Crypto Academy Week 15 - Homework Post for Professor @yousafharoonkhan – on Order Book.

.jpeg) source

source

Hi Steemians, I really enjoyed this very informative lecture by Professor @yousafharoonkhan. This lecture is well packaged to equip every trader for better trading through the effective use of Order Book. The followings are my assignment post.

Question no 1 :

What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy paste or from other source copy will be not accepted)

Order book consist of buys and sells option in an exchange platforms.

It is worth noting that, exchange firms never hold the coins, they only match buyers and sellers and take their fee as a commission.

Order book basically, represent how many orders are happening at what price.

Thus, order book is an exchange electronic book, that consist of lists of currency pairs of buy and sell orders at their present values.

Order book differs in so many areas from our local market.

Here in Africa, Nigeria to be precised, I will look at their differences in the following topics:

Accessibility.

Exchange order book has made available all the sells and buys prices in one spot. All you need to do is at the click of a button.

Whereas, in our local market, you will need to visit different locations to buy all that is in your buying list.

Bargaining.

There is no bargaining, compromise or price negotiation in the exchange order book, they are all based on current value or worth. However, in the local market, prices are subjected to bargaining.

Middlemen.

Exchange platforms act as middlemen by providing the platform for buyers and sellers to trade. Unlike, our local markets where there are no middle men.

Fee.

The exchange firm collects fee for every transactions made through their order book. Whereas, our local market charges no fees.

Question no 2 :

Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.(Answer must be written in own words)

Pairs

Support and Resistance

Limit Order

market order

The following are the steps to access order book. However, I used Binance exchange platform.

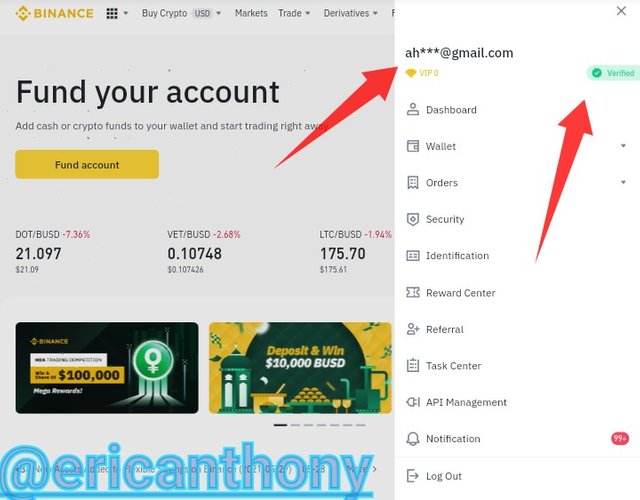

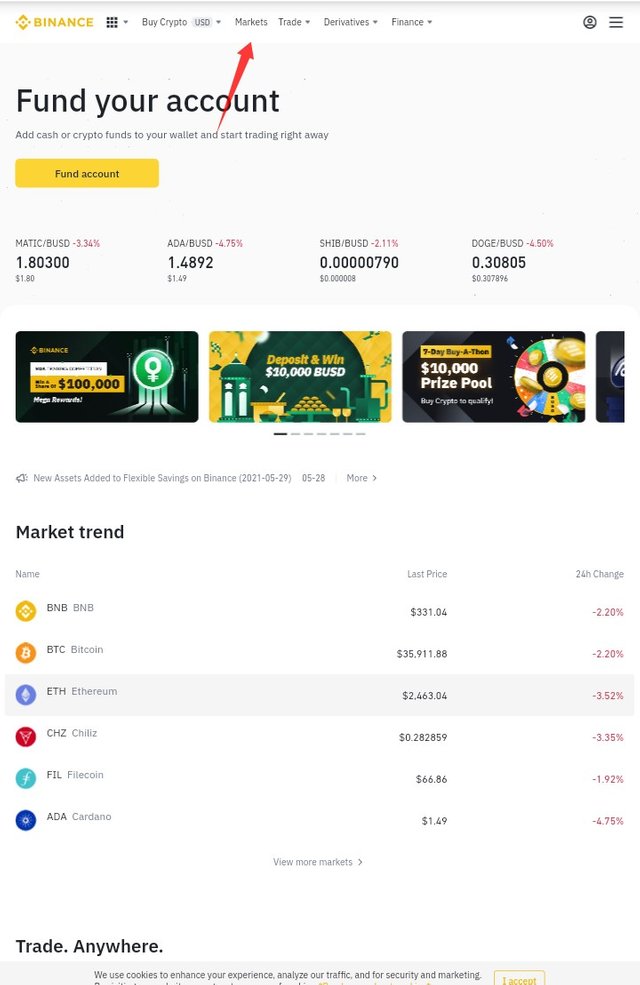

Step1. Login to your Binance account and click on market.

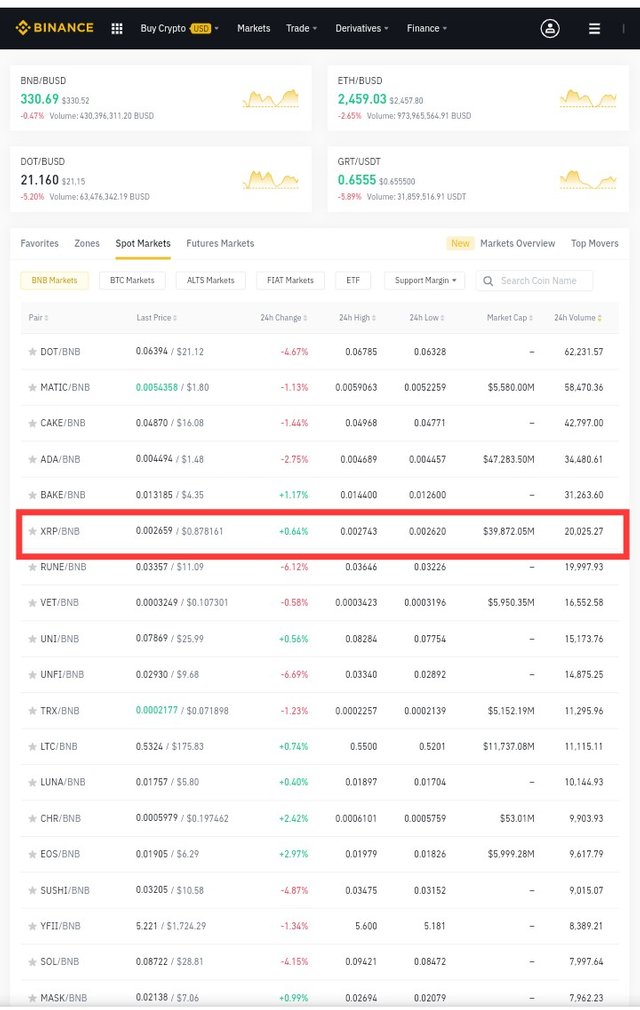

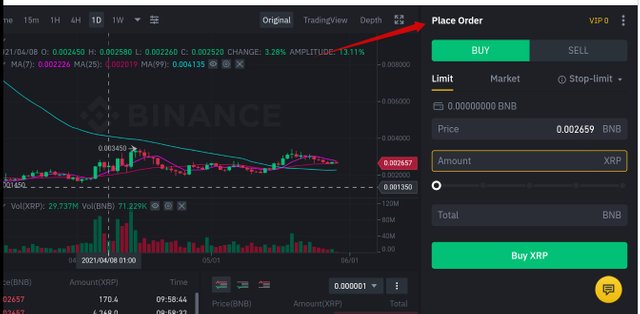

Step2. Having clicked on market, it will take you to all the currency pairs in the market, where you select anyone of your interest. Here, I clicked on the XRP/BNB currency pair. Which will launch you into Order Book.

Order Book.

Trading pairs.

These are assets that could be crypto trading pairs or fiat crypto trading pairs and can be traded for each other on the exchange platform. Example, BTC/ETH or BTC/USD.

Trading pair makes it possible for us to know or establish the true value of an asset, when we trade it with another asset.

Support.

It is one of the buy indicators in technical analysis where the bearish price of an asset does not cross in a given time, due to increase in the number of investors entering the market at this level in order to buy low. Usually, a simple line is drawn along the the lowest lows of a period of time.

Resistance.

This is one of the sell indicators in the technical analysis where the price of an asset encounters pressure on at it's bullish trend, due to the increasing number investors that wish to sell off at that level of price.

Usually, a line is drawn at this highest level when it has repeated up to two or more times as the resistance level.

Resistant level guides investors as to when best to sell. Example

Let's assume that Mr A is studying the price history of his XYZ asset to determine when best to sell off. Let's say over the last 6 months the price of xyz asset has traded (fluctuated) between $20 and $50 with interval of one month. So, by the end of the six months, Mr A. must have been able to establish the clear resistance level of $50 price for the xyz asset. Which is most probably, the best time to sell.

Limit Order.

This is an order that allows a trader to buy or sell an asset at a specific price or at a better price.

From the order book, a trader can set a limit price to buy or sell, by doing this, the trade can only be carried out when the market price is up to the limit set by the trader. Thus, traders or investors can utilize the limit order to earn more or to pay less.

Market Order.

This is an order to sell or buy an asset quickly, at the immediate best available price. However, the price at which the order will be executed is not guaranteed.

Question no 3 :

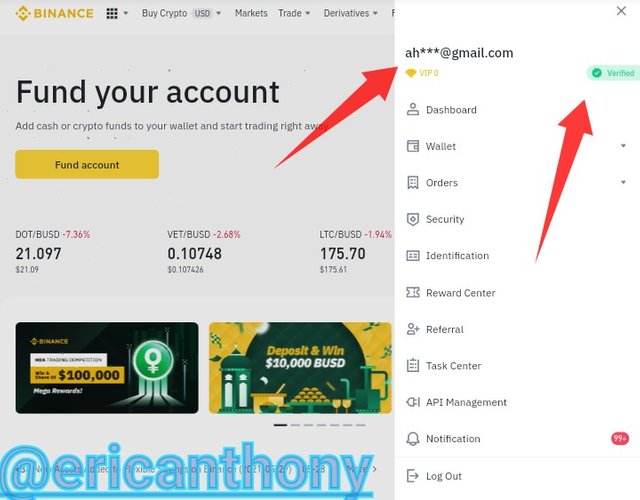

Explain the important future of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words)

Order Book.

One of the prominent features of order book is the buyers side (bid) and sellers side (ask).

So, from the buyers side:

Bid – is the price the buyers wants to offer.

From the sellers side:

Ask – is the price the sellers are wants to take.

Buy Order.

This is used to execute the purchase of the asset you desire, by selecting a pair of currency that services that very purpose. (exchanges the currency you have, to buy the currency you need)

Sell Order.

This is used to execute the sell of an asset. Here, you sell the currency you have in order to earn the value you need in another currency.

Question no 4 :

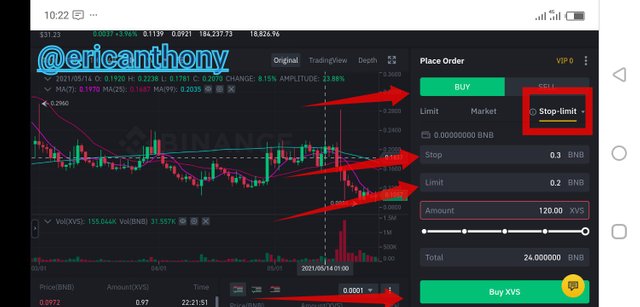

How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.(Answer must be written in own words)

Stop Limit Order consist of two aspects.

Stop Price: this is the price that initiate limit order.

Limit Price: this is the standard limit order. Usually lower than the stop price.

With this, once the stop price is reached, the limit order will be placed immediately.

How to place buy and sell order in stop limit trade.

Having logged into you Binance account. Click on market and select the currency pair of your choice. For the purpose of illustration, I used XVS/BNB currency pair.

For the buy stop limit order, I used 0.3 for the stop price and 0.2 for the limit price.

As I said earlier, that once the stop price is reached, the order becomes a limit order and will be placed at the limit price.

Same applies to Sell Stop Limit Order which I placed 0.7 as stop price and 0.6 as the limit price.

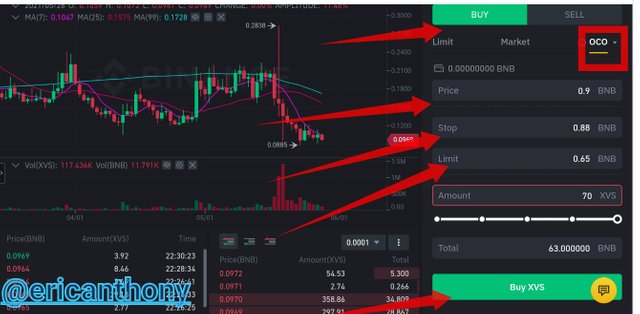

How to place buy and sell order in OCO

OCO (one cancels the other) makes it possible to place two orders at same time. However, only one will be executed.

Here, I used same currency pair (XVS/BNB) for the illustration.

Question no 5 :

How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

Order book is rich with informations for traders to take advantage of, to make profit and reduce loss. In otherwords, order book has made it possible for traders to make informed trading decisions.

With the aid of limit order, traders can set a certain price they want to buy or sell an asset and when that set price is reached, the order will be executed automatically. Which means that traders can still buy as low as they want and also sell as high as they want, it may take time but they will get what they want. Thus, the traders will be making huge profit.

There is also the flexibility OCO brings to the table, which allows the trader to buy and sell an asset automatically, to make profit or maybe little loss.

Order book also enables traders to accurately evaluate the liquidity of the market.

Conclusion.

Order book has proven to be a very useful tool in trading.

By just studying the order book, traders will know how healthy the market is. However, I have now seen that there is high need for all traders (potential and existing traders) to learn and understand how to read and use every aspects of order book in their trading. Thanks to professor @yousafharoonkhan for this very important informative lecture.

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

If you look at feature in the order book, you will see a lot of technical and simple advance feature. You have not searched for futures in detail. it is very much important to explore the order book to use the feature that will help you in trade

How an order book can help a trader make a profit ,your answer was very much short , need more detail to explore this question۔

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 6

Thank you professor @yousafharoonkhan. I really appreciate.