Steemit Crypto Academy Season 5 [Advanced Course] Week 8 - Dark Pools in Cryptocurrency

Introduction

It's another wonderful time to pen down another lecture in our dear Academy and I hope you all enjoying the new year already. I wish everyone a prosperous new year. This day, I will be sharing yet another important lecture in the crypto ecosystem and it's titled Dark Pools in Cryptocurrency. Let's take a walk together on this.

Designed with Adobe Photoshop

Background to the Study

Despite the privacy characteristics of the blockchain, many users in the ecosystem still want more privacy than the ones associated with the public blockchains and that has led to several innovations in the space. Remember, in a public blockchain it is not possible to see the name of a user on the explorer but other transaction details can be seen and easily traced, where information like previous transactions origination and the addresses interactions over time, and so on, are revealed.

As more privacy is so important to some individuals, the advent of blockchain protocols like Mimblewimble receives adoption from users that want more privacy in transactions. As such, only the ones involved in transactions done through this type of blockchain protocol can see the details (amount of transaction, the origination of the transaction, and so on), as it's hidden from the outsiders. You can read more about these in one of the lectures I presented in the previous season titled Mimblewimble protocol.

That said, some users do not only want privacy in transactions but also wants an avenue where they can choose to sell their assets at a predetermined price without being affected by slippage or causing any market chaos and this led us to the topic Dark Pools in Cryptocurrency. Let's go into it.

Dark Pools in Cryptocurrency

Dark pools have been around in the financial world for quite some time now, even as early as the 1980s which involves privately exchanging financial products that are not available to all the public. In cryptocurrency, dark pools are private platforms used for trading crypto assets at a predetermined price without being affected by slippage as associated with volatility of the assets in the ecosystem and other market factors.

In addition to the advantage that traders can sell or buy assets in dark pools at a predetermined price with no slippage issues, it also comes with privacy, as stated earlier, it's a private trading platform. Dark pools are not associated with visible order books as seen in other exchanges, as such each trader chooses to sell/buy assets based on personal preference. In essence, the dark pool is used for trading large volumes of crypto assets.

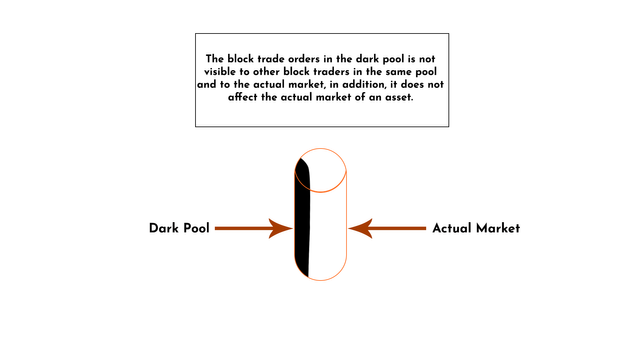

Designed with Adobe Photoshop

Trading in dark pools is often regarded as block trading which means a large volume of an asset are being traded and comes with the advantage that these trades doesn't have any impact on the market of the asset at the time it took place even if it's worth a couple millions of USD, quite awesome.

Highlights of Dark Pools in Cryptocurreny

- It's used for trading crypto assets in private and at a predetermined price.

- It is associated with less slippage or no slippage at all.

- Large volume of assets are traded using the dark pool through block trading.

- The block trades in dark pools don't have any effect on the market of the asset.

How Dark Pool Works?

To talk about how dark pools work, we would be looking at two things, limit orders and market orders. Most dark pools used the first (limit orders) of the aforementioned. Let's talk about them below.

Limit Orders

Limit orders are one of the methods used by investors to carry out block trading in dark pools. In this case, traders choose a predetermined price at which they wanted to sell/buy assets without any slippage. As such, volatility doesn't affect the asset placed for trading, this is a huge advantage as compared to the normal exchange of crypto assets. When the limit order is met with another potential buyer/seller limit order, the predetermined price of sale is what the trader achieves at the end of the day. Let's see the second one.

Market Orders

Market orders is another method of getting involved in trading in cryptocurrency, in this case, traders scan through available limit orders in an exchange and choose one at a price that is predetermined by another trader. As such, for market orders, the trader that chooses to buy/sell via this has to bear the slippage cost that is involved. For instance, selling an asset that is worth $500,000 at the time the transaction is initiated, for about $498,800, the user has to bear the slippage cost which is not associated with the limit orders method. Now, let's see how it works in an exchange.

Kraken Exchange Dark Pool

Kraken cryptocurrency exchange offers dark pools on their platform and the aim for their support is to contribute to the lesser impact of large volume of trades on the general crypto market. Like I explained earlier, we have compared limit orders in dark pools with market orders in normal crypto exchange, in the case of Kraken, they have eliminated market orders and only allows limit orders which most dark pools comply with and this clarifies what we have talked about limit orders in dark pools earlier.

On Kraken Dark pool, each trader chooses a predetermined price to create a limit order for their trades, this is invisible to others. Only the system matches limit orders to complete the block trading as specified by the trader, as such, you can't actually say if you are a market maker or a market taker on Kraken dark pool.

Crypto Assets supported on Kraken Dark Pool

As at the time of writing this piece of article, only BTC and ETH are the main crypto assets supported on Kraken dark pool. Some of the pairs available are; ETH/BTC, ETH/USD, ETH/EUR, EUR/GPB, BTC/USD, BTC/EUR, BTC/GPB and so on.

Requirements for Trading on Kraken Dark Pool

Before you can be involved in block trading on Kraken's dark pool, there are a few things one should take note of and this would measure your eligibility of participation in this type of trading. Let's see the list below;

- First of all, only limit orders are available on Kraken's dark pool, no market orders. Take note.

- Only users that have achieved the Pro Level verification on Kraken are eligible to use the platform for block trading.

- The minimum requirement for block trading of BTC pairs is estimated to be 100,000 USD and 50,000 USD for ETH pairs.

For advanced traders who have the intentions to carry out their trades using the Kraken Dark pool. The steps involved are quite easy to navigate through;

- Create a new account on Kraken exchange and get your email verified.

- Then, enroll for verifications till you achieve Pro level.

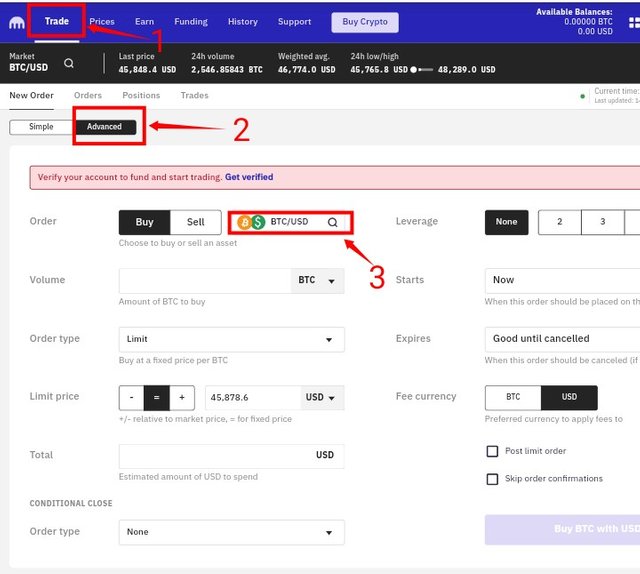

- Select trade from the landing page of the exchange, new order then switch to Advanced.

- Under the pair selection, scroll to the bottom and select darkpool to choose a darkpool pair of choice. See brief screenshot guidance below.

Screenshot from Kraken

Decentralized Dark Pool

We have highlighted an exchange dark pool above which belongs to Kraken, now we would be talking about decentralized dark pool. In short, a decentralized dark pool is the type of block trading that takes place on a decentralized exchange which eliminates the presence of third parties in transactions carried out in the dark pool and that makes it more secured as compared to the one offered by a centralized exchange.

Decentralized dark pool comes with the advantage of advanced anonymity as users don't have to go through KYC verifications before using the platform. The decentralized dark pool works in a way that when block trades orders are placed, they are broken into smaller parts and different nodes do the job of matching with any available orders in the dark pool. Also, the integrity of transactions on a decentralized dark pool can be verified by zero-knowledge proofs technology, which further strengthens the security of the trades.

Effects of Dark Pool in Cryptocurrency

There are a few numbers of effects of dark pools in cryptocurrency, some of which are positive effects while some are negative effects. Let's see a few of the effects below.

Price Impact

Remember, dark pools are associated with no visible order books, and transactions carried out in the dark pools are done outside the main market, as such it does not affect the market price of the asset. As such, a large volume of sales doesn't affect the market of the price.

Slippage Elimination

There is slippage elimination using the dark pool, the limit orders placed are matched with other perfect limit orders and it's triggered, as such, the block trading comes back with the predetermined price as placed by the block seller or buyer.

Elimination of Fear

The dark pool doesn't have a visible order book and this eliminates the fear that would have gripped small traders if they see huge orders being placed that could move the market of the asset towards the injected direction. For example, a few months ago I was exploring Binance exchange when I saw a large buy order placed at a price, for about 1.1 million units of STEEM, take for instance, if it was a sell order, do you know how much fear steem lovers would feel for the impact such large volume might have on the market.

Lack of Transparency

In some instances, in an exchange dark pool, it's possible a limit order placed by a trader is not matched with the best possible orders as it's prone to manipulations if the intermediary (even the trusted host) chooses to. And as there is no visible order book to compare one's limit order against.

Conclusion

In conclusion, dark pools in cryptocurrency helps to reduce the impact of a large volume of trades on the market price of an asset as it's carried out privately from the actual market. As much as that sounds as regards its impact on the market price, likewise, many questions are raised as regards if the trades carried out in dark pools are truly out of circulation or await another time to be injected again to manipulate the market. It gladdens my heart to be able to share with you again today and I hope you enjoyed the lecture. Thank you.

Homework Task

- Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

- Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

- What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

- For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

- What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

- State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

- Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

- Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

- In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

- What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Thank you for the lesson professor😁.

Regarding question number 2, can we still talk about Kraken’s dark pool?

Yes, you can. Thank you.

Ok thank you very much.

Hello professor.

I don't quite understand question 9. Do you mean the impacts of dark pool trades on the price of an asset or the impact of placing a dark pool trade on the market price probably with a market order?

The question is about its impact on the price of an asset.

Ok thanks.