Crypto Academy / Season 3 / Week 4 - Homework Post on CeFi - DeFi - Yield

Thank you very much professor @stream4u for this wonderful teaching on CeFi, DeFi and Yield farming.

Decentralized Finance (DeFi) is the current trend in the world of cryptocurrencies now; it has open up a lot of possibilities and in this write-up we will take a look at what DeFi is all about and also answer some questions asked by our professor.

Importance of the Decentralized Finance System

Decentralized Finance is a system that allow resources to be available peer to peer on a decentralized Blockchain without the use of a middle man like banks or brokers. In a decentralized Finance you can buy, sell, borrow or lend without interacting with any middle man when carrying out this process.

Why is DeFi important?

In a centralized Finance you are not in control of your assets but when it come to DeFi system you have full control of your assets and one thing again that make DeFi better and importance is that you can make a very good returns from your transactions when compare to that of a centralized Finance where the middle man make the highest gain using your assets to carryout some business deals and give you a small token in return. Another things is that DeFi save time because there is no middle man so you can easily have access to your assets or the funds that you need easily and also use can lend or access loan easily too, you don't need any permission from any operators or middle man to carry these transactions.

Smart contracts is one of the things that DeFi system introduced which help in a very greater way to reduce human error that occur on a daily basis when it come to a centralized system. If the Smart contacts is ok and written very well and correctly then there is a big rest when it come to human error.

Flaws in CeFi

Some of the flaws in centralized finance are

- The charging fee in centralized finance is always high when compare with that of DeFi system.

- Another flaw I will like to point out is in the area of security; due to the massive attack received by centralized finance it make it more vulnerabilities than that of DeFi system. The fact that the whole assets are in one place make CeFi witness more attack.

- Sometime or in most cases a single server is used in centralized finance and this limit the scalability.

Decentralized Finance Products

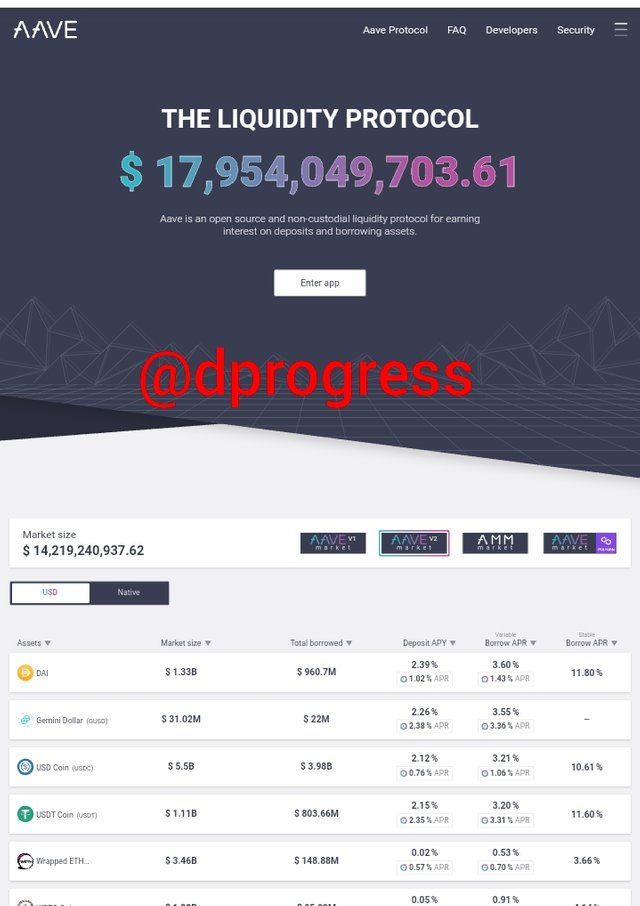

The first DeFi product I will like to explain is a lending product Aave

Aave

This is a protocol that allow user to deposit, lend or borrow cryptocurrencies assets at variable or stable interest rate.

It is an open source protocol. It has a lot of stakeholders that contribute in one way of the other to the governance of the Aave protocol, not only that they also contribute to the community and some of them are Definance Capital, DTC.Capital, Standard Crypto, Framework, Blockchain Capital, Winklevoss capital, Blockchain.com, Three arrow capital and Aparafi capital.

Aave was launched 2017 by Stani Kulechov as a ETHLend and in the year 2020 has undergone a great significant growth. It started by $600,000 worth of Ether exchanged to 1 billion Lend, this $600,000 Ether was raise in November 2017. It has it own native token called Aave token. The Aave support flash loans which requires zero collateral it's work with the time of the loan repayment. A charge of 0.3% fee is charge on flash loans.

Another good feature of Aave is that it has a flexible interest rates when compare with other lending platforms which help the user to get the best interest rate since they have the option of choosing either stable or variable interest rate on their loan.

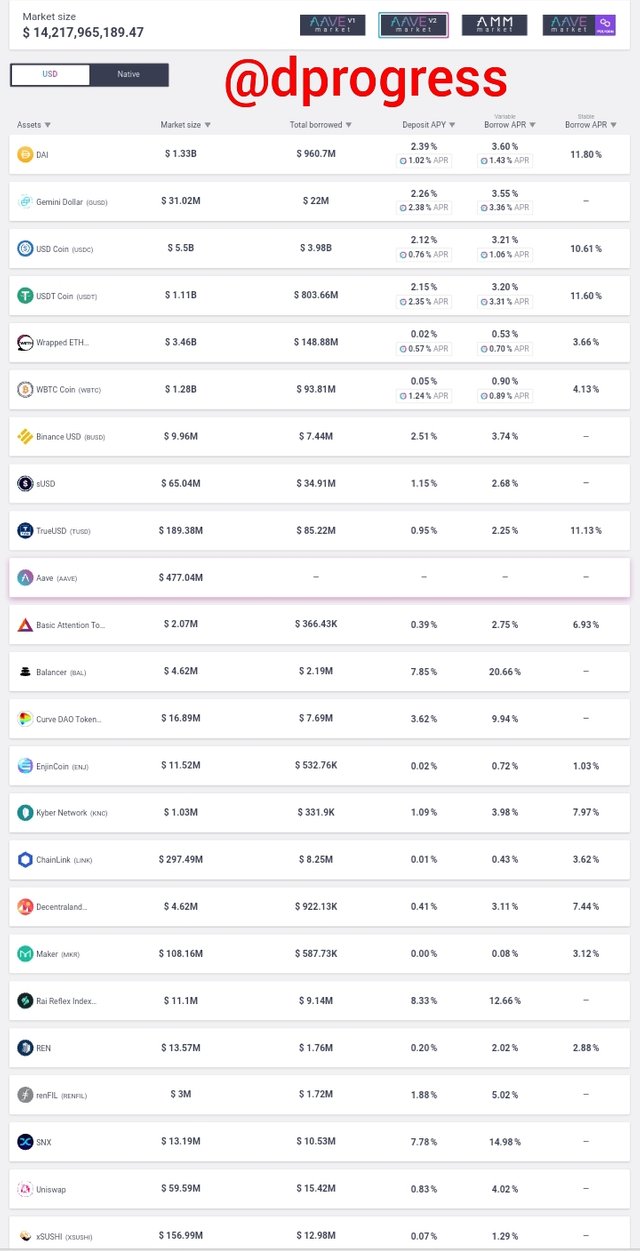

It supports a lot of Ethereum based assets such as Chainlink, Uniswap, Ethereum, Maker, USD coin, Aave, REN protocol, Tether, BAT, Kybar Network, Lend, TrueUSD and others.

Let look at some of the lending rate

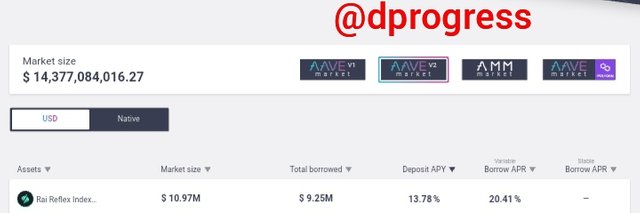

From the screenshot we can see the borrow APR both variable and stable for each assets. The deposit has it own APY rate also.

You can deposit, borrow or lend any of this this Ethereum based assets on Aave protocol. To start, kindly visit their site https://aave.com/ and connect with Web 3.0 wallet either Coinbase or Metamask.

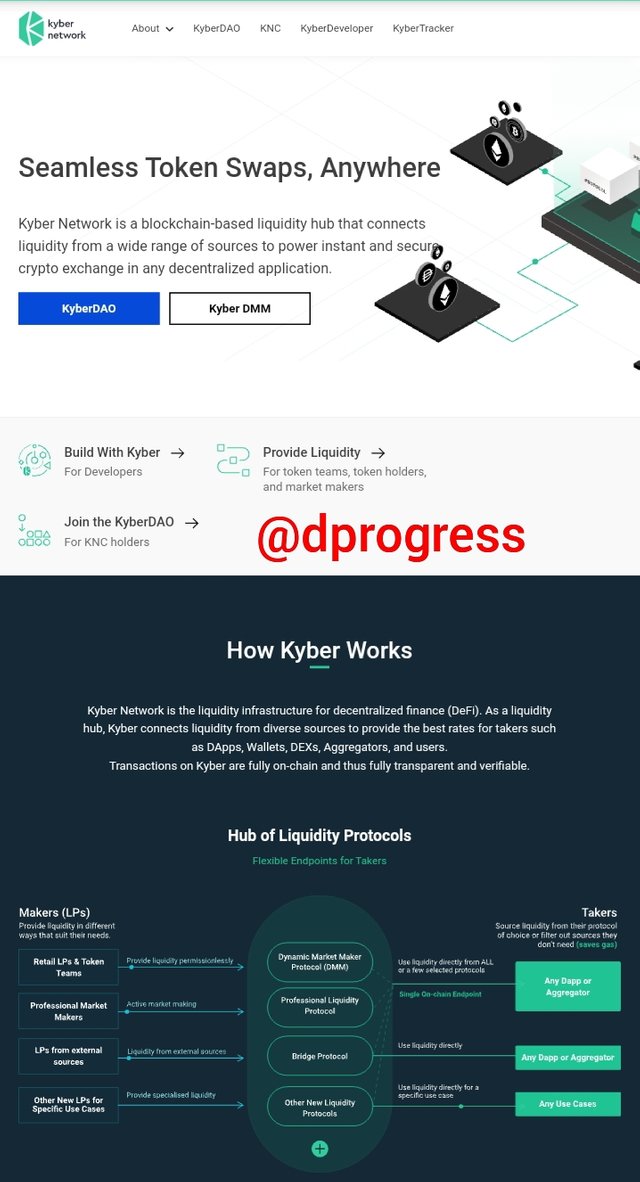

The second DeFi Product I will like to explain is a Decentralized Finance Exchange product called Kyber Network

Kyber Network

Kyber Network is a liquidity hub based on Blockchain which connects other liquidity from other sources and provide good best rates and secure cryptocurrency exchange in decentralized application.

Some of the takers that Kyber Network provide best rate for are Aggregators, DApps, DEXs, Wallet and Users.

All the transaction that taken place on Kyber are on-chain which help it to be verifiable and transparent. Any party can serve as Reserve managers and easily contribute to the pools of the liquidity.

Kyber is looking forward to connect liquidity network across different and multiple blockchains in other to have a frictionless and good cross chain token swaps which will further improve exchange function on Kyber network.

With the deployment of Katalyst upgrade, KyberDAO was summon which help the Kyber's native token holders to vote on protocol upgrades not only that it allow the holders to be involved in the governance. When they stake KNC to vote, they receive ETH as reward. The ETH is gotten from network fees that was collected on the trading activities Kyber Network.

Notable people that contribute to the development of Kyber Network are Loi Luu, CTO Yaron Velmar, Victor Tran and the advisors are Simon Seojoon Kim, Vitalik Buterin and Seng Hoe Long

The Kyber Network protocols is implemented as a smart contracts that allow the actors ( takers, Reserves, Registered reserves and maintainers) to interact with the network. All the actors are in one way or the other involve in the transaction and swaps that take place on the network.

You can visit their site https://kyber.network/ to start making use of the Kyber network.

Lastly some of the investment funds that support the Kyber project are Amino Capital, ZK capital, WolfEdge Capital and Cipher Ventures.

The risk involved in Decentralized Finance

Decentralized Finance also have is own risk, now let us also consider some of the risk involved in DeFi system

- One of the risk involved in DeFi is in a situation where errors occurred in smart contracts we can call these errors vulnerabilities, this vulnerabilities can cause a great lost of assets beyond your imagination.

- In a situation when a fraudulent activities occur, you are at the risk of loss your assets with no compensation unlike in a centralized finance that have insurances to cover for some of the losses.

- The volatility of the DeFi currency prone a great risk to the assets of the user. The price fluctuate alot when compare to that of the centralized.

Yield Farming

Yield farming is the act of locking, lending or staking your cryptocurrency assets which in return generate returns for you. As a cryptocurrency holder, when you lock your cryptocurrencies assets it yield and generate interest for you even though it is risky but yield farming has become widely known.

How Yield Farming work

In the working of Yield farming, the investors deposits funds and this investors are called liquidity providers, the funds are deposited into smart contract and when the smart contract is fill with cash, the Automated Market Maker use of the smart contract to create the liquidity pool which execute difference trades based on the predetermined algorithm.

A trade fee is always paid by user which are inturn share among the liquidity providers based on the among of their deposit in the pool.

Best Yield Farming Platforms

The two best yield farming platform I will like to discuss about are Uniswap and PancakeSwap

Uniswap

First when it come to Uniswap, the platform is rated as the second largest DeFi exchange platform. The interest that every Liquidity providers earn is high because more than $5.5 billion is lock on the platform and every time a transaction (swap) take place the Liquidity providers receive good percentage trading fee as their own interests. The interest rates on the platform is approximately between 20% APR to 50% APR, which sound good for every investor.

PancakeSwap

.jpeg)

This is also a DeFi exchange even though it function like Uniswap but it operate on Binance Smart Chain network. The difference is that Uniswap make use of Ethereum gas fee while PancakeSwap has more features than Ethereum. About $7 billion Binance Smart Chain (BSC) is lock on the exchange platform. PancakeSwap offers a gambling game of prediction of BNB and NFT price also it offer swapping of BSC tokens and staking pools that generate interest. lastly It offer the Liquidity providers interest rate of about 8% APR to 250% APR.

The APR interest rate of Uniswap and PancakeSwap make it good for yield farming because the Liquidity providers tend to make more returns on their funds that they locked.

The Returns Calculation method in Yield Farming

Yield Farming returns are calculated annually using two difference most common method which are Annual Percentage Yield (APY) and Annual Percentage Rate (APR). This two methods help the cryptocurrency holder to have a good returns on their assets that they locked and the difference between the two method is that Annual Percentage Yield calculate the returns using compound interest while Annual Percentage Rate do not calculate interests using compound interest.

Let use this example to calculate

A token called Rai Reflex index (RRI) has a market size of $10.97M and $9.25M total borrowed on Aave protocol. Note that Aave protocol is also one of the example of a yield farming platform.

Now the Deposit returns is calculated in APY at 13.78% while the borrow returns is calculated in APR at 20.41%

Let assume that a crypto holder decide to deposit $1200 worth of RRI asset. Take note that the Deposit returns is calculated in APY at 13.78%. So what will he/she receive at the end of the year?

Formula is [ A = P (1 + r/n) ^ (nt) ]

Where

A : the total amount received including your interest

P: the amount deposited $1200

R: your interest rate in decimal (13.78/100)= 0.1378

n: The number of time the interest is compound which is 12 months.

t: the time the money was invested which is 1 year

^ : raise to power

A = P (1 + r/n) ^ (nt)

A= 1200(1 + (0.1378/12)) ^(12*1)

A = 1376.21

So at the end of the day the total amount the person will receive back is $1376.21 where $1200 is the assets he or she invest while $176.21 is his or her return(interest) on the money deposited.

Now let assume again that another user borrow RRI token worth $700. Note that the borrow returns is calculated in APR at 20.41%. So what is the total he or she will pay back?

First let calculate the interest he or she will pay back first

Interest pay back = ((20.41/100) * 700) = 142.87

So the total RRI worth that he or she will pay back is 700 + 142.87 = 842.87.

$842.87 will be pay back where $700 is the money borrow and $142.87 is the interest paid back on the money borrow.

Advantages of Yield Farming

Some of the advantages in Yield Farming are

- Yield farming make loan easily and faster to access.

- It also help you to have a better returns on the funds deposited when compare to the banking system.

Disadvantages of Yield Farming

Some of the disadvantages are

- Liquidation in the collateral can easily occur in yield farming: The price of collateral can decrease or the price of loan increase.

- This volatility in the price of crypto assets can cause user to loss their funds.

- Error in the smart contracts or a hacker exploring the bugs in the smart contract use by the yield farming platform can lead to loss of funds.

- The gas fee increase sometime especially during high peak of DeFi season and this discourage investors.

Conclusion on Decentralized Finance and Yield Farming

In conclusion DeFi have open the eyes of a lot of investors especially cryptocurrencies investors and individuals carrying out one or more transactions on the possibility of eliminating the power of middle man (government, company or individual) and give it to individuals carryout the transaction and yield farming which provide a way of benefits from decentralized finance provide a better way of investing and earn more better returns and also it provides a better way of getting loan but it is important to understand the risk associated with it and know how to invest wisely to maximize the benefits.

Cc: @stream4u

Hi @dprogress

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable