Steemit Crypto Academy Season 4 - Homework Post for Task 5 : Bitcoin, Cryptocurrencies, Public chains: by @elvis101

(2) What Is Cryptocurrency and How Would You Like To See Cryptocurrency In The Future?

What Is Cryptocurrency ?

INTRODUCTION

The word cryptocurrency is currently overwhelming the financial world. The world is getting more acquainted with cryptocurrency as the days go by. Meanwhile before I go further to discuss the concept of cryptocurrency, I would point out some discrepancies associated with the word cryptocurrency.

⦁ Cryptocurrency does not imply the same meaning as “digital currency”

⦁ It is only a form of digital currency. All cryptocurrencies are digital currencies but not all digital currencies are cryptocurrencies

⦁ Digital currencies are simply currencies that are generated electronically and are transacted and stored in the virtual space. They are created by the digital computation of 0s(ZEROs) and 1s(ONEs).

⦁ However, cryptocurrency is more complicated and secured than the usual digital currencies that are issued by the Central Bank of a country.

Note: Virtual currency may be differentiated from digital currency in some context, the difference being that the latter is regulated by the Government of a country while the former is not.

CRYPTOCURRENCY

Cryptocurrency is an electrically generated money that relies on the encryption and decryption of Cryptography for its validation, security, and production of more coins.

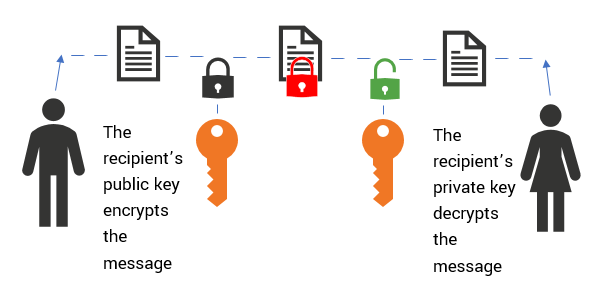

Cryptography is a means by which cryptocurrencies are made secure and maintain continuity. It primarily ensures that third parties are not able to sniff out valuable data from the network and it eliminates double-spending. It does this by its implementation of the private and public keys.

)

source

)

sourceThe Public Key is the public address that is visible to transacting parties. It can be likened to our bank accounts. It is the encryption key that can be made visible without our cryptocurrency being compromised.

The Private key is the private address that can never be made visible to anyone except the owner of the address. It serves a similar function as our ATM four-digit pin that is unique to every account holder. It is the decryption key that ensures that data is only discoverable by the intended receiver. Its exposure can compromise one’s account.

It all started with Bitcoin. Bitcoin adopted cryptography for securing and validating its coins. And it used the hashing function for encryption of its data. The Genesis Block of bitcoin had a 64 historic hexadecimal – a mode of securing and validating its transactions that would later be adopted by emerging cryptocurrencies.

Features of Cryptocurrency

Certain features are peculiar with almost all, if not all cryptocurrencies. These features combined uniquely separate them from other digital currencies.

Security: Cryptocurrency blockchains are highly secured. As discussed above, they use encryptions embedded in the public and private keys to ensure that information is kept safe from malicious hackers.

Anonymous Transactions: Here, the only means of identification is the public keys, therefore you don’t know who is at the other end when transacting in the crypto space. Transacting parties are entitled to their privacy and thus are difficult to trace.

Scalability: Scalability entails the timing or latency in the creation of a block. All cryptocurrencies have their creation time for a block (A block constitutes several verified transactions that serve as an input for the formation of a hashing algorithm (Identity of the block)).

Every block has the maximum number of information it should contain in a designated time interval. For example, it takes Bitcoin ten minutes to complete the creation of a block, 15 seconds for Ethereum, 20 seconds for Cardano, and 3 seconds for Steem, and so the list goes. More cryptocurrencies are coming up, intending to beat others in terms of scalability. Solana, for example, is a crypto blockchain renowned for its scalability speed.

Immutability: Cryptocurrency transactions cannot be reversed or changed once done. Cryptocurrencies operate in a decentralized model with information stored simultaneously on all connected computers (nodes), therefore it is very difficult or impossible to change information on all these nodes.

Decentralization: The mode of operation of cryptocurrencies ensures that all computers are connected one to the other without the interference of any middle man or centralized authority. It supports peer to peer network where all participants of a network can directly communicate with each other. However, some crypto blockchains are more centralized than others.

Proof of work: It ensures the security and continuity of a cryptocurrency. The Bitcoin blockchain is the progenitor of the Proof of work. This is a system that uses high energy in the mining of new crypto coins and validating of peer to peer transactions.

The proof of work is a combination of the complex computational algorithms (cryptography) and reward allocated to miners for solving these complex mathematical problems. The proof of work is not a feature that is atypical of every cryptocurrency ecosystem, as some such as Steem, Cardano and IOTA and numerous others do not rely on Proof of work for its continuity; however, it is still a major feature for thousands of cryptocurrencies. The proof of work eliminates the eventuality of double-spending.

- Proof of stake: This implies mining based on the number of coins held by a miner. This means that miners on ecosystems that support this model of mining must first purchase the coins as opposed to proof of stake where a miner can earn coins by buying them. Here, a miner’s mining power is determined by their ICO (Initial coin offerings).

Proof of stake chooses which node is eligible to add a block to the blockchain by a form of consensus among the members of the network. The requirement is that the node or participant must have a high stake in comparison with other participants on the network.

Steem uses a different variation of the proof of stake which is known as Delegated proof of stake (Dpos). Like the Pos, for a steem user to be eligible to add a new block to the blockchain, they must be a large holder of the SP (steem power).

The difference here is that steem chooses the node that adds a block through voting that is done only by steem's 21 witnesses. This is somewhat contrary to the underlining feature of Pos where the node that adds the next block to the blockchain is a product of the consensual voting of all nodes in the network.

A summarizing feature of cryptocurrencies is that they all thrive on blockchain technology.

What is Blockchain technology to cryprocurrency?

Blockchain technology is to cryptocurrency what a road is to a car. It is a technology where all nodes in a network are directly connected (peer to peer). Its major feature is decentralization (discussed above in point 5).

This ensures that no middlemen or central authority are dictating the network, giving all nodes in the network equal rights. Data in the network is equally distributed to all nodes making its record-keeping almost impossible to alter.

It is important to note that blockchain technology supports hierarchy, however, hierarchy here is determined by democratic processes as opposed to what is obtainable among centralized or private chains.

Merits

- Less fee.

- Faster transactions.

- Farther outreach (combats location barrier).

- Less prone to fraud.

- Can be used to solve a lot of problems in various sectors of the economy.

- It is generally a faster networking system.

- Highly secured.

Demerits

- High energy consumption.

- Problem with scalability.

- Lack of centralizing body and anonymity encourages fraudulent activities.

- Recovery of lost keys is almost impossible.

- Security with blockchain technology may be overly hyped.

Cryptocurrencies can be classified based on value and/or precedence (time of occurrence).

Table showing the classification of cryptocurrency.

| Crypto coin | Classification |

|---|---|

| Stable coins | Value |

| Alt coins | Precedence |

| shit coins | Value |

| Meme coins | Value |

| Fork coin | Precedence |

| Bitcoin | Value & Precedence |

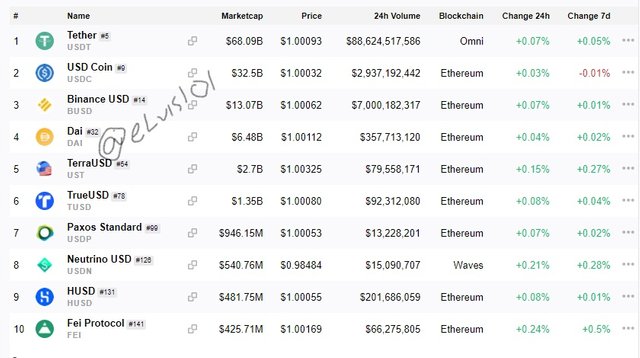

Stable coins: These are coins that have their value fixed to the value of a fiat currency or asset such as gold. For example, USDT is a stable coin to the US dollars, that is the value of 1USDT will always equal the value of 1USD. As of the time of writing, there are 34 stable coins in existence.

Shit coins: These are altcoins that have no definite purpose for being in the market, hence are deemed valueless or shitty. They are not solution-oriented. These coins usually lack long-term investors. These qualities make them unadvisable for traders to purchase, though some of them have shown to be very yielding.

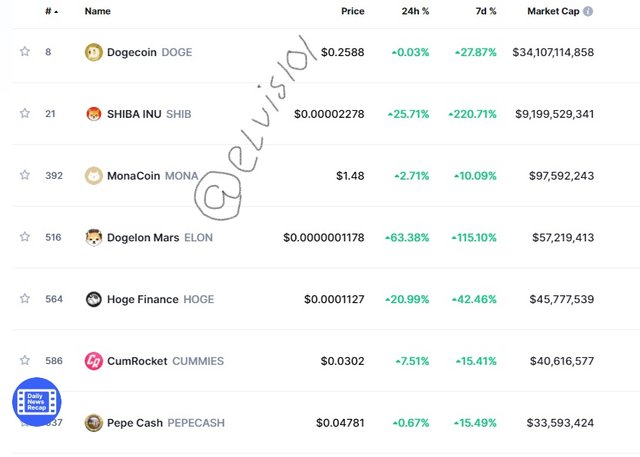

Meme coins: These are a group of cryptocurrencies that draw their value from jokes or funny pictures. They have been quite on the increase since the inception of the first meme coin - the DOGE coin in 2013. The majority of them have a small market cap because of the uncertainty investors have towards these coins, skeptical that they might just be shit coins after all.

Altcoins: These are all the coins that are borne because of the implementation of Bitcoin - the first crypto project in 2009. They are all the coins that are not bitcoin. They are all adopting the original bitcoin signature of cryptography and decentralization. Some of these altcoins were created to tackle the limitations of bitcoin: Some of which have grown to be very popular and may well compete with bitcoin in the nearest future. The first and most promising altcoin at the time is ethereum, which was created in 2013 by the developer, Vitalik Buterin. Others include Cardano, Solana, Binance coin e.t.c.

Fork coins: They are coins that are developed from already existing blockchains. They are a product of a change in the software protocol of these existing blockchains. The blocks of fork coins either break out completely from previous blocks (hard fork) or are slightly changed in protocol (soft fork), usually for better enhancement. Soft forks are managed by the original developers (management team) of a coin while hard forks usually mean a new set of developers controlling the system. One of the popular fork coins is the bitcoin cash – a forked coin of bitcoin.

_LI.jpg)

Bitcoin: Bitcoin is the first successful cryptocurrency experiment that was created in 2009 by an unknown personality that has come to be recognized by the pseudo name, Satoshi Nacomoto. it is the prototype of all cryptocurrencies in the market today. Bitcoin, as many believe, was created to rid financial transactions of the centralized influence of middlemen like banks.

Bitcoin rewards experience what is known as halving to ensure that it retains its value across time. Bitcoin halves after every 210,000 blocks are formed. In the early days of bitcoin, 50 BTC were rewarded to miners as Proof of work, it then halved to 25 BTC in 2012, and then 12.5 BTC in 2016, and by February 2021, miners began receiving 6.25 BTC. The reward will continue to be halved until bitcoin reaches 21 million coins.

The Genesis block of the bitcoin signified the launching of the bitcoin and carries with it all the necessary features (Data, hash, proof of work, reward e.t.c that would later become characteristic of subsequent crypto coins to emerge.

The concept of mining and cryptography (public and private address) all started with bitcoin.

Being the first cryptocurrency, bitcoin popularized the concept of blockchain technology.

It is important to know that cryptocurrencies don't exist in a vacuum: they have a place where they are stored and these storage devices are known as a wallet or rather Crypto wallets

Crypto wallet

Wallets are to cryptocurrency what our bank accounts are to our fiat currency.

A Wallet is an online or offline virtual storage device where cryptocurrencies are stored. it stores the public and private keys for transactions.

Cryptocurrencies are majorly stored in two types of wallets, they are:

1 Hot wallet (storage)

2 Cold wallet (storage)

Hot wallet: These are the more popular online wallets that are connected to the internet. This wallet has a public address that serves as an identification address and can be made visible for transactions or any other related purpose.

It also has a private address that is accessible only by the holder of the wallet. It is used to confirm a transaction. The information in these wallets is usually stored on a server, thus is more prone to hacking. They are less expensive and more convenient to use because they are directly connected to the internet.

Hot wallets are sub-categorized into web, mobile, and desktop wallets. Trust and Luno are examples of hot wallets.

Cold wallet: These are offline wallets that hold cryptocurrency. They also possess public and private addresses as explained above. They are not stored on any server as information in these wallets is only accessible to the holder of these wallets. This makes them more secure and difficult to hack.

They are more expensive and less convenient when it comes to trading because they are not directly connected to the internet. Hardware wallets and bitcoin paper wallets all pass as cold wallets. Examples are Trezor and Bit2 me wallets.

Someone new to the world of cryptocurrency may wonder how these coins are traded. How do people liquidate these coins? How can I convert a cryptocurrency to my local fiat currency and vice versa?

Thanks to the crypto space: It is almost a perfect system with all the necessary platforms that are needed for its smooth operation. Cryptocurrencies are traded in the market just like we do in the physical world; however, the crypto market runs online in the virtual space of the internet. A cryptocurrency market is known as an Exchange.

Exchange in Cryptocurrency

An exchange is simply a virtual market where you can buy and sell cryptocurrencies.

They determine buy and sell orders and provide trading pairs one can trade. Here you can choose to trade cryptocurrencies for fiat currency or trade between cryptocurrencies, for example, you can trade USDT for bitcoin. Exchanges also determine trading pairs that are available for trading; some have more trading pairs than others.

The table below shows the pairs available on some popular exchanges.

Exchanges are categorized into Centralized and Decentralized exchanges.

Centralized Exchange: A centralized exchange is an exchange that has a regulatory body that is responsible for the registration, verification, and identification of its users. This regulatory body oversees the activities in the exchange. This type of exchange has a unified server that attends to clients on the exchange.

Centralized exchanges are more popular among crypto users. They are preferred to decentralized exchanges because they have high liquidity and trading volume. Examples are Binance, Coinbase, and Kraken. All the crypto exchanges in the table above all happen to be centralized exchanges.

Decentralized Exchange: This is an exchange with no regulatory body to oversee registration and related protocols. Here there is no server-to-client communication because there is no unified server that attends to clients, rather data are distributed among different computers all over the world with none being a complete server.

These types of exchanges are less popular in the crypto space: however, that is not to say they are not patronized. Some of them such as Uniswap, PancakeSwap, and SushiSwap have relatively high trading volumes. A major advantage of this type of exchange is that it is difficult to hack because of its highly decentralized nature. Another advantage is that it charges zero or minimal fees. The major disadvantage here is that they have low liquidity and trading volume.

Cryptocurrency has attracted many investors over the years because of the benefits associated with it: It has been able to provide liquidity that outruns that provided by similar markets like shares and stock market, and its security is also an attraction that has kept many interested in this relatively new financial market.

However, it is not a perfect system because it still has its pitfalls and uncertainties. There have been times when the all-glorified secured cryptocurrencies have been hacked, exposing its loopholes.

According to the current crypto report, there are over 6000 cryptocurrencies with a total market cap that is above $2 Trillion and the combined value of bitcoin accounting for only 2.1% of the world’s money.

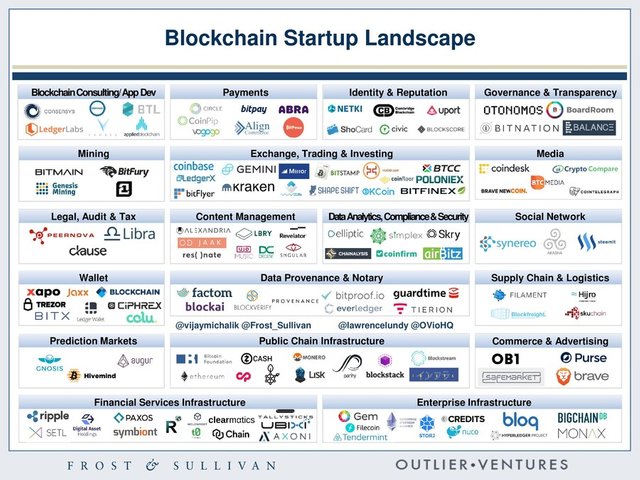

Below is an image that shows various areas of crypto blockchain technology.

How You Would Like To See Cryptocurrency In The Future?

One thing that has been on the mind of many is what the future holds for cryptocurrency. Will it be accepted by countries of the world as a means of exchange? Will cryptocurrency be a solution to the inflation of fiat currencies of the world? What will the value of cryptocurrencies be like in the future?

Indeed, we may not know for a certainty what the future of cryptocurrency will be like but we can make predictions from the information we have at the time.

From a personal point of view, I want cryptocurrencies to be accepted as a legal tender among countries of the world as time goes on. On 6/9/21, El Salvador became the first country to declare cryptocurrency as a legal tender. Improvement in the economy of this country may further encourage neighboring countries or economic partners to follow suit in this direction.

The next bull run and Inflation of fiat currencies especially in developing economies will see more people save their money in cryptocurrencies, thus increasing the total ratio of cryptocurrency to total global money. If this comes to be the case, antagonists of cryptocurrencies may have no choice but to queue into the process.

Also, I would like to see cryptocurrency rid people of the excesses of the banking sector. considering the cons of Cryptocurrency over the banking sector such as fewer fees and faster transactions, it may eventually override the banking system which I believe is part of the goal of the creation of bitcoin.

Future regulation of cryptocurrencies should not be to the hurt of investors. Because of some current cryptocurrency loopholes and governments' interests, attempts will be made by governments of the world to regulate and centralized cryptocurrencies.

If the IRS of the United States can probe some major exchanges to determine tax payment by crypto users in the United States, then I think cryptocurrencies will not be as decentralized as they currently are in the coming years. Countries may as well develop their cryptocurrencies.

I would like to see the value of cryptocurrencies rise. Investors may yet push up the value of cryptocurrencies especially bitcoin. Recent years have seen billionaires like Elon musk invest in bitcoin. Global corporations such as Walmart, AMC, and Amazon are also taking interest in cryptocurrencies. Walmart specifically, is moving to start accepting cryptocurrency as a means of payment. Many other global corporations will eventually follow the trend, thus increasing the usage and value of cryptocurrencies in the future.

And this is the more reason why cryptocurrencies will yet be heavily regulated so companies don't put their customers at risks that are currently characteristic of the crypto space.

From the above analysis, I can say that the value of major cryptocurrencies like bitcoin will yet spike up (pulling altcoins with it) because of more investors getting into the crypto space and other related factors, after which it will stabilize.

I can say the future of cryptocurrency is majorly tied to its security and so I would like that not only blockchains are secured but also exchanges, wallets, and other entities associated with cryptocurrencies. If cryptocurrencies continue to be compromised even after being adopted by big global shots, then there are yet negative uncertainties that may arise with the crypto space.

Conclusively, I would like to see cryptocurrency become a legal tender in at least 50% of the countries of the world and also a means of payment among global and local companies of the world.

The creation and implementation of cryptocurrency have proven successful and have brought with it so many opportunities. There are still yet untapped benefits to be unveiled in cryptocurrency.

However, the crypto space must be traded with caution as nobody knows for sure what the future holds for cryptocurrencies. The past is gone, the present decides the future, but the future is a product of a likely incomplete evaluation of the present.

That being said, we hope for the best while expecting the worst.

Thank you for reading. Thanks, prof @stream4u for the knowledge offered.