Zethyr Finance - Crypto Academy / S4W8 - Homework Post for @fredquantum.

Hello guys, hope you are all doing well. I am enjoying homework participation as it gives me knowledge about diverse aspects of crypto space. Today I am writing homework task for professor @fredquantum which is about Zethyr Finance.

What is Zethyr Finance?

Source

Zethyr finance is a decentralized money market protocol powered by smart contracts in the Tron ecosystem. Zethyr finance offers two pools of assets -- Supply Pool and Borrow Pool. As of now, it supports only TRX, USDT, WIN and BTT. A supplier earns floating interest for supplying tokens where as burrower pays interest for burrowing. The interest rates in both the pools are different. The borrowers need to pay the interest in the same token which they borrow and are free to pay interest anytime but any delay beyond one day leads to compounding of the interest and that is undoubtedly a burden for burrower and may trigger liquidation of collaterals. Rebalancing is carried out every 24 hours to ensure balance between supply and demand so as to keep markets liquid for users and offer better yields and lower Interest rates. .

I'll be briefly explaining the logic of floating interest rates on zethyr. The whole supply and demand chain is focussed at keeping the markets liquid and interest rates low to encourage burrowing and thereby benefit burrowers as well as lenders. If demand / supply is low, interes is kept low to encourage burrowing. On the other hand, if demand / supply is high, interest rste is kept high so that burrowers return loans immediately to avoid heavy interest rates and add to supply so that ratio is neutralised again. One more noteworthy point about Zethyr is that, there is no limit on lending period. We can say it in other words, as long as burrower is able to comply by the guidelines of the protocol, he can keep the burrowed asset.

The governance token on zethyr is ZTR. So ZTR entitles stakers to participate in governance of the ecosystem like propose any change etc.

What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

Zethyr finance is a decentralised application on Tron blockchian dedicated for providing service in the financial sector. The features of Zethyr finance that I can explore are given below ;

Supply/Burrow Markets.

The primary function of Zethyr is to allow suppliers to supply tokens (TRX, BTT, USDT, WIN) to the liquidity pool and pay them interest at floating rates. Similarly, burrowers can burrow tokens from the protocol after staking collaterals and pay floating interest rates. The rebalancing of assets is carried out every 24 hours to maintain liquidity of the market, mitigation of the risk and ensure better yields for both borrowers and suppliers. The mechanism of floating interest rates to ensure ideal demand /supply ratio is explained above.

Liquidation of funds is important concept to understand for burrowers. If burrower fails to pay interest at asked rate or price fluctuates in unfavourable directions after burrowing takes places, to protect what is known as lenders principle , zethyr is authorised to carry out liquidation of collaterals to pay debt. In case multiple token has been burrowed, liquidation of token with least monetary value in aggregate is carried out first .

The maximum amount of a particular token that can be burrowed by a burrower is based on collaterals and liquidation ratio of token.

Max credit limit of token = Deposited token value/ liquidation ratio of token

Liquidation ratio is the minimum collateralisation ratio of a respective digital token that Zethyr will accept to protect the protocol’s principal.

Collateralization ratio = Collateral value in USDT / Loan + Interest in USDT.

Without falling in trap of calculations, things will be clear as we perform transactions in subsequent sections.

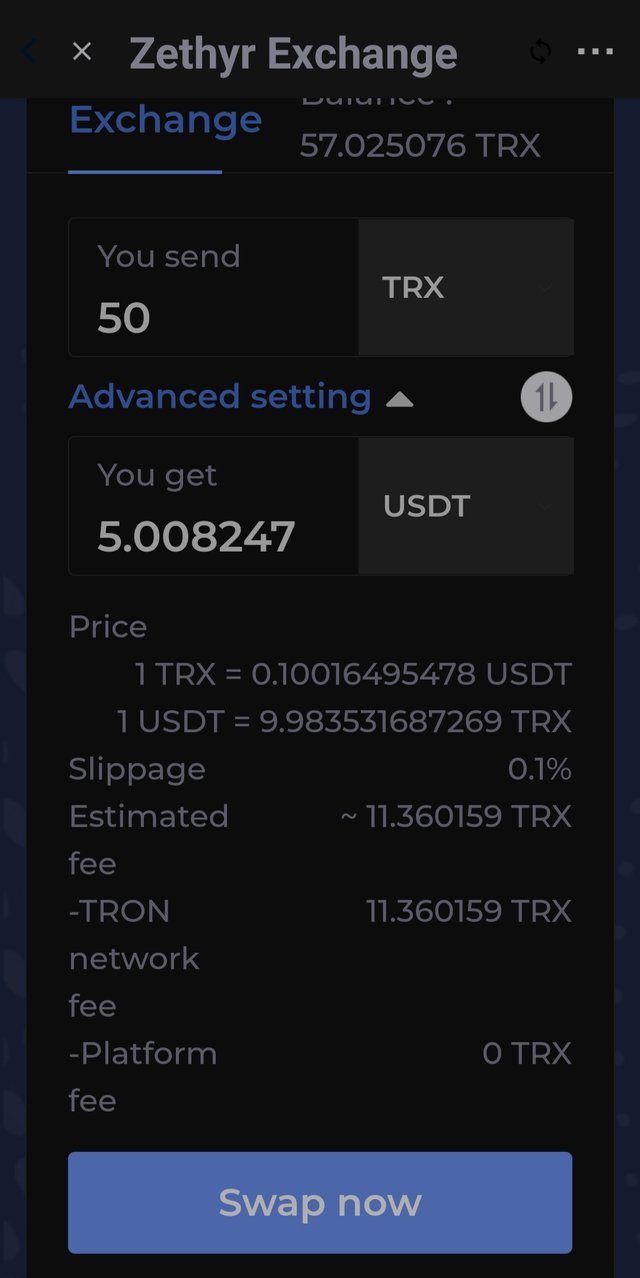

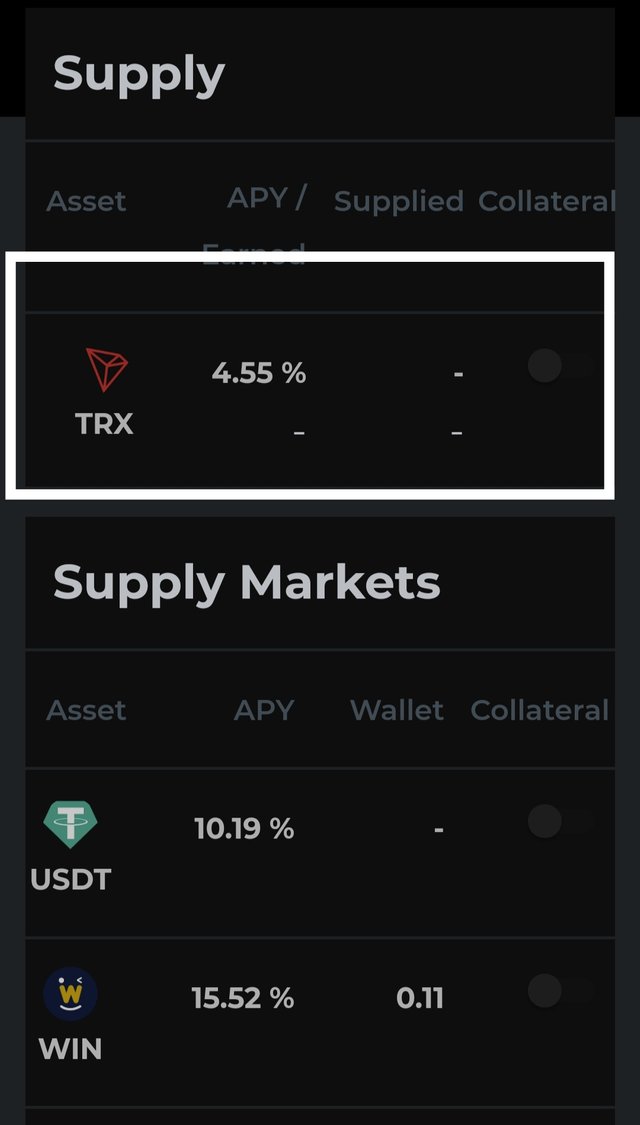

Zethyr Exchange

An exchange linked to money market protocol is not a common feature. The DEX linked to Zethyr allows users to swap tokens within the Zethyr for other tokens and utilise for desired purpose. One use case of exchange can be understood by swapping TRX for WIN token and than supplying WIN to earn better interest rates as TRX has interest rate of 4 . 55% while as WIN has interest rate of 16.14%. Zethyr allows swap of tokens like TRX, USDT, WIN, SUNOLD, WBTT, JST and many more tokens.

Source

In the screenshots above, we can see that for 50 TRX, we are getting 5 USDT (approx) and estimated fee is more than 11 TRX which is very high. Fee for swapping different tokens is different but i think it is a bit higher for all and one thing to be considerd is that the fee is fixed. So it may be profitable for those who have to perform swap of huge amounts.

Stable Swap

Stable swap is an exciting , interesting and unique feature of Zethyr. Stable swap refers to exchange of stable token of Tron network with that of other network like Ethereum. As we have only one stable token in the list so for and that is USDT. So we can swap it for USDT of Ethereum blockchain. All we need is the USDT deposition address of Ethereum blockchain.

We know that different blockchians are not able to interact with each other because tokens of one blockchain follow different operational standards like TRC 20 on Tron and ERC 20 on Ethereum. For Interoperability, tokens are first wrapped and than transferred like BTC to wBTC. So stable swap has eliminated need for wrapping but the limitation is that only stable tokens are available for swap and as of now there is only one stable token on zethyr.

DEX aggregator

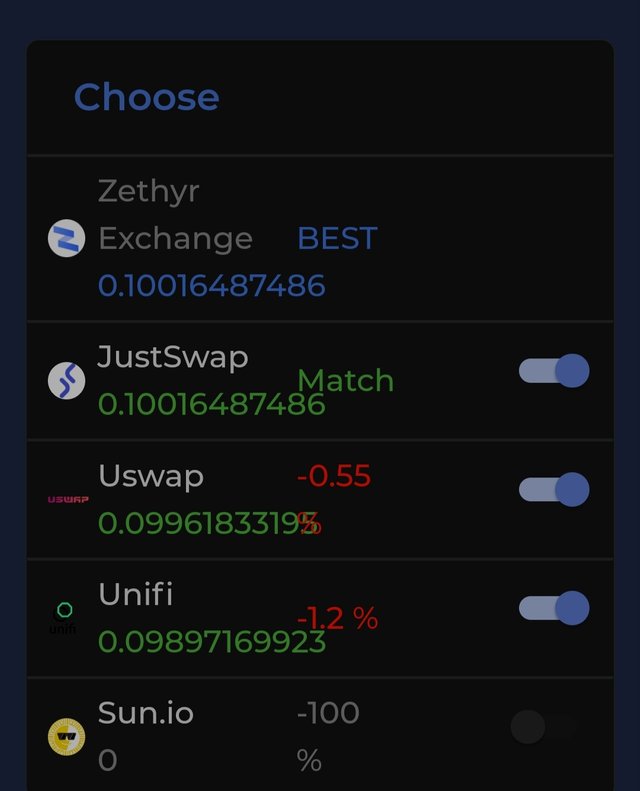

Zethyr exchange and Zethyr swap combined together as DEX aggregator because it aggregates various swaps and exchanges (UNISWAP, UNIFI, JISTSWAP) to keep markets liquid and ensure better price and yield. The swap is offered at the best possible rate . By incorporating zethyr aggregator, a user while performing swap gets order executed at the best possible price and yield offered by any of the aggregated exchanges. So zerhyr aggregator is allowing users to explore the aggregated markets without actually exploring these markets separately. So it is "many in one" offer of Zethyr.

We can see that zethyr matches JustSwap. It emphasise the versatility of Zethyr.

Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

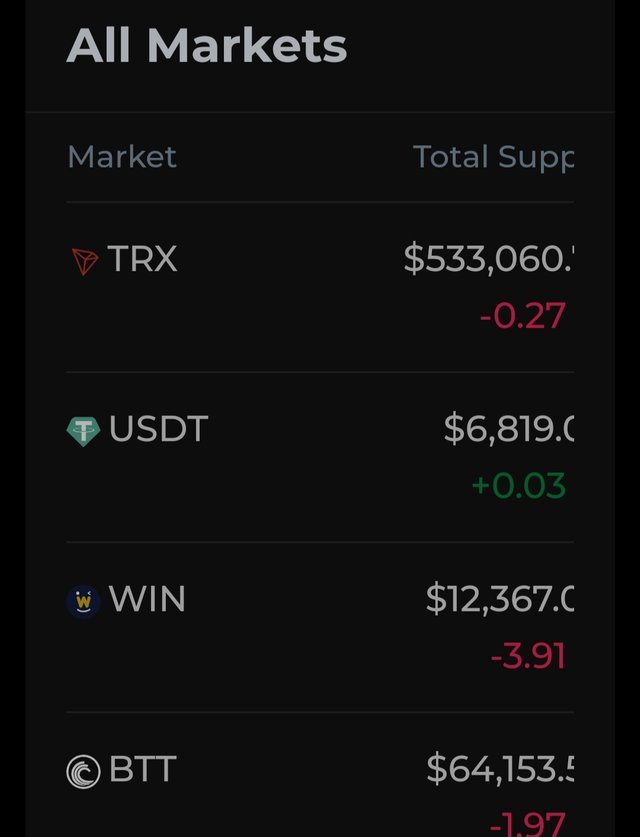

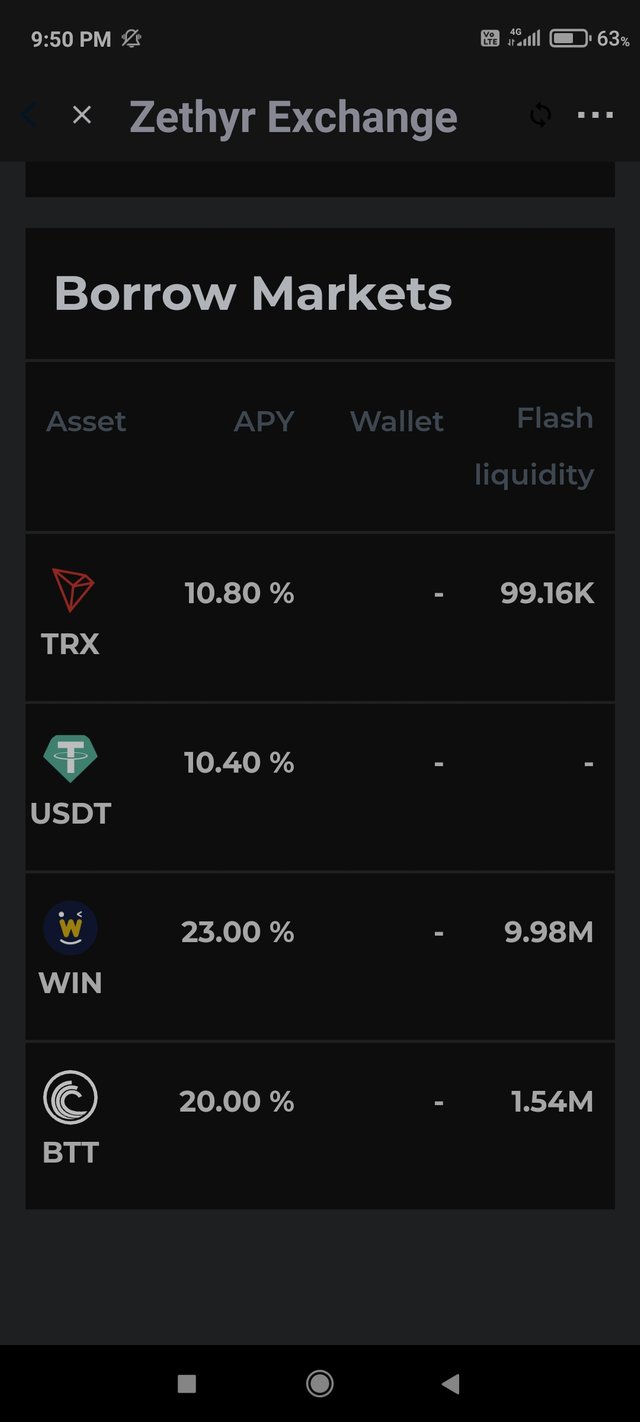

As for i can explore markets, zathyr finance supports only four markets and they are TRX, USDT, WIN and BTT. These four markets are available as Burrow as well as supply.

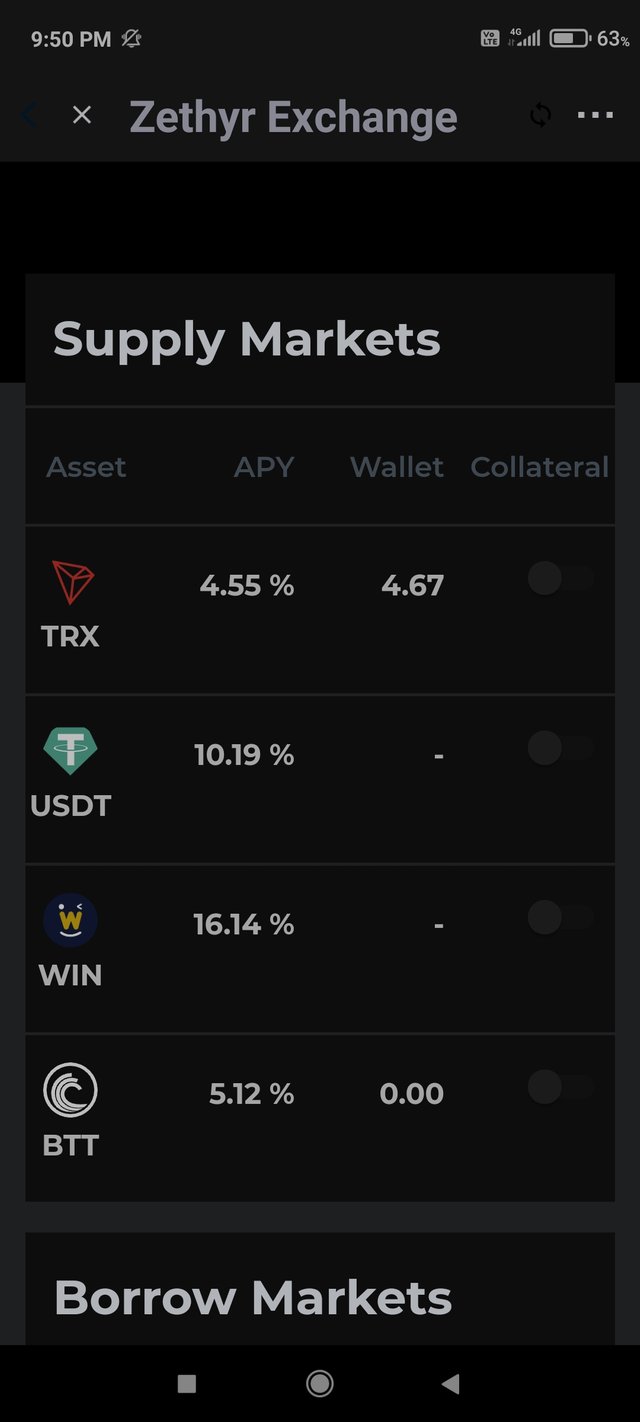

Supply Market

Zethyr finance allow users to supply tokens to the liqudity pool for which liquidity providers earn interest at different rates. As for the profitability is concerned, the highest APY is offered by WIN token which is 16. 14% and the least APY is offered by TRX which is 4.55%. USDT has APY of 10.19% and WIN has APY of 5.12% . APY stands for annual percentage yield . APY differs from APR (annual percentage rate) because former takes into account compound interest rates. Power of compounding in field of finance always culminates into magical profits. Zethyr offers interest on supplied assets in APY, so is

very profitable.

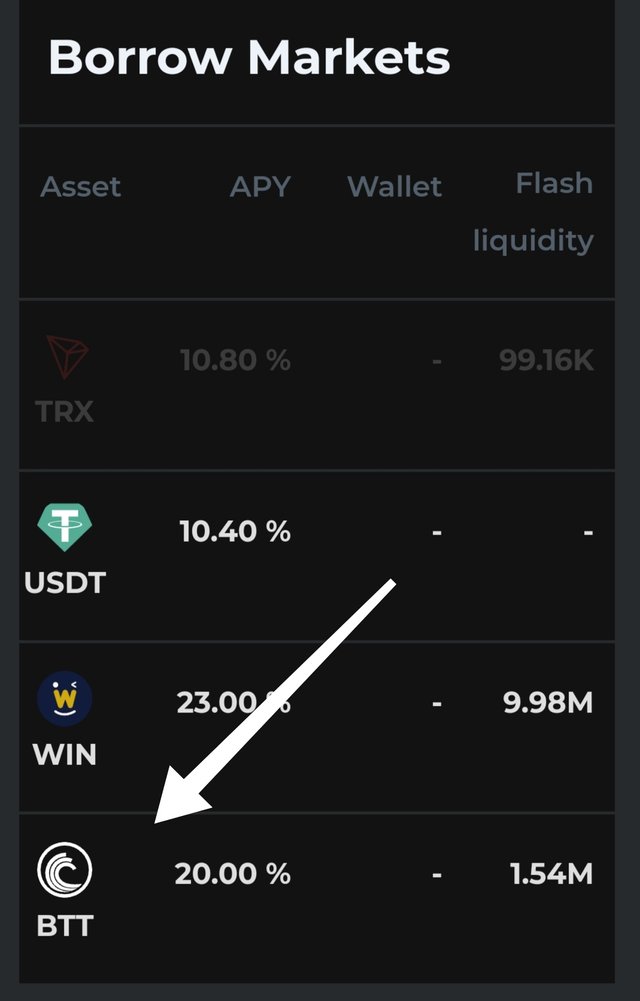

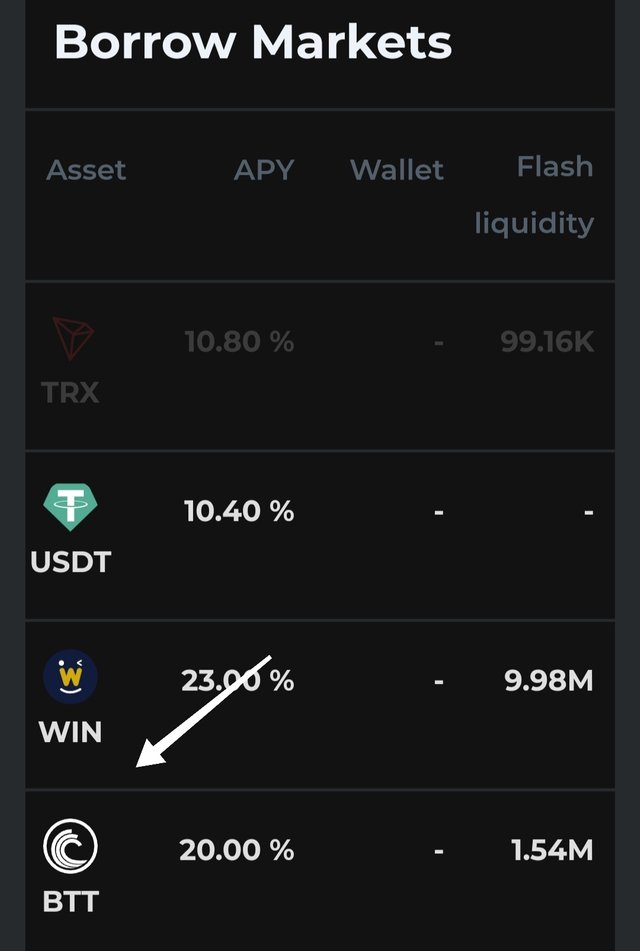

Burrow Market.

Zethyr finance lend funds of suppliers to burrowers for which burrowers have to pay interest at different rates. Highest APY in burrow market is offered by WIN token and that is 23% and lovest APY is offered by USDT 10.40% for burrowers USDT is most profitable and WIN token is least profitable.

Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

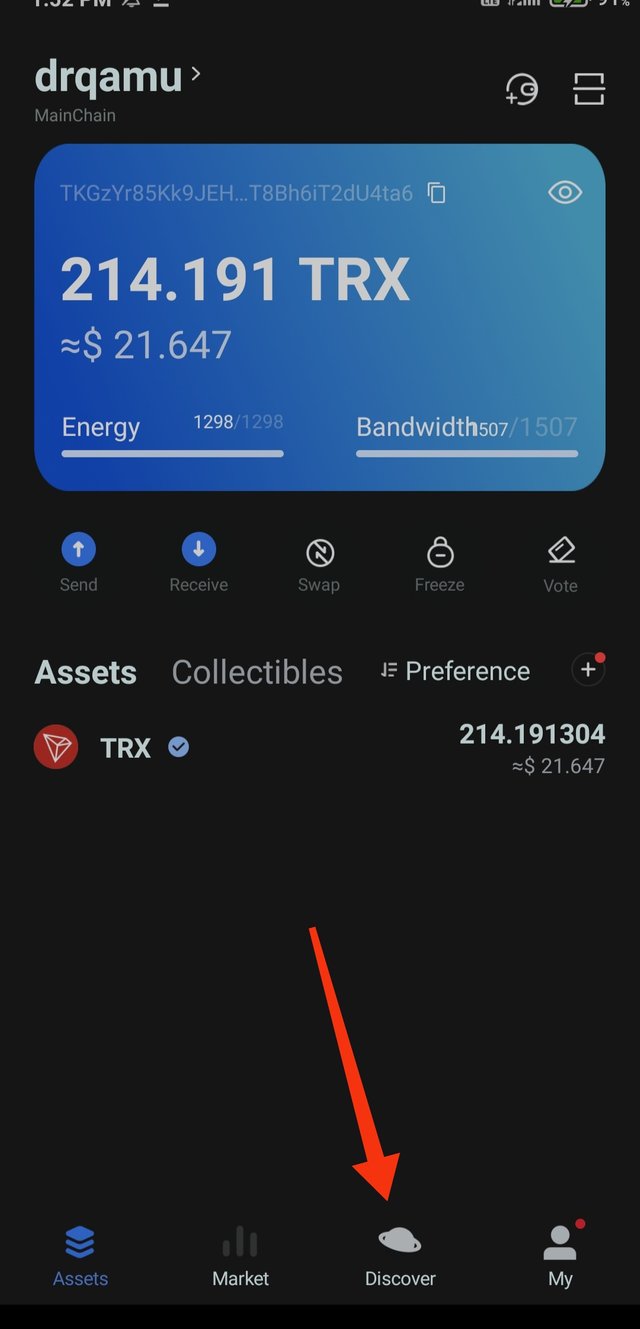

Connecting TronLink to Zethyr Finance can be achieved directly from TronLink App or from web browser like Chrome. Of these two methods , I find it simpler to connect via TronLink App. So I'll be demonstrating it with that method in a stepwise manner .

Open TronLink App and from the bottom panel of the main page of the app, click on "Discover".

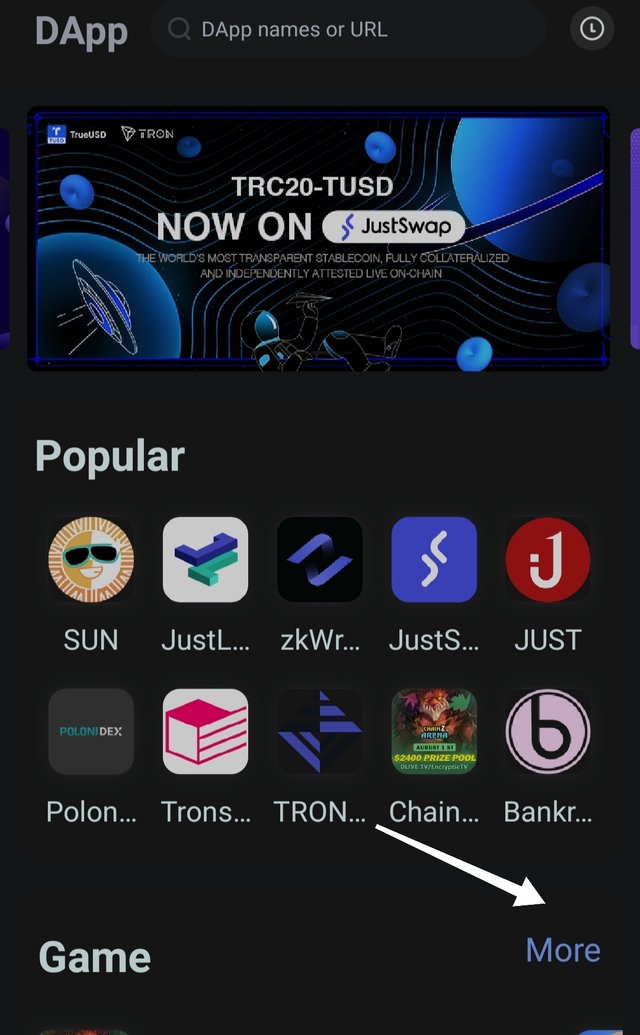

On the next page,

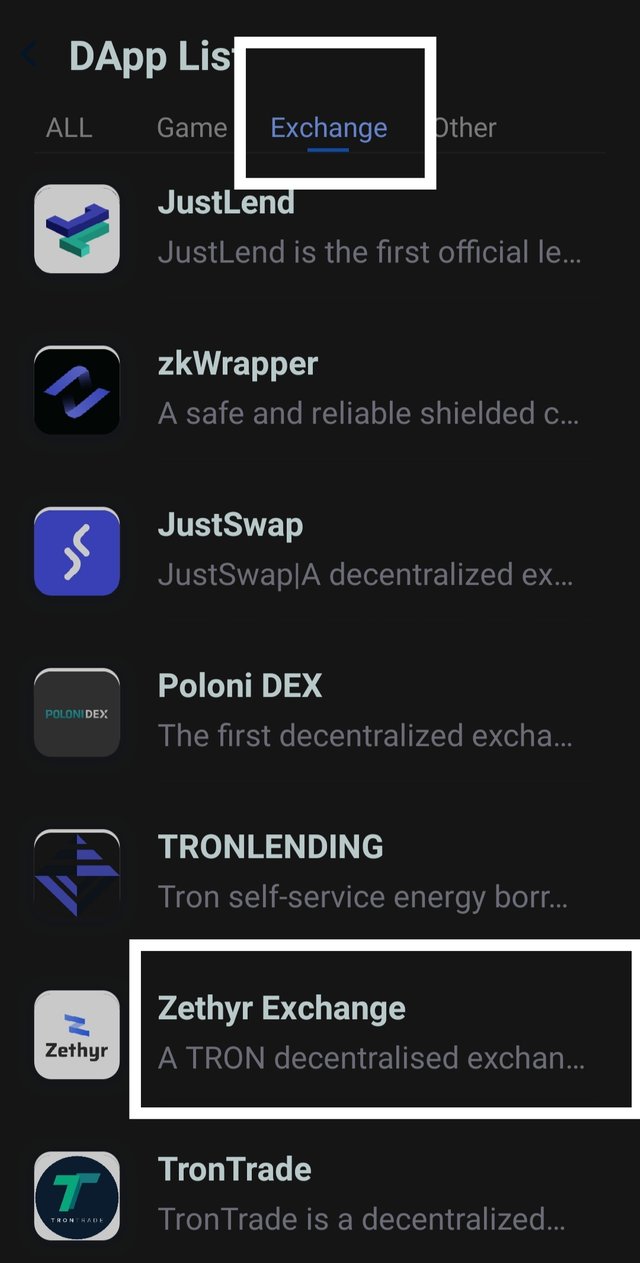

Tron Dapp icons will be seen, click on more and the list of Dapps will load. For easy accessibility click on Exchanges and look for Zethyr Exchange. Click on it and it will connect you directly to Zethyr Exchange.TronLink address will be seen at top right corner.

Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

zTokens are native tokens of Zethyr finance which we get after supplying any of the tokens available on Zethyr finance. They are pegged to underlying asset in the ratio of 1:1. To put it simply, we can understand it as, we get zUSDT after supplying USDT to the Zethyr protocol. Similarly we get zTRX, zBTT, zWIN after depositing TRX, BTT and WIN into the Zethyr finance. We get all of these in the ratio of 1:1 . When we withdraw supplied token from Zethyr exchange, zTokems are burned and underlying asset is released. The interest earned while supplying any token is credited automatically to the wallet in the form of Z tokens. With zTokems user can perform all the operations that can be performed with the underlying asset.

Another token of similar attribute is JToken on JustLend platform. For example, supply of TRX to JustLend yield us jTRX in the ratio of 1:1 .

Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

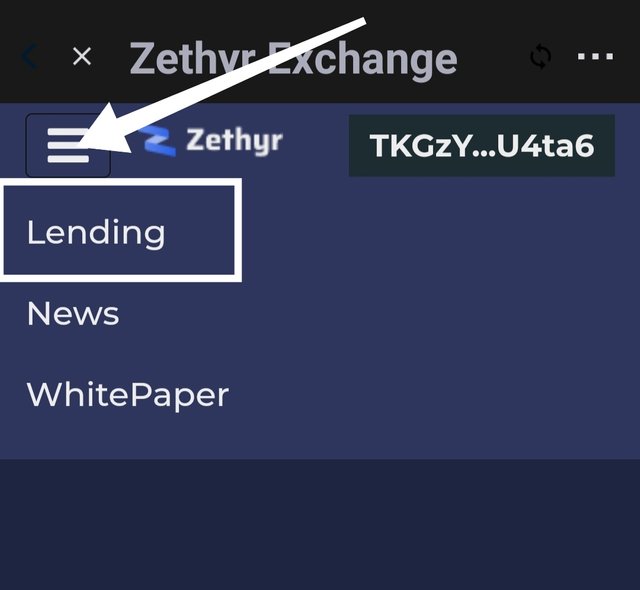

From the main page of Zethyr Finance, click on top left corner, a drop down menu will open. Select "lending *option from the menu.

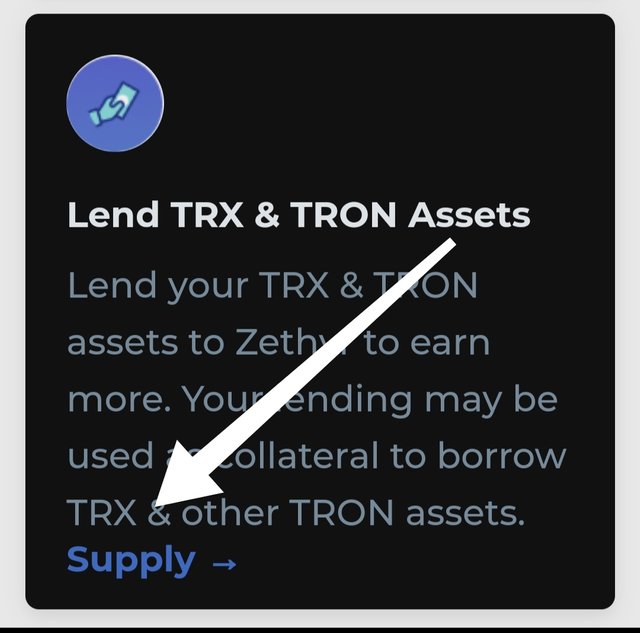

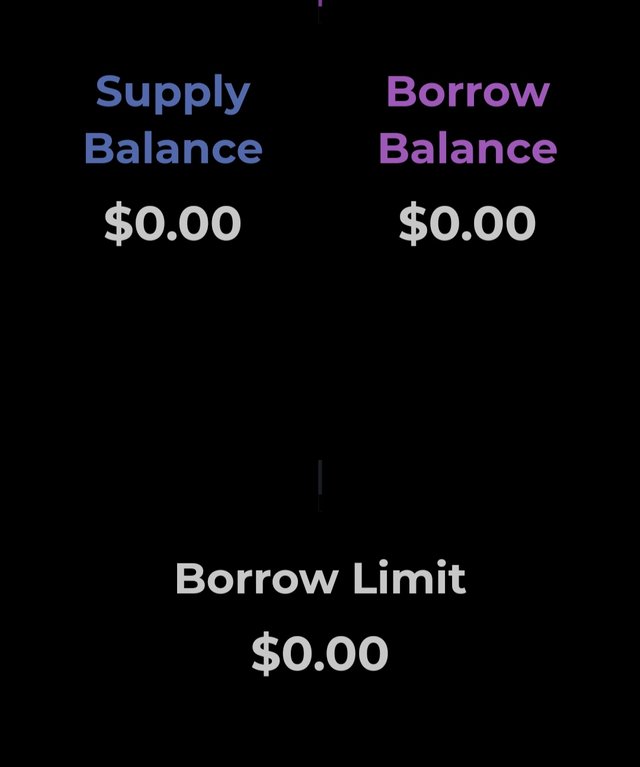

On the next page , we get to see the supply and borrow balance which is zero in both the sections as I haven't performed any transaction yet . Scroll down the page and we get to see option by the name of "Supply (lend) TRX and Tron now* . Click on Supply.

We need to enable the supply option first . Click Enable and complete enable process by submitting TronLink password.

Next we get to see the list of supply markets available along with APY. I choose to supply TRX, so I clicked on TRX.

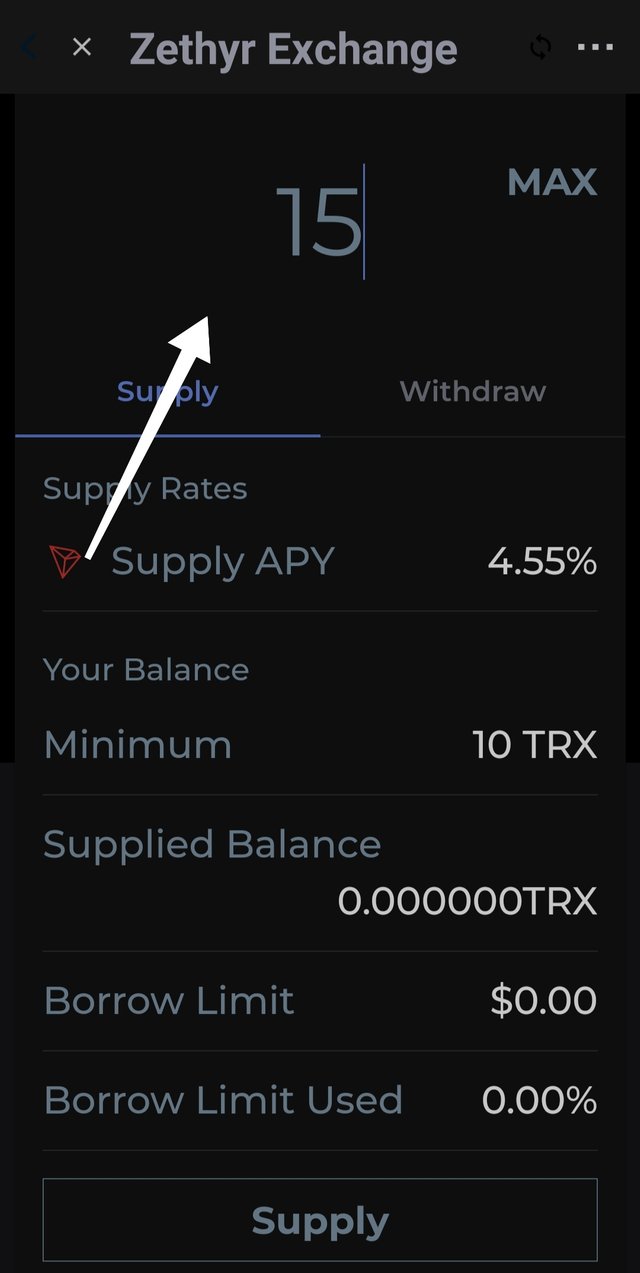

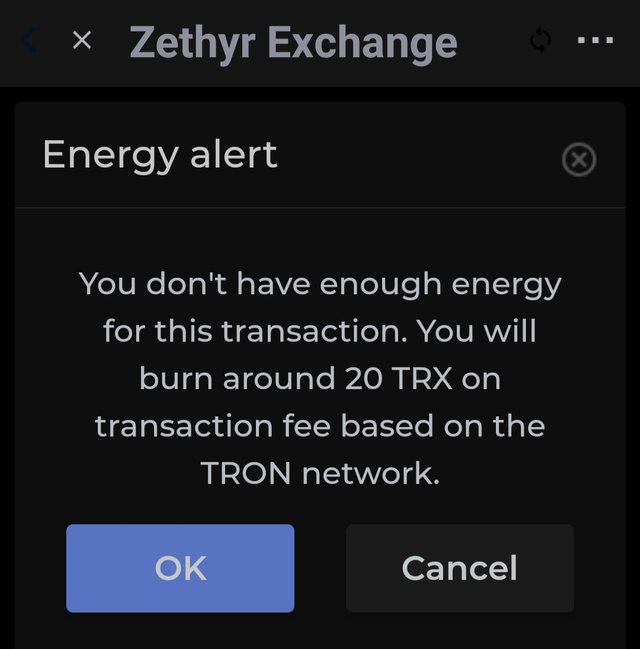

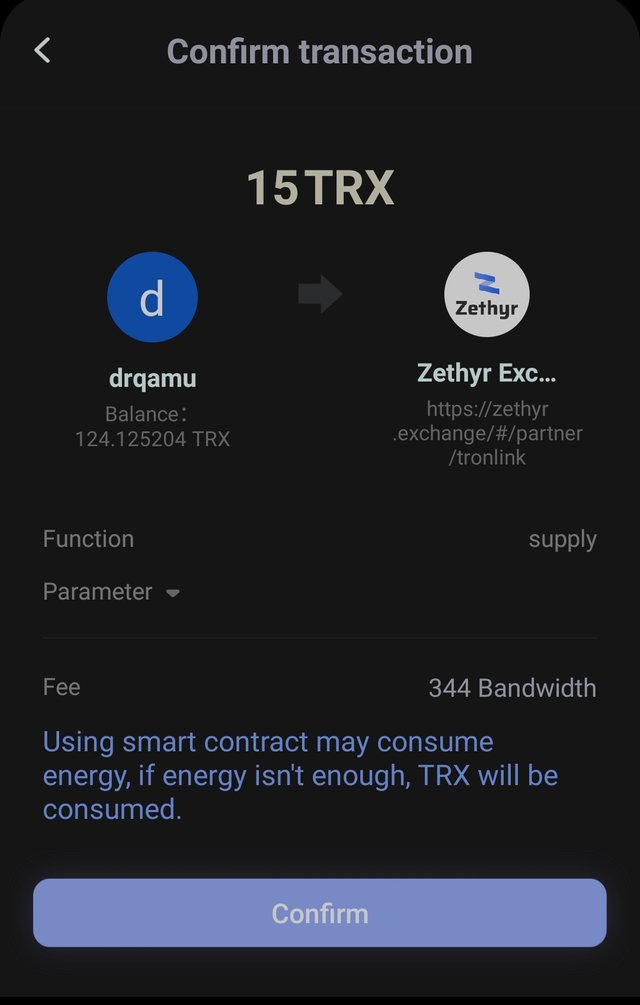

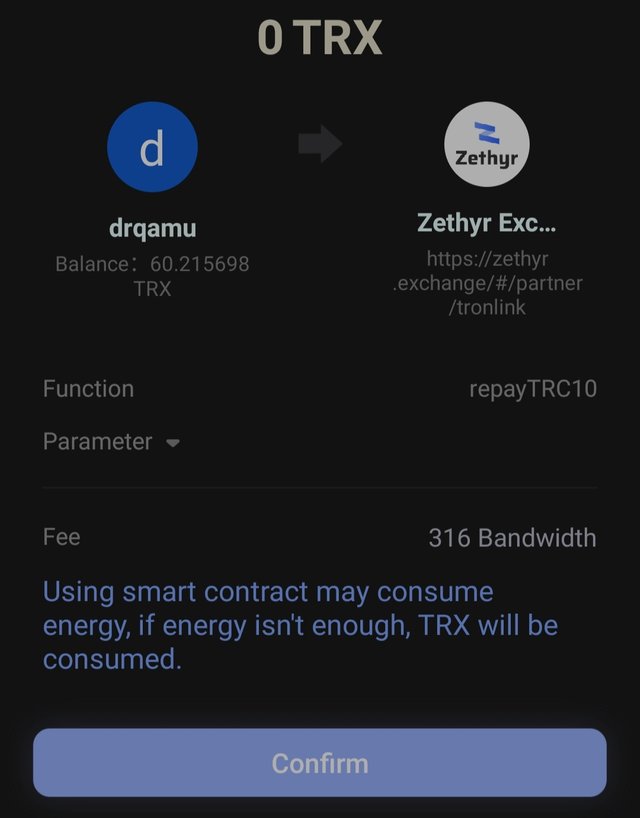

Enter the amount of TRX to be supplied and click on supply. I choose to supply 15 TRX. Next click on confirm after checking the details like energy , bandwidth and TRX .

Complete the transaction by entering the TronLink password.

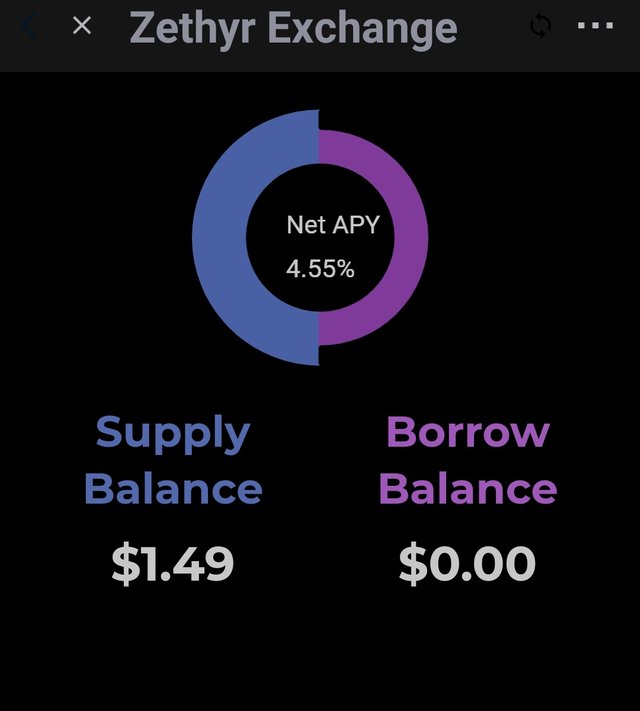

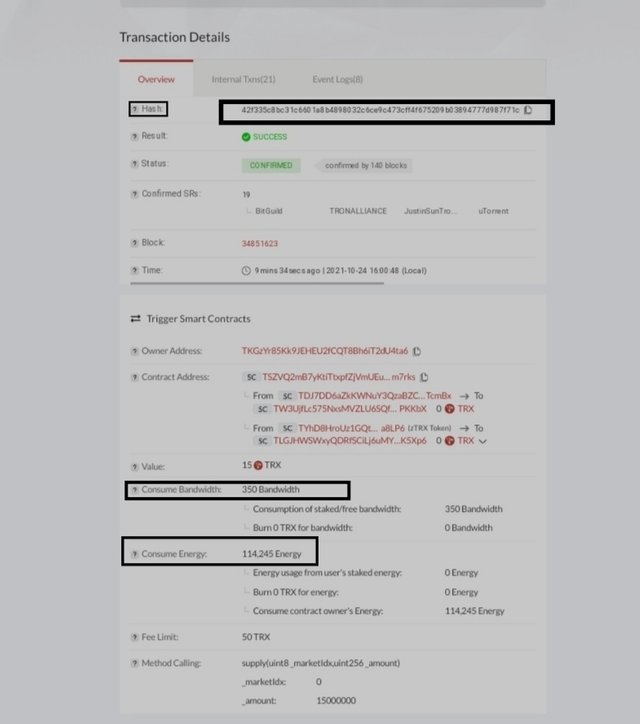

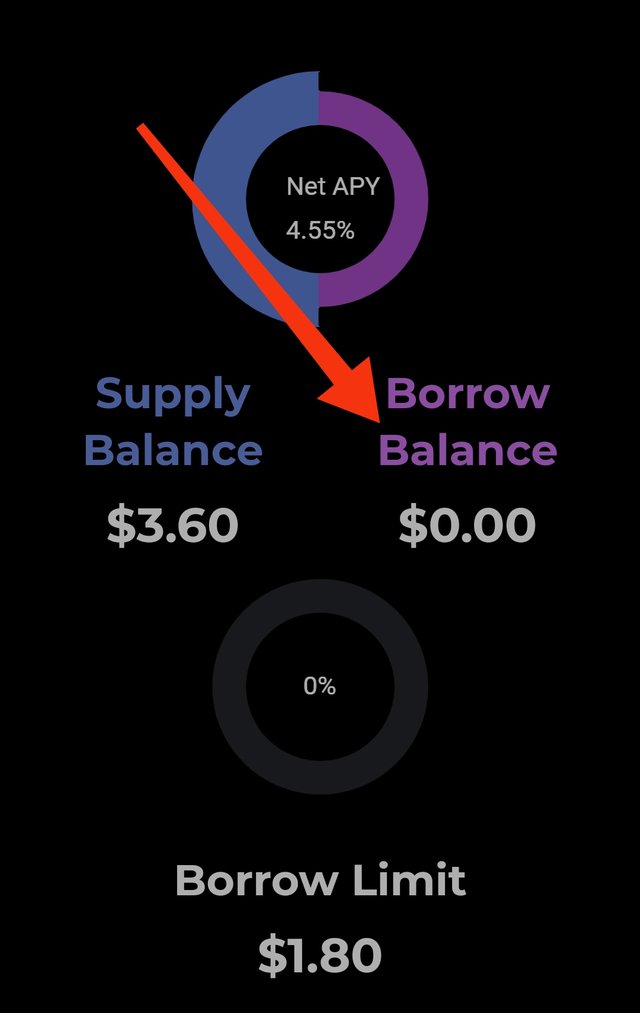

Next, we get to see the supply balance. In my case , I have supplied 15 TRX which equals $1.49 .

Next I'll be trying the transaction details from the Tronscan like energy consumed , Bandwidth consumed, transaction hash etc.

Hash

42f335c8bc31c6601a8b4898032c6ce9c473cff4f675209b03894777d987f71c

Bandwidth: 350 Bandwidth

Consumption of staked/free bandwidth: 350

Bandwidth

Burn 0 TRX for bandwidth: 0

Bandwidth

Consume Energy:

114,245 Energy

Energy usage from user's staked energy: 0 Energy

Burn 0 TRX for energy:0 Energy

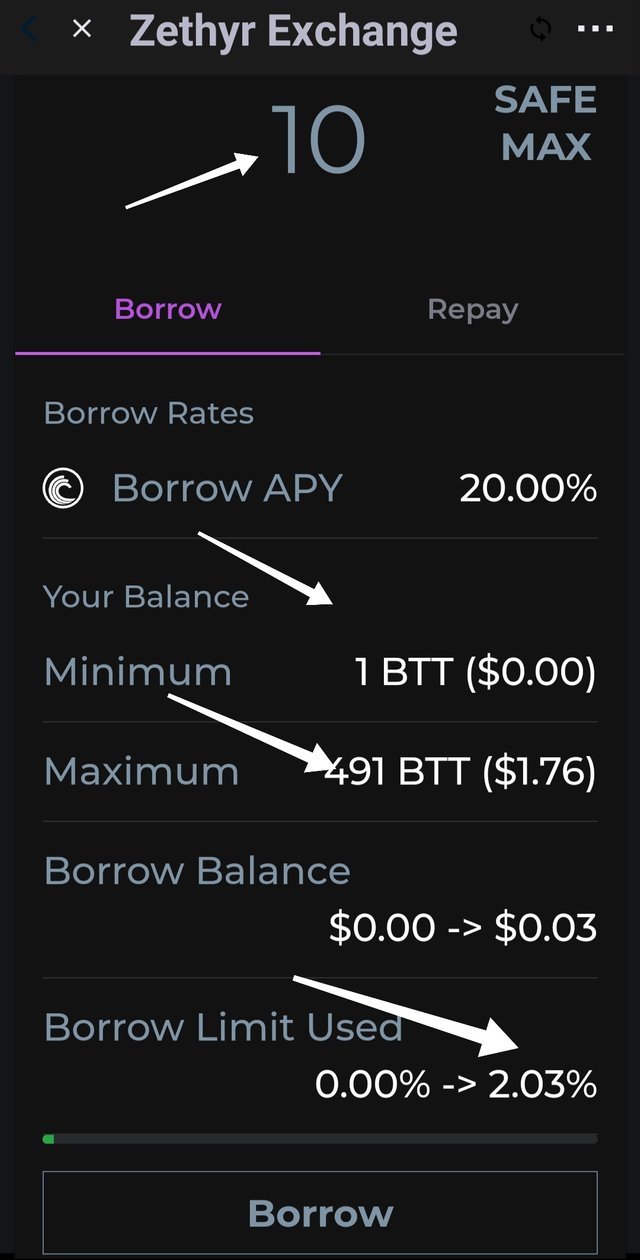

Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

- Again click on top left corner, from drop down menu, click on lending options (burrow option not here) , on the next page scroll down to find option " Burrow TRX and TRON". Click on burrow.

Next we will be able to see supply and Burrow market.

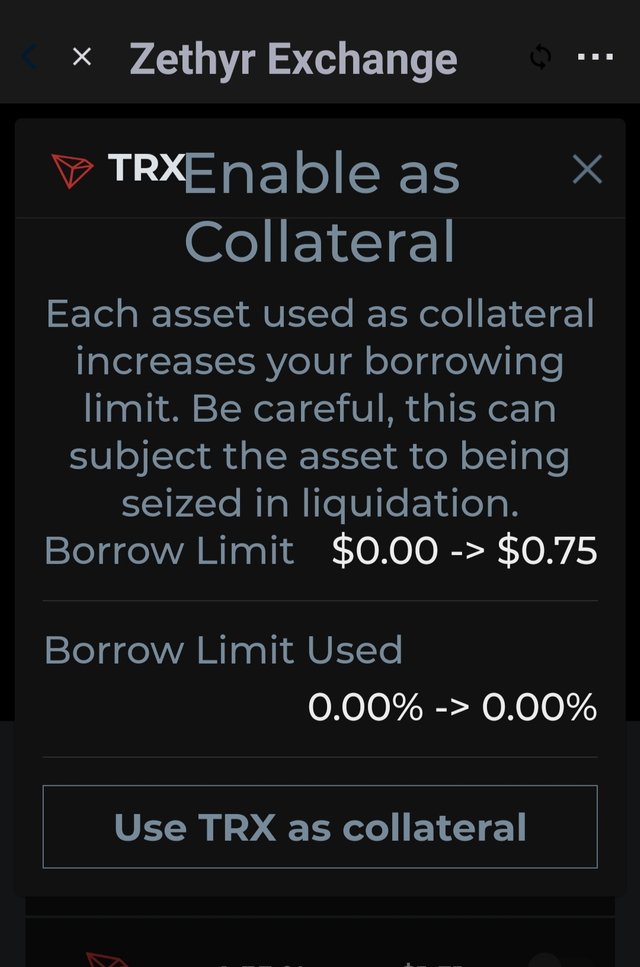

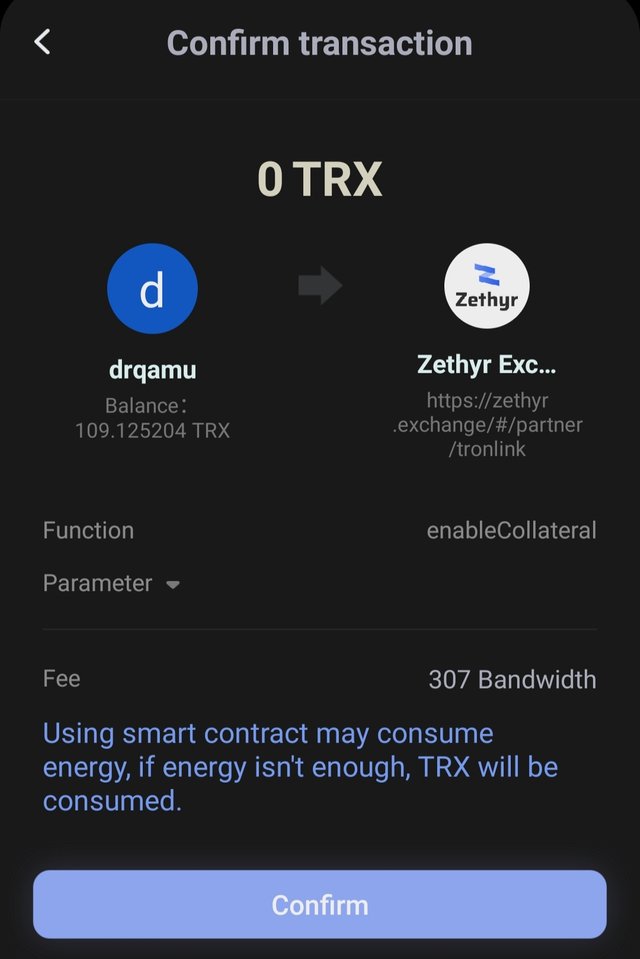

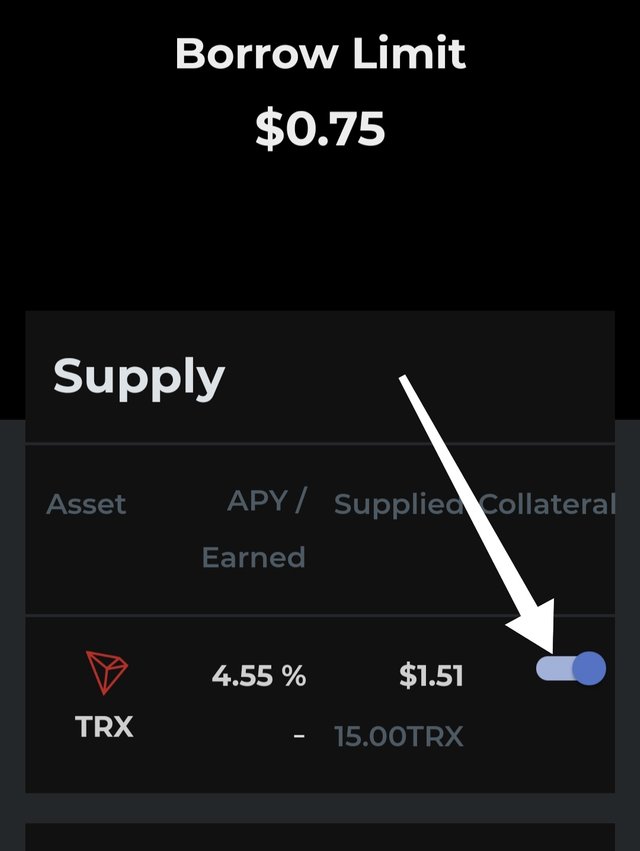

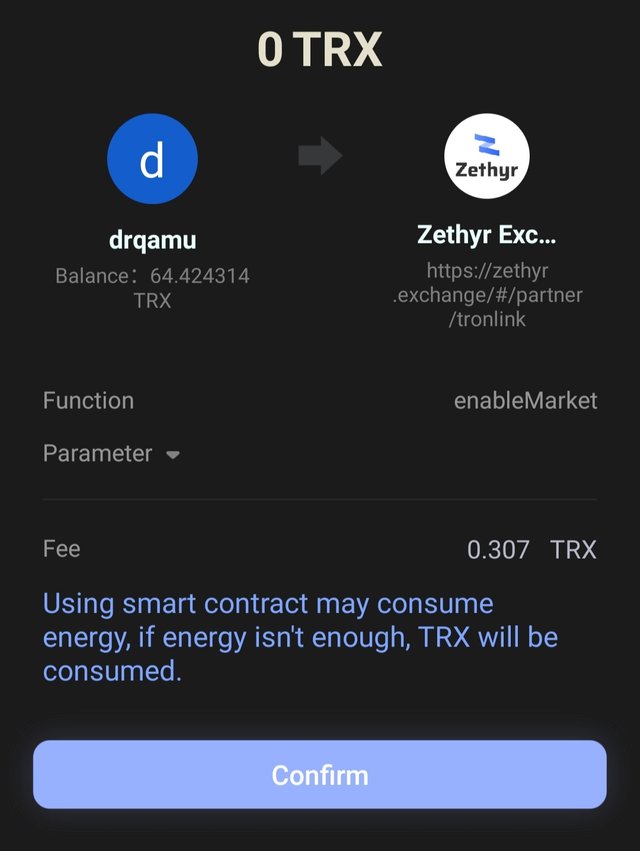

To burrow any asset on Zethyr finance, we first need to collateralize the supplied asset. For collateralization, click on collateralize option as shown against supplied asset (TRX). Next we need to enable it with the help of TronLink password.

Burrow tokens

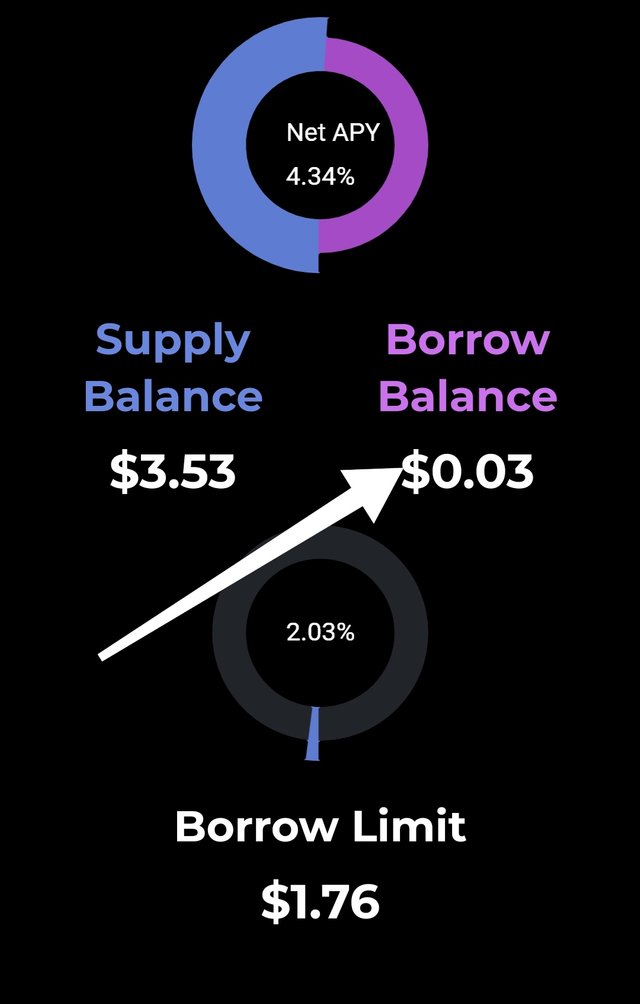

For 15 TRX that I supplied earlier I got a burrow limit of 0.75$ but Zethyr finance allows a minimum limit limit of $1. So I supplied additional 20 TRX to increase my burrow limit. So my supplied asset value increased to $3. 53 and burrow limit to $1.76.

Having collateralized the TRX, we cannot burrow TRX. So i choose to burrow BTT.

From burrow market, click on BTT. It has to be enabled first as done before.

Than come to borrow market again, click on BTT.

Next enter the amount of BTT to be borrowed. I can burrow a minimum of 1 BTT and max of 491 BTT. I choose to burrow 10 BTT. Click on burrow.

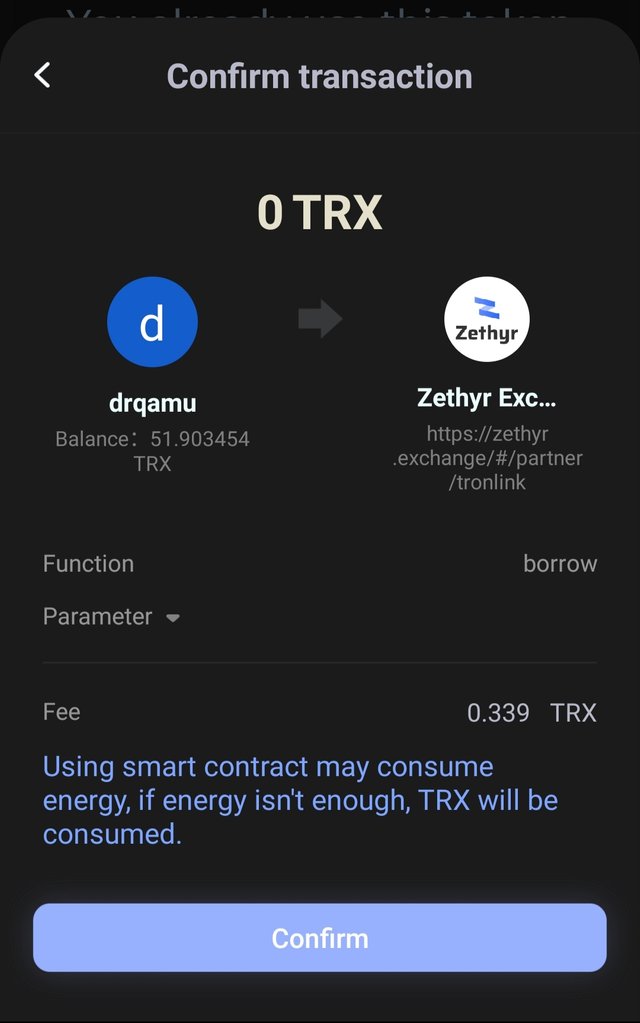

Confirm the transaction details .

Next complete the transaction with the help of TronLink password.

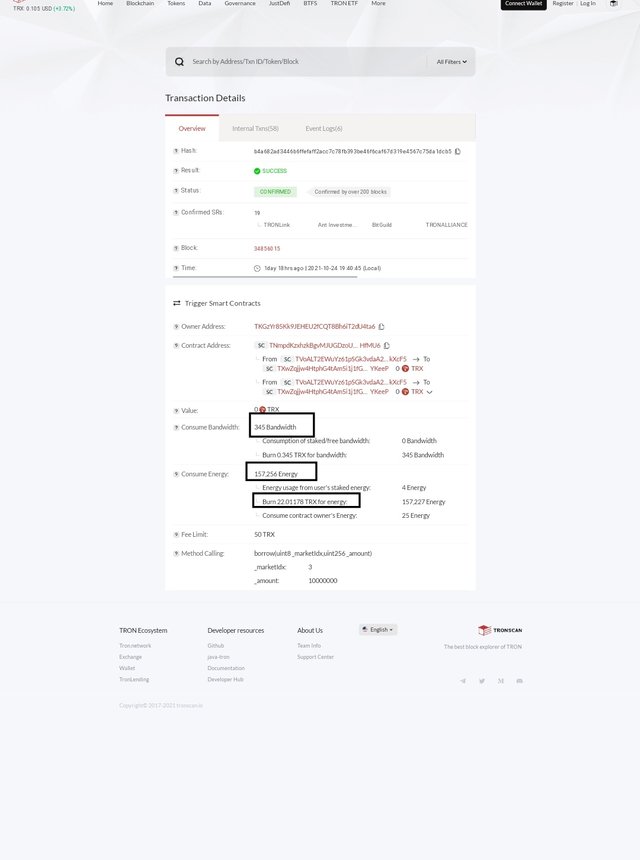

Hash > b4a682ad3446b6ffefaff2acc7c78fb393be46f6caf67d319e4567c75da1dcb5

Bandwidth consumed : 345

Energy comsumed : 145 246

TRX Burned : 22.011 for compensating energy

Repay burrowed funds

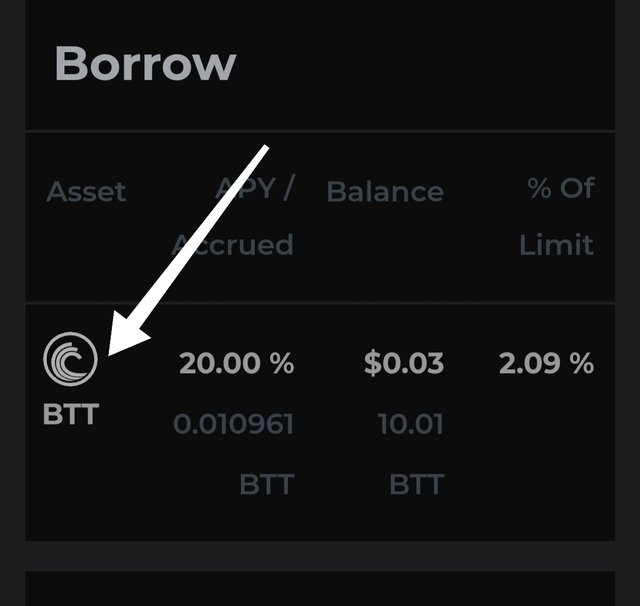

Go to burrow market. We have BTT supplied above.

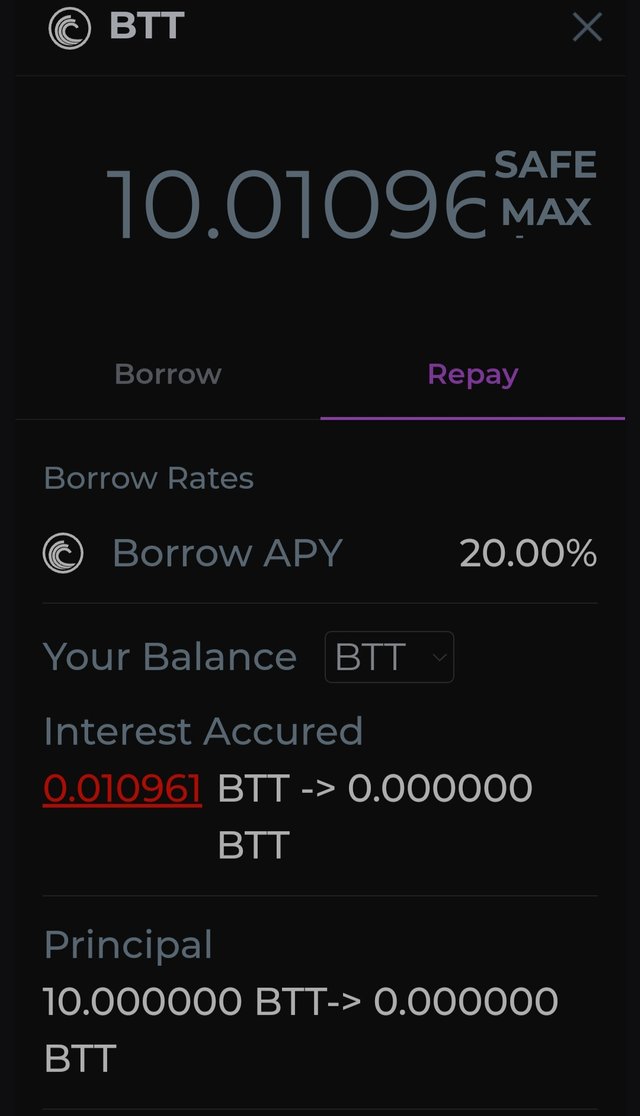

Click on BTT and next select repay.

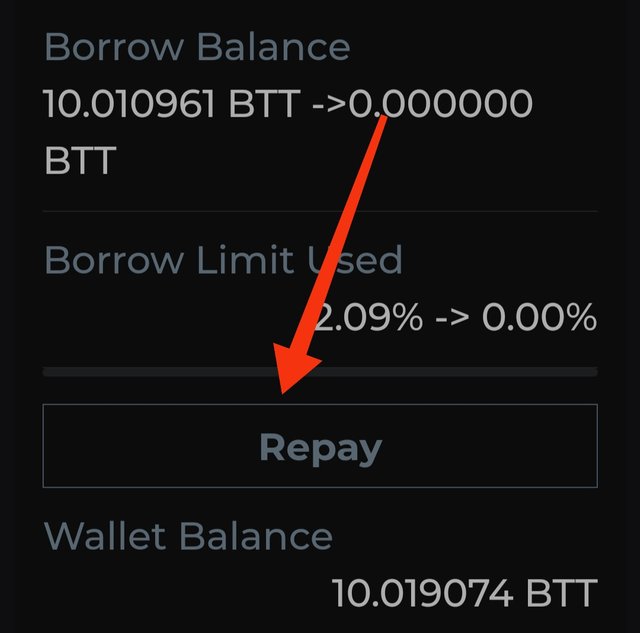

Enter amount of BTT to repay or simply click on Max.

Mext click on repay. Confirm transaction with the help of password.

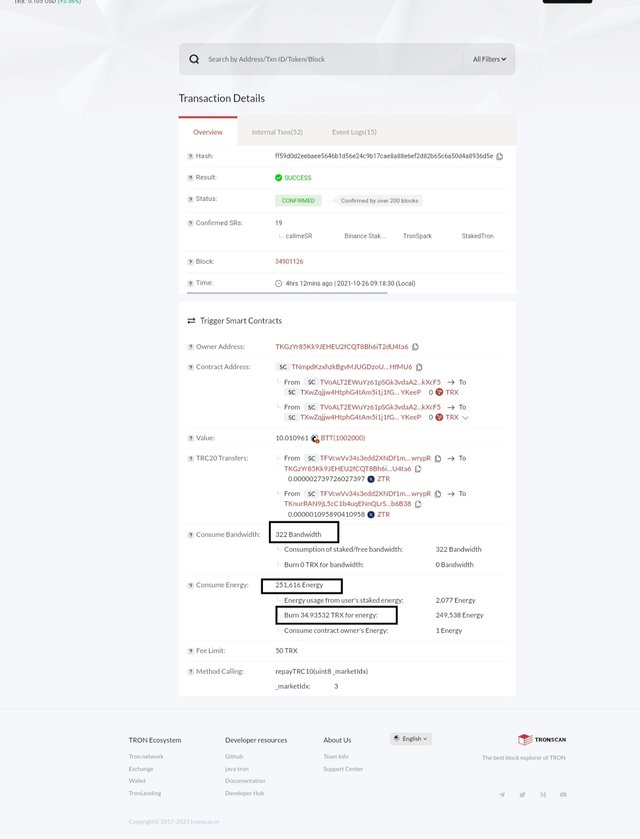

Hash > ff59d0d2eebaee5646b1d56e24c9b17cae8a88e6ef2d82b65c6a50d4a8936d5e

Bandwidth consumed : 322

Energy consumed:251 616

TRX Burned: 34.935 to compensate for energy

Observation

On TRON blockchain certain amount of Bandwidth and Energy are consumed to carry out transactions. If sufficient amount of energy is not available, than some TRX will be burnt for carrying out transactions and if TRX is not adequate to perform operations, than transaction cannot be confirmed and some TRX will be lost in this process without success.

What do you think of Zethyr Finance? Is it great or not? State your reasons.

Zethyr finance is a use case of DeFi that entitles users to accrue benefits of DeFi. I think zethyr is great system on Tron protocol for following reasons :

Suppliers can supply their spare funds to the protocol to earn profit.

Those in need of funds can lend funds from zethyr and utilise to fullfill their needs. Those who are capable of earning better interests can burrow funds at lesser rate on zethyr and utilise else where and get benefitted. However, compounding of interest in case of delay in paying back must be considered before hand.

Liquidity and yield of zethyr is better than other protocols of the same ecosystem because of DEX aggregator.

USDT can be transferred across blockchains for better utilisation

Floating interest rates are rebalanced every 24 hours to maintain an ideal supply demand balance and therby ideal price and interest for profitable yield.

zTokens offered in exchange for supplied asset can be utilised just like underlying asset as peg ratio is 1:1 and there is no need to withdraw supply from Zethyr.

- Zethyr protocol fee is 0.1% for both buy and sell markets which is cheaper than most of the other exchanges.

Conclusion

The DeFi ecosystem is gradually widening its horizon to encompass all the fields of traditional finance so as to evolve as a viable option. Tron blockchain empowered Zethyr finance is all set to meet all theae requiremets. Two major functionalities of finance are lending and burrowing that have been well adopted by zethyr finamce. More charm is added by DEX aggregator that is rare feature of DeFi protocols.

#club5050 😀

Great Post Keep it up. if you haven't get the free steem prize, worth atlast $400 based on your steem profile reputation you should get it ASAP, Maybe few days left for their airdrop. sign in with your steem account to claim it here: Get Free STEEM NOW

Sir but USDT is having the least APY so don't you think it is the most profitable.???

I was reading your task and it is well written sir. So much of information you have provided.

Yes actually you are right. I somehow missed that. Thank you.