Trading Cryptocurrencies- Crypto Academy / S4W6- Homework Post for @reminiscence01 by @ezege11

It is a great pleasure to participate in this week's crypto academic session by prof @reminiscence01 on cryptocurrency trading.

In fulfilment of the teaching i will be performing the given homework task.

Homework

- Explain the following stating the advantages and disadvantages:

- Spot trading

- Margin trading

- Futures trading

2 a). Explain the different types of orders in trading.

b) how can a trader manage risk using OCO order? ( technical example needed)- 3 open a limit order on any crypto asset with a minimum of 5USDT and explain thr steps followed (Screenshots needed from any cryptocurrency exchange).

4 using demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected

i. Why you choose the crypto asset

ii. Why you choose the indicator and how it suits your trading style.

iii. Indicate the exit order. (Screenshots required).

Introduction

Cryptocurrency can be seen as one of the most appreciated form of payment, because of its decentralized nature. Although, due to volatility there is a high possibility of loosing funds in crypto.

From the teaching, i learnt the following:

- i. spot trading

- ii. Futures trading

- iii. Margin trading

And many more. Below are the answers the the task following the teaching.

Question 1

What is spot trading?

Spot is derived from the word spontaneous meaning immediately. Therefore, spot trading is defined as the buying or selling of a crypto asset in a given moment using a favourable timeframe.

Here, transaction made are delivered immediately in to your wallet and the transaction is been taken cognisance of at that same moment.

In spot trading, the quantity/volume of asset needed is been delivered within seconds provided there is no problem with payment.

Spot trading are used in forex trading, commodity trading, stock exchanges as well as cryptocurrency trading.

Simply put, spot trading is a spontaneous transaction that occurs between two individuals that agree to exchange commodities or asset at a given point in time and at a specific price.

For instance if 500 dogecoin sells at $50 by 12:20 pm on a spot trade, on delivery, the quantity of dogecoin will still be 500 and at the same price.

That is to say in spot trading, once the necessary requirements are reached, transaction takes place.

Advantages of spot trading

Spot trading offers the following merits:

Makes provision for the best deal: a seller/buyer may decide not to make a given transaction why he/she searches for better offers.

Minimal capital required: spot trading, unlike futures and margin trading requires as low as $10 for a start.

Reliability: due to the fact that spot trading is short-timed, in the sense that a trader sees what he pays for within seconds, spot trading have gone a long way to eliminate doubt.

Elimination of counterpart delivery failure: spot trading gives no room for buyer-seller quagmire due to delivery failure.

Give room for absorption of pressure: a spot trader have the whole time to make good decision even when he or she is at loss which is not so in futures trading.

Disadvantages

Due to volatility in the crypto market, spot traders are disadvantaged because of the losses that can be incurred if one uses spot trade for a buy during a downtrend.

Taking more risk while trying to manage risk. In spot trading closing and reopening a loosing trade will bring about more looses because of the minimum volume of funds available for trading.

Loss of funds due to FOMO: traders especially newbies tend to rush into trades on seeing a pump due to fear of missing out without doing the necessary analysis.

Minimum profit: spot trade unlike futures trade have very low profit. i.e in spot trading, a percentage increase of 50% may end up adding $10 dollars to your wallet but in futures trade it is far greater than that.

Margin trading

Leverage is a concept that ideally explains margin trading. That is to say, margin trading deals with acquired funds from third party to capitalize on thereby giving you a more greater returns.

Here, the margin position is valued more than the volume of asset you are entering a trade with. For instance for you to be able to trade $40000 worth of bitcoin, you just need to have 1% of the volume you want to trade by so doing, you are keeping your position open or you are opening a position.

Advantages

Leveraging: being able to use acquired fund paves way for more trading opportunities.

Greater profit: for the fact that you acquire in multiples what you have in your wallet to trade with gives you the opportunity to make more money.

Disadvantages

In as much as you can use acquired money for trading, there is high risk obtained trading margin.

Inasmuch as margin trading gives room for massive profit, if trade shoild go the wrong way it will bring massive loss.

I always tell my guys that margun trading is not for newbies that is to say, a high level or knowledge is required for someone to trade margin sucessfully.

Future trading

Future as the name implies, talks about a agreement between a buyer and a seller to make a transaction in a moment yet to be without taking cognisance of the current market price of the commodity.

It is a treaty between two person to make a transaction at a stipulated price in the nearest future.

Future can be traded on different assets which may include:

- commodities

- stock

- indices

- currency pairs

Advantages of future trading.

Advantages of future trading may include:

Predicts future demand and supply of an asset. Future trading provides traders with a wide information about the future price of an asset.

Equal opportunity: future trading provides everyone equal opportunity to participate in a trade. Small traders participates by making their little deposit instead of paying up all the funds for the asset.

Gives room for better analysis: due to high risk and volatility future traders take good time to make their analysis to avoid liquidation.

Disadvantages

Rapid movement of future price: the price of a given contract can either increase or decrease on a daily basis and if it goes against you, you will be required to fund your wallet or leave the trade.

Contract deadline: future trading as a contract have an expiring date and once it reaches, the asset looses its value.

Difficulty in opting out of a contract: future trading is somehow difficult for a layman to deal with and may lead to loss of asset.

Difficulty in predicting the future: as it is hard to predict what will happen in the future or even the next day. Same thing is applicable in futures trading it takes a high level of expertise to predict market moves in futures trade.

Question 2

a) Explain the different types of orders in trading.

b) How can a trader manage risk using OCO order? ( technical example needed).

There are four types of order in trading. They include:

- Limit order: this is used when a trader wants to enter a given pair at a particular price other than the current price.

In limit order, the trader places his order and whenever the price of the asset reaches that point, it opens the trade.

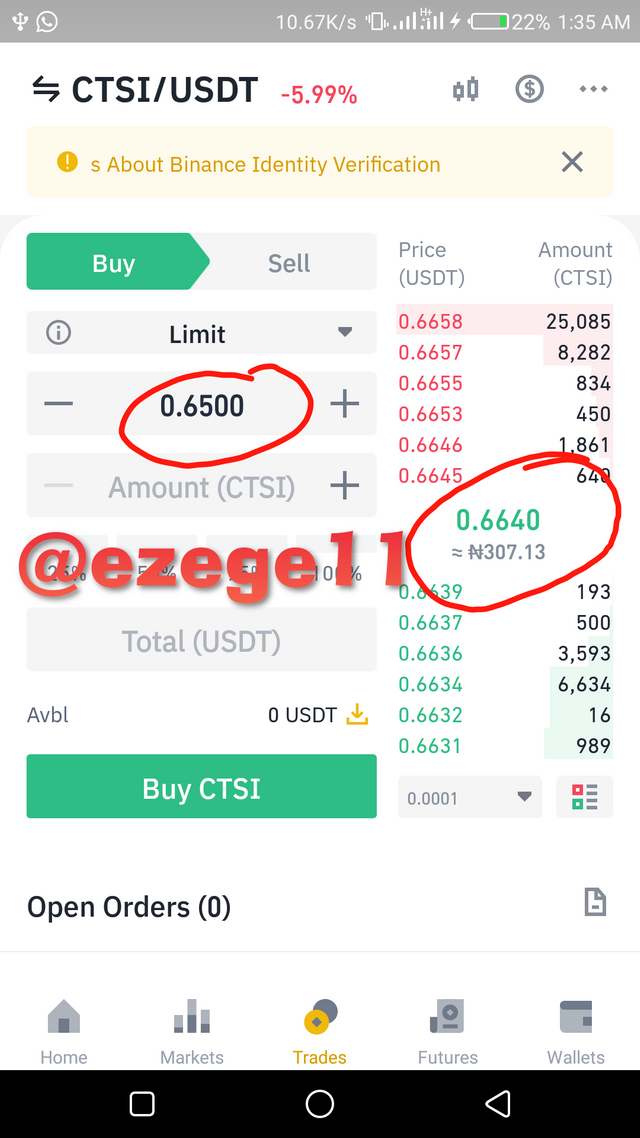

From the above screenshot, the actual price of CTSI is $0.6640 but the buyers wants to buy it at $0.6500 so he set his limit order at $0.6500

- Market order: here, a trader enters a trade at the immediate price of the asset.

That is to say, in market order, a trade is been open as soon as the trader places the trade because the price at that moment is been used.

From the above you can see that the price of the asset at that moment was used in opening the trade.

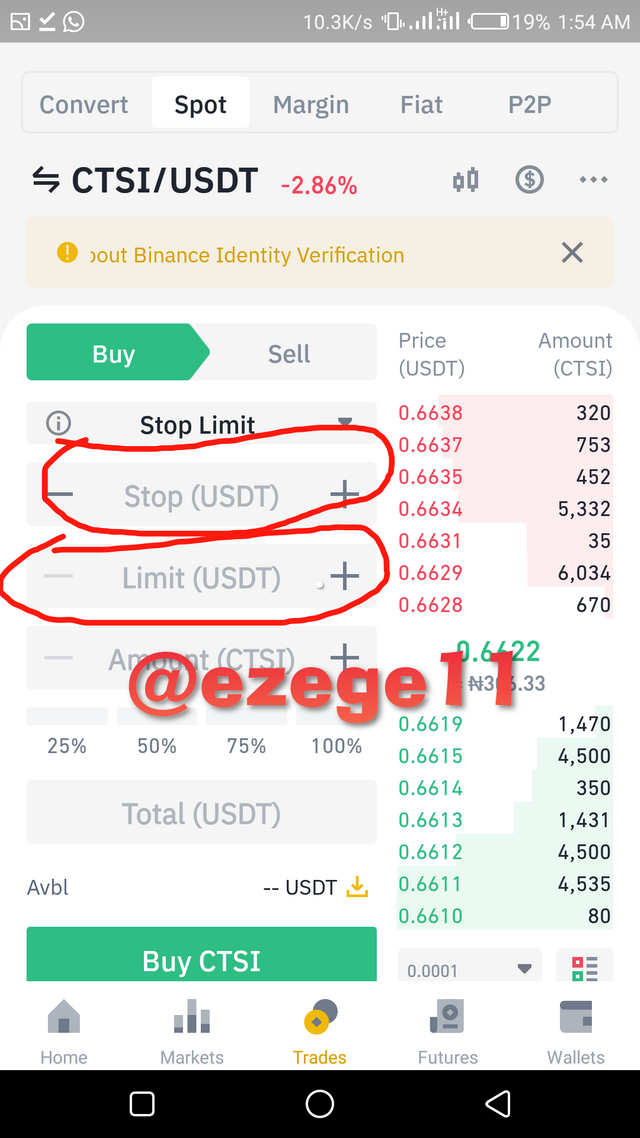

- Stop limit: here, there is the combination of both stop loss and limit order, in that you can place a limit order and also add a stop loss in order to minimize losses.

In the above screenshot, you can see that you open your order by placing a g order and then put you stop loss.

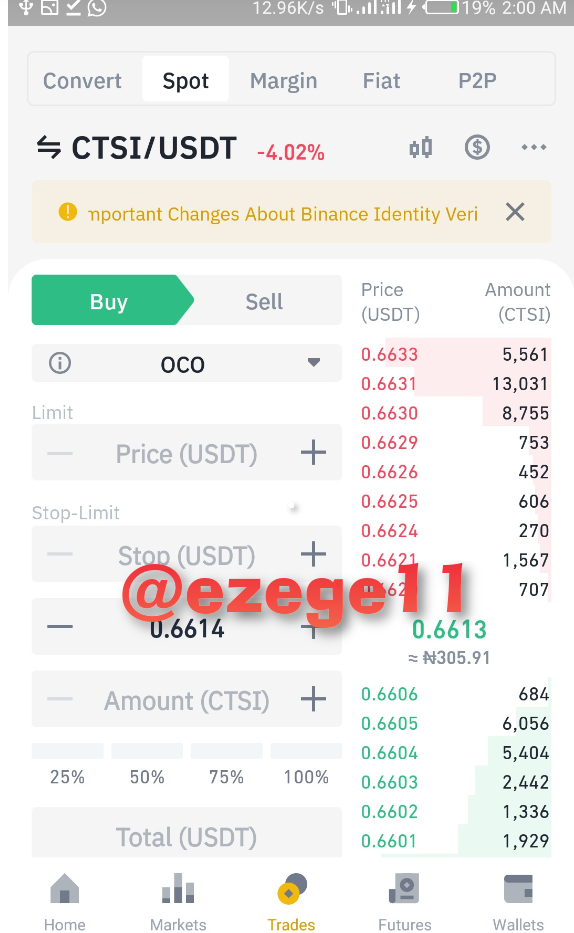

- OCO : this is a combination of limit and stop limit. In creating an order, you place a limit as to where will enter the market and also a stop loss to avoid loss of asset.

The above screenshot explains OCO order

b) How a trader manage risk using OCO order.

Technical example needed.

OCO order provides a trader with the opportunity to minimize loss in the sense thatthe trader one opening a trade inserts his limit (from where he want to enter a trade) as well as a stop loss which prevent loss of asset if the trade should go beyond that point.

By opening this two limits there are minimal level of risk in the sense that once the criteria for the buy is reached, the buy order opens and the other cancelled out.

The above screenshot is an example i will use to explain how OCO is used to manage risk.

Looking closely, i placed my limit order at $0.6629 and my stop loss at $0.6620 but the actual price of the asset at the moment is $0.6626.

As the price was going up, once it reaches $0.6629 my order will be opened and if there is any fall in price, once it reaches $0.6620 i will be dismissed from the market thereby preventing further loss. This is how traders manage risk using OCO order.

Screenshots used in explaining the above question were gotten from binance

Question 3

Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed).

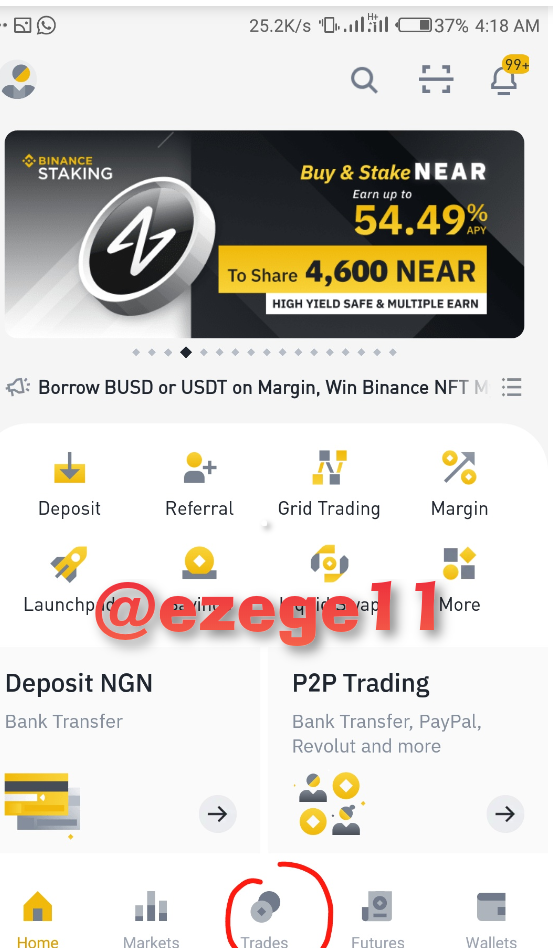

I will be using binance exchange for this task following the underlisted steps.

- STEP1

I will open my binance app.

STEP 2

I went to trade and selected spot.

STEP 3

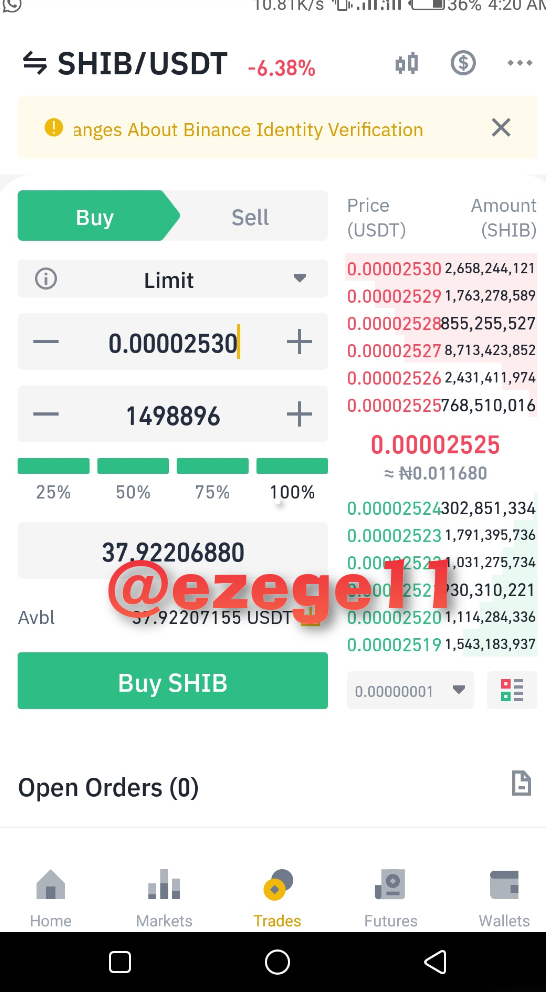

On the spot i traded shiba/usdt pair

In the above screenshot you will see that i places my trade above the current price at that moment and placed my order at $0.00002530 while the price of the asset was $0.00002525.

screenshots used in answering the above question was gotten from binance.

Question 4

Using a demo account, of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

i) Why you choose the crypto asset.

ii) why you choose the indicator and how it suits your trading style

iii) indicate the exit order

The above screenshot was gotten from https://www.trading view.com and was edited using https://www.visualwatermark.com/app/add-text/

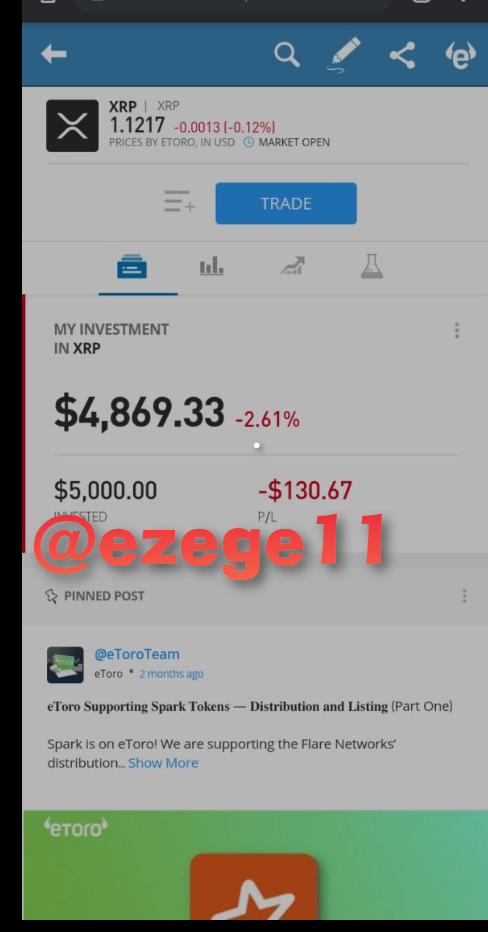

I chose xrp because its value is growing very rapidly and as a matter of fact i gat my eyes on xrp.

The technical analysis I used was the demand and supply strategy with the help of macd indicator which helps me with direction.

The supply and demand strategy help me identify where banks and bug institutions are buying this crypto asset and help me buy there too.

Below is my exit order for this experiment.

The above screenshot was gotten from https://www.hedgewithcrypto.com

Conclusion

My reputable prof. @reminiscence01 i really appreciate you for this lesson learnt and the assignment given making me gain more insight about cryptocurrency.

any trading robots you can trade with?

Hello @ezege11 , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Thanks for the correction I'll do better next time