will be delving into centralized exchanges and exploring deep into it.

Centralized exchanges and how they benefit to crypto users.

Centralized cryptocurrency exchanges are avenues, software/programmes, organizations, or systems developed by individuals and organizations/institutions to enable cryptocurrency holders and traders to carry out cryptocurrency transactions in a supervised setting, basically acting as a mediator/intermediary/ or middle man between traders.

A centralized exchange usually tries to earn the trust of cryptocurrency holders and traders so as to motivate them enough to trust them with the role as the middle man in their transactions, just as we have come to trust banks with our precious funds.

The motivation behind centralized exchanges is in their promises. They tend (or at least, promise) to provide securities which may not be guaranteed if we manage our assets ourselves or rely on open source decentralized projects.

Common examples of centralized exchanges include: Roqqu, Bittrex, Binance, Coinbase, Gemini, etc.

Benefits of Centralized Exchanges to Crypto Users

While centralization and the world crypto may not be all-friendly. There are obvious benefits of going down the route of centralized exchanges for asset management than the decentralized exchanges. Here are some ways centralized exchanges are better:

Better support: Unlike decentralized exchanges where no one can be held accountable when things go wrong, we could easily reach out to the help/support communication channels of centralized exchanges and lay different complains. We always underestimate the value of support till we notice is not their.

Better security and reliability: Since these exchanges have practically built a business around cryptocurrencies, they have more incentives to provide better security and reliability compared to most open source decentralized exchanges which are most times maintained by volunteers.

High volume transactions: It is estimated that 99% of cryptocurrency transactions are currently being carried out on centralized exchanges, which is only expected. Centralized exchanges due to the fact that they are businesses and organizations operate same marketing principles like other conventional business, which in turn bring them more users, and with more users means there is almost always someone ready to fulfill your orders, a fit that cannot be guaranteed through decentralized exchanges.

What I Look for When Choosing an Exchange to Trade my Crypto Assets

Cryptocurrencies are real money, and the earlier we appreciate this fact, the more likely we are to make conscious efforts to protect these valued assets. So, what should you consider when deciding on what exchange to trade your crypto assets on? Here are the key factors that usually inform my decisions with respect to this:

Reputation: Basically, I want to hear what people are saying about the said exchange, is it having positive reviews? Is it recommended? and more. Word of mouth is as important as other factors to consider.

Track record: How has the said exchange done over time? Have their been reports of account breaches and hacks? Usually, past activities and records could be used to predict future performance, even if this may not always be an accurate prediction.

Insurance: This is an important point to consider as no system is 100% proof. Even a 1% vulnerability could be exploited to cause unprecedented harm and losses. So, as much as it is important to do your due diligence, it is also vital to consider the insurance cover of the said exchange as part of the due diligence process.

Ease of use: I have not been so drawn to exchanges like Binance, not because it ain't nice or ultra secure, but it is a bit ambiguous to my liking. Binance devs also know this and even made a Binance lite interface that is less intimidating. So, if the learning curve is steep, I am probably skipping it.

My Country: My country is a unique place that it is very easy for a business to gain strong grounds. Think of a crypto exchange in Nigeria and anyone that is a bit vast in crypto will think of Binance. So, at this point, Binance has become the De facto crypto marketplace for Nigerians. I can't just jump ship and start using other CEXs as they have not made a lot of accommodations and compromises as Binance has to a accommodate cryto enthusiasts in Nigeria.

At the end of the day, it is important you do your own due diligence, and other factors not mentioned here are very important as well, including things like price, minimum investments, Fiat availability and other factors.

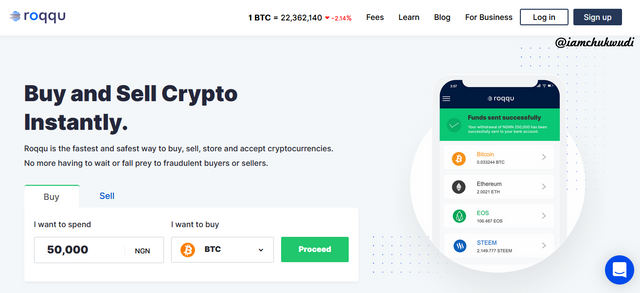

Review of my Favorite Centralized Exchange: Roqqu

Roqqu exchange is by far my favourite centralized exchange currently. This exchange is hosted in their web application available at Roqqu.com, as well as their mobile app which is available on both the Android and iOS app stores.

Roqqu is a nice centralized exchange for me for the following features:

Very simple: Roqqu is a feature-packed centralized exchange but yet very simple. The user interface on the web as well as on their mobile app is very visually pleasing and less intimidating compared to other exchanges. However, to achieve this, most features are lacking, but Roqqu has done well to nail down the fundamentals.

Faster P2P: With the Federal Government placing a restriction of bank-related crypto transactions, Roqqu was able to get around this while ensuring the safety of ones bank account, and ensuring significant transaction speeds.

Vast cryptocurrencies: Unlike other simple-looking exchanges, Roqqu supports a vast array of cryptocurrencies including Steem which was listed even earlier than the likes of Binance.

Quick Support: The Roqqu team operates an intercom which enables you to reach customer service within the shortest possible time.

USDT Investment: Roqqu gives you the option to save your USDT for 15% APR. While this is nothing too significant, it is nice to have the option.

Is there anything about your favorite exchange you will like to be changed? Discuss.

- More DeFi Features

In the spirit of Web 3.0, one major change I will like to see with my favourite centralized exchange and centralized exchanges in general is the adoption/gravitation towards DeFi.

While Decentralized Finance (DeFi) sounds as though it must have nothing to do with centralization, the truth is that most DeFi platforms are operated by centralized bodies.

So, I will like to see these exchanges carry provide opportunities like yield farming and the option of joining a liquidity pool. I am confident that if Roqqu implements this, it will be pleasing and easy to adopt for me.

- More Transparency

An exchange should be able to provide a user quick assess to each cryptocurrencies' explorer to help them track transactions and resolve issues quickly.

I saw the need for this recently as my transaction failed to go through for sometime, and on contacting support, the only and strongest evidence I had was the Blockchain explorer's details and a direct link to the transaction, and it was easier than ever for both me and them.

However, for most crypto noobs, this will not be easy. So, if for every currency, Roqqu could provide a direct link to their Blockchain explorer, it will add a layer of transparency, while not derailing from their centralized nature.

Shortcomings Seen on Centralized Exchanges and How do you think User Funds can be Protected

Centralized exchanges are generally not perfect, here are some obvious shortcomings:

High transaction fees: The convenience provided by centralized exchanges are paid for through their high transaction fees.

Custody/Ownership: Centralized exchanges are basically your asset managers in a way you do not want them to be. They hold all your keys and decide whether or not you get access to your funds. So, one must be careful to adhere to all rules, or risk penalties. And what if the exchange' management makes some bad decisions leading to their inability to operate again? The consequence of this is a severe loss.

Manipulation: Centralized exchanges has been found involved in some shady dealings that makes them less trustworthy. Binance, for example, has been caught blocking user accounts for whatever reason they can come up with and providing no avenue for resolution; other CEXs has been found carrying out insider trading, and manipulating the price of assets.

How CEXs Could Protect Funds

Get and Insurance: CEXs are usually registered as publicly/privately recognized organizations, nationally or even multinational, so they could easily get an insurance covering, and you should look out for one that is ensured. Having an insurance will help the CEXs deal with any form of loss they could potentially face.

Operate a Hybrid Exchange: Instead of just providing users with a wallet that fully operates on the CEXs, an option could be provided from within the exchange to transfer funds into a cold wallet in which the user owns custody, all from within the exchange. -

Conclusion

So far, so good, centralized exchanges has been discussed in sufficient details and it is evident that without them, it would be hard to do anything crypto-related for most of us. While they have clear advantages, measures to make them better are also recommended, as there are rooms for improvements, always.

Nice writeup, have used Roqqu exchange but it didn't end well my dear. Lost of fund that couldn't be recovered till, sometimes they are on maintenance for days. I think they have to really improve in their services. Thanks for reminding me about my first cyrpto exchange.

Roqqu is a good one for Nigerians who are new into crypto. When I started cryptocurrency,Roqqu was my favorite, but when I learnt about Binance and how to use it, I stopped using Roqqu as I was not able to recover lost funds. Nice one.

Yea. Most users complain of lost funds in Roqqu. I'm sure they are trying to improve. But whatever works best, there's no hard and fast rule.

You actually know my spec, that my favorite Even if has little flaws, I will still love it. Thanks for impacting such awesome knowledge

Yea. All exchanges has their flaws, but till I'm willing to go down the learning curve associated with others, I'll stick to my Roqqu for a little longer.

After all, Roqqulovesteem.

Roqqu is a nice exchange though I USED it since 2020 and even till date though not frequently that's because Binance exchange overtake it now. But all you've written about it is true. Keep it up!

Yea. In choosing a CEX, individual milleages vary. I don't intend to make Roqqu a live time choice, even if Roqqulovesteem, I'm still open to better projects.

Thanks for stopping by.

It's my pleasure

Thank you for publishing an article in the Crypto Academy community today. We have accessed your article and we present the result of the assessment below

Comments/Recommendation

Thank you for participating in this contest.

Total|8/10

Thanks Prof for your quality review. Though, I've not really used most exchanges to notice the difference in transaction charges. But I'll keep a closer eye and try exploring other options as well.

A great review! Congratulations!

I suppose there are always room for improvement in everything we do. Best of all, we always learn something new. I have learned from your post, thank you!

Thanks a lot @patjewell for finding the post insightful. Trust me, I'll do better.

I’m trusting you 👍🏻