RISK MANAGEMENT - Crypto Academy / S5W7- Homework Post for @reminiscence01

What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?.

Explain the following Risk Management tools and give an illustrative example of each of them.

a) 1% Rule.

b) Risk-reward ratio.

c) Stoploss and take profit.

HELLO STEEMIANS

This is my presentation on the lecture offered by Prof @reminiscence01. Risk management is a very important concept in trading and a barrier to the success of many traders like myself. I am glad the topic was discussed and hope to apply what I have learned from the course.

RISK MANAGEMENT

Risk management is the necessary safety precaution a trader must take when executing trades to optimize profit and minimize loss.

Since loss is inevitable in crypto trading as well as other forms of trading, a trader who wants to be successful over time must be disciplined enough to stick to precautions that mitigate losses.

Risk management entails that a trader does not depend on their emotions while trading but adheres strictly to their laid down strategy while ensuring that they stick to established Take profit and Stop loss rules (depending on their strategy).

A trader must accept the fact that loss is a part of trading and make equivalent plans on how to stop loss while taking profits.

For instance, risk management, if it were to be personified would shout at a trader who decides to observe the progression of an executed trade before setting their stop loss because it is risky!

Finally, risk management, as we were taught in class involves sticking to one's established (tested and confirmed) strategy, using the right indicators that correlate with one's strategy, and always setting a stop loss and a take profit alongside the order in such a way that the order is allowed to be executed while mitigating loss.

Importance of Risk Management

Proper risk management allows a trader to simultaneously maximize their profit and minimize loss. When a trader sticks to risk management, they don't do things that expose them to huge losses, unlike traders who don't adhere to these precautions.

Risk management prevents a trader from blowing up their account. It is easy for a trader to blow up their account when their mind is set on making profits and not accepting the inevitability of loss in the market. Yes, a trader who doesn't adhere to risk management may make some good money at first that lures them in, and then bam! The account is wiped out. Risk management prevents such occurrences.

Risk management relieves a trader from the stress of emotional trading like revenge trading. With risk management in mind, a trader is refrained from taking actions from emotions rather they stick to proper setups that aligns with one's trading strategy.

Risk management enables a trader to grow their small account. A trader who has a small account but sticks to proper risk management has a higher chance of increasing their account over time than a trader who has the same condition but ignores risk management.

Risk management helps a trader to build their confidence in the market. A trader knows what to do and when to do it, hence is not taken up and down the roller coaster of emotional trading.

Risk management eliminates the temptation of over-trading. Overtrading sure knows to mess with a trader's head. Research has it that more profitable traders execute fewer trades in a day than less profitable traders.

RISK MANAGEMENT TOOLS

- RISK-REWARD RATIO

Risk- reward ratio in trading is the relationship between the profit a trader is willing to make on a trade and the loss he is willing to incur.

Basically, the profitable risk-reward ratio for a trader is 1:2, though some traders would argue that 1:1.5 is okay. This implies that if the set loss to be encountered in a trade is equivalent to or more than the profit, then it is not a good trade and does not adhere to proper risk management. The loss to profit ratio should be at least 1:2 (as we were taught in class). This means that for every one dollar a trader is willing to lose in a trade, he should be making 2 dollars or more.

For instance, if a trader buys an asset at the price of $10, and is willing to lose $5 in the trade, then the setup of the trade should allow the trader to make an extra $10 or more (as determined by take profit and stop loss).

So as a trader, the risk-reward ratio also determines if a trader will enter a position irrespective of whether or not it fits the trader's entry point.

- THE 1% RULE

The 1% rule is another important sub-division of risk management.

The 1% rule requires that a trader should not risk more than 1% of their trading capital on a single trade. This prevents a trader from losing more than 1% of their trading capital on a single trade.

For example, applying the 1% rule, a trader who has a capital or trading account of $5000 would only risk the maximum of $50 on a trade: it could be less. This is particularly very helpful when building a small account.

Mathematically, if a trader who applies the 1% rule loses 50% of their trade in a month, they would still be making a profit if the trades were executed in line with the 1:2 risk-reward ratio.

- TAKE PROFIT AND STOP LOSS

Take profit and Stop loss is an integral part of risk management and its importance in trade execution cannot be overemphasized. Every trader who wants to be profitable over time must take into consideration the importance of Take profit and Stop loss while trading.

Take Profit

Take Profit is a functionality in trading platforms that enables a trader to automatically take their profit on a trade once the condition has been met. It is an IF, Then statement. If price moves from point A to point C, then exit the trade and I get to walk away with profit gotten from movement from point A to C.

Note: This can be done manually but is usually a violation of risk management as a trader is prone to factors like slippage and emotional trading.

A buy order by a trader implies the trader will take profit somewhere above the order price while a sell order means a trader will take profit somewhere below the order price.

If Trader A buys some satoshi of BTC at $1000, when BTC price is $45000 then the trader is likely to set profit above $45000.01. Similarly, if the trader sells $1000 worth of BTC at $45000 per BTC, then the trader is likely to set profit at somewhere below 45,999.9.

A question that often arises in the mind of traders like me is when and where to take profit?

Firstly, a trader must understand his strategy and what it entails for him in terms of Take profit and Stop loss.

A trader can use indicators to know when to take profit. Some examples of such indicators are moving average, RSI, trendline, support, and resistance, etc. Support and resistance have proven over time to be very helpful in signaling an exit point for a trader to take profit.

Thirdly, Take profit should be set alongside an order and it ought to exceed the stop loss by 1:2 ratio or 1:1.5 at the barest minimum. Take profit can be adjusted where the conditions - support and resistance, and 1:2 risk-reward ratio is present. If this is the case, then the condition which is both necessary and sufficient among the two conditions should be used to support the one which is necessary but not sufficient.

Stop Loss

Like Take profit, Stop Loss is also a functionality in trading platforms that enables a trader to stop their loss and exit the market. It is also an IF, Then conditional statement because it requires that once a loss condition is met, then the trade should be exited. Stop loss is as important as Take profit or more.

For a buy order, Stop loss should be set somewhere below the order price and above the order price for a sell order on a risk-reward of 1:2 ratio. The trader can also use indicators like support and resistance and other indicators that suit the trader's strategy to set stop loss.

Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required).

a) Trend Reversal using Market Structure.

b) Trend Continuation using Market Structure.

The following are expected from the trade.

Explain the trade criteria.

Explain how much you are risking on the $100 account using the 1% rule.

Calculate the risk-reward ratio for the trade to determine stoploss and take profit positions.

Place your stop loss and take profit position using the exit criteria for market structure.

TRADING CRITERIA FOR TREND REVERSAL BASED ON MARKET STRUCTURE

ENTRY CRITERIA

For this course, I would be using the same image to explain the entry and exit Criteria for trend reversal in market structure.

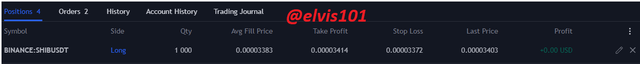

The screenshot above is a one min SHIB/USDT chart. It shows an uptrend reversal pattern based on market structure. The market was trending downwards (creating Lower Highs and Lower Lows) until price got to a point where it failed to create a new lower low while it retraces back and breaks the previous high, thus breaking the market structure. I waited for price to retest the breakpoint (forming new support) and after it had successfully done that, I entered the trade after seeing the formation of a bullish engulfing candle.

EXIT CRITERIA

To exit this trade based on market structure, Stop Loss is placed below the new support while the Take Profit is set at the next major resistance which happens to correlate with the 1:2 R:R ratio.

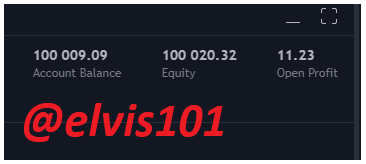

Based on the 1% rule, I risked $1000 on the trade because my demo capital is $100,000, so it would be that:

100,000 × 1% = 1000.

TRADING CRITERIA FOR TREND CONTINUATION BASED ON MARKET STRUCTURE

ENTRY CRITERIA

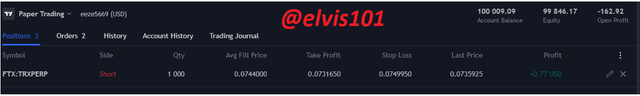

The chart above is a 1 min TRXPERP market on FTX as shown by Trading view. From the image, we can see that the market was trending downwards (creating Lower Highs and Lower Lows). I followed the pattern and waited for price to retrace and create a Lower high, after which I entered a sell trade at the sight of a bearish engulfing candle as is identified in the image.

EXIT CRITERIA

Based on exit criteria for a downtrend in market structure, I placed Stop Loss above the newly formed Lower High and Take profit below the Lower high (dynamic support) on a 1:2 R:R ratio, and since there is no nearby support that may interfere with my position, I rely solely on the 1:2 R:R ratio to exit the trade

As already explained above, I risked $1000 on the trade, which is 1% of my trading capital – $100,000.

Risk management is a concept that every crypto trader should be aware of as it protects a trader from the high volatility present in the market. For some traders, this may be the only barrier preventing them from being successful traders.

The course has increased my awareness on the importance of risk management and I have come to see how ignorance of risk management has negatively affected my path to becoming a successful trader.

Thank you prof @reminiscence01 for the lesson offered.

Hello @reminiscence01, I need a little help here concerning my eligibility for SCA. When I check it for the past one month, counting from the previous day, I get 161sp but when I check it counting back the last one month from the current day, I get 90+. Now the thing is I have actually been watching it's progression. It moved from 135 to 145 to 151, then finally161 when I powered up 10 steem about four days ago. It is quite confusing to me that when I check from Nov 30 (which is the last day of Nov) to Dec 31, I get 161 but when I check from Dec 1 to Jan 1, I get 90+. It doesn't seem to make sense. Please I need your reply, however if you are not so sure of the way the app works, you may ask someone who has better understanding of the way the app works. Thank you.

Hello @elvis101 from the time and date of submission your powered up steem is 91.415, Dating from 01 Dec 2021 to 01 Jan 2022. Per the academy guidelines, you're not eligible to participate in the club5050. The minimum requirement is 150 Steem.

Thank you.