Cryptocurrency Triangular Arbitrage-Steemit Crypto Academy | S4W4 | Homework Post for @reddileep

INTRODUCTION

Hi steemians, welcome to steemit crypto academy season 4 week 4. Today I'll be making a post based on the lecture given by professor @reddileep on arbitrage trading.

Define Arbitrage Trading in your own words.

Before we get into what Arbitrage Trading is. Let's first understand what the word "arbitrage" means. Arbitrage means taking advantage of the price difference in two or more different markets.

From the above definition, we can coin out the meaning of arbitrage trading. Arbitrage Trading is a type of trading that involves buying

assets which may be cryptocurrency, gold, silver, goods ,etc from one market and selling for an higher price in another market. It involves using the price difference in 2 markets to make profit off buying and selling.

Let's take a scenario where a trader sees the price of an asset at maybe $10 on one market and buys it,then sells it for $10.5 on another market . The trader has taken advantage of the $0.5 difference in price.

Now let's relate it to the crypto currency market. If a trader sees a coin let's say steem at exchange one for $0.45 and then sees steem at exchange two for $0.50 . The trader then buys 1000 u it's of steem for $450 at exchange one and then sells it at exchange two for $500. That is an example of arbitrage trading.

Now let's look at the types of arbitrage trading we have.

Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

There are several types of arbitrage trading. In this section I'll mention 5 and explain 3. The types of arbitrage trading include;

Exchange arbitrage

Funding rate arbitrage

Cross currency arbitrage

Covered interest arbitrage

Statistical arbitrage

Let's take a look at the definition of some :

EXCHANGE ARBITRAGE:

This is arguably the most common type of arbitrage trading. This type of trading involves buying in one exchange at a lower price then selling at an higher price in another exchange. The price of cryptocurrencies aren't always the same on different exchanges no matter how close the prices are ,they're never the same.

CROSS CURRENCY ARBITRAGE:

In exchanges, one coin could have different pairs with different currencies. This is where this type of arbitrage trading comes in. Here, arbitrage traders take advantage of the different prices in different pairs. It involves converting assets over 3 different currencies. It is also called TRIANGULAR ARBITRAGE.

FUNDING RATE ARBITRAGE:

This type of arbitrage trading deals with hedging cryptocurrency price movement with a contract. Funding rates are often paid to traders based on the difference between spot price and contract price. So in this type of trading, the trader buys a cryptocurrency and then enters a contract with that cryptocurrency that has a funding rate that is often smaller that the price of purchase.

Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

Triangular Arbitrage strategy is a type o arbitrage strategy that is used by arbitrage traders. This involving trading across several cryptocurrency pairs to get to one coin. It involves using 3 coins. Coin 1 is converted to coin 2 and coin 2 is converted to coin 3 then coin 3 is converted to coin 1.

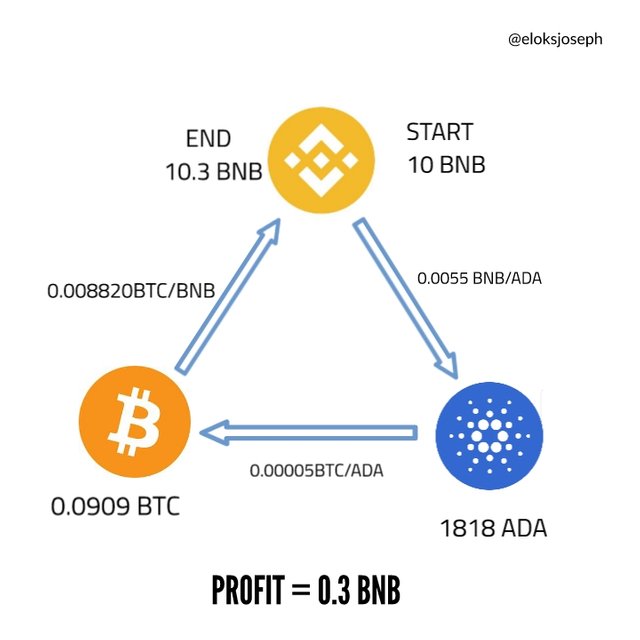

Let's do a simple illustration. I'll be using coin ADA, BNB and BTC. (Note this is an illustration so the actual prices are not used).

Let's buy 1818 units of ADA with 10 BNB at the rate of 0.0055 BNB/ADA That means we have 1818 ADA. Then we convert the 1818 ADA to BTC at the rate of 0.00005BTC/ADA so we'll have 0.0909 BTC. We can now convert this BTC back to BNB at the rate of 0.008820BTC/BNB.The resulting BNB will be about 10.3 units. From the triangular arbitrage trading, we have made a profit of 0.3 BNB.

Let's take a look at a diagramatic summary of the trade above.

Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

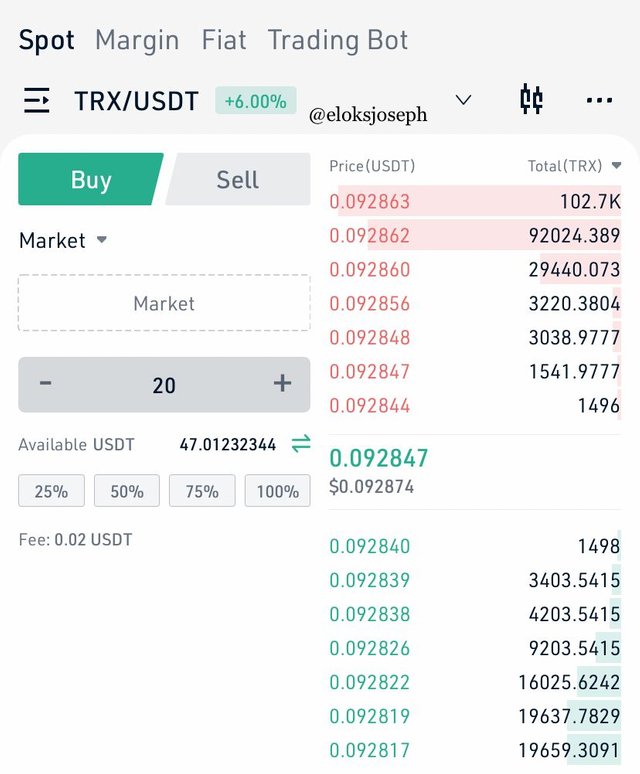

In this session, I'll be buying 20usdt worth of TRX on my kucoin account and then sell it on my binance account.

- First I buy $20 worth of TRX in kucoin using the bid price of $0.092847 per TRX.

I got about 215.5 TRX

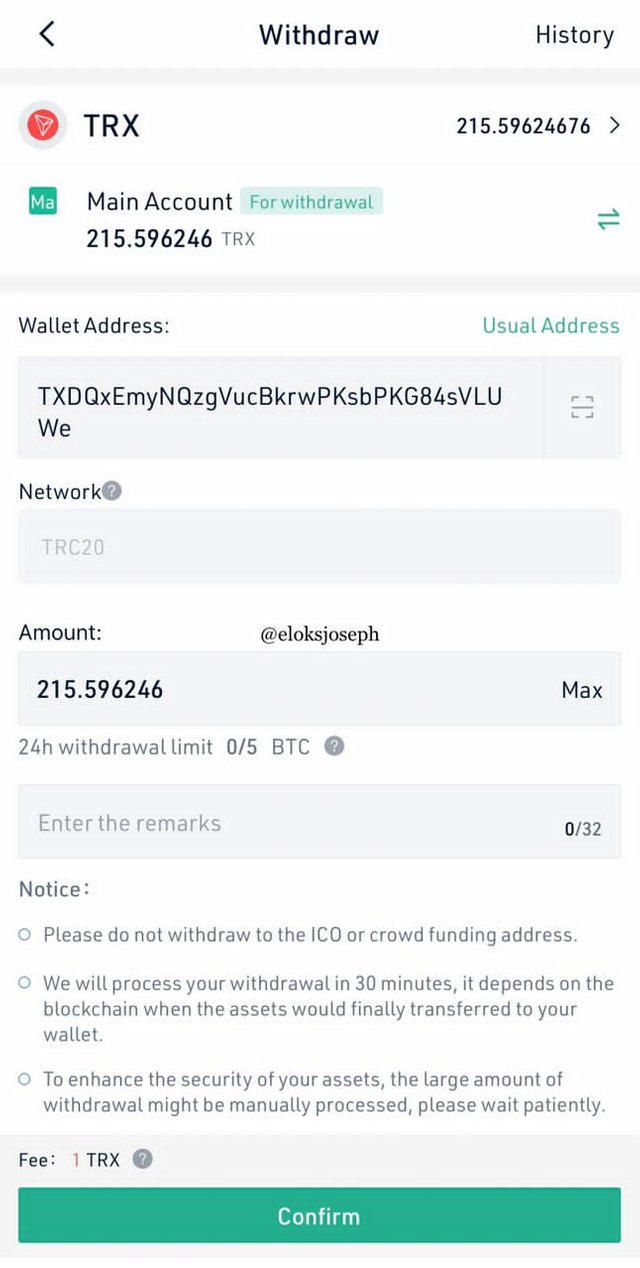

- Next ,I transferred it to my binance account :

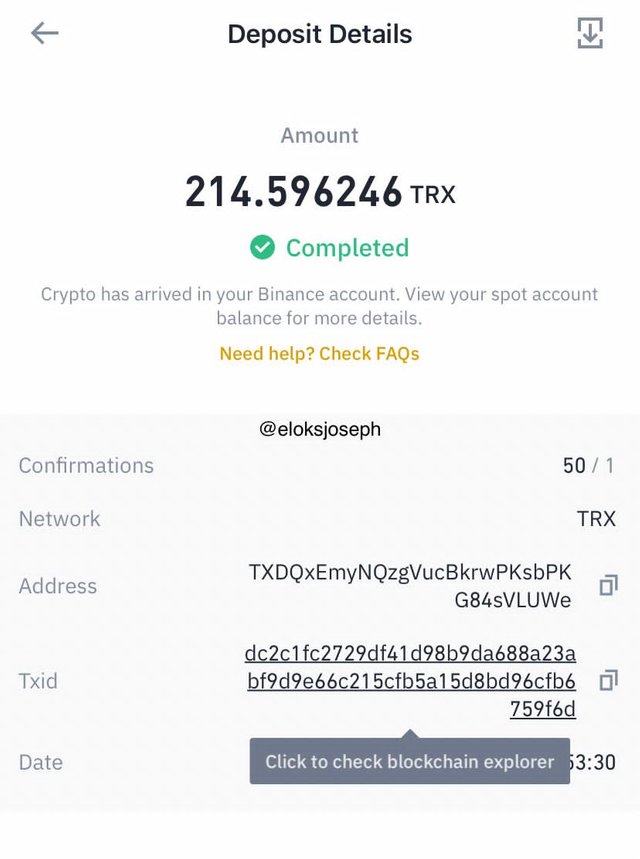

- Using 1 TRX as transfer fees, I deposited the remaining 214.59 TRX in binance.

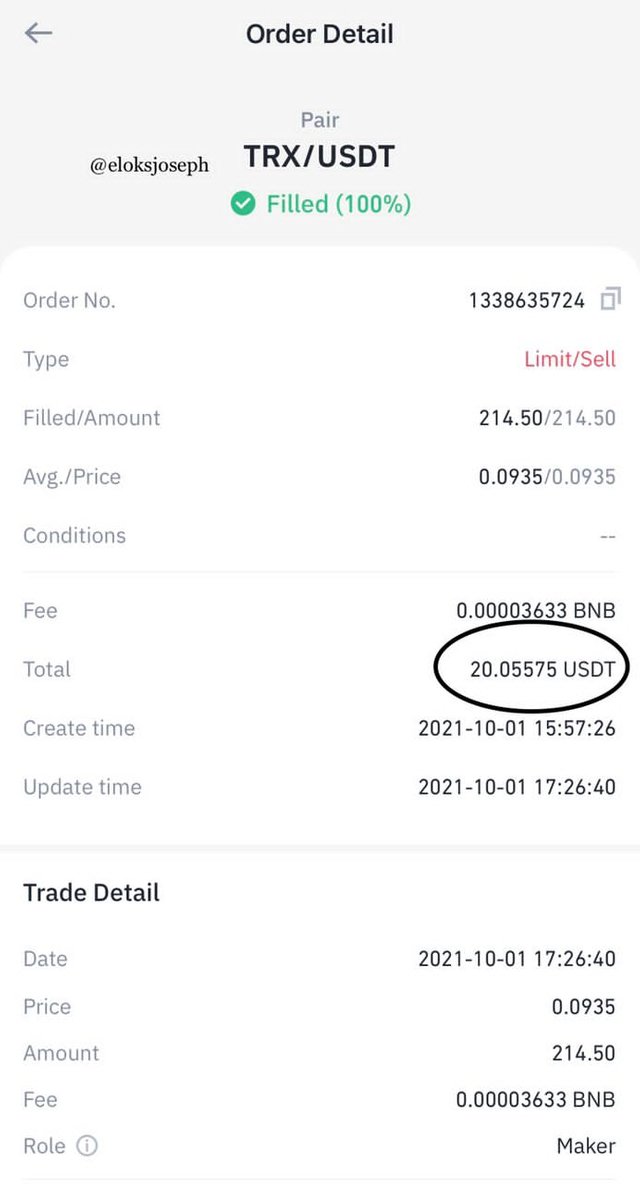

- After depositing, I converted the TRX back to USDT and got $20.055 . Here's the transaction details.

At the end of the arbitrage trading, I made a profit of $0.05575.

Bid price; $0.092847

Ask price; $0.093500

Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

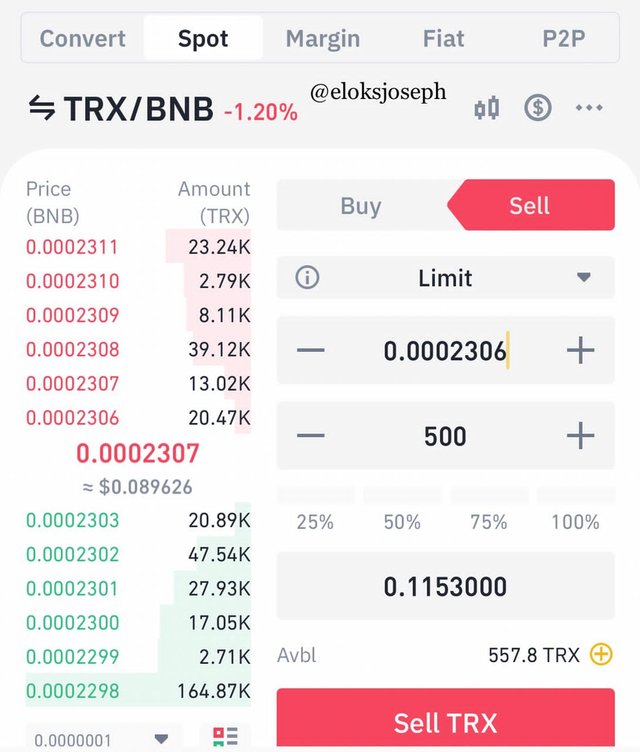

In this section, I'll be using my verified binance account. I'll be using 500 TRX to do traingular arbitrage trading strategy.

- For my first step, I'll be converting 500trx to BNB using market price.

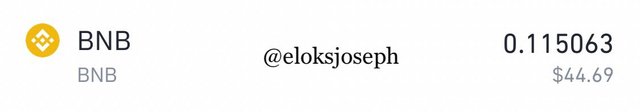

After converting, I got about 0.115063 BNB

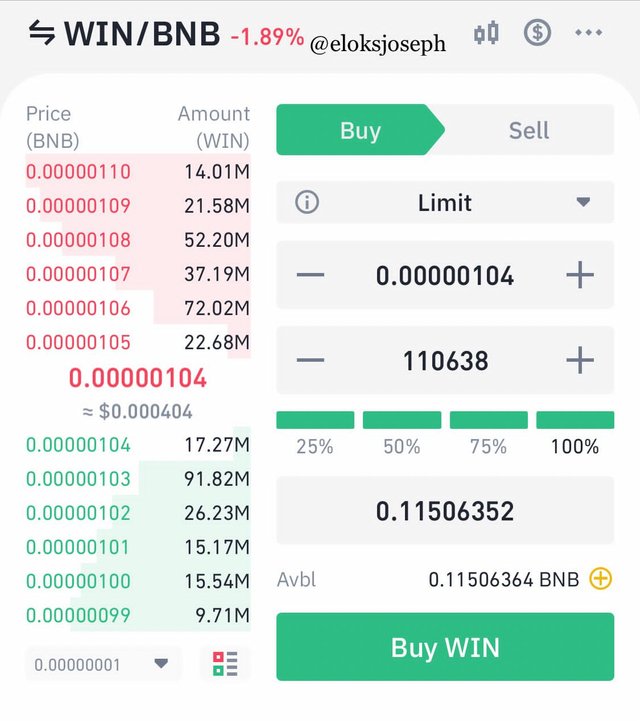

- Next, I'll be converting the BNB to WIN tokens using market price.

After converting, I got about 110527 win tokens.

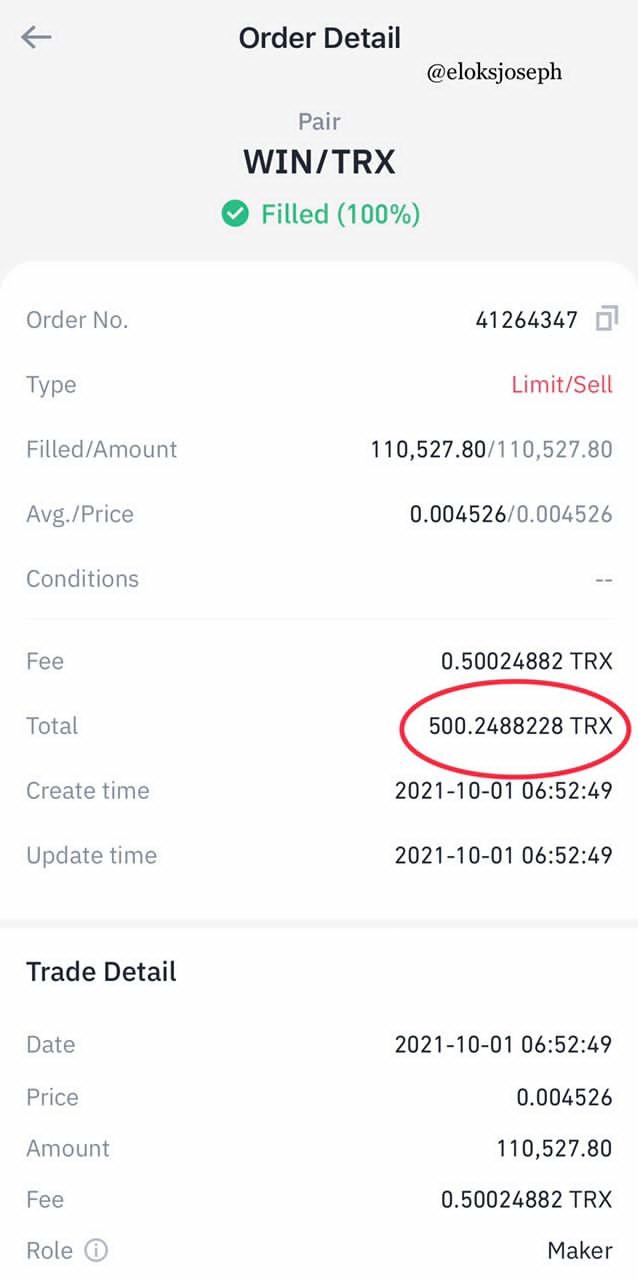

- The next and final step is converting the Win tokens back to TRX. Here's the transaction description.

At the end , I got back 500.24 TRX tokens making a profit of 0.24 TRX.

Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

Now that we understand what arbitrage trading is all about, let's take a look at some advantages and disadvantages.

ADVANTAGES OF ARBITRAGE TRADING

- LOW RISK:

Arbitrage Trading offers a low risk or risk free trading strategy. It contains little risk as profits are made from low risk exposure so loss of funds is rare.

- SWIFT TRADES

As we know some trades may take hours , days to be executed but in arbitrage trading, trades are done swiftly .

- SECURE TRADES BY OPERATING SYSTEMS

Since arbitrage trading requires speed, large volume of assets and a lot of money, many arbitrage traders use operating systems which identify arbitrage opportunities and does the trade for them so the trades are protected by advanced security systems

Now that we've seen the advantages of arbitrage trading,let's look at some disadvantages.

DISADVANTAGES OF ARBITRAGE TRADING

- VERY EXPENSIVE

Arbitrage Trading is very expensive and requires a lot of money to get a successful trade as price difference are often very little so very large volumes need to be traded.

- TRANSACTION COSTS

When we talk about arbitrage trading, we often overlook the trading fees and cost which often sum up to a lot .

CONCLUSION

Arbitrage Trading is a type of trading used by traders that involves taking advantage of different market prices and using it to make profit. There are different types of arbitrage trading; some are done in the same exchange,some are done over different exchanges.

Thank you professor @reddileep for the lecture.