In-depth Study of Market Maker Concept - Steemit Crypto Academy | S4W6 | Homework Post for @reddileep

Hi guys , welcome to steemit crypto academy season 4 week 6. It feels very nice to be writing again after going off for a couple weeks. Today , I'll be making a post based on the lecture given by professor @reddileep on the In-depth Study of Market Maker Concept.

1- Define the concept of Market Making in your own words

Before going into the concept of market making. Let's take a look at some important terminologies. First, what is a market? A market is a place, region , platform ,etc where trading is done. Trading involves the exchange of goods , services,etc between a buyer and a seller.

For every asset , commodity, stock ,etc , there's always a market price. Most times the buyers and sellers wager this market price to what favors them . This leads us to the MARKET TAKERS and MARKET MAKERS. Market takers are those who buy and sell at the current market price. On the other hand, market makers set their own price limits. That is, they set their own buy and sell price using limit orders. In this post, we'll be focusing on the market makers.

Liquidity is provided in the market through the buy and sell order limits set by these market makers. Liquidity deals with how fast a trader can buy and sell. The way this liquidity is made is that the limit orders are set down so when a trader comes and wants to buy , he already has an order waiting for him made by the market makers. The concept of market making is a very unique one and traders can use it to make profits. Let's take an example; if the current market price of crypto A is $9.5 , a market maker can put to buy at $9.0 (here he saves $0.5) and can also put to sell at $10 (here he makes an extra $0.5). Market making involves inputting your own price .

2 -Explain the psychology behind Market Maker. (Screenshot Required)

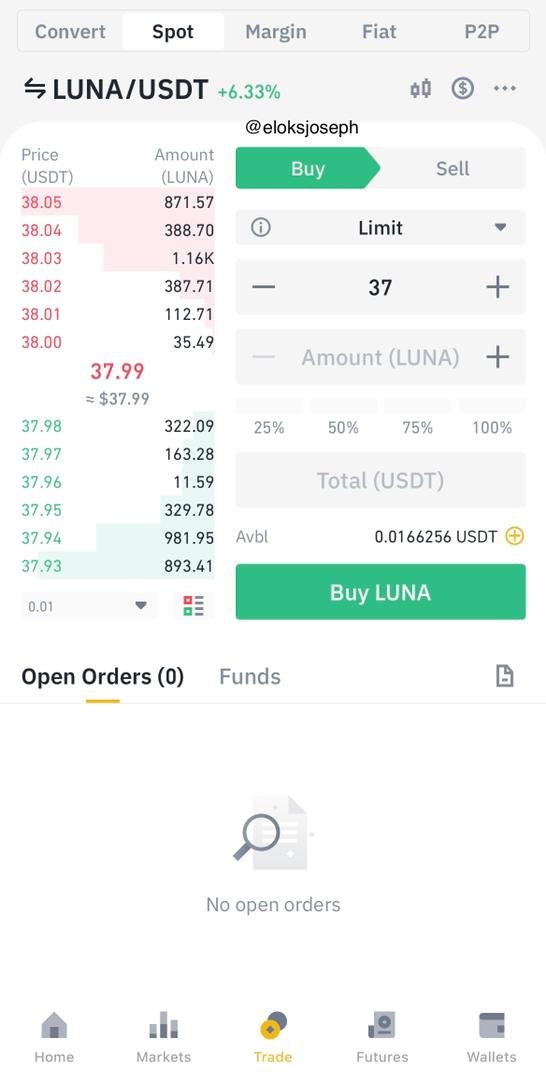

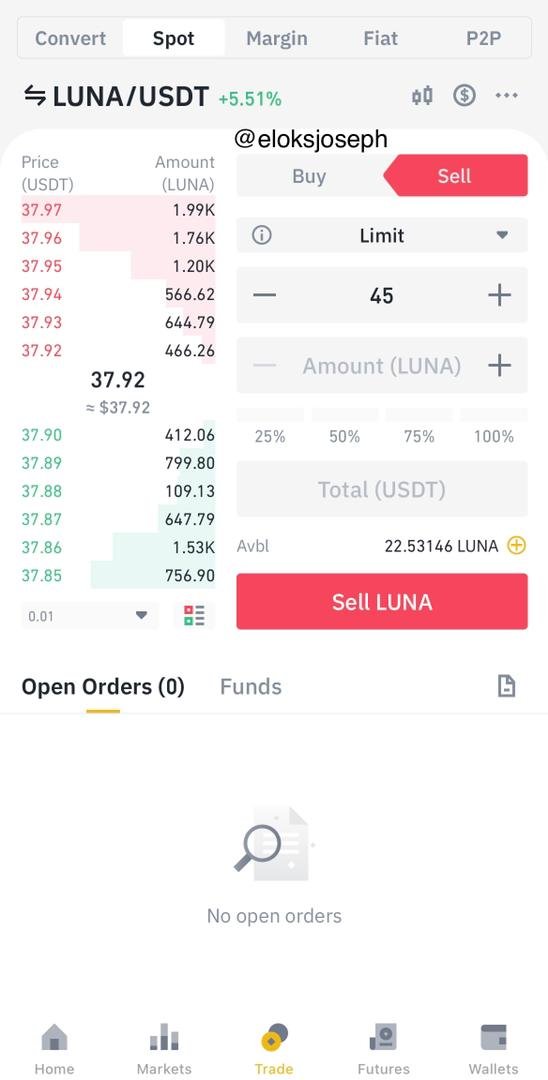

The market is often filled with buy and sell orders. The ability for buy and sell orders to be executed is often from the liquidity provided by the market makers . These market makers can also influence market price. Let's take the example from (1) above. Since the buy price the market maker set is at $9 and the sell price is at $10, the market takers would be able to buy within this price range because of the liquidity generated by the market makers. Let's use a crypto currency to test the market makers psychology.

From the screenshots above , there are buy and sell order screenshots. The buy order is below the market price and would be executed when the market price drops to that level. In the other screenshot, the market maker puts a sell price way above the current market price, so when the price gets to that level ,it'll be executed. The buy and sell orders placed by market makers are sent to the order book. In the screenshots,you can see the orders placed for the coin .

Market makers can influence asset price by their orders. They do this by moving the price of an asset towards one position. For example , if a coin worth $10 , and a market maker buys for about $15 (which is higher than the current price) , and this same buyers puts a sell order for his assets at $20 ,others traders seeing this would want to to sell their assets too withing that $15 - $20 range, thereby increasing the worth of the asset.

It is not as easy as it sounds though, for this to work there'll need to be a lot of large volume holders of that same asset. These large volume holders are known as WHALES. Whales in cryptocurrency are people, institutions and organisations who hold large volumes of a particular cryptocurrency. Example of popular bitcoin whales are MicroStrategy and Tesla. These whales can use the market making concept to either increase or decrease the market price.

3- Explain the benefits of Market Maker Concept?

Since we now understand what the market making concept is, let's take a look at some of the benefits;

LIQUIDITY;

This is undoubtedly the most important benefit of market making. Without liquidity,trades would barely be executed as liquidity is how fast a trade can be executed. Market makers are responsible for providing liquidity in the market ,so this is a very important advantage of market making.

PROFIT MAKING;

When market makers pump the price of an asset,those who own that coin will gain a lot of profit from the price pump.

PREFERRED ENTRY POINT;

Some assets may worth more than a traders capital at a time so marking making allows the trader to pick a buy limit of his choice.

APPRECIATION OF ASSET PRICE;

When market makers come together, they can appreciate market price by using bid and ask prices way above the market price causing the worth or value of an asset to increase.

4- Explain the disadvantages of Market Maker Concept?

DEPRECIATION OF ASSETS;

Just the way market making can appreciate asset prices, they can also depreciate asset price. This is don't by placing buy and sell orders way below the price of the asset thereby causing the asset to lose value.

WHALES TAKING ADVANTAGE OF SMALL INVESTORS;

Since whales control large volumes of assets , they can move prices to their favour so as to buy crypto off small traders at a very cheap rate. They do this by increasing price of the asset so they can sell theirs ,then they buy again at cheaper price.

MARKET MANIPULATION;

Market makers may often manipulate the market into the direction of their choice since they provide liquidity. This is a disadvantage to other small time investors who don't know the pattern the market makers are following.

5- Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

1. MOVING AVERAGE (MA);

Moving average is a trend based indicator , it follows market movement. It is often placed on the main chart. It consists of 2 or 3 lines following the market trend. When the lines are above the candles, the market is in a downtrend and when the candles are above the lines , the market is in an uptrend.

The MA is often used to get buy and sell signals using the golden and death cross. The death cross occurs towards the end of an uptrend and it serves as a sell signal and the golden cross occurs towards the end of a downtrend serving as a buy signal.

Knowing that small time traders may use these signals, the market makers make take this information and then use it to their advantage. Let's take an example of a deathcross. We know the price is meant to downtrend after, but the market makers may fill it with buy orders thereby triggering the stop loss of small investors.

From the chart above ,we can see that there was a deathcross formed but the barrage of buy orders caused the market to reverse and then continue its uptrend.

2. RELATIVE STRENGTH INDEX (RSI);

The RSI graph is an indicator that is often used to show when a market is in overbought or oversold positions. The overbought positions is above the 70 level and the oversold is below the 30 level. When the market goes into the oversold level(below 30) ,it is a buy signal and when it goes above the overbought positions, it is a sell signal.

Once the market reaches the overbought position, most traders sell off their assets and when it is at the oversold position, most traders buy this asset. Let's take a look at an example of how a chart would look when manipulated by market makers.

From the chart above, we can see that the price of the asset was overbought and a lot of traders would want to sell, knowing this , the market makers create selling pressure causing the price to keep going in an uptrend.

CONCLUSION

Market makers are important parts of day to day trading as they provide the liquidity for all other traders in the market. Their actions also influence market price and market movement.

Thank you professor @reddileep for the lecture.