Initial Exchange Offering and Binance Launchpad. - Crypto Academy / S5W6 - Homework post for Prof. @nane15

Explain in your own words what an IEO is.

One of the best project investment tools that have captured the attention of exchanges, project teams, traders, and investors in the cryptocurrency world are the Initial Exchange Offerings (IEOs). In other words, it's a token sale that is held or supervised by cryptocurrency exchanges. Surely, the definition is much similar to the Initial Coin Offerings (ICOs), this is mainly because their objectives are in fact the same but conducted through different platforms. Initial Exchange Offerings are administered by exchanges on behalf of entrepreneurs and startups that seek to raise enough funds through their newly issued tokens.

The first Initial Exchange Offerings (IEOs) took place four years ago ( 2017) but the trend did not really escalate until early 2019 after the launch of Binance Launchpad. Before then, there had already been over 50 IEOs which raised over $154 million as per ICObench. In January 2020, BitTorrent that was purchased by TRON commenced a token sale on Binance Launchpad and an amount of $7.2 million in less than 16 minutes in a crowd-sale. It's cool, right? yeah, it is exactly what every crypto startup can ever dream of. After observing the successful come up of the Launchpad, other notable exchanges also announced to launch their IEO platforms. Some of the IEOs platforms include Huobi Prime, KuCoin Spotlight, Bittrex IEO, OK Jumpstart (OKEx), and Bitmax Launchpad. The majority of the IEO platforms are currently supervised by Asian exchanges, however, the European platforms are also preparing to join the dance party.

Choosing a good platform to host your IEO is very necessary because it gives or provides the project with great opportunities to achieve its fundraising objective. Some of the things you should consider when choosing an IEO platform include safety and high security, multi-coin support and a strong technology, easy to use, and finally must have a high liquidity.

The requirement of IEOs has been very considerable due to several factors thus, IEOs literally represents a radical change in the ICO design module in terms of trust. Also, IEOs promote only legit or genuine projects, unlike ICOs.

How does crypto IEOs operate?

To begin with, Exchange platform performs a series of verification before commencing any sale to ensure that the new cryptocurrency in question is what it claims to be. Thus, it done to prevent or avoid scams.

Also a whitepaper is required (similar to our normal academic papers). The whitepaper aims to inform and educate investors concerning the new project. It entails all the technical aspects of the project, its architecture, the solutions to all the problems it hopes to resolve, the team's vision for the product, and the reasons why the potential developers and investors should be interested in it.

The Initial Exchange Offerings platform will thoroughly exam the whitepaper along with other factors before the project gets accepted by the blockchain. Once the it gets accepted by the exchange, investors are the KYC (Know Your Customer) and AML (Anti-Money Laundering) measures. Benefactor and investors are also provided with full transparency concerning the project's progress.

Do you consider IEOs an advantageous way to make an investment? Explain.

Well, this is a question that I will always say YES to regardless. Because there are multiple opportunities for participants to earn maximum profits. This is mainly because most of the tokens are undervalued before it's presale which provides investors with an opportunity to buy them at a less price and earn huge when the price is bullish after the crowd sale. Also, the exchange on which the project is based on performs a thorough background search on each project team member and on the presented whitepaper as well the making it a very secure and reliable. Finally, it also provides a user-free environment that directs investors to exactly where they want to go on the platform, which in turn minimizes the rate of money loss. It protects investors from mistakenly sending funds to different projects on the platform

List advantages and disadvantages of participating in an IEO.

IEOs are essentially advantageous due to the following reasons:

It provides maximum security for both the investors and token issuers because of the mandatory Know Your Customer (KYC) and Anti-Money Laundering (AML) verification measures.

The IEO project teams are neither fake nor anonymous, so they will never run away or disappear with your money because of the background check the blockchain does on each team member before their project proposal.

It increases the investor's confidence level because they do not directly deal with the IEO team but with the associated exchanges which makes it more authentic and reliable in case things go south.

Initial Exchange Offerings platforms provide a much more user-friendly environment which enables investors to easily visit links and also toggle between tabs.

IEOs allow token issuer startups to benefit from projects due to enhanced marketing by the exchanges, exposure, and interests in the product.

However, they are also subject to below risks and concerns:

Unclear regulations and restrictions:

A lot of countries have issued on ICOs complete which may reflect very badly on IEOs due to some features they slightly have in common.A limited number of investors:

Many investors have been complaining repeatedly about not being able to purchase tokens during Initial Exchange Offerings which is very bad.Pump and dumps are still a risk that most cryptocurrencies struggle with after a token sale. Meaning some digital assets rise in value extremely fast after a token sale and falls dramatically afterward.

Payment of listings fees by crypto projects: Although the tokens of startups are listed after the crowd sale is over, but comes with an associated cost of token sale which appears to be seemingly high. The fees for listing a token can go as high as 20 BTC while exchanges also take about ten percent (10%) cut from the tokens of the fundraising companies.

The compliance of Know Your Customer (KYC) and Anti-Money Laundering (AML) procedure by every investor. The cryptocurrency world is known to be full of privacy-obsessed users, so going through the AML and KYC measures may be a big no-no for most of them.

Explain how to participate in an IEO, for the process explore various exchanges, choose one of them and explain the process. (Please use screenshots.) (No need to participate, just register, present proof of verified account and explain the whole process, do not use Binance)

HOW TO PARTICIPATE IN AN IEO

In a way, Initial Exchange Offerings make it far more easier for average users to participate. Unlike ICOs, it's not required for users to send funds to smart contracts or double-check details of transactions. Below is how a typical IEO process looks like.

You need to first find an IEO you want to invest in through thorough research.

You are required to sign-up or register on the exchange hosting the IEO and verify your account by passing the KYC or AML procedures.

Look for cryptocurrencies that you want to use to participate in the IEO and deposit funds into them.

Wait for the commencement of the IEO and purchase the tokens.

However, the process may not be as simple as described here because each IEO platform has its own methods of ensuring a fair process to its users. And mind you, every IEO tends to sell the tokens very quickly so be ready and alert when the time comes.

To make things less difficult for you, I managed to explore some of the top exchanges for you and the first on the list is Binance Launchpad.

Binance Launchpad: It's recognized as the World's largest exchange in terms of trading volume. Binance is one of the top most trusted exchanges every individual would love to explore. It supports multiple devices and languages along with superior technology and a seamless user experience.

KuCoin Spotlight: It's also popular in the industry for selling the MultiVac project in just 7 seconds when it was launched in 2019 attracting several users worldwide. At start the only requirement to participate was to have a verified account with the exchange which was based on a principle known as first come, first serve, but has announced its plans to soon use a lottery model.

Huobi Prime: This platform is actually one of the first to follow in the footsteps of Binance. It is a formidable platform that positions its Launchpad as a direct DPO platform (Direct Premium Offering). All the tokens purchased through Huobi Prime are deposited immediately into the user's account and can be used to trade on Huobi Global (against Huobi token HT).

OKEx Jumpstart: OKEx is also considered as one of the leading exchanges in terms of trading volume. It's a Malta-based exchange with unique subscription and allotment approaches used to provide uniqueness to its platform. The subscription opens for only 30 minutes and closes early if the oversubscription limit is reached and the allotment approach follows afterward.

Bittrex: Bittrex exchange is one of the first to attempt an IEO back in 2014 but didn't go as planned. Although the initial attempt (RAID) was a total failure due to some controversies surrounding the RAID's business status and the funding of the project. It managed to come back strong and launched VeriBlock in 2019 which sold out in less than 11 seconds.

Now let's choose one of the exchanges and explain the steps involved when a user wishes to participate in an IEO project. In this case, I would be using Huobi Global.

- To be able to participate in Huobi IEO, you are required to first create an account by visiting its homepage. Click here to enter homepage

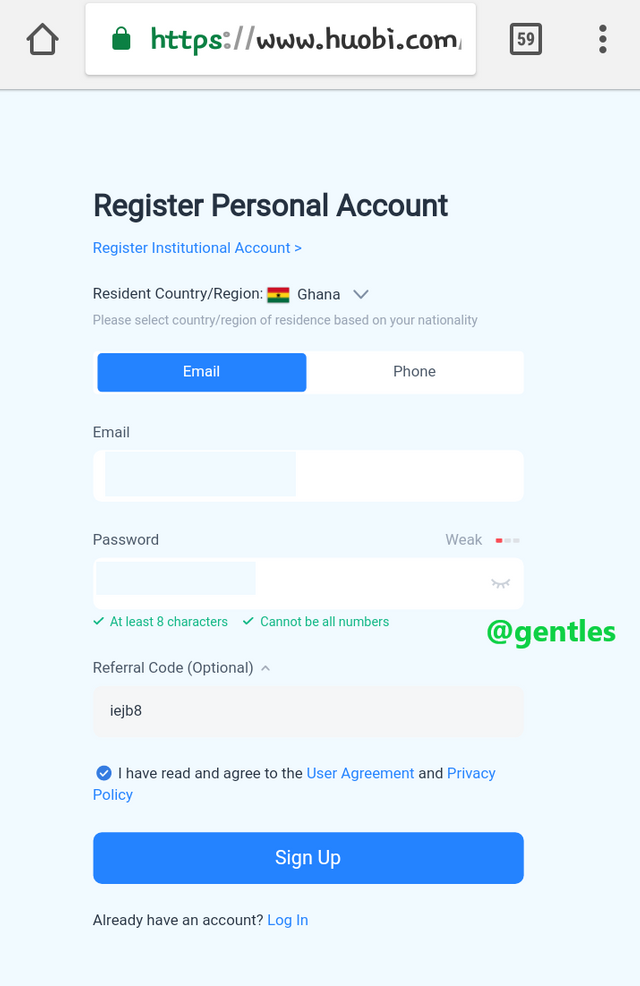

On the homepage, click on Sign Up and enter all your credentials. In this case, I entered my e-mail and password as shown in the screenshot below.

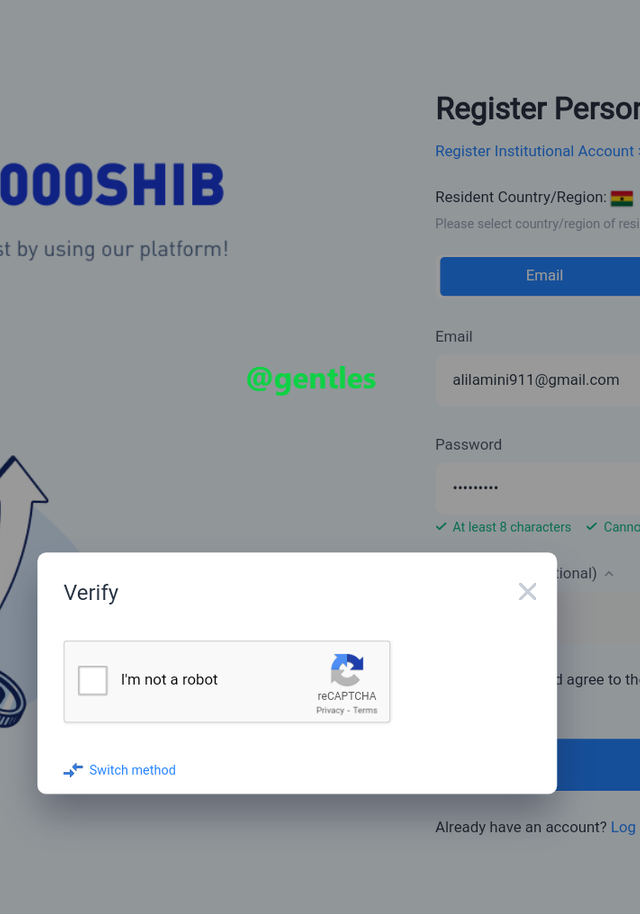

Accept their user terms and agreements by ticking the small box provided. Click on the Sign Up option afterward and verify that you are not a robot.

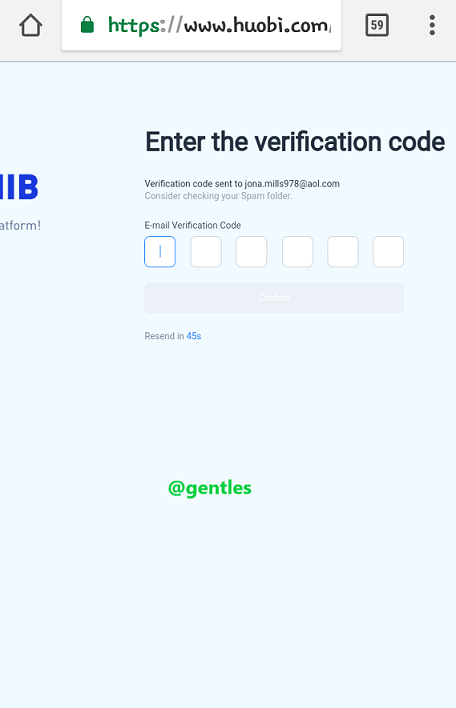

A verification code will/would be sent to you by the Huobi team via email or SMS depending on the one you used to Sign Up. Now enter the code and you would be automatically directed to the user homepage.

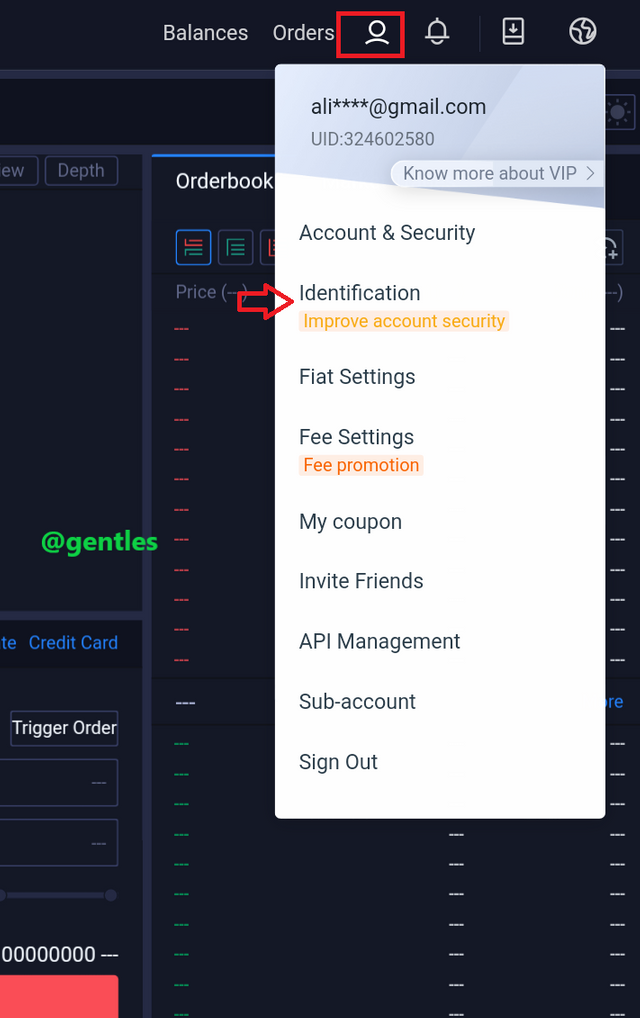

Your account has successfully been created, it is now time to do the most important thing (account verification). From the homepage, locate the user profile by clicking on the "human head" option as shown below. Click on the Identification option from the pop-up list to proceed.

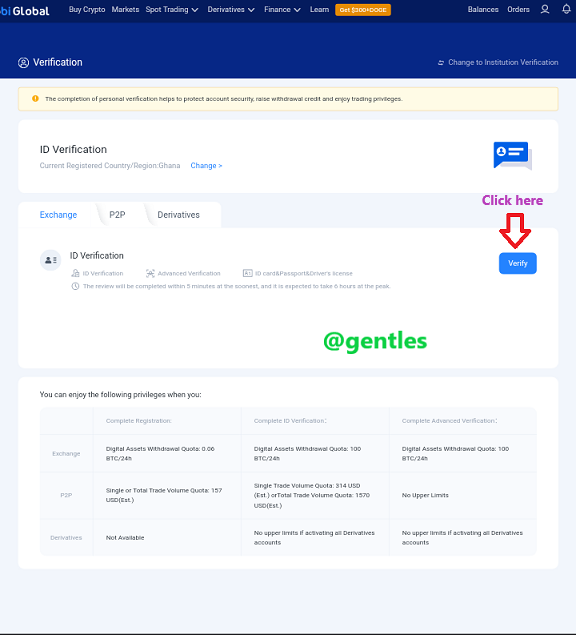

From the newly loaded page, click on Verify to commence the verification process. This is done because it enables users to enjoy trading opportunities.

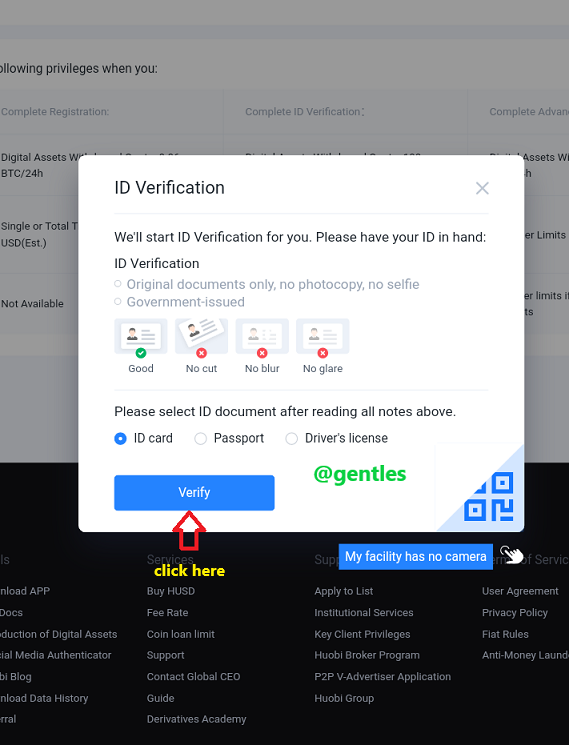

Now, select the type of ID verification you would like to use. In this case, I will be using my ID card. Click on Verify after choosing your option.

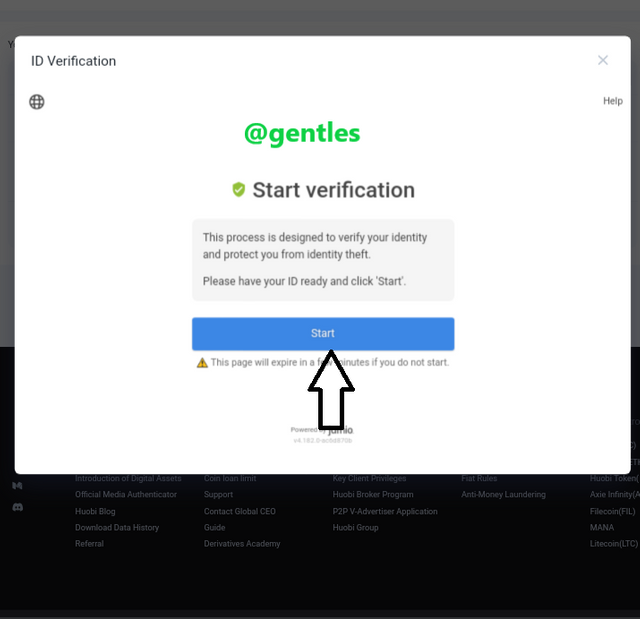

Click on Start to begin the verification process.

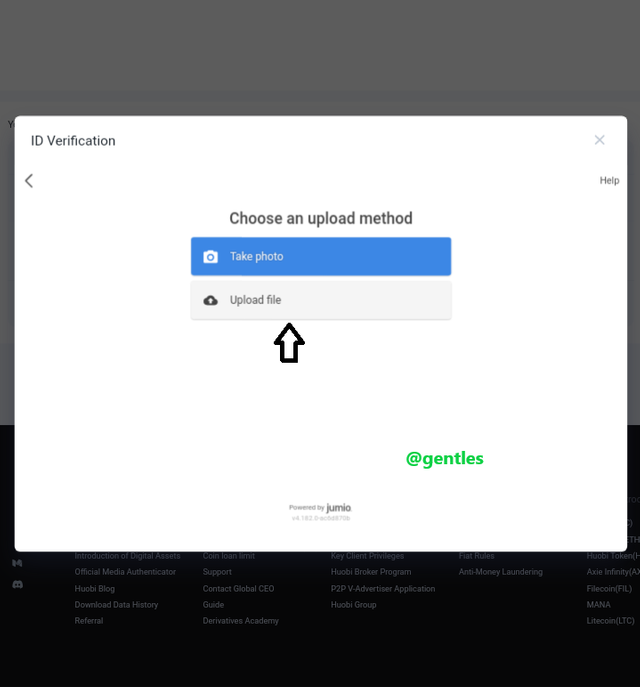

You can now choose to take a new picture of your ID or you can simply upload it if you have it already saved on your device. I have mine already so I am going with the second option.

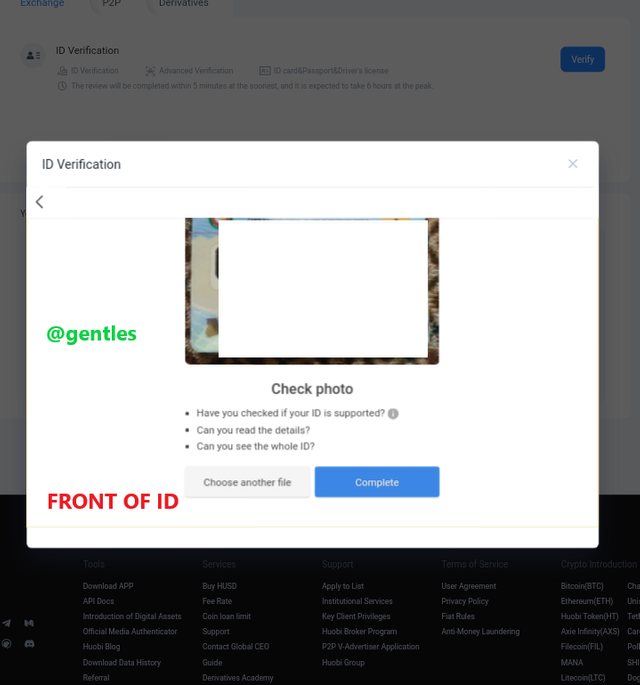

It's now time to upload both the front and back sides of your identity card as shown below.

Since everything has been uploaded successfully, sit back with hands crossed for at least 5 minutes to finalize the process. This part of the process will determine whether you are going to get approved or not, so make sure all the identity pictures you upload are legit.

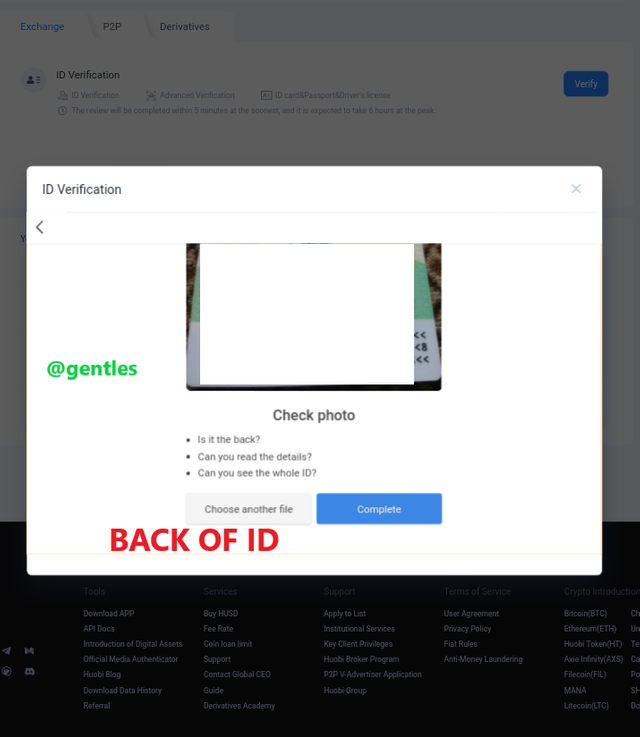

As seen from the above screenshot, I have successfully be verified..

As an example of a project that had a successful IEO, explain that project. Be on topic. (Use from screenshots.)

VeriBlock (VBK) is a decentralized blockchain protocol that is developed to harness Bitcoin's blockchain security. It allows other cryptocurrency blockchains to utilize Bitcoin's security through Proof-of-Proof (PoP) consensus algorithm which protects them from 51% attacks. Individuals are able to generate VeriBlock through PoP mining which enables them to leverage the Proof-of-Work (PoW) from well-known superior blockchains. VeriBlock pre-mined about 714 million prior to the MainNet which was launched in March 2019. The miners of VeriBlock initially receive exactly 165 VBK per block and mining rewards are halved every four years.

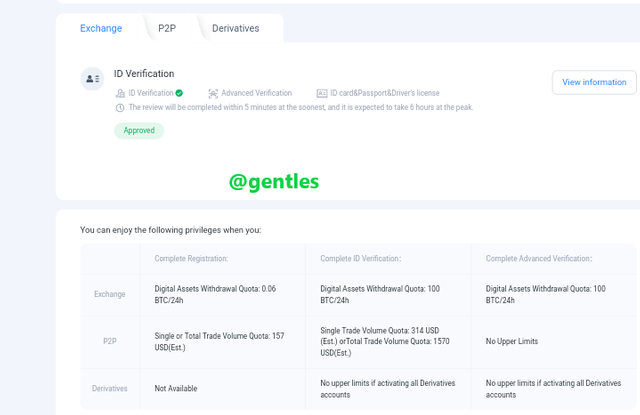

VeriBlock has currently a supply of approximately 1,095,934,995.7 with 0 in circulation. The live price of VBK as of when I made my analysis was $0.00407 USD with a day trading volume of $635.9 USD and it's ranked #6943 according to CoinMarketCap as shown in the screenshot below.

CONCLUSION

Initial Exchange Offerings play a very important role in lives of investors by securing their assets and making them profit from them in addition. Just like we already know, every good thing comes with a bad or negative side. Same applies to Initial Exchange Offerings (IEOs), so we shouldn't spend all our time considering the negative aspects of it and neglecting the positive sides.

Considering the ban of China's late 2017 Initial Coin Offerings which left cryptocurrency startups in the country trying to find solutions by any means necessary to raise enough funds for new projects. They searched for a while and later discovered the new trend of IEOs which enabled them to raise maximum funds for their projects without fear of authorities. This explains one of the significances of IEOs and how reliable they can be, in difficult situations.

Unfortunately, not every individual can participate in IEOs because it regulations still constraints many countries. So you are advised to make a thorough research on the platforms you would want to participate in and check whether your country is allowed or not.

This was a very nice lecture @nane15, keep it up.