Bitcoin, Cryptocurrency, and Public Chains - Steemit Crypto Academy Season 4 - Homework Post for Task 5

.png)

~INTRODUCTION~

Good day Steemians!

This is my second Steemit Crypto Academy Beginners' Task, and for this, i have chosen to take on Task 5 - Bitcoin, Cryptocurrency, and Public Chains. The lecture was well taught by Professor @stream4u and I picked up a few new things from it.

I will be answering the 2nd question of the assignment:

(2) What Is Bitcoin and what was the Aim Behind Bitcoin Invention? Is Cryptocurrency Good For A Business To accept As Payment? Why?

Bitcoin, Bitcoin, Bitcoin!

From 2008 till date that word has been tossed around by many men, and it is only gaining more and more traction as the years go by. In the modern day, if you haven't heard about Bitcoin, you must ave been living under a rock for the past 10 years. However, although many have heard of Bitcoin, only a few people actually know what it is, and even fewer know how it works. In this task, i will do my best to intimate us on the idea behind Bitcoin, Bitcoin itself, the way it works, and why you should probably get it, if you don't have some already.

Hope you all enjoy reading!

What Is Bitcoin and what was the Aim Behind Bitcoin Invention?

Bitcoin is the first successful cryptocurrency.

But no, this is not the best place to start. To explain this better, and for you to fully understand, let's start with understanding money, and why Bitcoin had to be.

What is Money?

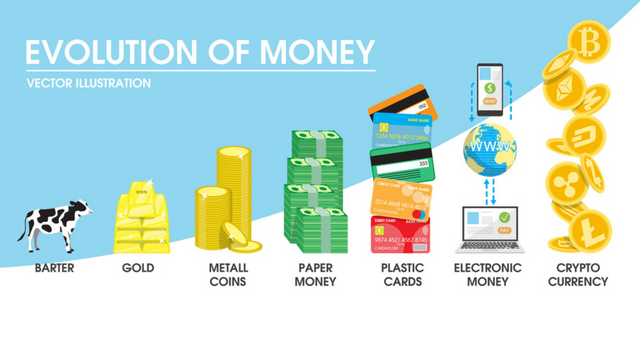

We have all heard stories about the evolution of money, so i will skip the boring details and go straight into it. Essentially, humans have developed a long way from the barter system where one had to exchange one thing for another which they deemed to have equal value, to a system whereby one can exchange a certain amount of money for goods and services. But what makes money, money?

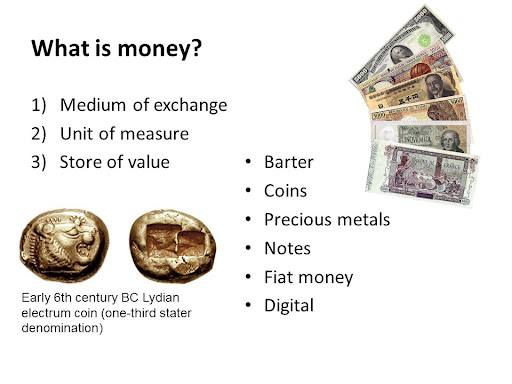

Money is, simply, a store of value, a medium of exchange of value, and a unit of account. For money to be money, it must fulfill these three functions. It must also be owned by enough people, and merchants must accept it as a form of payment.

Aim Behind Bitcoin Invention

During the financial crisis of 2008, the value of fiat money (government-backed currency) dwindled so much, and the inflation rate was so high that it crashed a lot of businesses and evolved into a global economic meltdown. As the global economy began to crash, many central banks decided to effect a strategy called quantitative easing i.e. they printed more money.

In a bid to prevent a re-occurrence of the Great Depression (1930), central banks pushed more money into the markets and slashed interest rates to near zero figures. This caused huge fluctuations in fiat currencies and a lot of central banks began to competitively devalue their currency in order to make their economy more viable. Governments had to bail out banks and so they printed more money, which devalued their currency even more.

To bail out the banks, there was a net transfer of debt to the public purse, increasing liabilities of future taxpayers. This was only one of the many great effects of the quantitative easing. People became agitated because the central banks and the governments were taken them into uncharted waters, and were devaluing the money just to keep the economy going. And this economic turmoil was what brought on the creation of Bitcoin

Bitcoin is a decentralized financial system with no one in charge/no legal lender

Bitcoin was created to be a "a peer-to-peer electronic cash system". The creator, Satoshi Nakamoto, intended to create a trustless financial system, eliminating the middlemen (the government or banks) and achieving decentralization. This means that Bitcoin is owned by everyone, and no one, and owners of bitcoin, are in full control of their assets. It is interesting to know that the founder of Bitcoin, Satoshi Nakamoto is, to this day, unknown.

Now that we know the aim behind the invention of Bitcoin, lets look at what it is, and how it works.

Bitcoin is a digital currency, meaning that there are no actual physical "Bitcoins" in existence. The bitcoin currency is built on the Bitcoin blockchain, and was the first succesful implementation of the blockchain technology. The blockchain is what makes cryptocurrency so unique. So, to understand how Bitcoin works, we need to understand what a blockchain is, and what it does.

What is a Blockchain?

A Blockchain is literally just that; a chain of blocks. However, the creation, and linking of these blocks is what makes bitcoin so revolutionary.

A blockchain is a permanent, decentralized, digital ledger. It is, essentially, a continually increasing list of records that is securely linked together using advanced mathematical theories and cryptographic techniques. Each of the records is called a block, and these blocks contains specific types of information. For the Bitcin blockchain, this data is essentially the transaction data, a timestamp, and a pointer to the previous block which links it to the previous block and ensures that the information in each block can't be changed.

Blockchains are designed to be un-modifiable, and this enables them to record verifiable and permanent transactions betweenn different parties efficiently. This is what creates the decentralized and trustless nature of the Bitcoin cryptocurrency.

The Bitcoin cryptocurrency refers to the assets built on top of this blockchain, which can be transferred between parties directly, without the need for a central lender, or middleman.

Here are some of the benefits of Bitcoin:

No central lender/middleman, so there is freedom of transaction

Bitcoin can be accessed by anyone, anywhere with an internet connection

Bitcoin can be used as a store of value

Irreversible transactions, reducing risk of fraud.

Is Cryptocurrency Good For A Business To accept As Payment? Why?

Yes... And No...

Why Yes and No?

Well, this is very heavily dependent on the cryptocurrency being used.

You see, cryptocurrencies differ in their use and function, as well as differ by scalability an throughput, transaction fees, decentralization model, smart contract support, and blockchain model, as well as other factors. As of the time of writing this post, there are over 6,500 cryptocurrencies in existence, all with different functions and use cases.

In my opinion, it would not be a good idea to use bitcoin as a form of payment for a business. This is because of the high transaction fees associated with transfer of bitcoins and the high cost of Bitcoin. Bitcoin, as a cryptocurrency, works better as a store of value, than an actual implementable currency. Bitcoin is to the cryptocurrency world what gold is to the finance world. And just like you wouldn't use gold for your day to day transactions, i believe bitcoin should not be used for business transactions.

Also bitcoin is highly volatile and not a stable currency. This means that what 1 Bitcoin is valued at today, or even this moment, may not be the same thing it will be valued at by tomorrow, or even an hour from now. This is okay for someone who is betting on the future of cryptocurrency as a whole, but for a business where one may want to take profits in order to expand, the fluctuating price and high volatility would pose a a huge risk.

On the other hand, they are many other cryptocurrencies which can be used as a mode of payment in businesses, without posing much risk to the business or business owner. These include cryptocurrencies built on 3rd generation blockchains; these aim to solve the problems of expensive transaction fees and scalability found in Bitcoin. These include cryptocurrencies like SOL from the Solana blockchain and ADA from the Cardano blockchain.

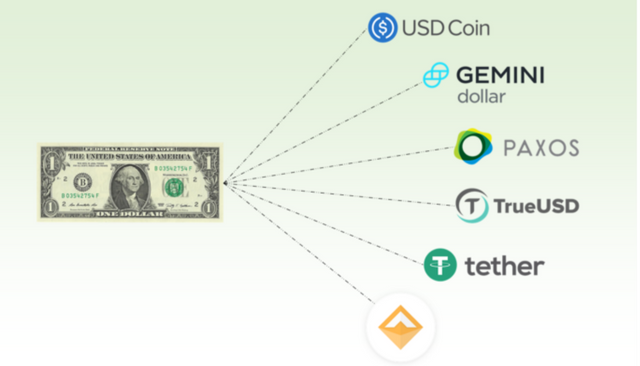

One can also make use of stablecoins as a secure, implementable mode of payment for their business. Stablecoins are cryptocurrencies whose value are pegged to a fiat currency. Stablecoins experience little to no volatility, hence drastically reducing the risk of loss for the business while allowing the business to progress into the cryptocurrency world. Examples of stablecoins include USDT, USDC, BUSD, and may others.

So, as we can see, there are types of cryptocurrencies which would be sensible and practical to use as a mode of payment for one's business, although not every cryptocurrency.

~CONCLUSION~

The lecture was a wonderful one to go through, and in this task i have spoken extensively on the origin of Bitcoin, and why its such a fascinating and revolutionary concept. Thanks for reading!

-IamEl the ModestPoet

N/B: All pictures not cited, were designed by me using Canva, powerpoint, or gotten from the respective websites.