BTCUSDT Sell | S6T3 - Team Trading Post for Fredquantum-Kouba01 Traders Team.

Hello beautiful steemians. It's another week of our popular trading contest and on this day, I will be trading on Bitcoin.

1.The name and introduction of the project token, and which exchange can be traded on, project/technical/team background, etc.

About Bitcoin

Bitcoin is the first ever decentralized cryptocurrency whose context was established in a whitepaper in 2008 by the popular anonymous Satoshi Nakamoto. in January 2009, the Bitcoin was launched.

Bitcoin can be described to as an online currency that can be traded via peer-to-peer (p2p). This statement implies that Bitcoin as a currency can be traded only online and between two participants with there various independent network. It also entails that Bitcoin does not require the intervention of a middle man before it's transfer can be completed between two users.

Although there has been some concepts that details about the functioning of an electronic currency even before Bitcoin, but Bitcoin upholds itself as unique by being the first electronic decentralized currency to gain an actual recognition and have various use cases as well.

Founders of Bitcoin

The founder of Bitcoin is the popular but anonymous original Satoshi Nakamoto and as of 2022, the real identity of Nakamoto is still unknown

Nakamoto published the whitepaper of Bitcoin which entails the practical implementation of a peer-to-peer online currency. It was in this whitepaper that the origin of Blockchain began. Nakamoto introduced a kind of transaction that will use a decentralized ledger that records transactions in batches (known as blocks). After two months of releasing the whitepaper, Nakamoto mined the first block ever on the 3rd of January, 2009 which was later referred to as the Genesis Block.

Nakamoto whom is the founder of Bitcoin as well as the first person to implement the Bitcoin protocol had earlier handed control of the code repository and alert key to Garvin Andresen who later joined the Bitcoin Foundation as a lead developer. Ever since then there has been series of Bitcoin software developers who have at some point added some value to the Bitcoin protocol for better use.

More about Bitcoin

At the time of launching, the price of Bitcoin was $0 and the initial bitcoins then we're not bought rather they were mined.using mining software and moderately powerful devices.

May 22, 2010 marked the date of the first recognized commercial transaction of Bitcoin when 2 Pizza was purchased by Laszlo Hamyecz using 10,000 pieces of Bitcoin. Bitcoin officially started trading in July, 2010 at a price range of $0.0008 to 0.08.

Tokenomics of Bitcoin

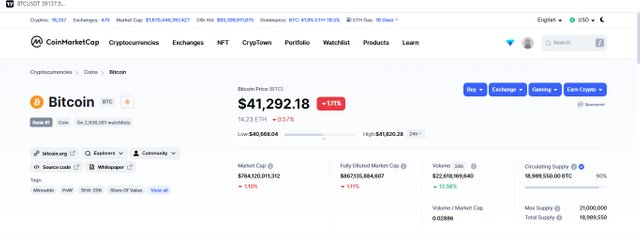

Bitcoin is the native token of the Bitcoin protocol usually abbreviated as (BTC). It has a stipulated Max supply of 21,000,000 Bitcoin and a circulating supply of 18,989,550 Bitcoin. It has a price of $41,292 USD with a market cap of $784,120,011,312 and a trading volume of $22,618,169,640. It is the first listed coin according to coinmarketcap.com and it is also the first on other list of coins at other places.

Some other Bitcoin fundamentals include;

| Fundamental | value |

|---|---|

| Source code | github.com/bitcoin/bitcoin |

| Explorer | blockchain.coinmarket.com, blockchain.info, live.blockcypher.com, blockchain.com, explorer.viabtc.com |

| Whitepaper | bitcoin.org/bitcoin.pdf |

| Consensus algorithm | Proof of Work |

| Market dominance | 41.90% |

| All-time high | $68.789 |

| All-time Low | $65.53 |

Market Place if Bitcoin

Places where Bitcoin can be purchased include

| sn | Exchange | Pair |

|---|---|---|

| 1 | Binance | BTC/USDT, BTC/BUSD, ETH/BTC, BTC/TRY, ADA/BTC, XRP/BTC, GBP/BTC |

| 2 | KUCOIN | BTC/USDT, ETH/BTC, BTC/USDC, LUNA/BTC |

| 3 | Coinbase exchange | ETH/BTC, BTC/USDT |

| 4 | Houbi Global | ETH/BTC, BTC/USDT, |

| 5 | Bitfinex | BTC/JPY, BTC/GBP, BTC/EUR, ETH/BTC, BTC/USD |

2. Why are you optimistic about this token today, and how long do you think it can rise?

I am optimistic about Bitcoin’s today because of the following reasons;

1. Uniqueness of Bitcoin: The unique nature of Bitcoin comes mostly from the fact that it is the first cryptocurrency to ever be created. Since it's inception, it has created for itself a global community and has also inpired the birth of new approach towards financial exchange and investment. Today there are over fifteen thousand Cryptocurrencies that exist all which was inspired by Bitcoin. Consequently, Bitcoin also created diverse safe and easier streams of wealth accumulation via creating, trading, staking and investing in a crypto project.

2. Decentralized System: Bitcoin uses a cryptographic method to send and recieve value. Cryptography is a means of sending information or value between two participants. The both participants posses special keys which are unique to only the both of them. One of the keys is used for encryption and the other for decryption. Without these keys, then a sent message cannot be uncovered. Bitcoin uses this technology to transfer value thereby making the need for middlemen unecessary or irrelevant. The anonymous transaction identity of Bitcoin has attracted investors to it and is still attracting.

3. Increase in Use Case/ Adoption: Bitcoin is the first cryptocurrency to have ever existed and also the first to have a use case or a real life application. Ever since then, Bitcoin has continued to remain relevant with an increase in its number of use cases. The major use of Bitcoin is to store financial value. Also, it's adoption rate has increased ever since then. Some establishment today now accept payments of goods and services using Bitcoin and some other cryptocurrencies. With the continuous increase in the use case of Bitcoin, then Bitcoin is guaranteed to always break past it's all-time high.

payment services, online games and more.

3. How to analyze the token? (using the analysis knowledge learned from professors’ courses) —- important part

For today's trading excercise, I will use KUCOIN exchange and I will trade on BTC/USDT pair. The analysis tools I will employ are Fibinacci retracement tool, RSI indicator and Triangular Moving Average Cross (TMA cross).

• Fibonacci Retracement: Fibonacci Retracement refers to horizontal lines that tries to expose places where there is a possibility of the price to reverse direction. It Shows this points in the market using support and resistance lines. Traders tend to buy at a Fibonacci support level at the Retracement when the the market is in an uptrend.

• Triangular moving average (TMA): is referred to as double smooth. So, it is the average of an average. What it does is to smoothen things out even more unlike the noisy and spiky Simple moving average (SMA). TRIMA is technically the average of a given no. of SMA.

Relative Strength Index is a scale which tries to show that a market is in an uptrend, downtrend or mere consolidation by means of identifying overbought and oversold regions of the market. The 70 level is usually set to be the overbought region while the 30 level is set to be the oversold region. With the understanding of these regions, traders are able to make profiting trading decisions.

Firstly, I open tradingview site and on the Chart, I add the various indicators. I have used 10 and 20 periods of (TMA). On adding the fibonacci retracement, (since the market is in an uptrend) I put the firstt point on the lowest price candle and the second point on the highest price candle.

Since the market is in an uptrend, then I had to watchout for where the RSI hit the overbought region.

I had to wait a little for the longer period TMA (20) to cross over the shorter period TMA (10). At this point, I await the action of two candle sticks as confirmation of the bearish trend reversal. Next I use the fibonacci retracement levels to determine where the market may possibly establish a support and it is with this support that I set my take profit. I then place my stop-loss slightly above the TMA cross point.

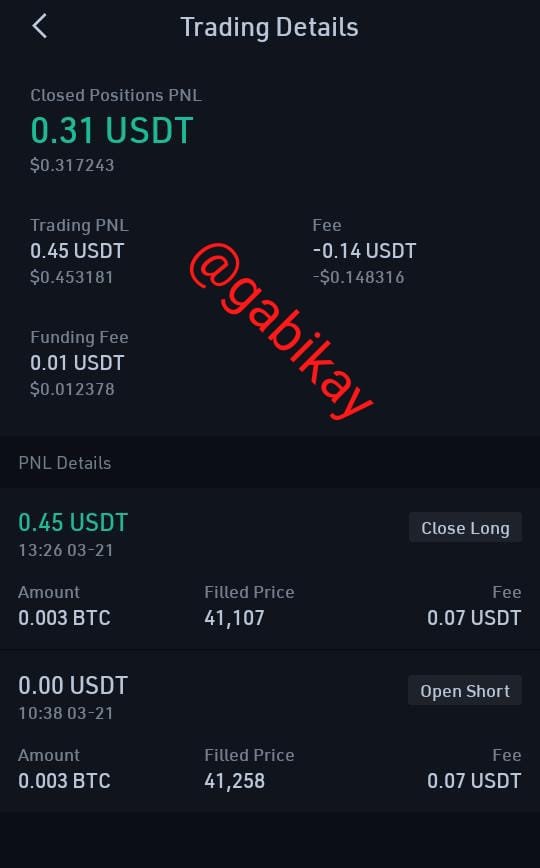

screenshot from kucoin mobile app

screenshot from kucoin mobile app

4. Your plan to hold it for a long time or when to sell? / Do you recommend everyone to buy? and the reasons for recommending/not recommending

Bitcoin as we all know is the first ever Cryptocurrency to exist which was created by the anonymous Satoshi Nakamoto. As contained in the whitepaper of Satoshi Nakamoto, Bitcoin is to be halved after every 210,000 blocks which is approximately four years. Halving refers to the division of the block reward by 2 after 210,000 blocks have been has been added to the blockchain. This is done to reduce inflation with intensions to decrease supply of Bitcoin and increase its demand.

This in theory should have a positive effect in the price of Bitcoin. Fortunately, this theory has never failed. For every halving event of Bitcoin, there is a significant increase in its price. The last halving had happened on 11 May, 2020 and it caused the block reward to be reduced to 6.25 Bitcoin. The next halving which should occur at about 11th May 2024 will leave the block reward to become 3.125 Bitcoins. Also, the price is expected to exceed it's all time higher and create a new support that will be above it's current all time high.

Hence, I believe that buying Bitcoin now to HODL is a wise choice because Bitcoin is already half way to it's next halving. I plan to buy and hold Bitcoin before it's next halving.