Steemit Crypto Academy Contest / S15W2 - Stock To Flow Model

A gold miner is tasked to find and mine new gold. He begins the task and the way at which he can find new gold is called the "stock", and the rate at which he can mine, it is called the "flow". Now, let's imagine that the gold which the gold miner finds is not infinite, - it has a finite amount. And at the same time the cost of mining gold goes up over time.

This is called the "stock to flow model", and it is a way to measure the scarcity of a commodity, especially Bitcoin. The stock to flow model can be used in so many aspects such as real estate, arts, products manufacturing and more.

In the second week of the Steemit Engagement Challenge season 15 in this community, we shall together, explore the concept of the "Stock To Flow Model"..

Pixabay edited using pixellab

The Stock to Flow Model is a way to measure the scarcity of an asset. It looks at the ratio between the stock (the amount of the assets that is presently available) and the flow (the rate at which new set/units of the assets are being produced). The higher the ratio, the more scarce the assets will become. It can be used to compare and determine different assets to know which ones are more scarce.

In cryptocurrency, we have the Bitcoin's Stock to Flow Model. It is way of measuring the scarcity of Bitcoin just like other cryptocurrencies, based on the total supply and the rate at which new ones were been created. The model was first proposed by an anonymous analyst called PlanB. It uses the concept of the stock to flow ratio to predict the price of Bitcoin.

According to the model, the rate of scarcity of Bitcoin will increase over time and as so the supply of new coins decreases which should result in an increase in price of Bitcoin as demands suppases supply.

The Stock to Flow Model can be used for various things and various ways;

- It is used to measure the scarcity of an asset.

- it can be used to determine the value of an asset or to compare the scarcity of various assets.

- It can also be used to make predictions on future prices of assets based on its scarcity.

- It can also be used to make assessment on the risk associated with an asset based on its scarcity.

- Finally, it can be used to help investors in making informed decisions on which assets to invest in.

There are both advantages and disadvantages of the Stock to Flow Model and they include;

Advantages

- It is easy to understand and easy to use.

- It provides a simple way in measuring the scarcity of an asset.

- It can help investors in the market to make informed decisions on/about which assets to invest in.

- It can be used to assess the risk or investment per time .

Disadvantages

- It doesn't take into the account, all of the factors that affects the price of an asset. Such as demands, market sentiments, regulatory changes, global economic conditions and completion from other cryptocurrencies. For example, it doesn't fully take into account, supply and demand, which can create big impact on the price of an asset.

- It can be difficult to get 100% accurate data on the Stock and flow of an asset.

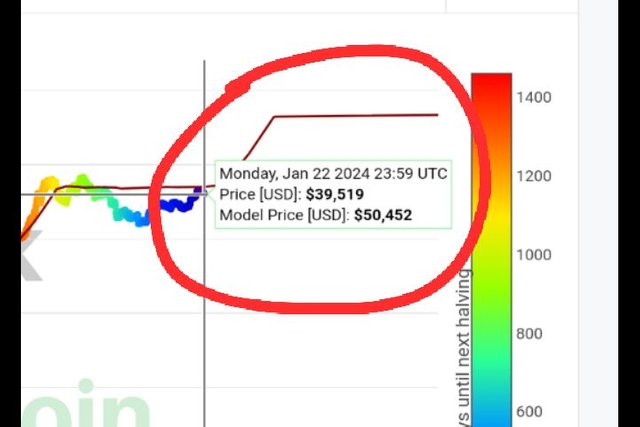

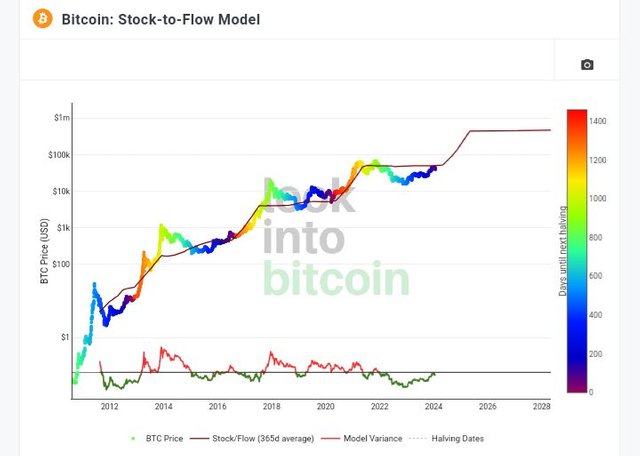

On the above chart of Bitcoin, we can see that the price is lapped on top of the Stock-to-flow ratio line. First, we have to look very well to see if the trend of the line over time s generally going up or down. This alone will give us the idea of the overall trend of Bitcoin prices. And so, the trend of the line on the chart above is generally going up, showing that there has been significant increase in the price of the asset.

As of Monday, 22nd of January, 2024, the price of Bitcoin was $35,519 and the model predicted price was $50, 452. Now we can see that the price of Bitcoin was lower than the predicted price. This could or may mean that the Bitcoin market is currently undervalued.

This could be due to a number of factors such as low demands, negative news about the assets(Bitcoin), or lack of confidence in the market. It could also be due to some technical reasons, such as a lack of trading activity and lack of liquidity.

In most cases, the price may be artificially down be as subject to manipulation or other market forces. However, it is important to note that the stock To Flow model is just one tool amongst many that is used to analyse the Bitcoin market/token, and it's not always 100% accurate.

Yes, the Stock to Flow Model graph can be applied to STEEM, but with some injunctions or to some extent. It can help us to understand the potential future price of STEEM just like Bitcoin. The major limitation is that STEEM is a digital asset that can be "created" or "mined" at any time. This means that the supply of STEEM can be increased or decreased at any time which affects the stock and flow of the cryptocurrency.

In addition, the price of STEEM can be affected by other possible factors, such as the competition from other digital assets/cryptocurrency, market Sentiments and demands.

So while the stock to flow model can provide some perception in the supply and demand of STEEM, it should be used with caution and care. Just as there are other means, the stock to flow model should not be relied on exclusively, but with other analysis tool and techniques.

In conclusion, the Bitcoin stock to flow model is a useful tool for analyzing the Bitcoin market, but it is very important to always remember that it is not perfect. The model can be inaccurate in some cases because of some factors it doesn't considers or take into account which will affect the price of Bitcoin.

It is necessary to remember that past performance is not an assurance for future results. So use the stock To Flow model as just one tool in your analysis and not the only to be used as there are others!

Thanks for reading

I invite @kidi40, @patjewell and @dar22

Greetings @emmy01, your explanation of the Stock-to-Flow Model's various uses is truly impressive. You've highlighted how it measures scarcity, determines value, makes predictions, assesses risk, and aids investment decisions, showcasing its incredible versatility. This makes your article not only informative but also practical for readers interested in understanding how this model can be applied not only in the cryptocurrency space but in the financial market across assets.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

@emmy01 Your explanation of the Stock to Flow Model is spot on making it easy for anyone to understand. I appreciate how you broke down the advantages and disadvantages offering a balanced perspective. Your analysis of the Bitcoin Stock to Flow graph is insightful. Best of luck in the contest!

Highlighting the various uses of the Stock to Flow Model, including measuring scarcity, determining value, making predictions, assessing risk, and aiding investment decisions, showcases its versatility.

This makes your article not only informative but also practical for readers interested in understanding how this model can be applied in the cryptocurrency space. Well done!

Looking at your analysis of Bitcoin on the graph.

You truly understand the concept of stock to Flow model, and can Apply it well.

Understanding that stock to Flow model helps very well to analyze and predict market prices in cryptocurrency, it's also limited to not considering all necessary factors of the commodity, and also difficult to get accurate and full data involved.

Though it can be applied to steem but steem is kind of different a little and thus needs critical and logical steps to apply well.

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

@emmy01

You have given us the example of a gold miner is assigned to find new gold and the miner starts the task in which he finds new gold and the gold finder gets a limited amount of gold. If you talk, there is a quantity of this gold and the quantity is known according to this quantity. If I remain, the rate increases, so the price can be estimated. Explained how the stock-to-flow model is designed to determine the value of Bitcoin is specifically used to determine the value of an asset, meaning that it is clearly related to Can tell your post is admirable indeed you are doing excellent work and I hope you will get success in this competition.

Saludos cordiales gran amigo emmy01, un gusto para mi saludarte y leer tu participación.

Buena presentación, una buena calificación, un gran trabajo para explicarnos el método stock to flow y sus ventajas.

Te deseo muchos éxitos, que tengas un feliz y bbendecido día.

Hello dear friend greetings to you, Hope you are having good days there.

The "stock to flow model", is a way to measure the scarcity of a commodity, especially Bitcoin. Very well said. You also said that the stock to flow model can be used in so many aspects such as real estate, arts, products manufacturing and more, that's so much amazing analysis platform. You say using it for STEEM also work on Minor level. Yeah true, but I think we should use it for major commodity like BTC, or gold.

The best post dear, best wishes for the contest.