The Bid Ask Spread (Part II)- Steemit Crypto Academy- S4W3- Homework Post for @awesononso

INTRODUCTION

Hi guys , welcome to steemit crypto academy season 4 week 3. Today's post is a continuation from a previous lecture given by professor @awesononso on the bid ask spread. In case you missed the previous lecture, you can read and catch up here.

THE ORDER BOOK

The order book is a crucial part of trading exchanges. You can't make a trade in an exchange without making an order. An order has to be placed for a trade to be executed. But before we go into what the order book is, let's get a brief understanding of the word ORDER.

The word order means an instruction. Sometimes an order could be a request. Now from this , when we hear the word order book, what comes to mind would be a book of requests or instructions. Now let's try to relate this to the cryptocurrency ecosystem.

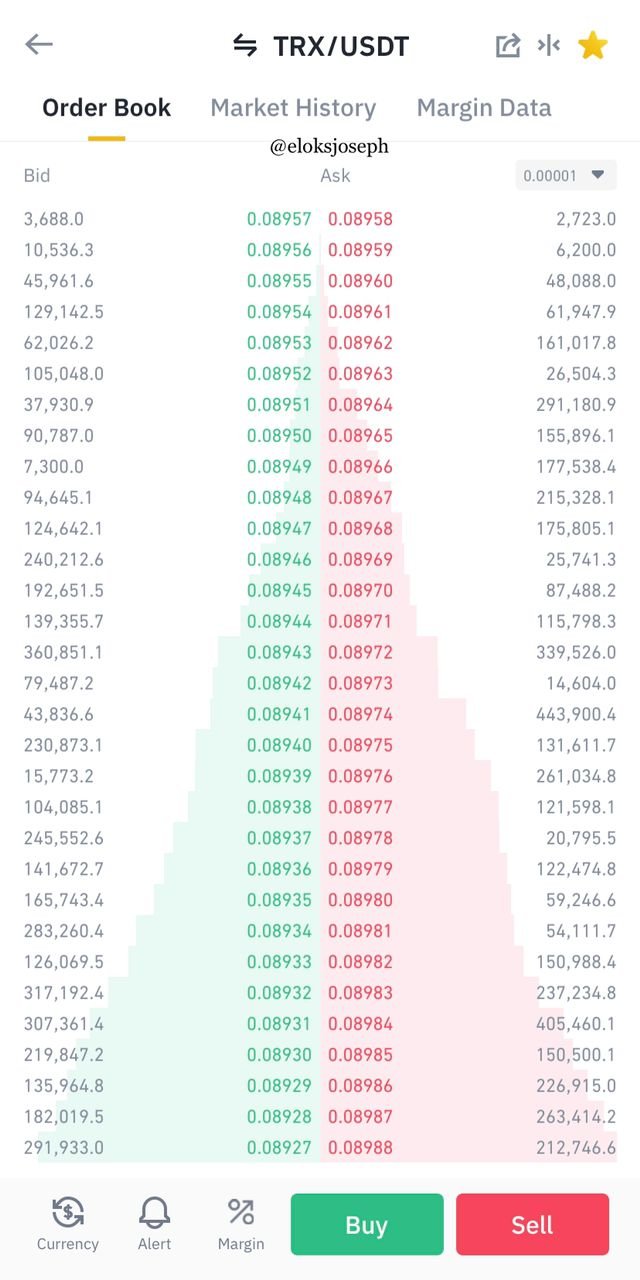

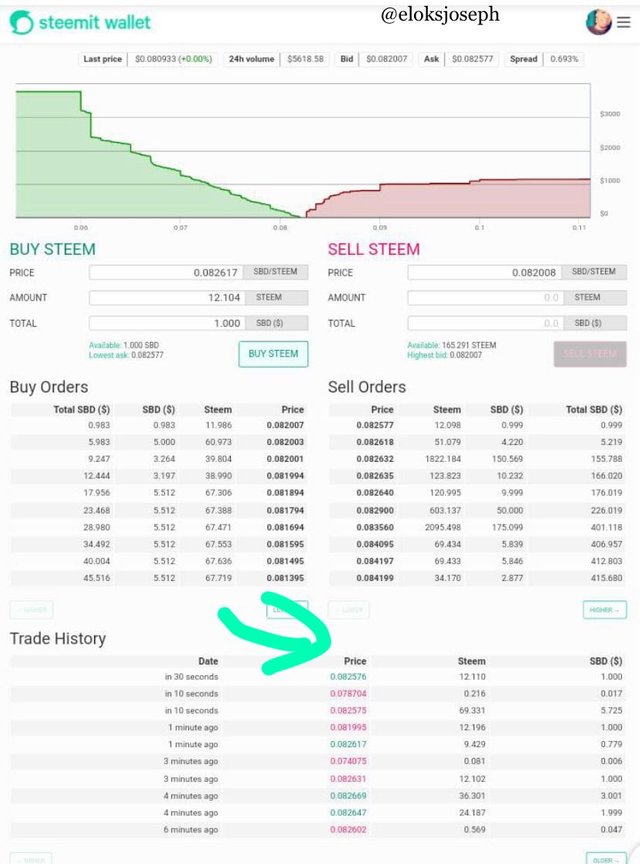

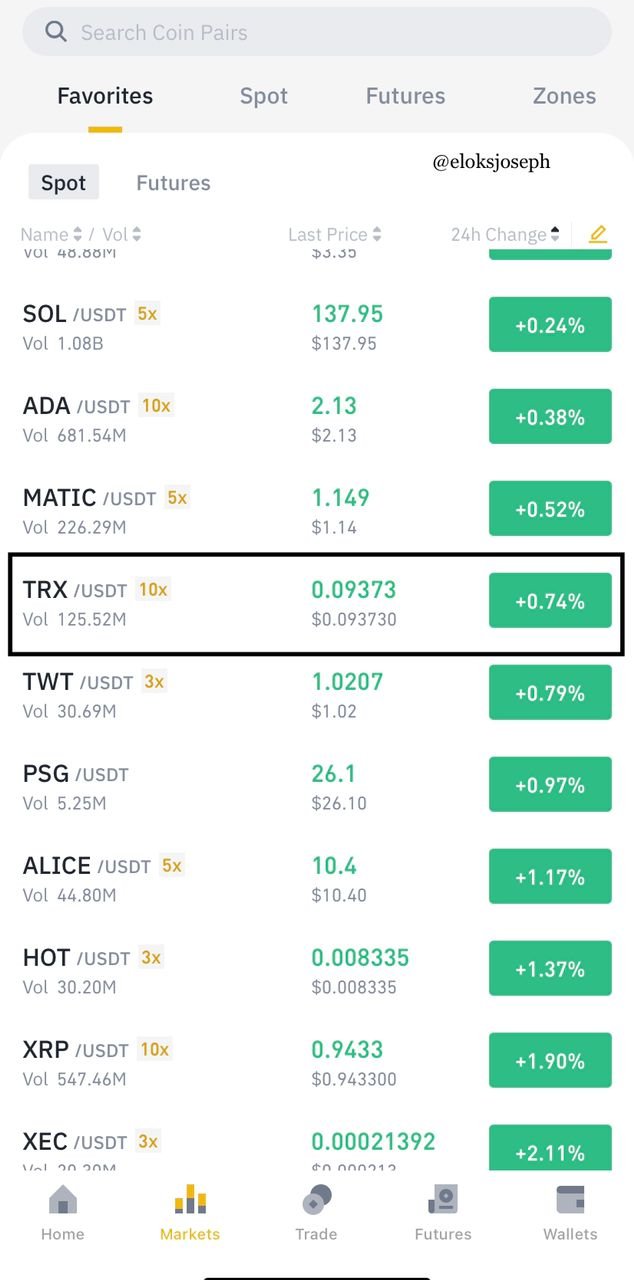

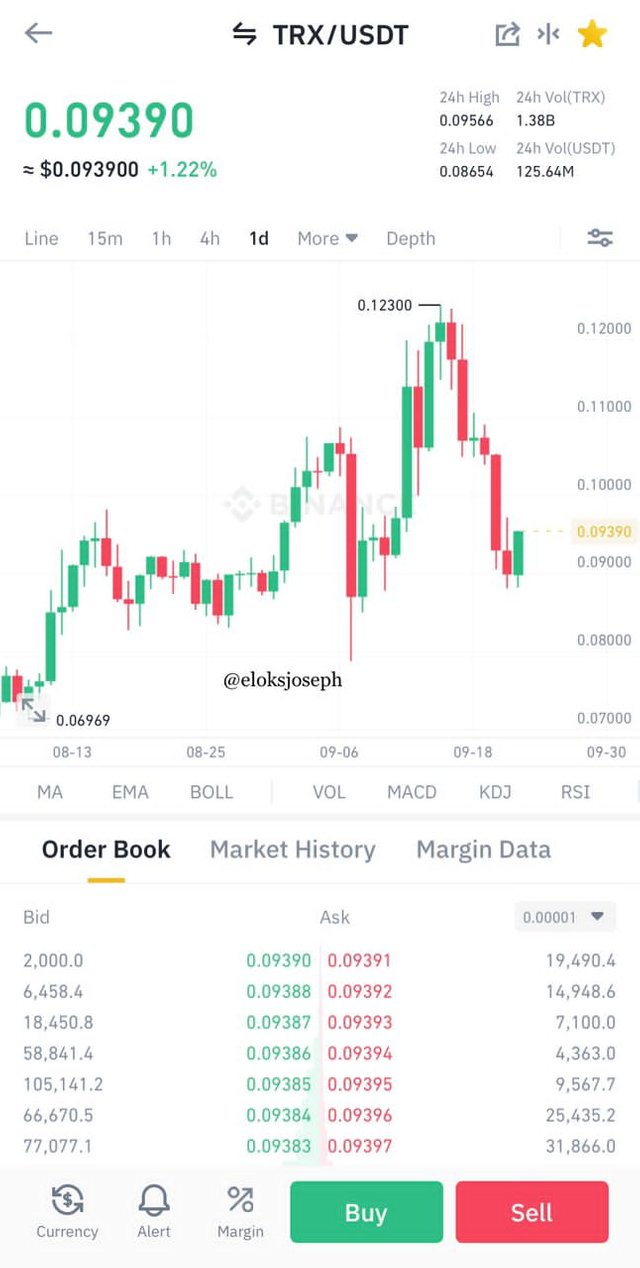

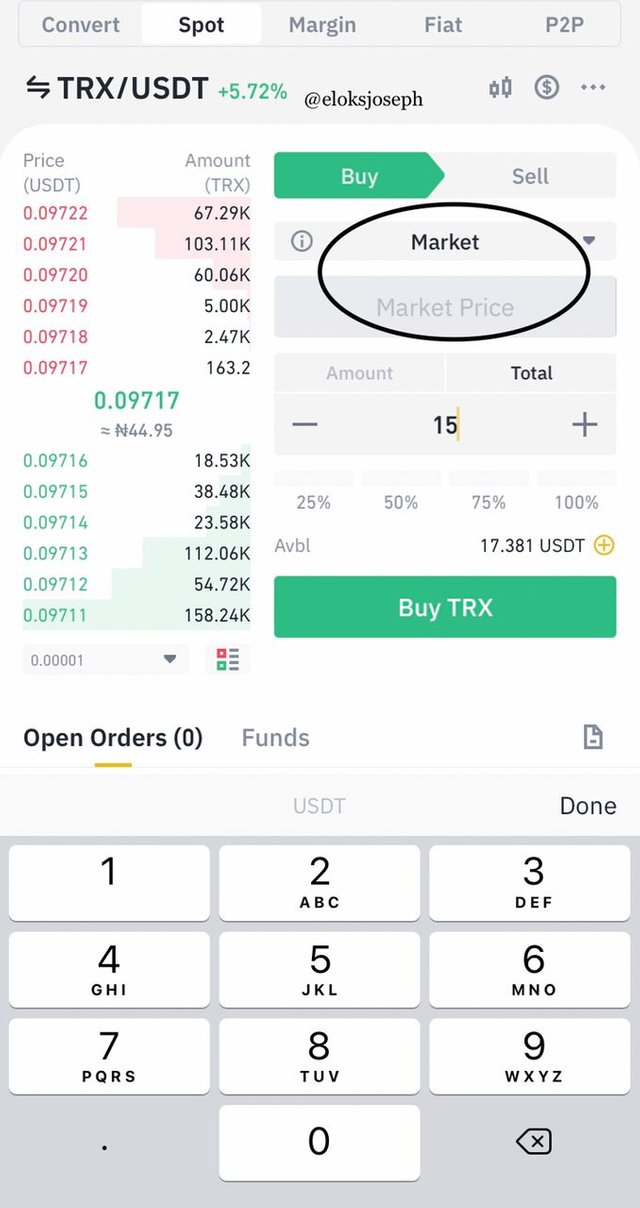

The order book is a record of open orders for a particular trading pair. The order book is often found in exchanges looking like a spreadsheet containing the amount , the bid/ask prices and the total cost of the order. Let's take a look at the TRX/USDT order book in binance exchange mobile app.

The screenshot above is that of an order book. As you can see, it has 2 sides, the green side ( bid side /buy orders) and the red side ( ask side/sell orders). Let's take a look at them separately.

BID SIDE

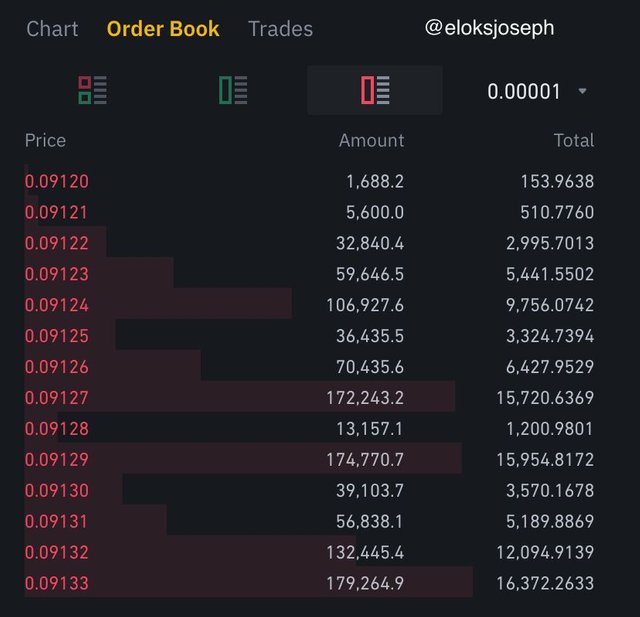

ASK SIDE

The bid side has information on the amount of the TRX , the bid price of each unit (in USDT since it is a TRX/USDT pair) and the total cost in USDT. As you can see the buy orders according to unit price are arranged in descending order of cost from top to bottom.

The ask side also shows information on the amount of the amount of TRX, the ask price of each unit ( in USDT) and the total cost in USDT. Here, the sell orders are arranged in ascending order of cost from top to bottom.

MARKET MAKERS AND MARKET TAKERS

Most times when the current market price doesn't favor the trader, he sets his own price . These type of people are called market makers. Market makers are traders that set a limit for their trades . They choose the price they want to buy and choose the price they want to sell. Of the market doesn't fall or rise to their limit price, the trade isn't executed.

Market takers on the other hand trade based on the current market price. They don't set their own limits instead they trade on the instantaneous rate. They buy and sell at the current market price so their trades are executed instantaneously.

MARKET ORDER AND LIMIT ORDER

Market orders are orders placed at the market price. These type of orders are often made by market takers and they are executed immediately.

Limit orders are placed by market makers. These type of orders are set at a price different from the market price. Most times these orders don't get executed immediately as the limit price is different from the current market price.

MARKET MAKERS, MARKET TAKERS AND LIQUIDITY

Before I explain how market makers and market takers let's revisit how liquidity works. Liquidity means how fast a trade would be executed. Now , if there are a lot of market makers in the market, there'll be a lot of limit orders ,that means there'll be an order at almost every price.

Knowing that market takers trade at the current market price and that the cryptocurrency market is a volatile one so the market price changes rapidly. When the market price changes, thanks to market makers ,there are limit orders at each price so when market takers trade at the market price, they meet an existing limit order from the market maker and then the trade gets executed.

From the little explanation above we can see that the market makers and market takers directly influence liquidity. The more limit orders in the market, the faster market takers are able to trade .

ORDER OF 1 SBD USING LOWEST ASK ND ALTERING LOWEST ASK

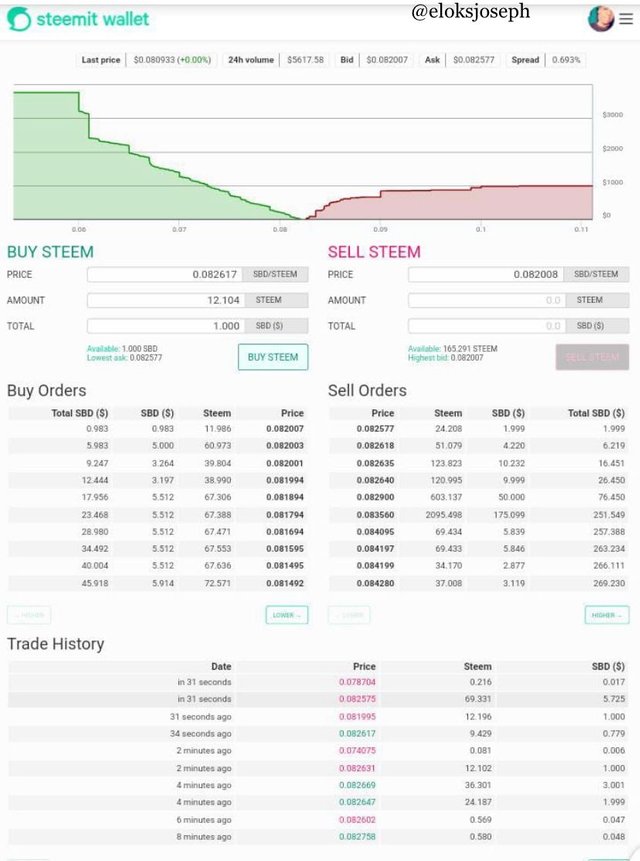

Screenshots in this section are from steemit wallet

Here, I'll be making 2 orders. The first , I'll be trading using the lowest ask and the second I'll be altering the lowest ask.

TRADE USING THE LOWEST ASK

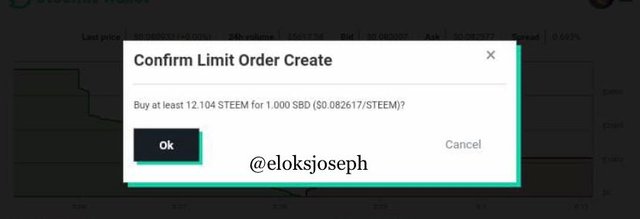

At the time of placing this trade, the lowest ask was at 0.082617 and the order was created. Due to circumstances above my control, as it is well known that the crypto market is very volatile, the lowest ask reduced to 0.08576 as my order was placed. This made the trade execute immediately.

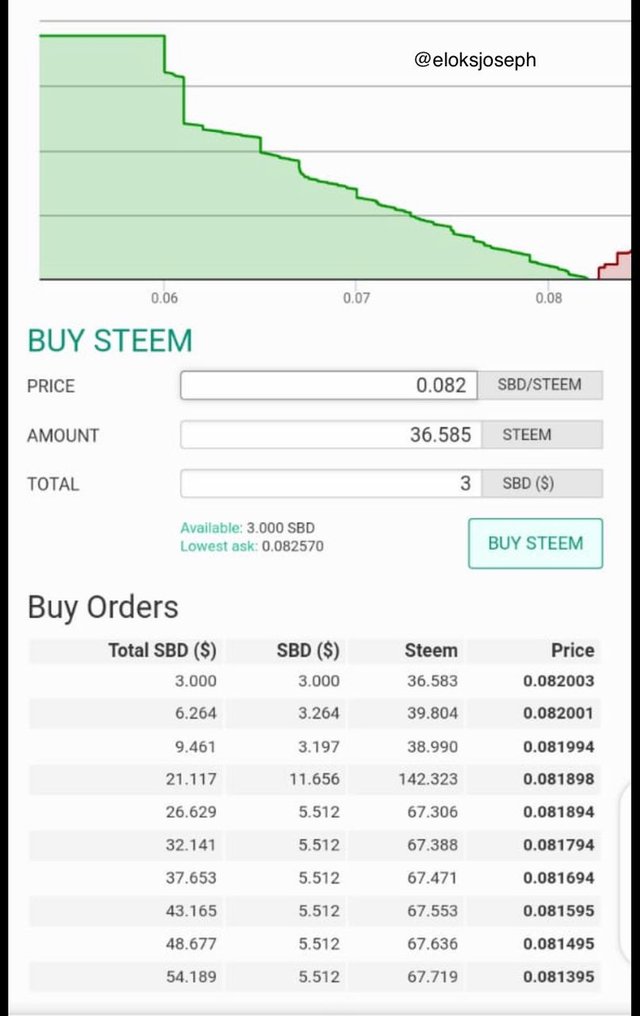

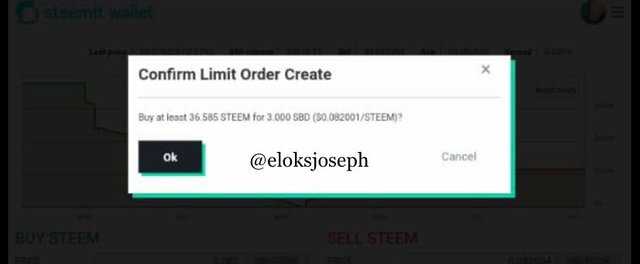

ALTERED LOWEST ASK

In this second trade, I altered the lowest ask and changed it from 0.082570 to 0.082001 and placed the order. The trade was kept in the order book and wasn't executed immediately.

***

From the 2 orders I made above, it is obvious that when making buy orders, if the market is bought above the lowest ask, the trade is instantly executed and if the market is entered below the lowest ask, it is not executed immediately until the price drops to that level.

BUYING $15 WORTH OF TRX ON BINANCE EXCHANGE USING MARKET ORDER AND LIMIT ORDER

To buy $15 dollar worth of TRX, first you need to have at least 15 USDT in your account. I'll be using the TRX/USDT pair. Let's go over the steps to trade on binance.

- Find the TRX/USDT pair and click on it.

- Click on the buy option. Here you can decide what type of order you want. I'll be using both the limit order and market order.

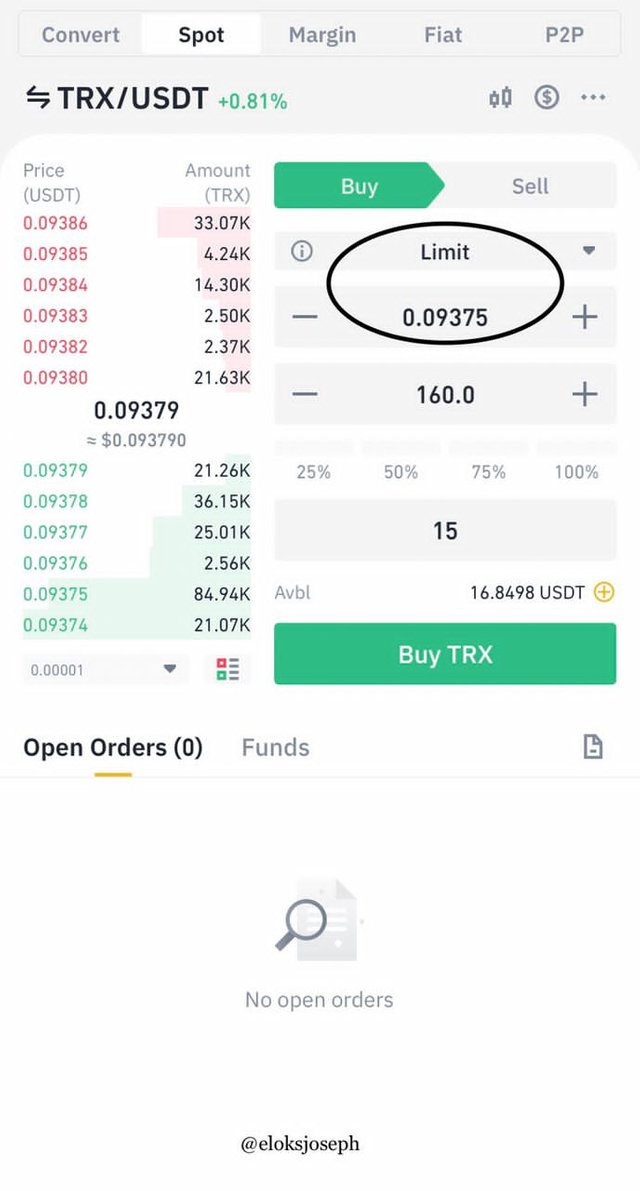

LIMIT ORDER

The current lowest ask was $0.09379 but I set my limit at $ 0.09375 for about 160 trx.

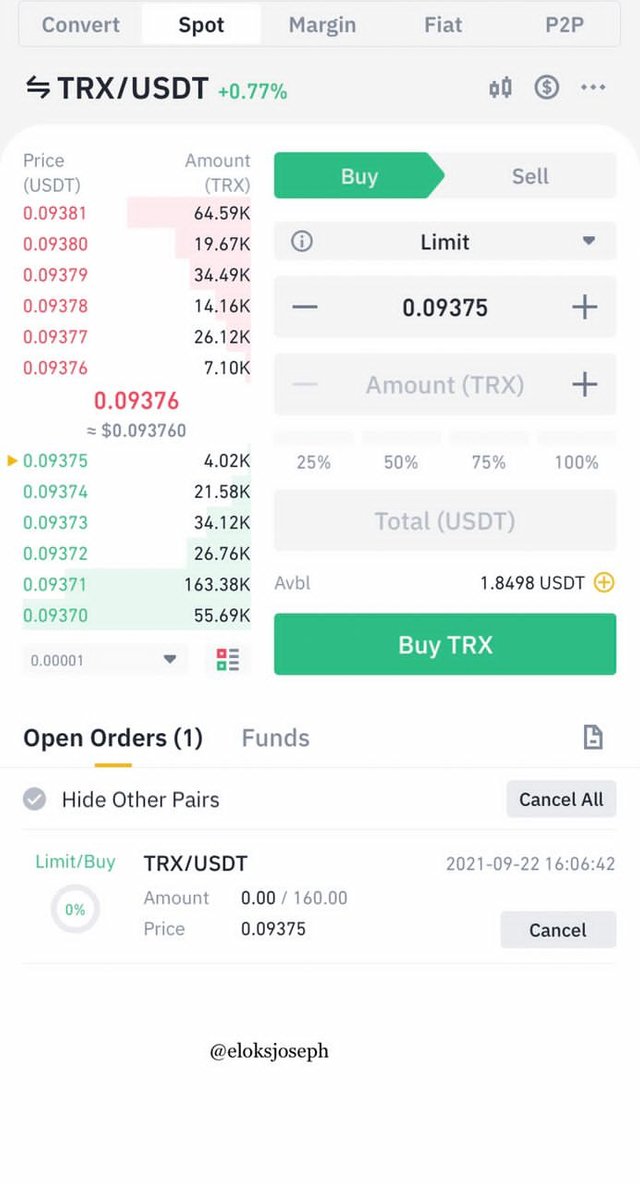

This is the limit order in the open order book.

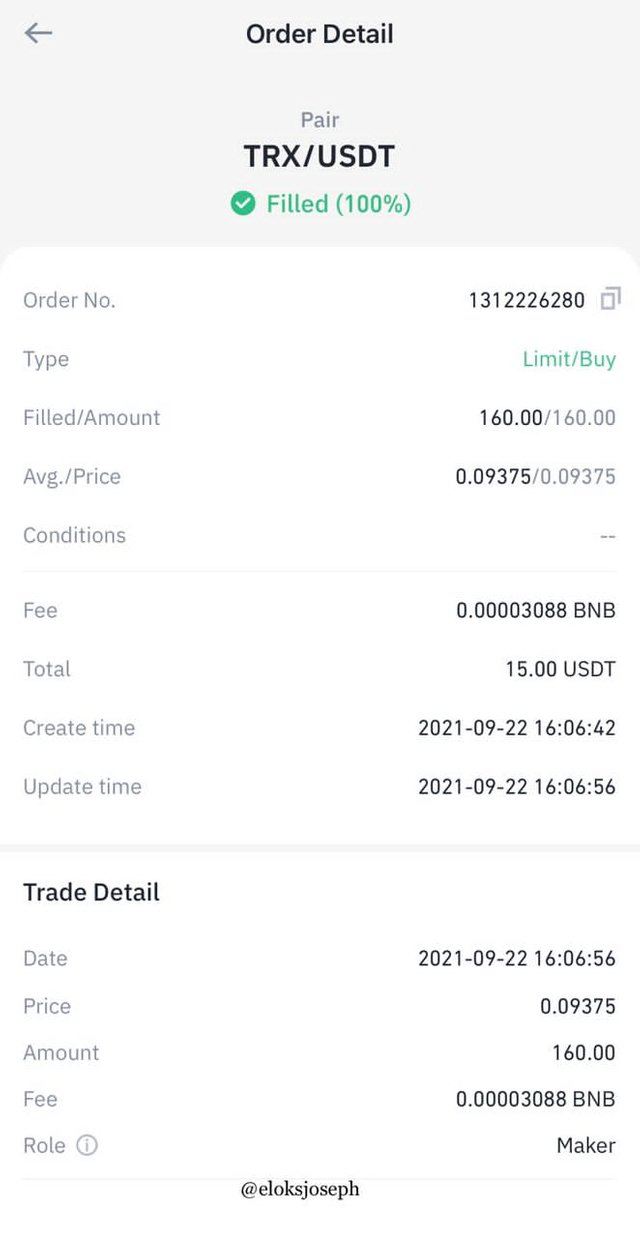

These are the transaction details.

As I have placed my order using a limit price , I have performed the role of a market maker . The impact my order had on the market is that it has increased the liquidity in the trading pair. Also, since my limit is below the market price,if there are a lot of orders like mine below the market price, the value of the asset could decrease.

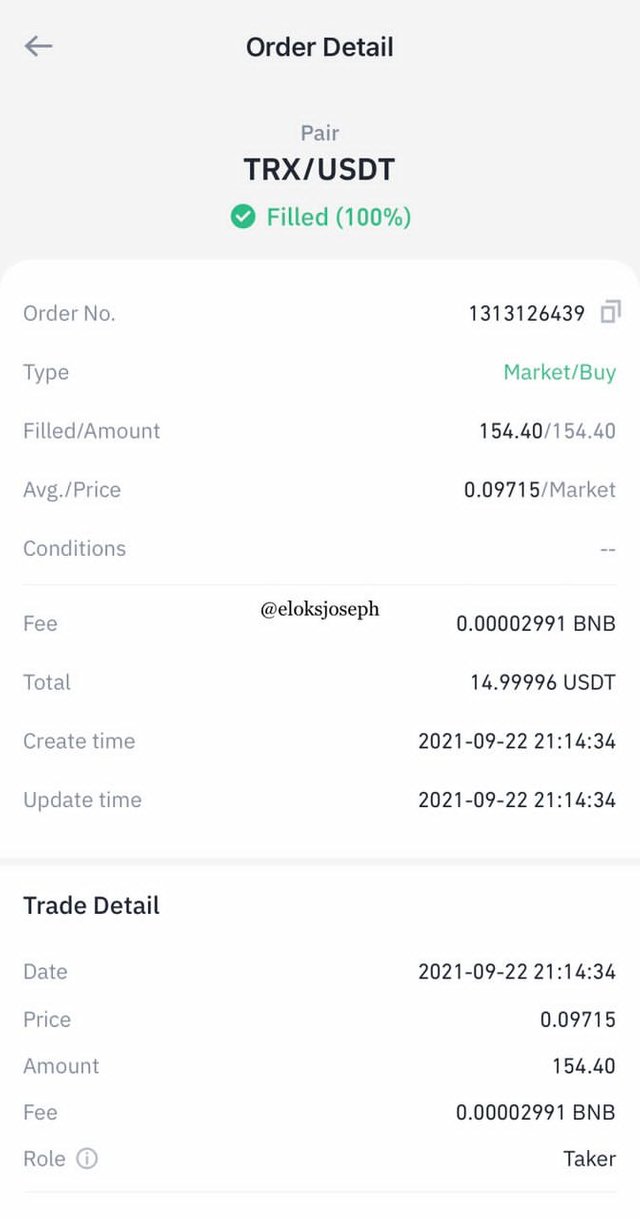

MARKET ORDER

The current market price of TRX was at $0.09717 . I placed a market order for TRX worth 15 TRX.

The transaction didn't show in the order book as it was executed immediately.

I have just performed the role of a market taker and the impact of my order on the market is really simple. I reduced the liquidity provided by a market maker.

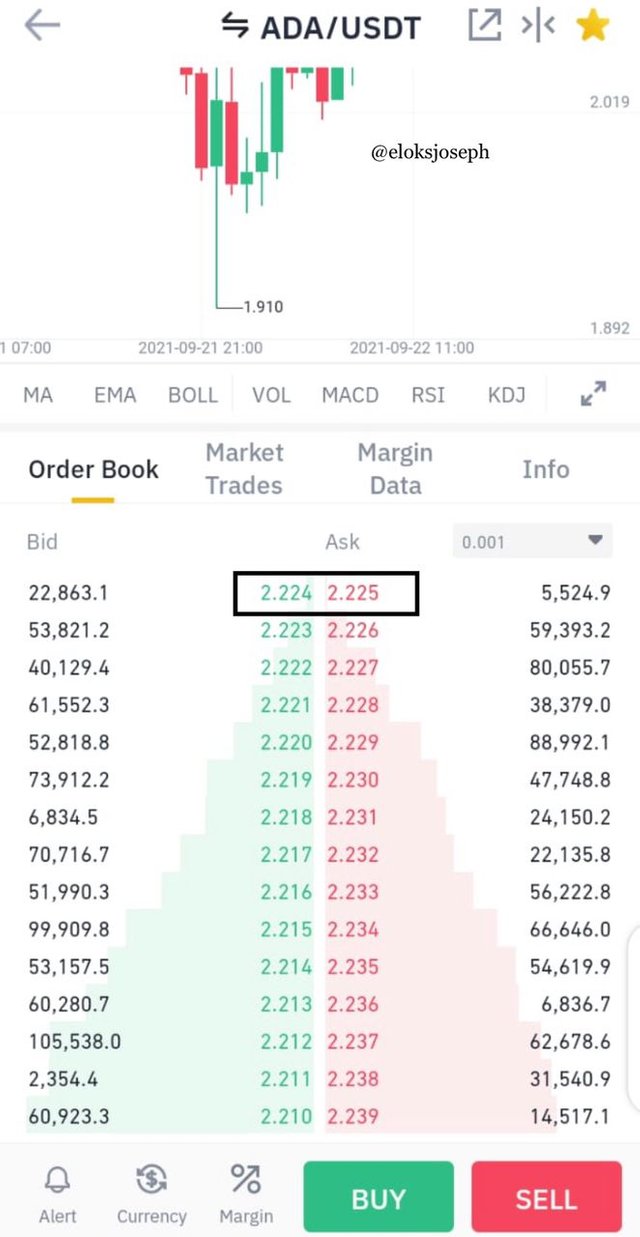

CALCULATING THE BID -ASK SPREAD AND THE MID MARKET PRICE FOR ADA/USDT TRADING PAIR AS AT TODAY

From the screenshot above we can see that ;

The Bid Price = $2.224

The Ask Price = $2.225

Recall that,

The Bid-Ask Spread = Ask price - Bid price

Bid-Ask Spread = $2.225 - $2.224

Therefore, Spread = $0.001

Also recall;

Mid-Market Price = (Bid Price + Ask Price)/2

The Bid Price = $2.224

The Ask Price = $2.225

Mid-Market Price = ($2.224 + $2.225)/2

= 4.449/2

=$2.2245

CONCLUSION

The order book shows in depth analysis on the price buyers are willing to pay for assets and price sellers are willing to sell their assets. The order book contains limit orders made by market makers. From the order book the bid ask spread and the mid market price can be calculated.

Thank you professor @awesononso for the lecture.

Thank you all for reading my post.

all images in this posts are original screenshots

Hello @eloksjoseph,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You have done well on his topic.

Some parts need to be developed more. Question 5, for instance, needs more work.

Question 4 also needs some work to make it better.

You should present your images better.

Thanks again as we anticipate your participation in the next class.