Steemit Crypto Academy Season 4 Week 4 [Advanced Course] | Crypto Assets Diversification (CAD)

I welcome everyone to Week 4 of Season 4 of the Crypto Academy and trust you are all doing great. In the lecture today, we would be discussing the topic Crypto Assets Diversification (CAD) and see how it's beneficial to us in our journey in the crypto ecosystem. Let's get into it.

Made in Canva

Background to the Study

There are numerous investments out there giving investors fortune at the moment. The success of these investments depends on the practice employed by the investors, as such, we can say it's all about doing it the right way, and if not it tends to lead to loss. Out of these numerous investments, we have the trading of cryptocurrency which has changed so many lives, in short, some lives solely depend on it.

Trading cryptocurrency is a great way to make fortune if practiced the right way. Remember, cryptocurrency is characterized by market volatility as it's subjected to heavy fall or rise over time. Knowing this, our cryptocurrency trading should be carried out properly so that we don't fall into the bad side of the ecosystem. And this is where our topic today comes into play, let's dive properly into Crypto Assets Diversification.

What is Crypto Assets Diversification (CAD)?

Diversification is a very common investment strategy used in the financial realm, well, many people still don't practice it but it is important to know/practice it to ensure a safe ride in the financial world. Crypto Assets Diversification is an investment strategy specifically employed in the crypto ecosystem to properly manage one's portfolio to ensure one has a successful story to tell.

Remember the English proverb that says "don't put all your eggs in one basket", what happens if the basket's base is cut off due to pressure? Definitely, it leads to total loss and if not total, the casualties to be recorded will be so great, likewise, the crypto market is volatile and the pressure of heavy sell can affect the ones with a lone asset, therefore our crypto assets require proper diversification to stay safe in investment.

Crypto assets diversification is very important for us to vary our portfolio and not use our entire capital to purchase an asset. In this way, you are required to split your capital for effective management of your funds so that you don't feel too much pressure when the market volatility affects your assets. As we proceed in this context, a strategy would be taught to ensure one's safety in the crypto ecosystem.

Construction of Crypto Assets Diversification

Under this section, we would be looking at two key strategies, namely; Analysis and The 1 - 4 Rule. These two strategies above would help us to some extent to effectively diversify our crypto assets and keep us on the safe side of the investment. Let's take a look at each of them in the sub-sections below.

Analysis

Analysis is a very important aspect to be discussed as we look forward to effective diversification. The analysis encompasses detailed research about the crypto in question which involves the type of asset, price, where it was created, the team and so on, in the form of Fundamental and Technical analysis. We often get informed by friends to buy a crypto asset or sometimes we see a crypto asset rising fast, in that case, one tends to enter the market and that's where FOMO (Fear of Missing Out) sets in. If we are pushed by FOMO, then one may end up losing in the investment.

As stated earlier, even when FOMO sets in, one shouldn't forget DYOR (Do Your Own Research), research about the asset before concluding and this would prepare you for effective diversification. Let's proceed to discuss the second part of the section.

The 1 - 4 Rule

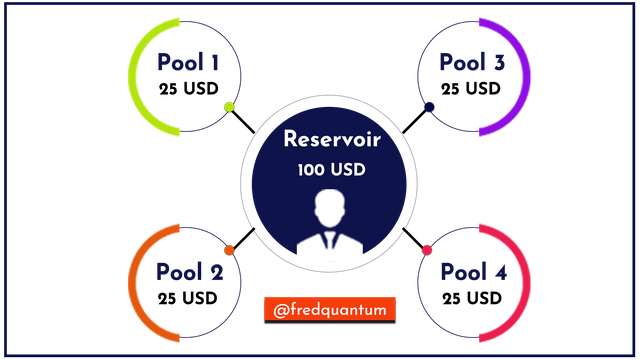

I call this strategy the 1 - 4 Rule and this is where the English proverb "don't put all your eggs in one basket comes into effect and I will be using the terms, Reservoir and Pools. The 1 - 4 Rule states that you should divide your total capital into at least 4 parts before investing in any crypto asset. Reservoir represents the overall capital which is 1 and Pools represents the 4 parts which is the result of the capital's diversification.

With this, a user tends to effectively manage his/her resources as he doesn't have to go in with all his capital but only 25% of overall capital at a time while he does the same for other assets until he fully utilized his available resources. Let's see the graphics below.

Made in Adobe Photoshop

From the above, we assumed that the user has researched about a cryptocurrency. Now, the total 100 USD in the reservoir was divided into 4 according to the 1 - 4 Rule and he's going into the trade with a part of it while he does the same for other investments until full utilization of his capital. This satisfies this rule as he doesn't expose himself to too much risk even if his position goes wrong in one, the others would be there to help. In addition, the trades must be equipped with proper take profit and stop loss levels.

Effects of Crypto Assets Diversification

Risk Mitigation

Note that we diversify our investment capital into different assets having studied the asset and satisfied with their performance based on fundamental/technical analysis. For instance, if we put the whole capital in a single asset and such asset experienced a fall of about 50%, you can see that half of the investment would be gone but with diversification, the loss won't climb up to such. In short, proper crypto assets diversification helps to reduce one's exposure to risk.

Reduced Return on Investment

We have discussed how crypto assets diversification reduces one's risk in terms of loss, likewise, it also affects the return on investment. In a normal buy position, assuming an asset's price moved in the direction of analysis and hit up by 50%, the profit would be lesser as compared to putting the whole capital into the asset whose price moved well.

Arbitrage Trading in Cryptocurrency

Arbitrage trading is very common in the financial world and the cryptocurrency ecosystem is not an exception. It is another investment strategy that is carried out to make profits from differences in crypto assets' prices across several platforms. For instance, BTC/USD is trading at 43,500 USD on Huobi Global and the same pair BTC/USD is also trading at 43,780 USD on Binance. With this illustration, there exist an Arbitrary opportunity and users can easily benefit from such.

There are several types of arbitrage trading, some of which we have Exchange arbitrage and Triangular arbitrage. Taking advantage of Arbitrage opportunity in cryptocurrency is quite simple as it is based on the concept of Buy low and Sell high, it's quite simple. Let's look more into it below.

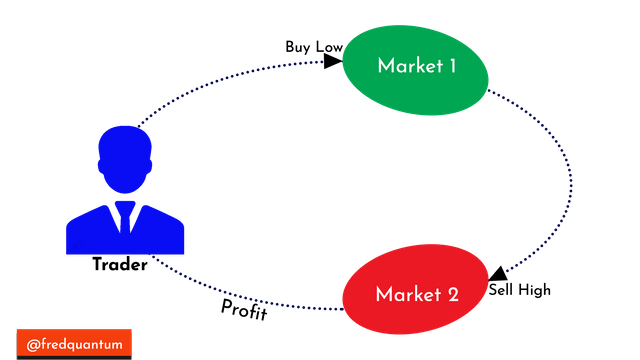

How to take Advantage of Exchange Arbitrage

This is the type of arbitrage opportunity that exists when a particular asset is trading at different prices on different platforms. In the example given earlier, where BTC/USD was trading at 43,500 USD on Huobi Global and the same BTC/USD pair was trading at 43,780 USD on Binance. Taking advantage of the above is quite simple, buy on Huobi Global and Sell on Binance, in that process some profits would have been generated. See the graphics below.

Made in Adobe Photoshop

From the above, the trader buys from Market 1 where the price of the asset is low and moved to Market 2 to sell, and in that process, he has taken some profit from the market.

How to take Advantage of Triangular Arbitrage

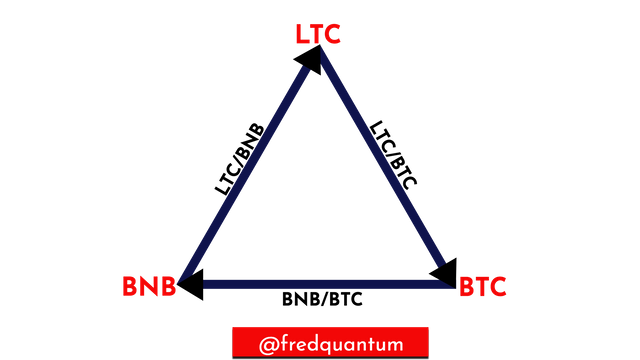

This type of arbitrage opportunity occurs when there is a price difference between 3 cryptocurrencies, remember, a triangle comes with 3 sides that's where the name is generated. In this case, traders can benefit from the cross-cryptocurrency price differences in such a way that an initial asset is sold for an asset, the new asset is sold for another asset and the third transaction is used to acquire the first asset again and that completes the triangle.

For example, having 3 cryptocurrencies BTC, BNB and LTC with price differences in a way that the equivalent price of BTC and BNB is not exactly equal to their respective value against LTC. With the above illustration, we can go in to take advantage of the triangular arbitrage. Let's see the graphics below.

Made in Adobe Photoshop

The illustration above shows how to take advantage of Triangular Arbitrage. I started with LTC assets, then, I acquired BTC by selling my LTC asset using the LTC/BTC market. At the second stage, I used the BNB/BTC market to sell off my BTC asset in the quest to acquire BNB, now at the last stage, I used the LTC/BNB market to acquire the LTC asset again. If I have properly identified the Triangular Arbitrage opportunity, then, I would have made some profit at the end of the process.

Conclusion

We have discussed the topic Crypto Assets Diversification where we highlighted what is meant by the concept, the construction of crypto assets diversification, and the effects of the process of diversification as it mitigates risk and reduces the return on investment, there are many other effects we didn't touch in this piece and I hope you'd explore them during your research.

In addition, Arbitrage trading is another trading strategy to maximize one's chances of taking profits in the crypto ecosystem. We discussed exchange arbitrage as the type whereby assets' price varies across exchanges and users can easily buy low and sell high to make profits. Also, triangular arbitrage enables traders to trade 3 assets with different cross rates.

I hope you have learned something new today and I appreciate your participation. Thank you, all.

Note that the 1 - 4 Rule isn't a standard widely accepted financial rule rather it's teaching you not to go below that range, many traders like myself utilize it and works well. The 1 - 4 Rule was only used for this lecture to teach crypto assets diversification, although, it's quite effective in putting traders on the safe side of the investment. If dividing your assets into many other parts greater than 4 is your style, you can go on with it.

Homework Task

1. Explain Crypto Assets Diversification.

2. What are the Benefits/effects of Diversifying one's assets?

3. Construct Crypto Assets Diversification according to the 1 - 4 Rule - Choose 4 crypto asset (State the reasons for choosing them), discuss each of the assets, and perform a detailed fundamental/technical analysis on them. Invest a part of at least 15 USD into each of the assets based on the diversification constructed earlier, proper stop loss and take profit levels must be put into place. A real trade on a centralized exchange is expected here. (Graphics/Screenshots/Charts are required). Note that: You are expected to show your verified account screenshot, your reservoir and the steps involved while investing (For example, if you are investing a part of 15 USD at a time, then, the reservoir must have been 60 USD clearly shown, you can use Fiat or Stablecoin for construction). Kindly take note.

4. Explain Arbitrage Trading in Cryptocurrency and its benefits.

5. Discuss with illustration how to take advantage of Exchange Arbitrage.

6. Creatively discuss Triangular Arbitrage in Cryptocurrency. How to identify Triangular Arbitrage opportunities and the risks involved.

very expensive course it is,, i have to pass. Thanks,anyway.

😭

Nice lecture @fredquantum, although am not eligible to take this class, however I have a question to ask as regards this well delivered lecture.

How do I know the coin to test my arbitrage trading with including the pair such that I don't run at loss and also caught in the web of exchange commission which might end up swallowing the profit aimed at.

You need to have identified a valid triangular arbitrage opportunity of which I stated some in this lecture and others to be researched by the students. You have highlighted some of the risks involved in this piece, I won't be able to go deeper because most of it is given as homework task.

Thanks, @lhorgic.

Thanks for the reply...I really appreciate Prof.

👏👏👏👏.. outstanding

Thanks @olabillions.

excellent informative lecture professor. Is the 1-4 Rule similar to averaging down our position?

No, it's different.

Thank you.

Excelente conferencia Profesor, un tema muy interesante que nos ayudará a tomar mejores decisiones a la hora de invertir.

Sin embargo tengo una duda, en la pregunta #3 debemos realizar una inversion en 4 crptoactivos de $15 c/u, es decir una inversión total de $60 ?

Yes, at least $15 investment in each to make $60 in total. For example, if you are investing $20 in each then the total would be $80. I hope that clarifies your doubt.

Thank you.

Entendido profesor. Muchas gracias.

Hello professor @fredquantum, please it is unfair to compel students to invest when they don't want to or are not ready to. The practical examples of investing at least $60 is not necessary. If the student has done their fundamental analysis and you're satisfied with it you score, else you do as you deem fit.

Hello @jehoshua-shey, I perfectly understand your plight on this. Remember, this is an advanced level and the academy looks beyond mere teaching as we want people to make use of whatever they are been taught. This topic is centered on investment and if no practical investment was involved, I don't think we have done anything. Thank you.

@fredquantum, this is not a good notion about investments. It's not something you can do at anytime even if you want to prove a point.

You can request for a demo portfolio or even a watchlist. But now, you want people to possibly close positions they've been holding for sometime and plan to hold even longer just to show you how to buy coins while investing, I think you're not being realistic here.

Advanced courses nonetheless, you could have just asked for a demo or asked people who have portfolios to list some of the assets they hold and possibly run fundamental analysis on them.

Funny enough, you didn't do an investment of $60 to show us samples 😏.

For my entry, please, I'm going to show some assets in my portfolio and talk about some other ones I would love to invest in but I'm not buying anything now because I can't.

I'm pretty sure money is not one of the criteria for participating in advanced courses except I'm wrong. Thanks.

You have your point likewise I have mine which the homework task solely depends on, unfortunately, it has to be fulfilled.

Your suggestion may be considered in subsequent lectures. It stands this way for the week. Thank you.

It's been my practice for quite some time and that's exactly why I deem it fit to teach and I would love to see people do it with all seriousness.

This is not the first time trading styles were taught in the academy and requires investment like this. You can call me out because I'm new on the team, likewise, I might not be here tomorrow, it's all good, but the homework task has to be fulfilled.

If you choose to do it your own way, I'm afraid it's gonna have a negative impact on your grade. Thank you.

Dear professor, please I'm not calling you out because you're new on the team. Infact, you've been doing a great job since you joined the team. I'm only saying $60 worth of real investments is quite a lot.

You said you have held investments, so you understand what it means to have to close some of those investment prematurely just to fulfill a task, it's kind of victimization.

I really appreciate your response on this issue. I'll do the assignment to the best of my financial abilities. But if I score low because I don't have enough $$, it goes without saying that there's a scent of discrimination.

hey @jehoshua-shey I read the thread and I agree with you that the $60 investment is not a small amount, but if we look it from another perspective, I think the Academy is shifting more towards practicality. If we look at the last week's intermediate lecture by prof allbert, we saw that he too demanded an investment of atleast $15. To what I have understood, I think they are now focusing more towards real life trades

Yes, practicality is important especially in advanced level courses. If you can do the task that's ok. Not all can.

Thank you Prof for this week's lesson. Excellent thoughts from you. I will be participating for sure.

Thank you, @xkool24. I look forward to seeing your entry.

Wonderful

Thank you.

Hello Professor @fredquantum, is it mandatory to set stop loss and take profit levels or can I make a normal purchase without setting them?

Yes, it is mandatory. Your take profit and stop loss levels must be well equipped.

Can you pls show a screenshot of how to set stop loss and take Profit @fredquantum

Show the levels on the charts and if you used fundamental analysis, tell us how you resolved to the levels.

Extraordinary Chapter ❣️

Thank you @eh-shohag