Crypto Academy Week 10 - Homework Post for @fendit | Crypto as a Source of Passive Income

“Buy and HODL” are two common words that are often used together in the crypto community. But, is that all there is about cryptocurrency? In @fendit’s guide earlier this week, she encouraged us to talk about how we can make cryptocurrency work for us. In today’s task, I will be talking about my risk aversion, and also examine high-risk products, Launch pools, flexible and fixed savings, etc.

What is my risk aversion?

I would say I have a moderate tolerance to risk. When I bought my first coin, I had a very conservative view towards cryptocurrency. Not like I viewed it as shady like my peers, but I had very little understanding of its basic concepts. Over the years though , I’ve been more open minded to take bigger risk. Hence, my journey with crypto has been a bitter-sweet experience.

I wanted to make money like the whales and dolphins, but that needed more risk on my part. Like every newbie, I bought my first Bitcoin and traded for profits. Little did I know that it sparked a feeling in me. I liked when the market favoured me, and felt really bad when the market moved in an opposite direction.

I’ve also made hasty decisions for quick profits. I still remember when a friend introduced me to futures trading, I didn’t initially like the idea. When I needed quick gains, I had to call that friend of mine to explain over the phone how I could trade the futures.

On my first day I made good profit from trading futures, hence, I felt like a pro. I also used the x20 leverage option he recommended, so the profits were bountiful. But surprisingly, my second day became my last day. I lost all the profits I made the previous day, my capital and additional money I had funded on my futures account. So I made the decision never to trade futures again.

Well, I didn’t let that prevent me from spot trading. And I was still on the search for a risky and yet profitable crypto venture. It was at this point another friend introduced me to Launchpools. He told me about Julswap and he made profits from participating in their IDO. He had $TFF and other tokens. Well, I liked how confident he sounded, so I did my research.

After studying how Launchpool works, I realised it wouldn’t expose me too much as futures trading did. It was at that point I knew it was something I would try. I knew there was risk involved, but that wasn’t going to stop me. I did some digging of mine and I found other Launchpools on different blockchains that offered a similar service. I did a few IDOs and within a week I made over twice my investments.

I would pick Launchpools over fixed and flexible saving anytime any day. That’s another way to let your crypto work for you, but I just feel that’s not for me. I would rather let my crypto idle on an exchange that put it in savings. Well, that’s that. Let’s look at other ways to get passive income from crypto.

Fixed Savings, Flexible Savings, High-Risk Products, and Launchpools

Depending on your risk appetite, you can choose to participate in Launchpools or other Risk Products or simply use flexible or fixed saving. Well, high-risk is not for someone with a life-threatening health condition, e.g. High blood pressure. In that situation, you can pick between flexible or fixed saving.

Fixed Savings

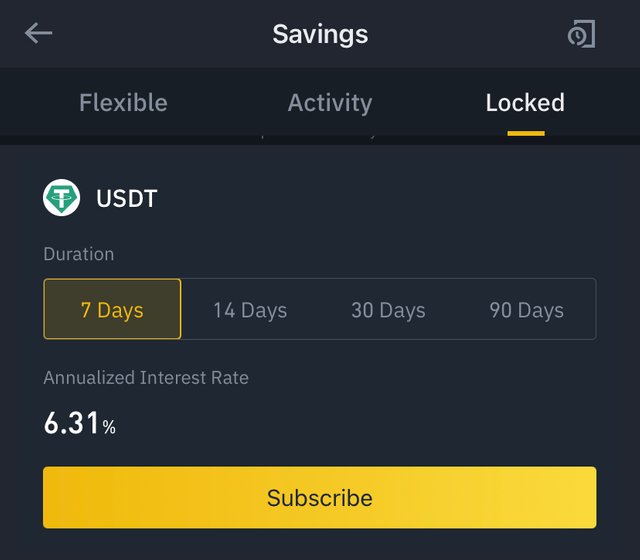

I like to view fixed savings like fixed deposits. If you’ve done fixed deposits with your bank before, you’d agree with me that they have so much in common. In fixed savings, you agree with the platform that you would not request for your crypto for the period you want to lock or fix it. The period can range from one week, 2 weeks, a month or even up to 3 months.

When you head over to a bank and tell them you want to fix $10,000, they’ll tell you the rates and then agree on a duration. Similarly, when you fix crypto on fixed savings you’re given a rate and duration. Please note that all rates are usually quoted per annum, unless otherwise indicated.

Flexible Savings

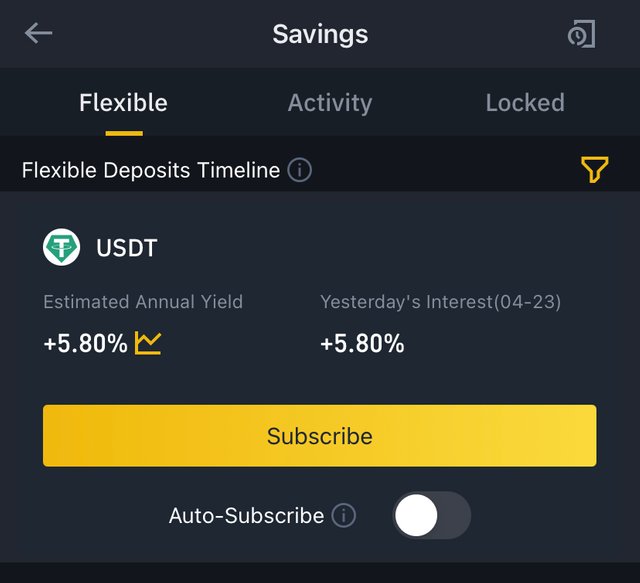

One advantage flexible savings have over fixed saving is that you can always collect back your coin or token anytime you want it. Especially during a bull run, you can simply withdraw from the savings and sell for profit. Hence, it gives flexibility that is unavailable in fixed savings.

If you’re interested in flexible savings, you’d have to transfer the token into the savings account and then subscribe for the product. If you withdraw at anytime you’d be given the profits it has accrued for the duration.

Launchpools

This is my favourite as I’ve earlier mentioned. There’s endless opportunities in Launchpools. If the exchange or swap has a token, then you’d be expected to stake a certain amount in order participate in the IDO or ICO. The amount staked is what will be used for providing liquidity when the token is later listed.

High-Risk Products

I would not recommend High-Risk Products, unless you have what my friends would often call “strong mind.” That is you have a really thick skin when it comes to investments. As the name implies, high-risk products are very volatile. It’s possible to make very good profits with this kind of investment, as it is also possible to lose all your money.

High-Risk Products consists of DeFi Staking, Dual Investments and Liquid Swap.

| Name | DeFi Staking | Dual Investments | Liquid Swap |

|---|---|---|---|

| Concept | DeFi stands for Decentralized Finance | Investment of two coins, usually one staked token and one stable token | Automated Market Maker Protocols |

| Example | Staking 1INCH, DODO, etc | e.g. DODO and BUSD | JulSwap, 1inch, Uniswap, etc |

How to Use Raydium Protocol’s AcceleRaytor Launchpool

Apart from Binance’s Launchpool, Raydium Protocol’s AcceleRaytor is another launchpool that I have monitoring for a while. Raydium is on the Solana blockchain, which is currently one of the hottest in the DeFi world. This is because Solana have lesser fees than that of Binance Smart Chain.

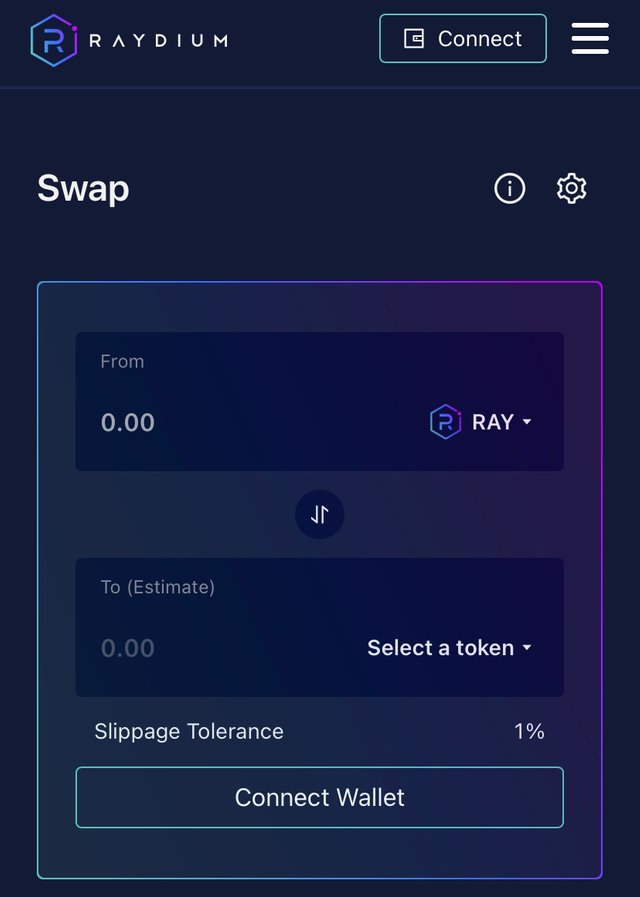

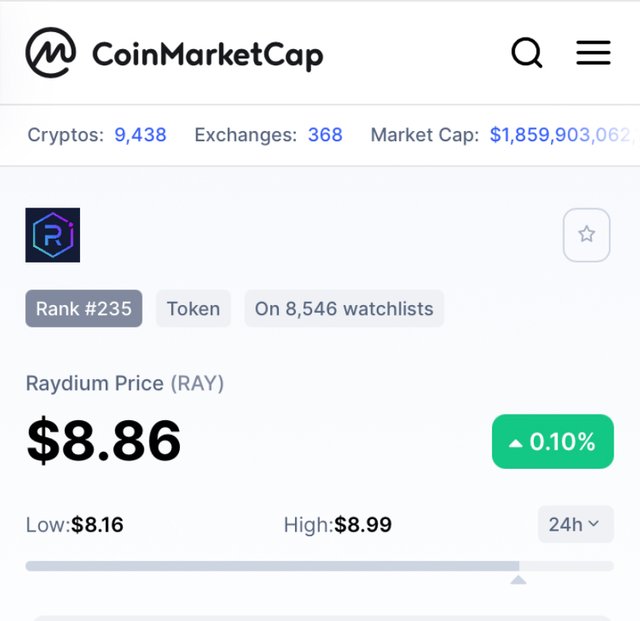

In order to participate in the launchpool, users have to stake 20 $RAY token 7 days before the pools are opened on its AcceleRaytor. In few days time, Media Network will be launched on the platform. Users have already staked their $RAY tokens in anticipation of the pools opening.

$Ray token is currently worth about $8.86. So the total amount required to participate in the IDO is $177.2. You can purchase $RAY from FTX, Gate.io, Uniswap, Sushiswap, MXC, Serum DEX, 1inch Exchange and Sushiswap.

Step 1

After buying your $Ray tokens, head over to raydium.io and select launch app.

Step 2

Connect your Sollet wallet to Raydium.

Step 3

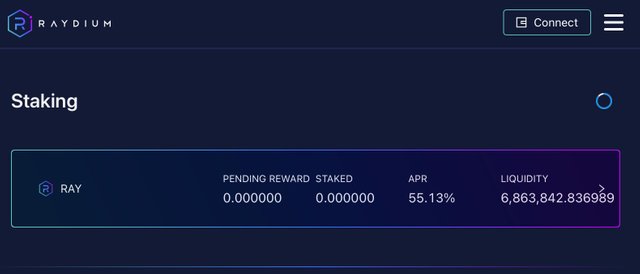

Go to the staking section on Raydium.

Currently, over 6 million tokens is staked on the platform.

Step 4

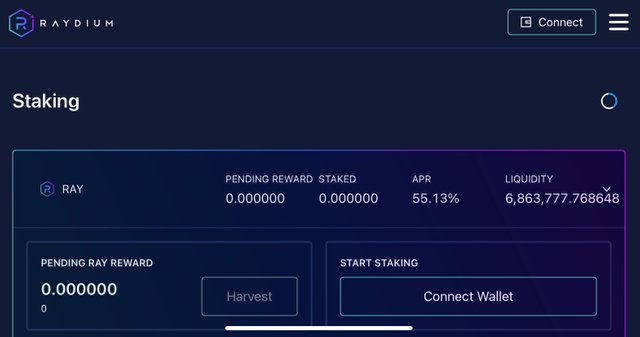

You can confirm if you have successfully connected your sollet wallet and staked your tokens.

Step 5

Step 6

After staking, your tokens you can sit back and relax till the pools are opened.

| Raydium AcceleRaytor | BSCPad | Binance Launchpool | |

|---|---|---|---|

| Barrier of Entry | Low amount | High amount | Low amount |

| Days of Staking required | 7 days | 7 days | 7 to 14 days |

| Blockchain | Solana | Binance Smart Chain | Binance Smart Chain |

In comparison with BSCPad and Binance’s Launchpool, the AcceleRaytor has lower barrier of entry. When it is oversubscribed, participants simply receive percentage of their amount used for subscription.

Conclusion

One interesting thing about Launchpool is that the price of the tokens begins to go up as soon as it is released for the general public. In reality, Launchpools make it easier to access the token before majority of people. It requires a level of risk tolerance as well, but not as risky as high risk products. It is best to gradually increase one’s risk, instead of a newbie buying a high-risk product. Crypto can definitely be used as a source of passive income.

Cc: @fendit

Thanks for the opportunity to talk about my risk tolerance and passive investment in crypto.

Thank you for being part of my lecture and completing the task!

My comments:

Nicely done!

You made a great work on all tasks, they were all explained to perfectiong and I really liked that you showed how to take part into another launchpool that's not Binance.

Well done!!

For future references, try to focus a bit more on markdowns, as they help you polish your work a lot more! :)

Overall score:

8/10