Yield Farming - Yearn Finance - Crypto Academy S5W3 - Homework Post for @imagen

The advancement of Blockchain technology has resulted in beneficial prospects, one of which is DEFI.

Defi stands for Decentralized Finance and refers to all decentralized apps based on the Blockchain technology, such as ethereum, tron, and others. Defi apps are distinguished by their permissionless, trustless, transparent, immutable, and smart contract capabilities. In decentralized finance, there are a variety of ways to make money, one of which is yield farming.

Yield Farming

Yield farming is a new cryptocurrency investment option in which individuals known as yield farmers lend their cryptocurrency to DeFi platforms in order to gain the rewards.

Yield farmers put their crypto assets in a BTC/ETH-based smart contract-based liquidity pool. Other users can borrow the stored crypto assets for speculative trading on the same protocol.

Instead of the order books used in traditional systems, yield farming uses an automated market maker to enable trade among users. Liquidity providers and liquidity pools are two crucial concepts to understand.

Liquidity providers are similar to investors that contribute their crypto asset or token to the liquidity pool in exchange for a return. Liquidity providers are critical because they keep the protocol running while also supplying assets for others to borrow and trade on the network.

A liquidity pool is a smart contract that accumulates cryptocurrency assets to make lending, borrowing, buying, selling, and swapping of cryptocurrency assets or tokens easier. Annual percentage yields are used to determine investment returns. The annual percentage yield on a certain investment is the rate of return earned over a period of time, usually a year. It's essential to understand a protocol's annual percentage yield (APY) before entrusting your crypto asset to it. Yield farming protocols include aave, compound, curve finance, uniswap, sushiswap, yearn finance, and others.

Let us now discuss staking, another key idea in cryptocurrency.

Staking

Staking is the process of committing crypto assets to facilitate and confirm transactions on a blockchain network.

Staking is only applicable to cryptocurrencies that process transactions using the proof of stake consensus mechanism. Proof of stake is a consensus algorithm that is more environmentally friendly and scalable than proof of work.

Staking is a fantastic way for cryptocurrency users to make extra income by committing their coins to the bitcoin protocol. Validators are chosen by the network from among users to confirm transaction blocks. The likelihood of being chosen is proportional to the number of crypto coins pledged; the more crypto assets pledged, the greater the likelihood of being chosen.

When a user stakes an asset, the user has custody of the asset and can unstake it at any time, albeit certain cryptocurrency networks need a certain period of time before you can unstake your asset.

Staking is only applicable to cryptocurrency that implements the proof of stake consensus mechanism, as I previously stated. To stake your crypto asset, you'll need a cryptocurrency that uses proof-of-stake and the ability to do the following:

- Set up a crypto wallet you would like to use for staking.

- Send the cryptocurrency you're staking to the wallet.

- Choose a staking pool from the available options and enter the amount of asset you want to stake for the time being.

- Lock up your crypto assets for staking and collect your stake rewards.

New cryptocurrency coins are created and distributed as staking rewards to the validator of a new block when it is added to the network. Most of the time, the rewards are the same cryptocurrency that the user staked, thus if I staked Ethereum, I'd get Ethereum as a reward.

Now that we know what staking and yield farming mean, let's answer the questions asked in the homework given by our professor after his class.

Question 1: Describe the differences between Staking and Yield Farming.

Differences between Staking and Yield Farming

- There is a difference in the rate of return between yield farming and staking: The return on yield farming varies because different protocols offer different apy and other bonuses to incentivize users. Staking APY ranges from 5% to 12%, depending on the method used and the token staked. The yield farming apy ranges from 2.5 percent to 100 percent or higher.

- Duration: Unlike most staking networks, yield farming does not require users to lock up crypto assets for a specific length of time before they may move them, whereas most staking networks need users to stake their asset for a set period of time before they can unstake it.

- Staking is more safer than yield farming: since anyone who breaks the protocol's rule in staking is more likely to lose their assets, making it difficult to commit fraud. Yield farming, on the other hand, is vulnerable to hacking because it is based on a smart contract that isn't always sufficiently secured.

- Level of Risk: Staking carries a low level of risk, however yield farming carries a higher level of risk, such as high market fluctuation and fraud vulnerability.

Question 2: Login to Yearn Finance. Explore the platform completely and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options) Show screenshots.

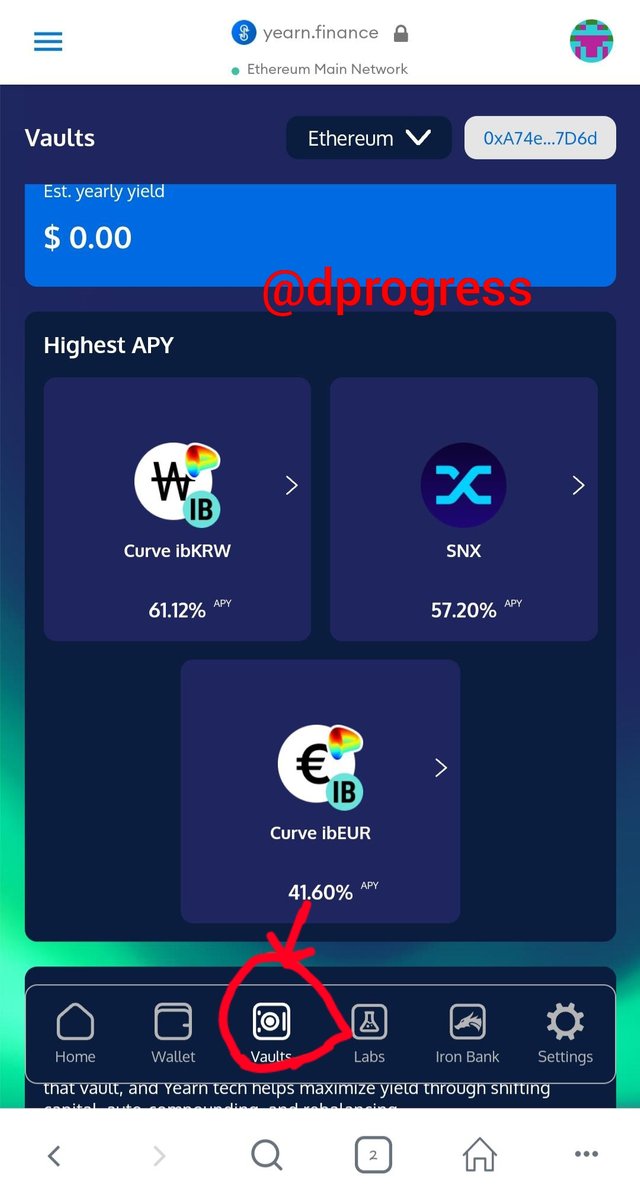

Yearn Finance is a DeFi network powered by Ethereum that allows users to take use of services such as yield farming, lending, trading, and insurance. Users are rewarded for depositing their crypto assets into the protocol's VAULT.

In a process known as yield farming, the assets in each Vault are pooled and deposited into other DeFi networks to offer liquidity.

Yearn distributes assets across several protocols autonomously in order to provide the greatest APY for its users. For users, this streamlines and improves the yield farming process.

The following are some of the network's services and features:

- Earn is a way for system users to get the best interest rate on lending, and it works by searching across different lending protocols to find the best rates, such as Aave or Compound.To receive those interest rates, a user must deposit his or her crypto asset on yearn.finance.

- Zap enables users to make multiple investments with a single click. A user can, for example, trade USDT for yCRV in a single click. This saves time and money on transaction costs.

- Annual percentage yield is abbreviated as APY.The apy function analyzes Earn's lending procedures and estimates the user's annual reward.

- Vault: Vaults are pools of user investments that are managed by automated methods, allowing you to maximize your profits without having to manually switch between various yield farming methods.

Using the yearn.finance protocol has a number of advantages, including the elimination of third-party transactions, the reduction of excessive ethereum gas fees, and the reduction of time spent by users looking for the best APY.

Andre Cronje founded the network in 2020, although it wasn't called yearn finance at the time; instead, it was called iEarn. In the same year, the name was changed to yEarn finance. The protocol's native token is called YFI. The token's initial fixed quantity is 30,000, although there are plans to raise the amount. The network charges a 5% fee for the Vaults service and a 0.5 percent fee for the Vaults and Earn services.The yearn.finance system keeps $500,000 of the cumulative revenue fee and shares the rest to YFI holders.

The network generated revenue fee of more than $460,000 in its first week of operation, and it is expected to generate close to $21 million in revenue fee yearly.

Holders of YFIs have voting rights in the network's governance system and are entitled to network fee earnings.

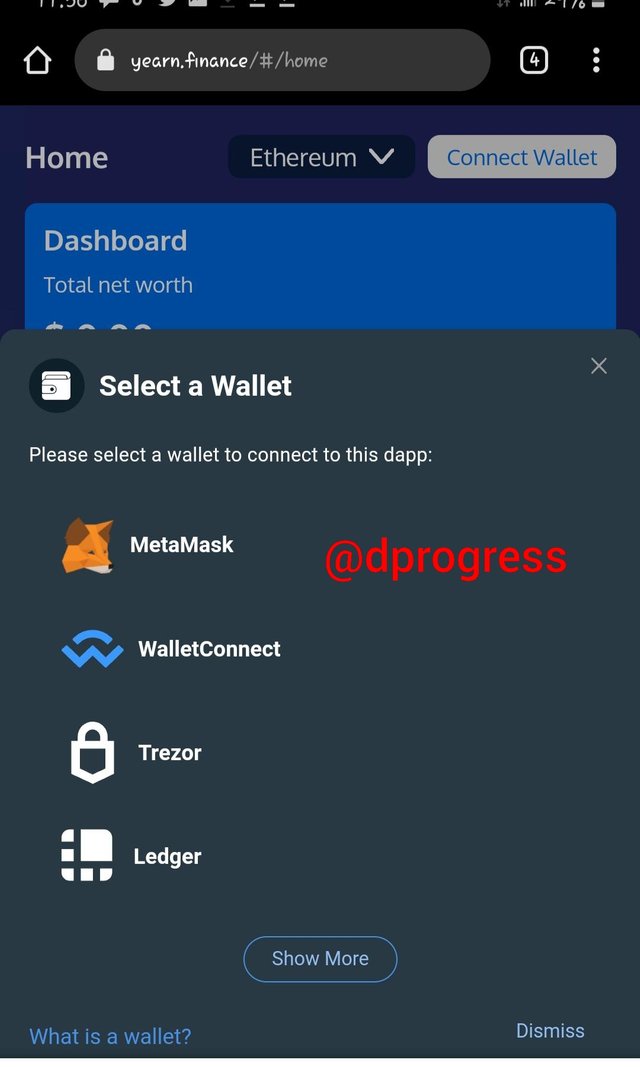

Wallet Connection

Connecting yearn.finance to a wallet is simple. Simply follow the steps below:

Note: It is critical to have a MetaMask wallet installed on your devices as well as a stable internet connection.

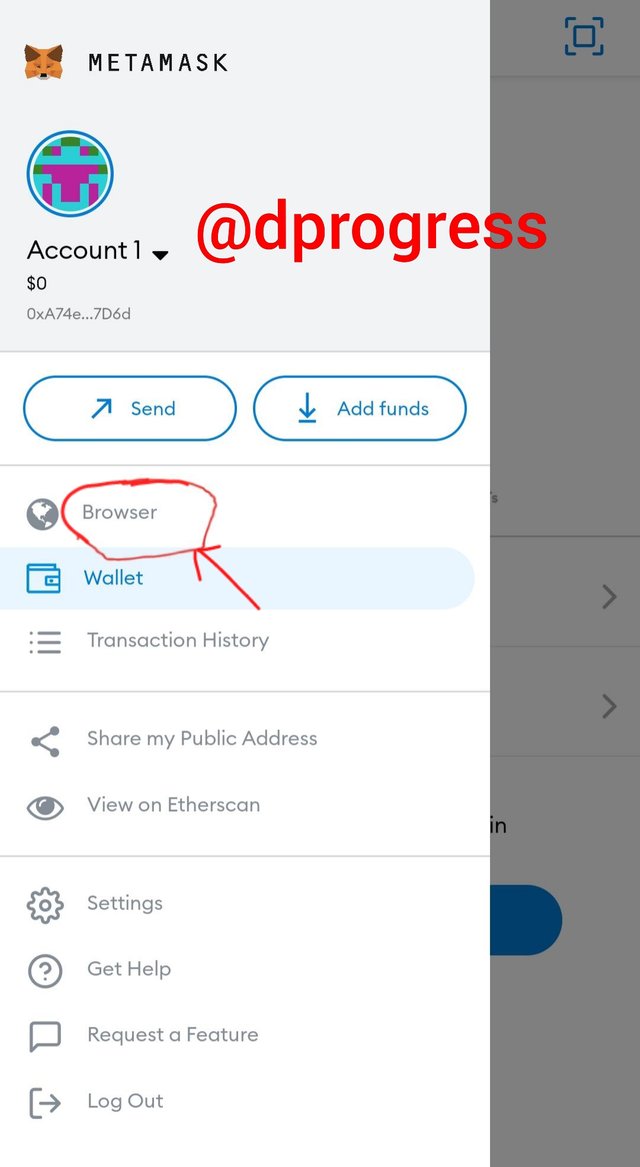

Click the three bars in the top left corner of your MetaMask application, then browser.

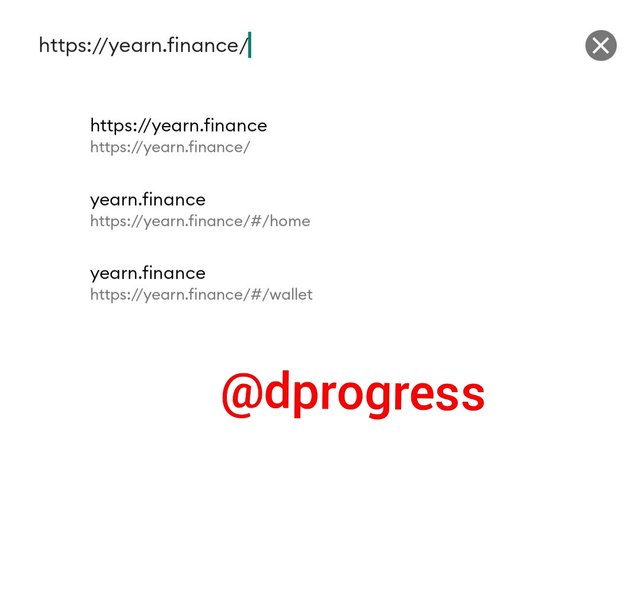

Copy and paste the following address into the search bar: https://yearn.finance/ and wait for it to load.

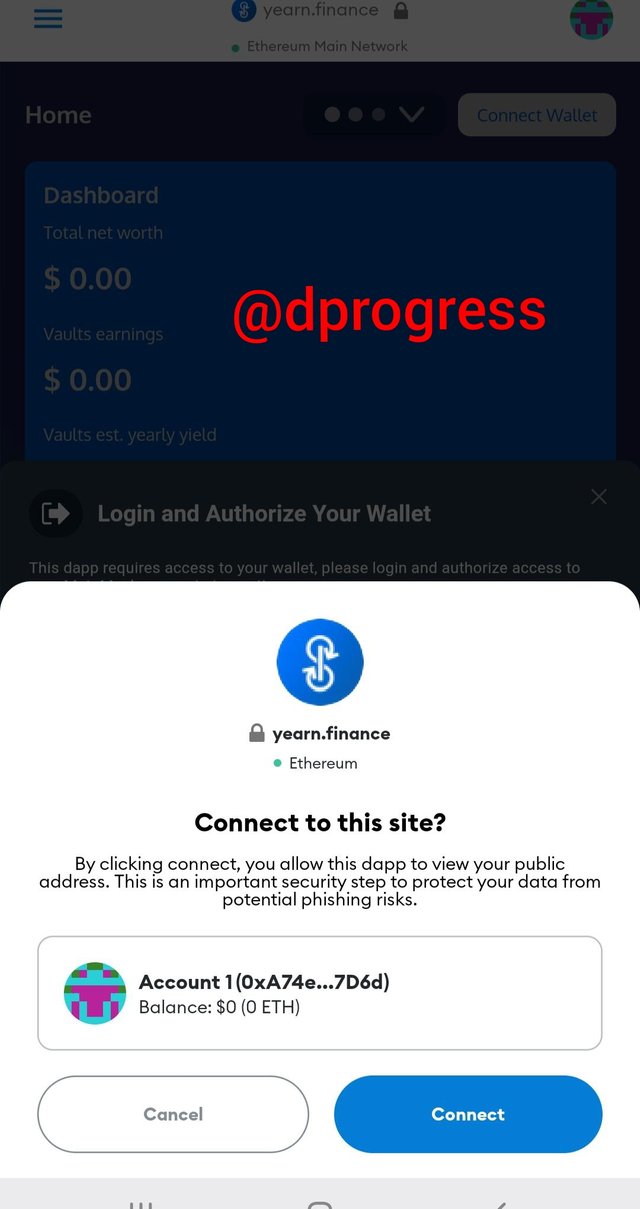

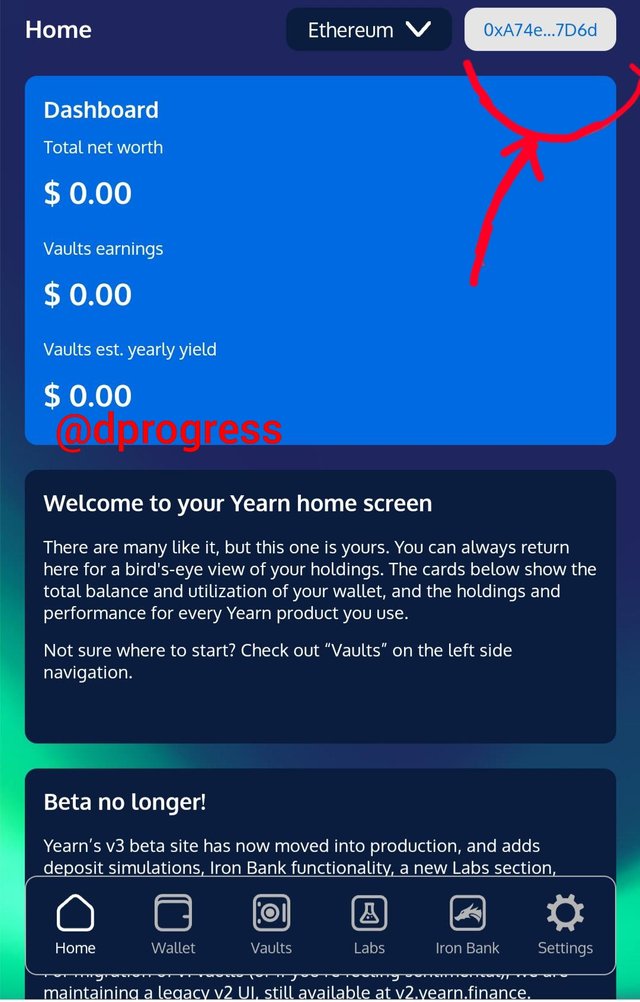

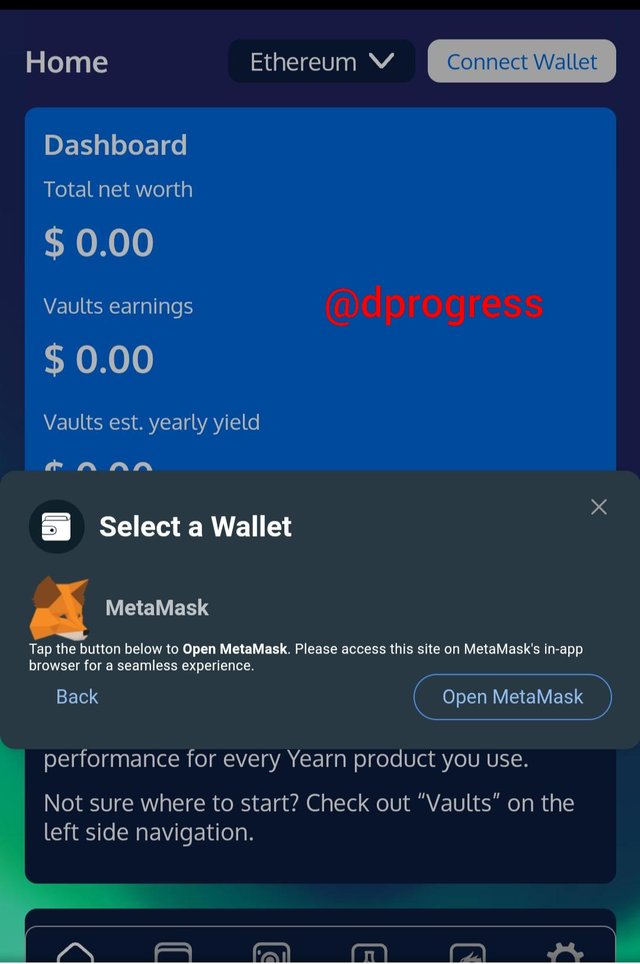

When it loads, you'll notice a section instructing you to link your wallet in the top left corner; click on it, and your MetaMask wallets will connect to yearn.finance automatically.

If you're using an internet browser, you'll be asked to choose a wallet from a selection of options; select MetaMask and you'll be taken to the MetaMask and complete the processes I described earlier.

Funds Transfer

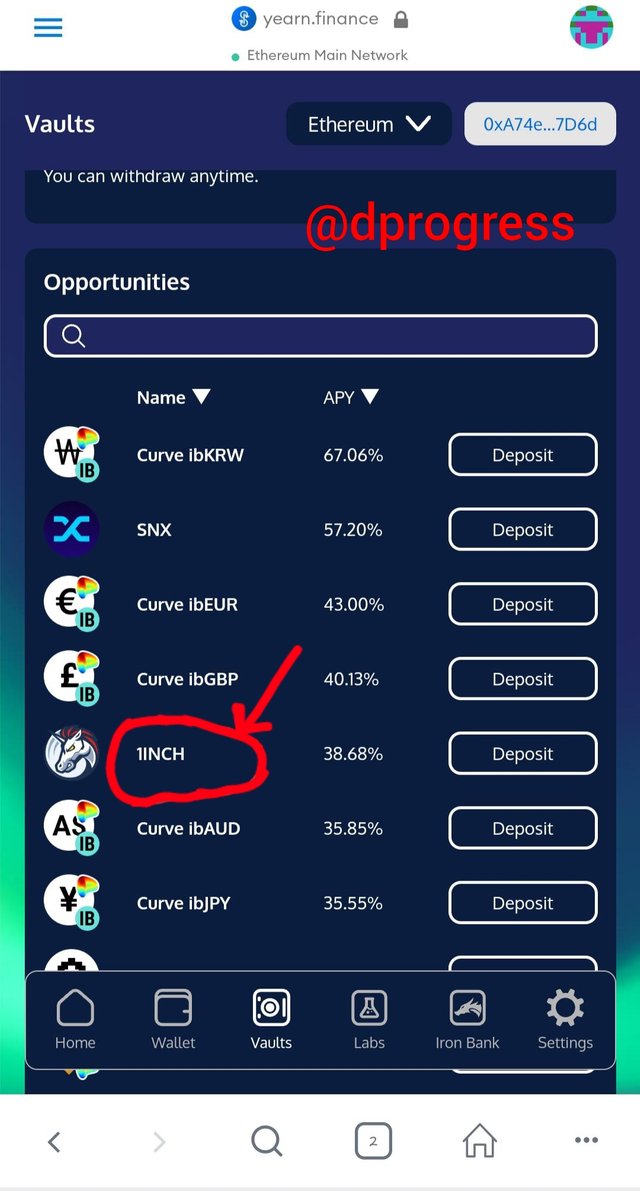

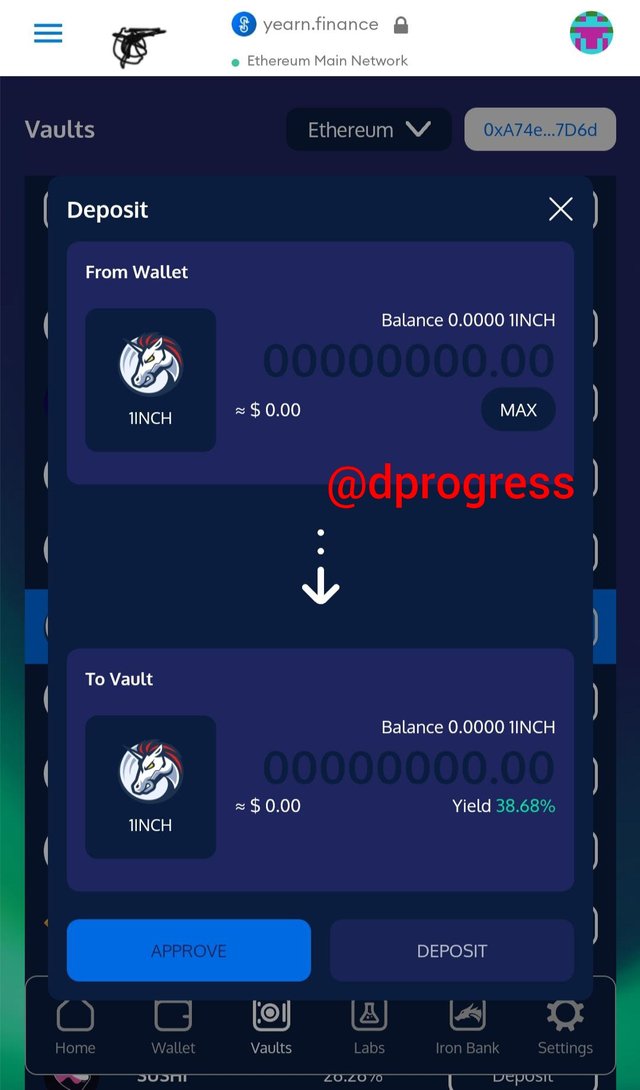

To transfer funds, go to the vault and select acrypto asset, there are many different cryptocurrencies; choose the one you have in your wallet and want to deposit. 1 inch is my choice.

Fill in the number of tokens you want to put in the vault.

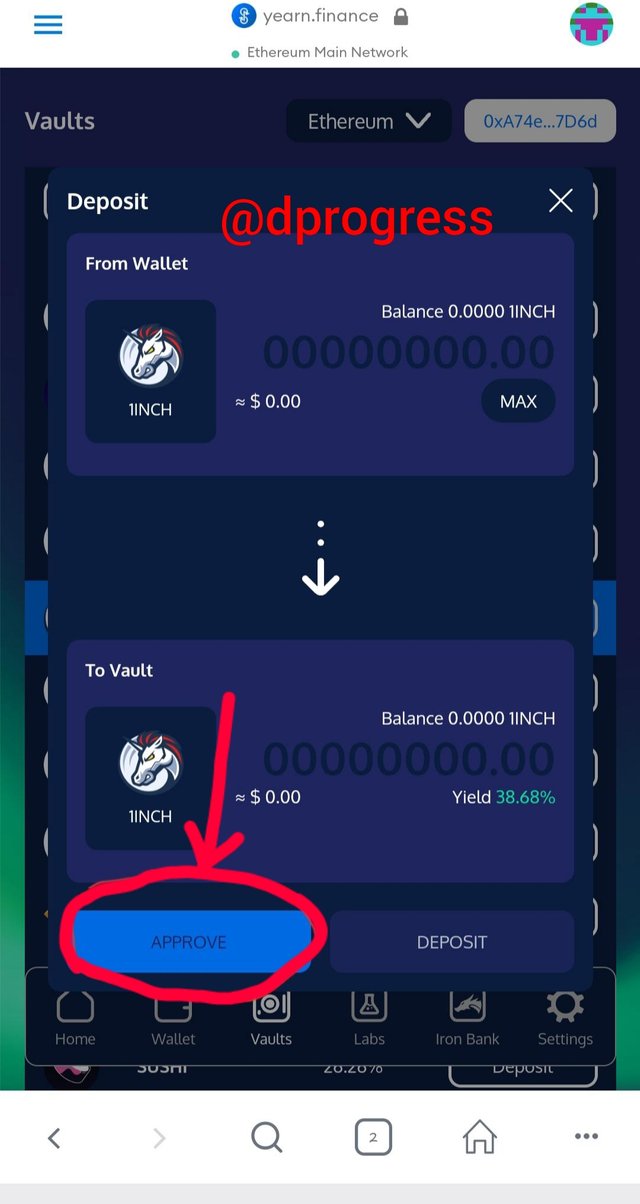

When you click "approve," your wallet will verify that the transaction request is genuinely from you.

To withdraw, simply select withdraw and enter the amount you wish to withdraw.

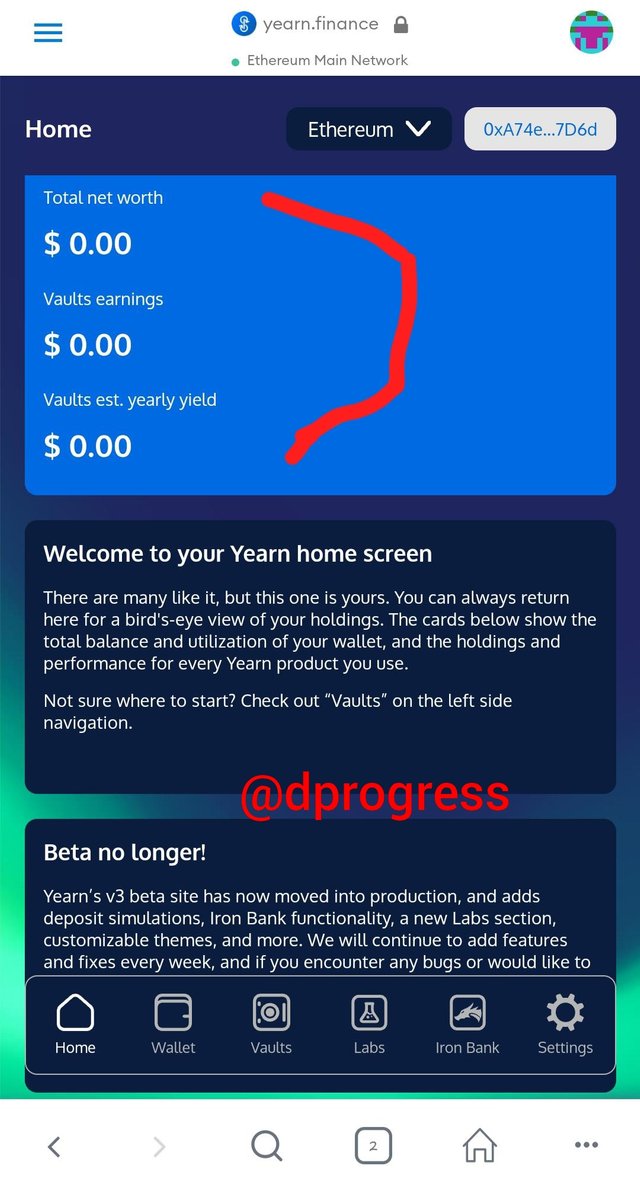

Your overall net worth and vault profits are displayed on the home icon.

There's also the iron bank, where you can borrow new crypto assets using your asset as collateral or supply your asset to get more reward.

Question 3: What is collateralization in Yield Farming? What is function?

Collateralization in yield farming refers to the use of a valuable crypto asset to secure a loan, with the lender which is the network, having the power to seize and sell the asset if the borrower defaults.

Collateralization is vital in yield farming because it provides sufficient comfort to liquidity providers against default risk.

Furthermore, because of the use of collateral, borrowers must repay their loans on time in order to avoid losing their asset.

To make things clearer, let's use the AAVE protocol.

Aave is a DeFi (decentralized lending and borrowing) system based on the Ethereum blockchain. From stablecoins to altcoins, the platform hosts a variety of cryptocurrencies. Users can borrow these assets at fixed or variable interest rates, and they can also lend cryptocurrencies into liquidity pools and earn incentives. AAVE is the native token of the lending system. We also have atokens, which are interest-bearing tokens from Aave.

When assets are deposited on the network, derivative tokens called aTokens (for example, 1inch would become A1inch) are created. The value of aTokens is pegged 1:1 to the value of the deposited assets (50 1inch is the same as 50 a1inch ).

To be able to borrow on the network, a user must first deposit a digital asset as collateral, with the value of the asset being greater than or equal to the amount to be borrowed.

This emphasizes the importance of collaterals, which are vital to the network's survival. The borrower has nothing to lose if there is no collateral, and the lender will not be willing to invest his or her asset in a protocol, putting the network at risk of liquidation.

Question (4.) At the time of writing your assignment, what is the TVL of the DeFi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token? Show screenshots. (4.1.) The YFI token, is it overvalued or undervalued? State the reasons.

The total value locked is the sum of all assets put in DeFi protocols that yield rewards, interest, new cryptocurrencies and tokens, fixed interest, and so on. The aggregate liquidity in liquidity pools is referred to as TVL. It's a useful statistic for assessing the state of the DeFi and yield farming markets as a whole. It's also a good way to compare the "market share" of various DeFi protocols.

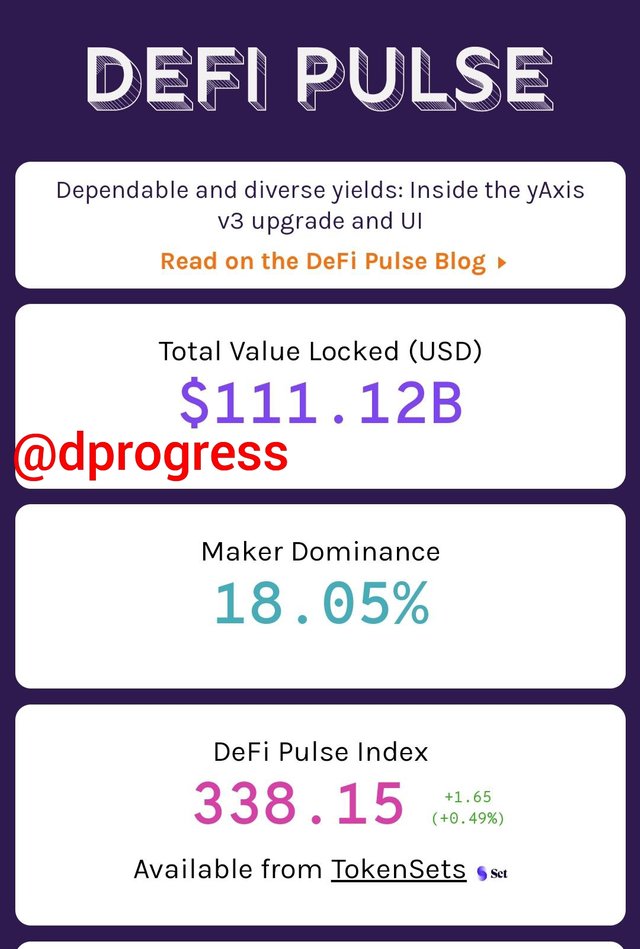

The TVL of the defi ecosystem is valued at $111.12 billion at the time of writing this article.

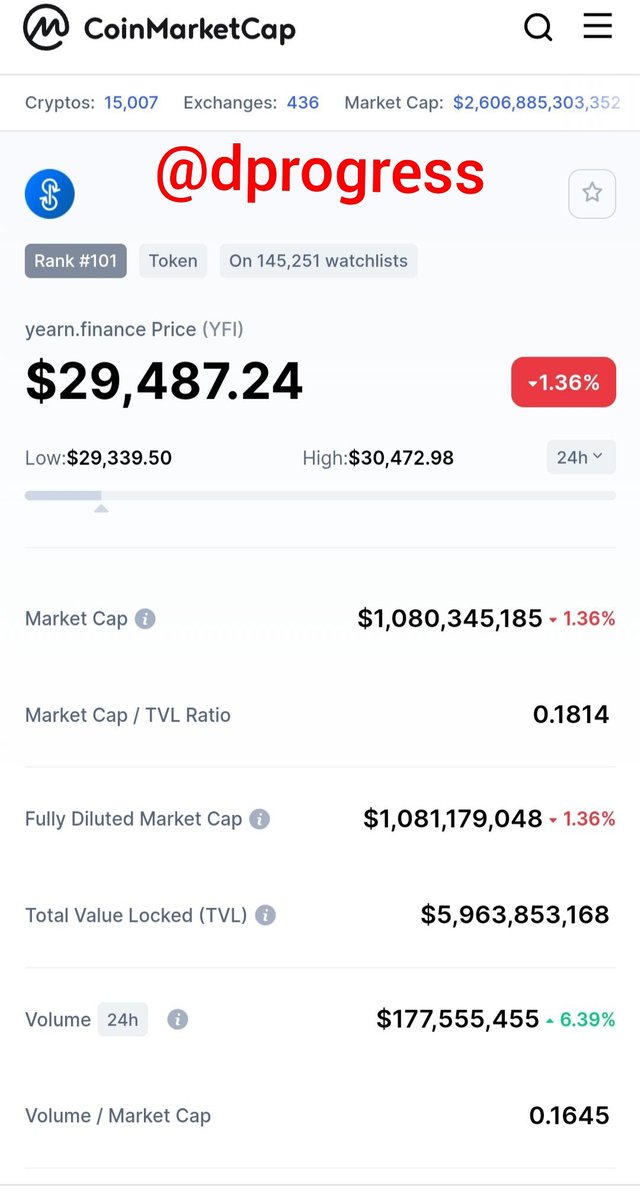

With a tvl of $5,963,853,168. Yearn.finance has a tvl of $5.

YFI has a market capitalization of $1,080,345,185and a TVL ratio of 0.1814.

Tvl and market cap are key in calculating the tvl ratio because the tvl ratio is calculated by dividing the market cap by the tvl.

With a TVl ratio of 0.182, we may conclude that the YFI token is undervalued, as assets with a TVl ratio less than one are usually undervalued.

Because the TVL is so high in comparison to the market cap, the YFI token has a good potential of increasing in value in the future.

If the ratio is approximately 3 or above, the assets are considered overvalued.

Question 5: If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality? Explain the reasons.

Because I can't use bitcoin for yield farming, it's difficult to assess the potential return. The apy would calculate my potential return on investment for the YFI token. The current yield on YFI is 12.23%.

As a result, 12.23/100 x $500 = $61.15.

My yfi token return would be $61.15, and I would be entitled to $561.15. (with capital)

Question 6: In your personal opinion, what are the risks of Yield Farming? Give reasons for your answer.

The following are some of the risks linked with yield farming:

- Yield farming is difficult; it necessitates a large sum of money if you want to earn a high rate of return, and its strategies are difficult for new and inexperienced users to understand because they risk losing money.

- Yield farming can be hacked. Yield farm protocols aren't always well-secured; they're often created by a small group of developers with limited resources to improve the system, and hackers can simply exploit these flaws to steal funds. Furthermore, the smart contract functionality could be hacked, resulting in fraud. Harvest Finance, for example, was hacked and lost nearly $20 million.

- Yield farming imposes a high transaction fee. The protocol's ethereum gas fee is relatively large, making a small investment unprofitable.

Conclusions

One of the various ways to make money with cryptocurrency is through yield farming. Yield farming is a method of lending a crypto asset to a liquidity pool in exchange for a reward. The yield farming business is booming right now, but it's important to do your homework before jumping in, to understand the risks involved, and to do your homework before choosing a platform.

Cc: @imagen