Waves Platform - Crypto Academy S5W7 - Homework Post for @imagen

INTRODUCTION

From what we already know, blockchain is a decentralized digital ledger of transactions that utilizes numerous computer systems to offer us a private, secure and transparent network.

Every transaction on the blockchain is verified and secured despite the fact that there is no central authority or overseer that verifies or validates these transactions. This is made possible because of the activities of consensus algorithm, they are part of the main parts of a blockchain.

A consensus algorithm is a method where a large number of the interconnected nodes (peers or computers) on a blockchain come to a consensus on the present state of the distributed ledger. This is to help stop unethical miners from bringing in false blocks and transactions and also to help ensure the reliability, integrity, and trust between the nodes on the blockchain.

There are different types of consensus algorithms, however, in this post, we will be talking about the leased proof of stake consensus mechanism. Some examples of other consensus mechanisms are;

• Proof of work (POW)

• Proof of stake (POS)

• delegated proof of stake (DPoS)

Question 1

Describe the Leased Proof-of-Stake (LPoS) consensus mechanism. What are the differences with Proof-of-Stake (PoS)?

Answer

Describe the Leased Proof-of-Stake (LPoS) consensus mechanism

The Leased Proof of Stake (LPoS) consensus mechanism is a different version of the Proof of Stake (PoS) mechanism and it is also said to be better. The leased proof of stake mechanism allows users with tokens to lease out or offer their tokens to other nodes that serve as block producers on the network and gain a certain proportion of the returns as rewards. This consensus mechanism is used on the Waves platform and can be a very good source of passive income for a Wave token holder.

How the LPoS works

First, the leaser will have to lock up the number of funds he wants to stake. The staked token will remain in the account of the leaser and he will not be able to spend or use it in any way until the lease contract is terminated or canceled.

A node is more likely to be selected as the one to generate the next block and gain the corresponding reward if it stakes more tokens. Also, at any point in time, the token owners can choose to terminate the lease contract

The lease contract will have the following information for security;

• It will contain the address of the lessee (the recipient of the lease)

• The total amount of the leased token

The operator of the nodes combines his mining power and that of the mining power of other users without the need to transfer any WAVES which implies the WAVES do not leave the wallet of the leaser. The lessee uses this mining power to help produce new blocks for the integrity and development of the network. And when they receive rewards from the block production, it is divided at a certain proportion and shared with the leaser. The higher the amount of the token staked, the higher the rewards. The leaser gains as more transactions are executed on the network

There are some requirements and rules that an appropriate node operator should abide by and also rewards distribution may not be the same with all nodes so it is up to the leaser to do a proper screening and find the appropriate node operator to lease to. For instance, on the Waves platform, the node operator is required to have a minimum of 1000 WAVES.

To clear the doubts that readers may be having about DPoS and LPoS, the LPoS gets similar to the Delegated Proof of Stake (DPoS). To differentiate them, In the DPoS the block validators are chosen by votes from holders who stake on the platform. However, in the LPoS, the token holder can borrow and lend tokens directly to partake in validating blocks themselves.

Advantages of Leased Proof of Stake

• At a specified time, only a few nodes are involved in block validation and this makes it very fast and efficient

• It uses low energy to operate, it can even be operated on a phone. A few nodes can now perform the duties of multiple nodes which might have consumed a lot of power.

• Users have so much control over their funds. When the tokens are staked, they get locked up in the wallet of the user and cannot be used for any transaction. However, the user can choose to cancel the lease which will make the funds available for other transactions

Disadvantages of the Leased Proof of Stake protocol

• Some users may engage in malicious activities by leasing out their tokens to a single full node which will give it an advantage over others in the validators pool.

• This technology is still new and it might have some shortfalls that may have not been discovered yet.

What are the differences with Proof-of-Stake (PoS)?

The Proof of Stake and the Leased Proof of Stake mechanisms are similar as they both involve staking, there are a few differences.

We understand that in the Proof of Stake mechanism, users directly stake their tokens and earn rewards directly without any third person. However, in the Leased Proof of Stake mechanism, users are allowed to lease their tokens to a node operator, who will produce blocks on the network and gain rewards which will be shared between the leaser and the lessee.

In the normal Proof of Stake mechanism, every node is capable of adding a new block to the network, while in the leased Proof of Stake mechanism, users can choose to either operate a full node or choose to lease their stake to a full node and gain some rewards. This mechanism offers any user the opportunity to partake in maintaining the Waves network.

Other differences are listed below

| Leased Proof of Stake (LPoS) | Proof of Stake (PoS) |

|---|---|

| In this mechanism, users with less than the minimum amount to stake can lease out their tokens to full nodes who will stake and share the rewards | here, not every user is allowed to be a validator. If the required amount for validation is not met, the user cannot validate |

| It is an improved version of the Proof of Stake mechanism which allows users to lease their tokens for a shared benefit | this mechanism allows users to directly stake their coins and also earn the rewards directly |

| The rewards are shared between the leaser and the lessee | the rewards here are not shared |

| There is no fixed time to cancel the lease, it can be done at any time and this makes it very flexible | the staked token has a fixed time which has to be used up before the stake can be canceled |

| Users can lease out their tokens via a cold wallet which is independent of the internet and makes the tokens safe from hacks | staking can only be done on the internet which makes it less secured in case of a hack. |

Question 2

Login and explore Waves.Exchange. Indicate your functionalities or options. What are the investment modalities that you offer to your users? Show Screenshots

Answer

Login and explore Waves Exchange

The Waves exchange is a public blockchain platform available over the world where users can go and invest or trade. It was founded in 2016. Its main purpose is to enhance the issuance, exchange, and trade of tokens on blockchain technology. It earned about $16,000,000 in its initial coin offering in 2016.

This platform not only serves as an avenue for trading, users can also use it to create their own custom token. This token could be used for building a loyalty rewards program, serve as a native token of an application, or used to crowdfund a certain program.

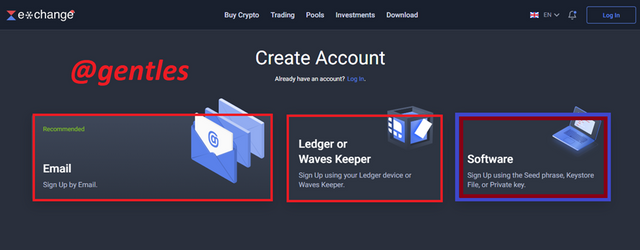

Now let us log in to the Waves platform.

We first have to create an account if you don’t have one already. Click on Sign Up on the top right corner of the page.

You can choose to create an account with your email by clicking on Email, a ledger device by clicking on Ledger or Waves Keeper, or a seed phrase by clicking on Software. I will choose Software to register with a seed phrase.

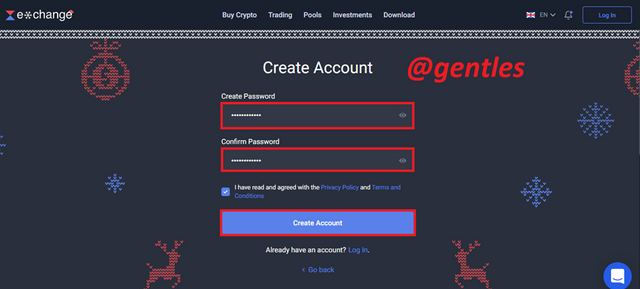

Spaces will be provided to create a new password. Enter a preferred password, it should contain an uppercase letter, a symbol, and a number. Confirm the password, tick the Terms and Condition box then click on Create Account to continue.

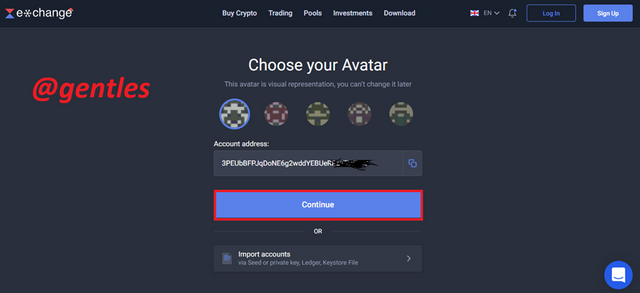

The address of the account will be given to you. You can choose to copy and paste it somewhere safe. Click on continue. You can also click on import account to open an existing account with a seed phrase, ledger, or Keystore file.

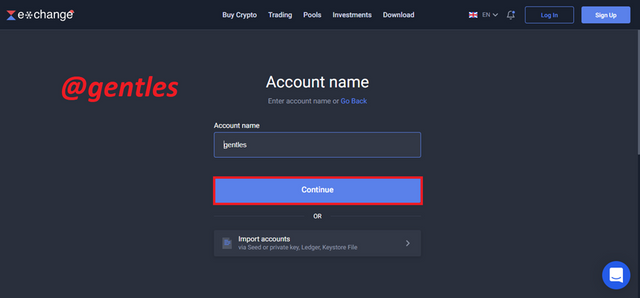

A box will be provided where you can enter a preferred account name. Click on Continue after entering a name.

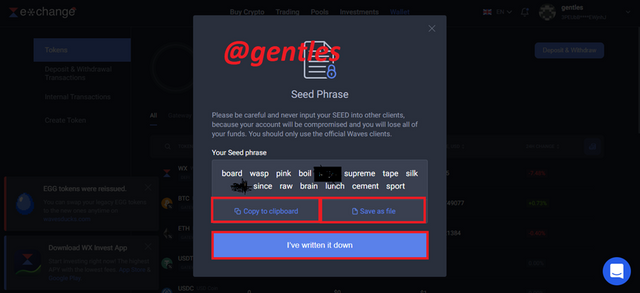

The Seed Phrase of the account will be shown. You can choose to write it down, copy and paste it somewhere or you can click on save as a file to create a text file of the seed phrase. Click on I have written it down to continue.

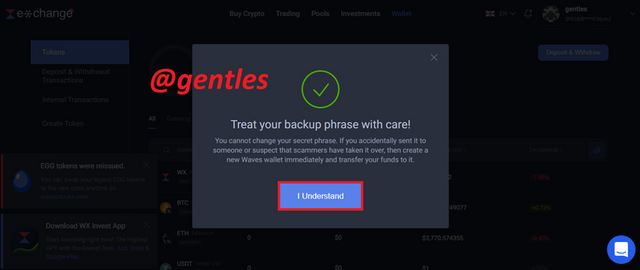

The platform will caution you to keep your seed phrase safe. Click on I understand

The account has been created successfully.

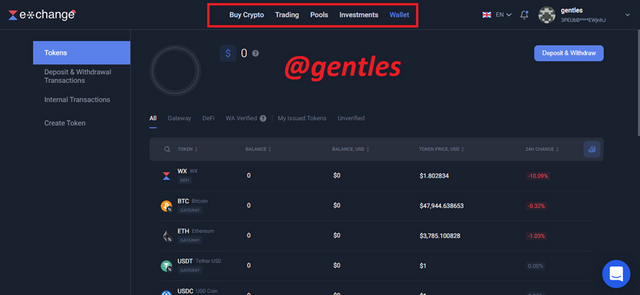

Exploring the Wave exchange platform and indicating the functionalities or options.

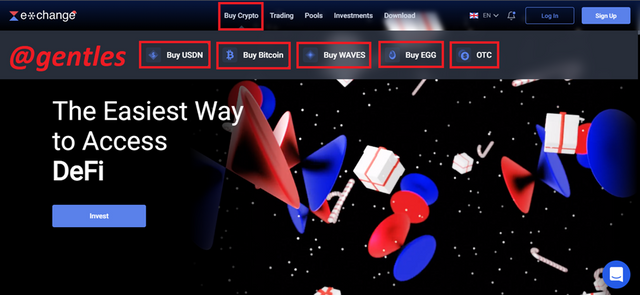

When we enter the waves platform, we see a lot of options on the page. Some of the options are; Buy Crypto, Trading, Pools, Investments and Wallet. We will look into them one after the other.

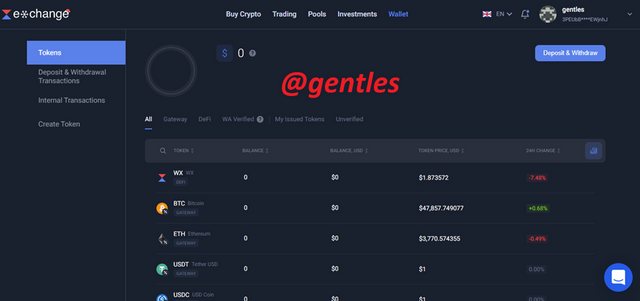

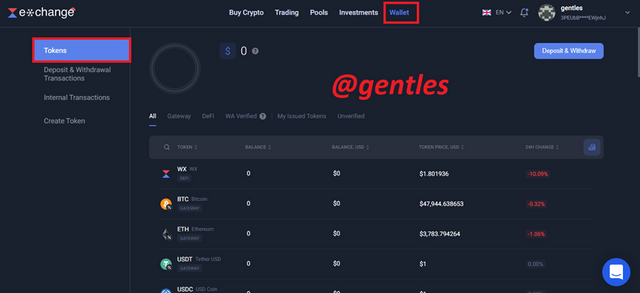

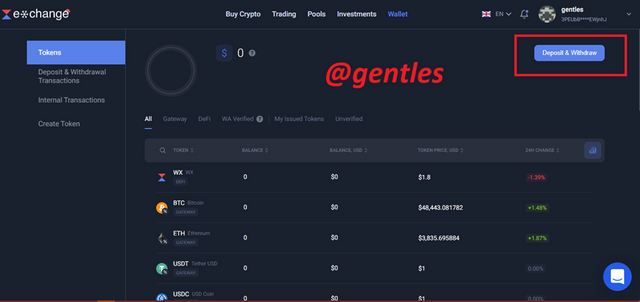

Wallet

In the wallet section, there are other sub-options and features available to the user. We have Tokens, Deposits & Withdrawals transactions, Internal transactions, and Create Token

Tokens

The Tokens sub-option is where we get to see details of our transactions on the platform. You can see tokens you are holding and their respective balance in your account. A 24hr change of the tokens is also displayed for the user.

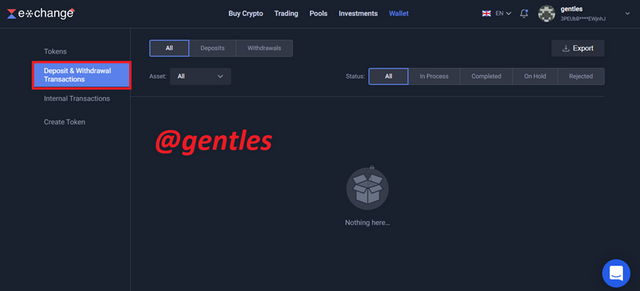

Deposits & Withdrawals transactions

Every transaction involving deposits and withdrawals is displayed here including transactions that are pending, completed, on hold or rejected. I have not made any transactions yet.

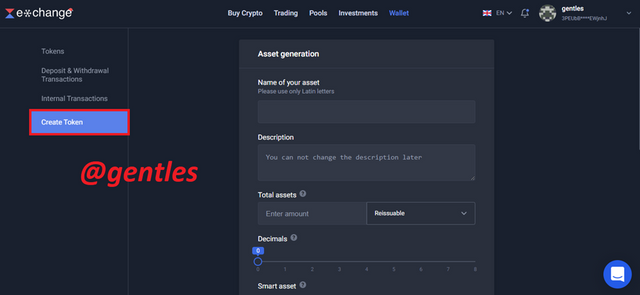

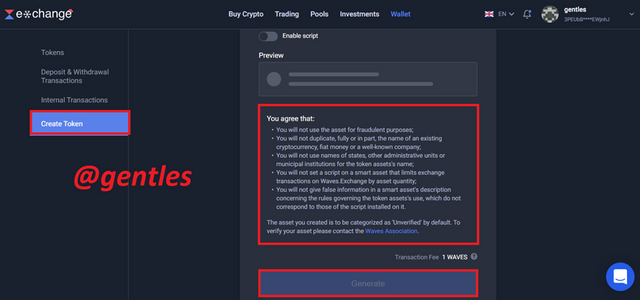

Create Token

One of the main features of this platform is the feature that allows users to create their own custom tokens. The user will be required to fill a form with the name of the Asset, the Description of the asset, the total amount of the asset you need to create, and decimals. This process absorbs a transaction fee of 1 WAVE.

Also, the user will be required to abide by some given rules before they will be allowed to create the custom token. Some of the rules are; the user will not use the token for malicious purposes, they will not make a duplicate of any renowned token, they will not use any names of a state or administration, they will not give a false description of the asset, etc.

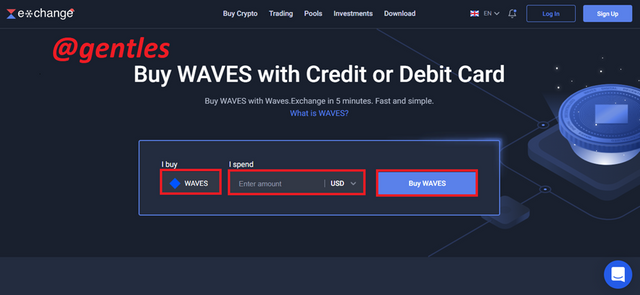

Buy Crypto

This option allows users to purchase any of the listed cryptocurrencies. It could be USDN, Bitcoin, Waves, EGG, or do an OTC transfer with other users. The OTC transfer feature allows users to directly exchange currencies.

To purchase any of the listed coins, click on it to buy.

For instance, if I click on buy WAVES, the buying process begins. Just enter the amount you want to buy and click on buy WAVES

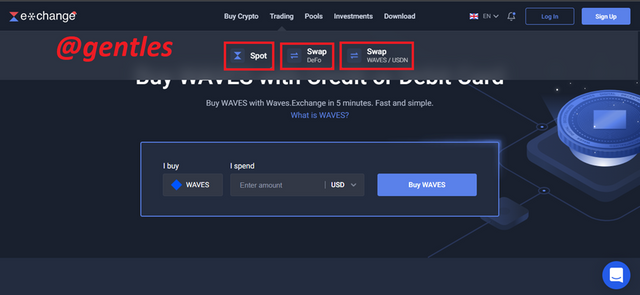

Trading

As the name suggests, this option allows users to trade listed cryptocurrencies. Some forms of trading are available here. We have the Spot Trading and Swap

Spot Trading

This feature enables users to buy and sell tokens at the current price also known as the spot price.

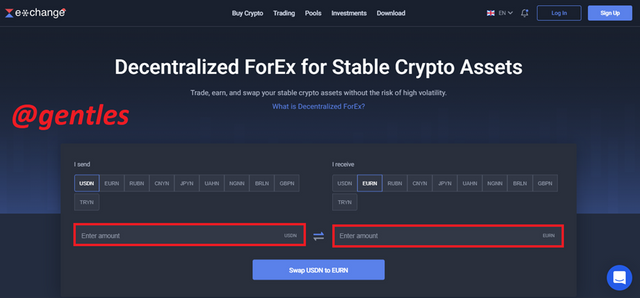

Swap

The swap option enables users to conveniently exchange a crypto coin for another without the need to leave their wallets.

Just select the currency you want to send and the currency you want to receive, enter the amount of one and the corresponding amount of the other will appear. Select swap to swap the coins.

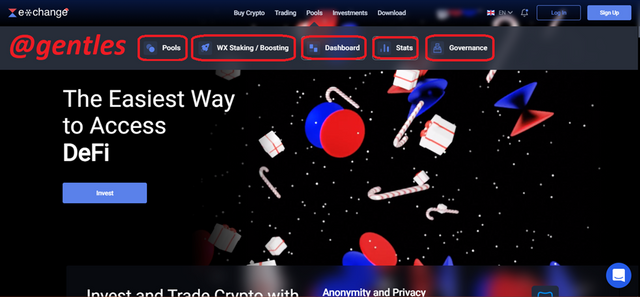

Pools

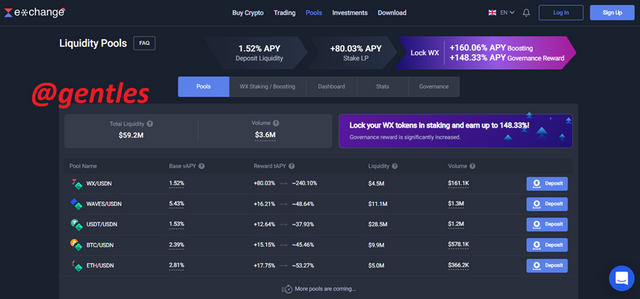

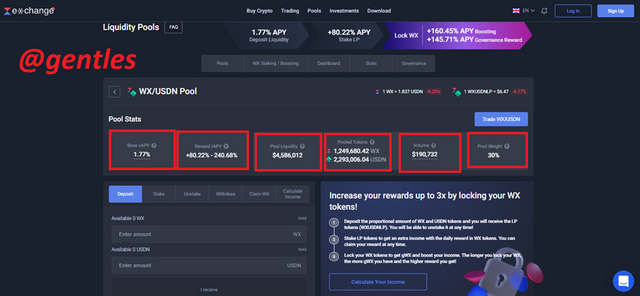

Users who are interested in staking on the platform will come to this section. It contains details of any staking activity by the user on the platform. This option has sub-options as well, they are; Pools, WX Staking / Boosting, Dashboard, Stats, and Governance

Pools

Various staking Pools with their respective Annual Percentage Yields (APY) otherwise known as returns or rewards. Choose your preferred pool with your preferred APY and click on deposit stake in it.

There are some staking details that are also displayed here for the user. Some of the details are the total liquidity on the platform which is currently at $59.2M, and a volume of about $3.6M.

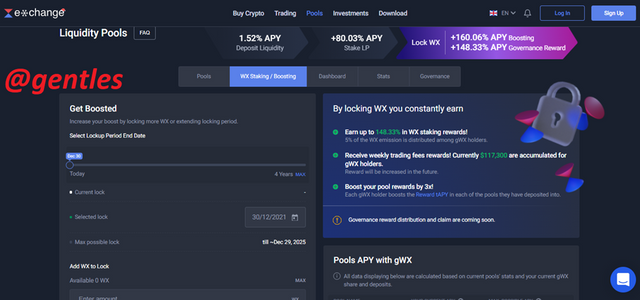

WX Staking / Boosting

Offers that will help the user to boost their rewards on their stake are available here. For instance, users can Boost their rewards by staking more WX or prolonging their staking period.

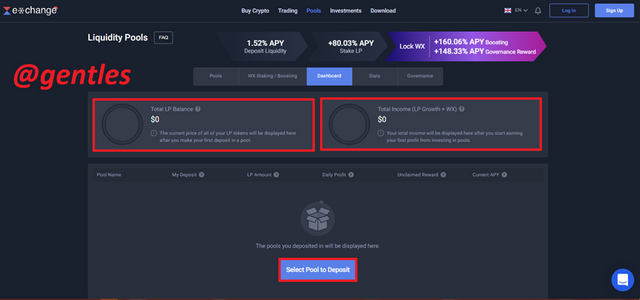

Dashboard

The dashboard gives a summary of your staking activities on the platform. It shows your total LP balance, total income from pools. It also shows the current pools you have staked in, the deposit, the amount, daily profits, etc.

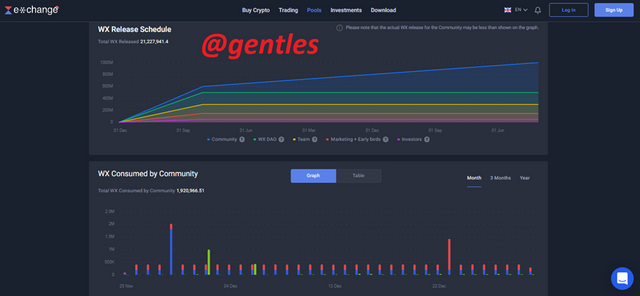

Stats

This option gives some statistics on pooling on the Waves platform. Statistics on the WX token used on the platform are also shown here in a graph according to Actual release, locked and burned.

There is also a graph on released WX / locked WX. We can also see that the total WX locked on the platform are 1,160,180.9WX and they are locked with an average period of 2years 4months 4 weeks and 1 day.

Governance

This is where the user is allowed to deposit their tokens and partake in the voting process on the platform. The governance token on the platform is gWX, to gain this token, users will have to lock WX on the boosting page and receive gWX for the voting process. The user will also gain governance rewards when they remain as gWX holders. The amount locked is proportional to the vote and WX gained.

There are subsections that show, voting processes that are ongoing and those that have been completed. The user will also see their governance tokens here.

Investments

Investment opportunities available on the platform are shown here. It has liquidity pools, Lambo investments, algorithmic trading, and many more

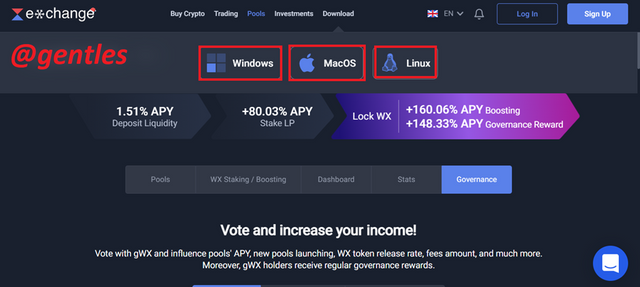

Download

Here users can download the Waves platform app onto their PC. The different OS is available. Click on your OS to start the download process.

What are the investment modalities that you offer to your users?

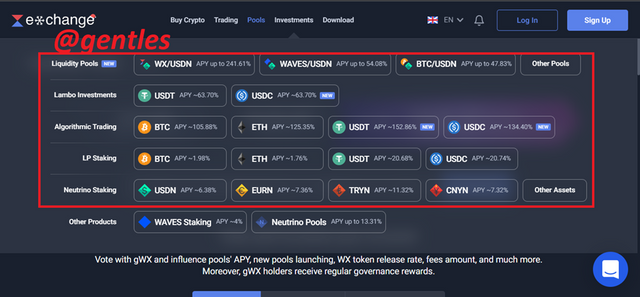

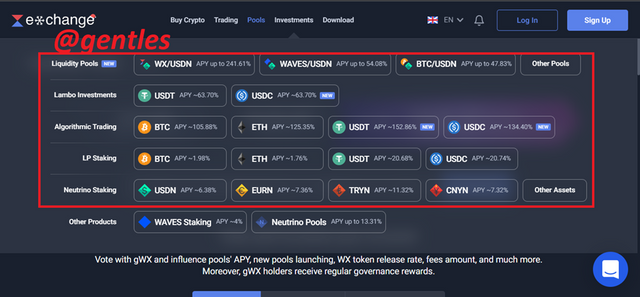

As I have already mentioned, when we go to the Investment tab, we get to see the investment modalities that the platform offers.

Investment opportunities available on the platform are shown here. It has liquidity pools, Lambo investments, algorithmic trading, LP staking, Neutrino staking, and other products.

Great caution has to be taken when venturing into any of these investments. Hackers may take advantage of any loophole that might be found in the smart contract and make away with some funds which may cause great losses to users.

Now let’s take the investment modalities one after the other

Liquidity Pool

In this investment option, there is WX/USDN with an APY of about 258.6%. With this APY, users can make huge profits, they can earn a profit of over $1,000 in a year with just an investment of $500. To use this opportunity, the investor will have to deposit equivalently the same amount of WX and USDN. When a deposit of 23.4 USDN is made, an equivalent of about 10WX at an exchange rate of 1 WX = 2.34 USDN has to be deposited with it.

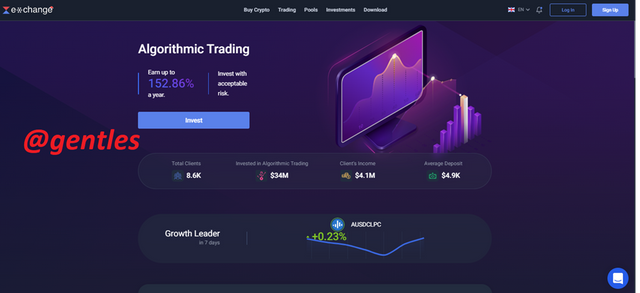

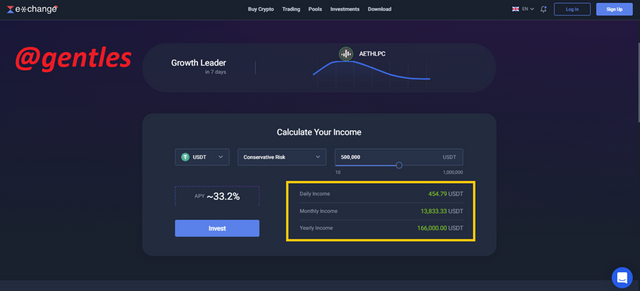

Algorithmic Trading

In algorithmic trading, the funds are used for trading in centralized exchanges where automated market makers are used to trade and make profits that are shared with the investors. Investors can earn as high as 152.86% in APY

The coin with the highest APY in this investment modality is USDT. It has about 152.86% APY. A user investing 500,000 USDT will earn about 454.79 USDT daily, 13,833.33 USDT monthly, and a yearly income of about 166,000.00USDT

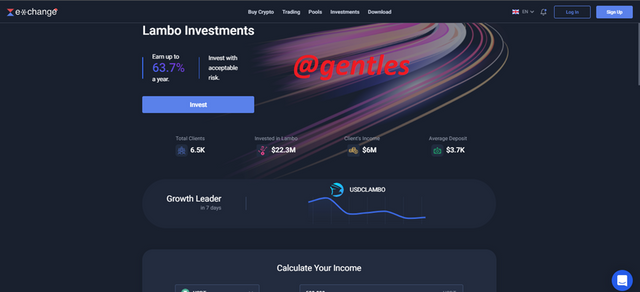

Lambo Investment

The highest APY an investor may earn in Lambo investment is 63.7%. Lambo investment is a Semi Defi investment product. It is controlled by automated market makers that trade automatically to earn profits for investors.

After the investment is made, the investor receives LAMBO tokens which serve a proof that the user has made an investment in the smart contract. It has a lower risk than algorithmic trading. This guarantees your investment. It also has a very flexible deposit size and period.

LP staking

The coin with the highest APY in this section is USDC. It offers about 20.79%. this investment operates just like a bank, investors will just hold their coins in this investment and make profits.

Neutrino Staking

This investment allows users to stake their Neutrino assets. This asset is the USDN and it tracts the price of the USD and is backed by WAVES. When this asset is staked on the platform, it can offer as high as 13.3% in APY.

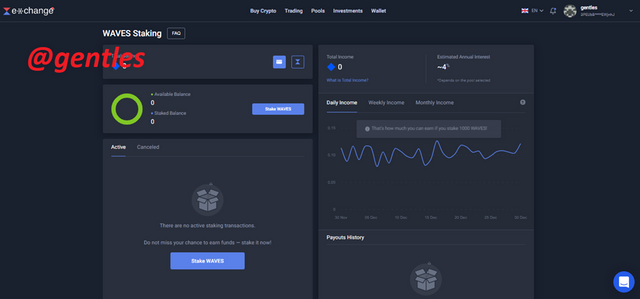

WAVES staking

In this investment protocol, WAVES of the user is locked for a certain period. Within this period that the WAVES token is locked, the investor will earn rewards. These rewards have an APY of 4%.

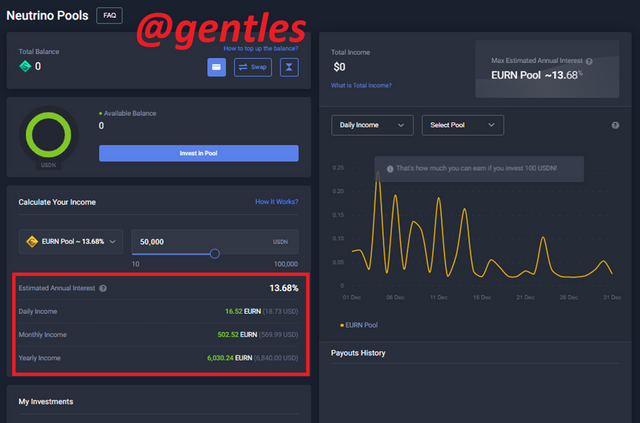

Neutrino Pools

This investment allows users to deposit their neutrino assets in pools available on the platform to earn rewards. It offers an APY that can get to about 13.68%.

Here are some investment ideas available on the neutrino pool. We have the EURN pool with the highest APY of 13.68%, followed by GBPN pool which offers 7.7% APY, BRLN pool which also offers 6.33% APY, CNYN pool offers 6.26% and many more.

Question 3

Make from your account a purchase of WAVES for an equivalent amount of 10 USD from an available exchange (Binance is not allowed). 3.1) Describe the process. Show screenshots. 3.2) Show how the process is carried out to transfer the asset to the official Waves platform. (The demonstration is mandatory but the transfer is not)

Answer

Make from your account a purchase of WAVES for an equivalent amount of 10 USD from an available exchange (Binance is not allowed)

I will be using the Huobi Exchange for this task.

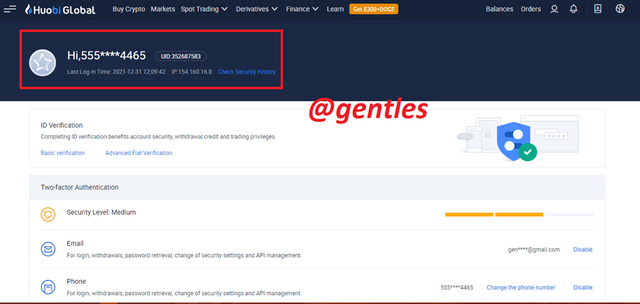

Here is my Huobi Account.

I have about 0.00023327 BTC which is equivalent to 11.2 USD. I will use my available BTC to buy WAVES on the spot market using the WAVES/BTC pair. To do that I will click on Market at the top of the page.

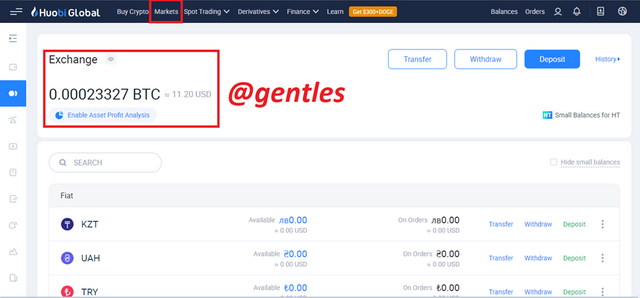

At the time of this assignment, the price of WAVES/BTC was 0.00030940. At this spot price, with 0.00023325 BTC, I will have 0.7539 WAVES. I accepted the price and clicked on Buy WAVES.

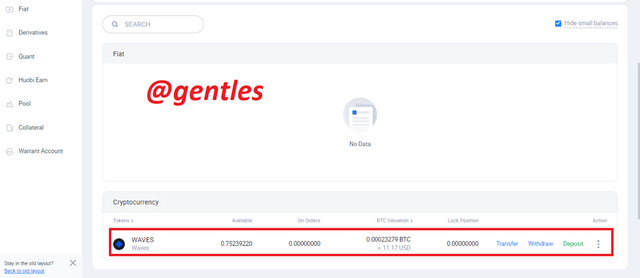

The Trade was successful and I had the WAVES in my wallet. The total amount of the WAVES was 0.75239220 WAVES which is equivalent to 11.17USD.

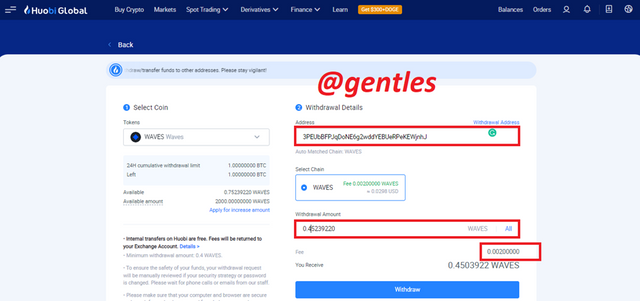

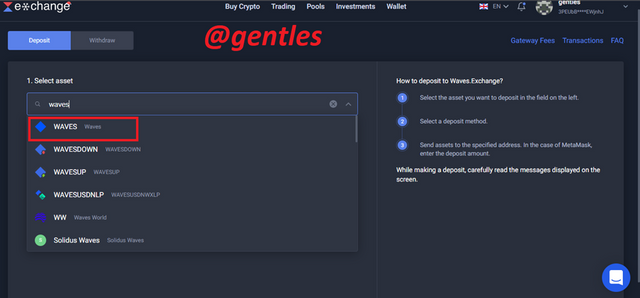

Show how the process is carried out to transfer the asset to the official Waves platform

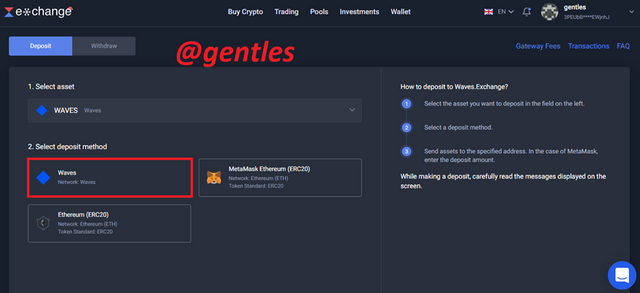

To transfer the WAVES token to the WAVES platform, go to your WAVES account, and in the Wallet section click on Deposits and Withdrawals

The page is by default on the deposit section. Search for the asset you want to deposit. In our case, we will search for WAVES. Then Click on the official WAVES token.

We have three different deposit methods. We will choose WAVES.

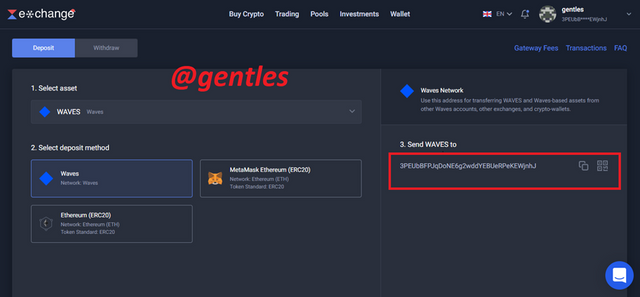

A deposit address will be given, copy the address to be pasted on where we will be sending the WAVES from.

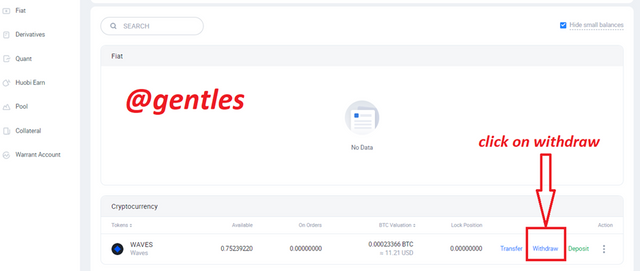

After we have copied the address, we will go to the Huobi Exchange platform where we purchased the WAVES. Go to the wallet look for the WAVES asset and select withdraw

Fill in the withdrawal form with the address that was copied from the WAVES platform. Enter the amount you want to withdraw and click on withdraw to transfer the WAVES assets to the Waves platform.

However, we have to note that there will be a withdrawal fee of 0.002 WAVES and also note that if the withdrawal address does not match the one on the platform, the assets may be lost beyond recovery. So much care must be taken when entering the address.

Question 4

What is the WX token? What are its functions within the Waves ecosystem? What is your value and Market Capitalization at the time of writing your post?

Answer

What is the WX token

The WX token is the formal native governance token of the waves.exchange platform. This token has a team made up of 60 professionals with great experience and knowledge in blockchain technology working on its project.

The token was released with the purpose of improving the decentralization of the platform. this governance token WX is also supposed to be used to help take care of problems associated with liquidity, market making, and listing of coins.

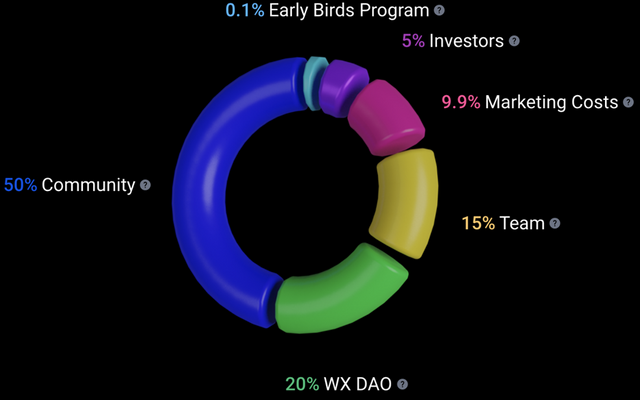

There was an IDO of the token which where funds were raised to help develop the waves exchange platform. The following is how the WX tokens were given out;

• 15% of the WX token was released to the smart contract team

• 9.9% was absorbed in marketing the project

• 50% was given out to the community

• 0.1% was issued to the early bird’s project

• 5% of the token was given out to investors

• And 20% was issued to the WX decentralized autonomous organization

What are its functions within the Waves ecosystem?

The WX token has a lot of functions on the Waves platform. It is used for most operations on the platform. Here are some of the activities it is used for

• Staking: the WX token can be used on the Waves platform to stake and earn rewards. In this case, the WX token is locked on the platform for a specified period. Users who stake this token earn rewards in both WX and gWX. gWX is the governance token of the platform. The rewards are proportional to the amount of tokens staked.

• Transaction fees: most transactions are charged in the WX token

• Trading: this token can be used to swap and trade for other currencies on the Waves platform.

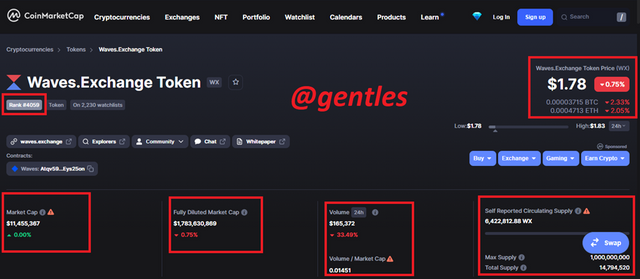

What is your value and Market Capitalization at the time of writing your post?

The WX token is ranked number 4059 on coinmarket cap with a current price of $1.78 which has dropped about 0.75% in the last 24hrs. The token has a market cap of about $11,455,367. According to coinmarket cap, the token has a self-reported circulating supply of 6,422,812.88 WX

Question 5

Describe Waves Ducks What is this project about? How is it accessed? Be as explicit as possible

Describe Waves Ducks What is this project about?

Waves Ducks is described to be an NFT game where users can go, play and earn at the same time. The players utilize different techniques and mechanics to gain rewards in EGG tokens also known as eggs on the platform. These tokens can be used to purchase duck NFTs which are used to play the game.

Users buy more ducks to increase their rewards in EGG which can be used to buy more ducks. With this method, gamers get to build or develop their duck farm. These ducks that the gamer earns can be sold on the marketplace to make more profits. From what I said about the EGG token it can be perceived that it is the native token of the game.

The Waves ducks platform is becoming very popular among blockchain games. The trading volume on its NFT marketplace is growing every time and has earned the 10th position in the NFT marketplaces according to trading volume. It has a daily trading volume of about 35,424USD

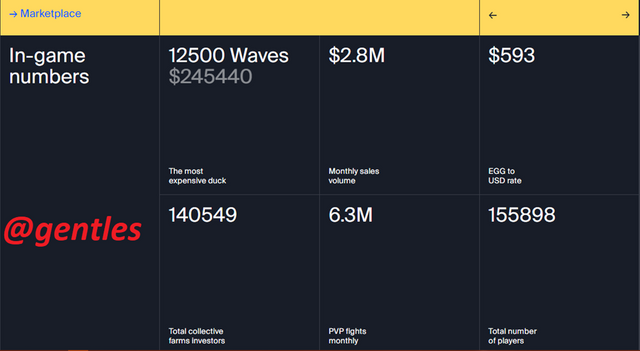

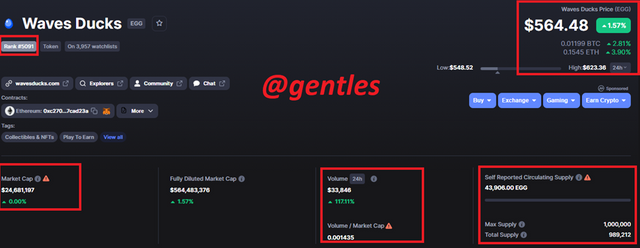

Let’s look into the numbers in the marketplace of the platform.

As we can see the platform is doing well with the numbers shown below. Waves ducks make about $2.8 USD in sales volume. It has about 155,898 players with about 140549 investors in farms. The most expensive duck on the platform stands at $245440.

The EGG token

As I mentioned earlier, the EGG token is the native token of the waves duck platform. It is used to purchase NFT, initiate transactions, etc. It has a current price of $564.48 and it is ranked 5091st on coinmarket cap with a market cap of $24,681,197. In the last 24hrs, the token has gained a trading volume of $33,846.

How is it accessed

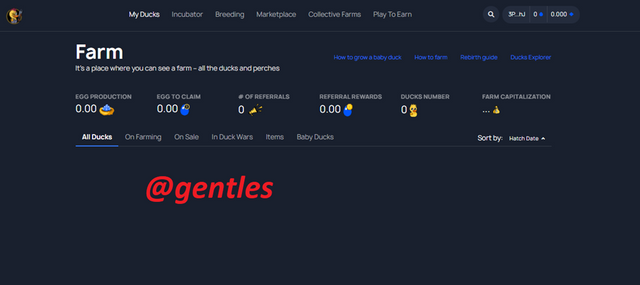

As soon as an account is created on wave.exchange platform, an account with the same logins is created for the user in the waves duct platform. The user is not required to create another account

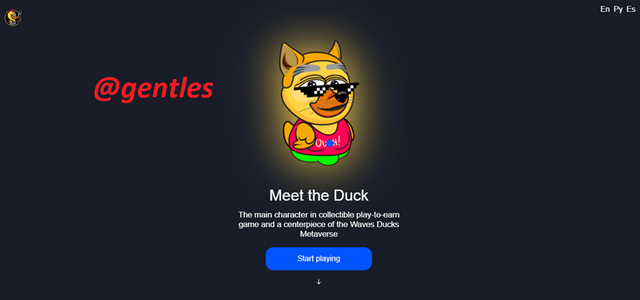

To access the platform, we have to visit wavesduct.com. Click on start playing at the front of the page.

Enter the login details of your waves.exchange platform.

We have successfully logged into our waves ducks account.

Conclusion

We started this post with the Leased proof of stake mechanism. It was explained to be the mechanism that allows users with tokens to lease out or offer their tokens to other nodes that serves as a block producer on the network and gain a certain proportion of the returns as rewards.

The Waves platform is an astonishing blockchain in the crypto world. It has a lot of amazing features that allow users to perform some activities like creating another token, engaging in the leased proof of stake consensus, etc.

Users on this platform are also offered an opportunity to earn rewards through their numerous investment modalities and also through playing duck games and earning rewards at the same time.

Thanks to Prof.@imagen for this task

Except otherwise stated, all screenshots were taken from;

and