[SuperTrend Indicator] - Crypto Academy / S5W7-Homework post for kouba01

.png)

1. Show your understanding of the SuperTrend as a trading indicator and how it is calculated?

2. What are the main parameters of the Supertrend indicator and How to configure them and is it advisable to change its default settings? (Screenshot required)

3. Based on the use of the SuperTend indicator, how can one predict whether the trend will be bullish or bearish (screenshot required)

4. Explain how the Supertrend indicator is also used to understand sell / buy signals, by analyzing its different movements.(screenshot required)

5. How can we determine breakout points using Supertrend and Donchian Channel indicators? Explain this based on a clear examples. (Screenshot required)

6. Do you see the effectiveness of combining two SuperTrend indicators (fast and slow) in crypto trading? Explain this based on a clear example. (Screenshot required))

7. Is there a need to pair another indicator to make this indicator work better as a filter and help get rid of false signals? Use a graphic to support your answer. (screenshot required)

8. List the advantages and disadvantages of the Supertrend indicator

9. Conclusion:

1. Show your understanding of the SuperTrend as a trading indicator and how it is calculated?

We have that the SuperTrend indicator measures the volatility of a crypto asset, but also identifies the value of the candles by the ATR average. Then I can understand that the SuperTrend indicator provides us with support and resistance when we identify price movements with the indicator, taking into account that in a bullish phase we find support and in a bearish phase we find resistance thanks to the SuperTrend.

In the graph we find the Supertrend in colors, which when it is green will be because we are in a bullish phase and when it has a red color it will be a bearish phase. Traders will always seek to operate in favor of the trend and many more if the SuperTrend indicator is used, since we will be looking precisely to operate in the direction of the price. In theory, this indicator can be a bit confusing, but in practice, it is relatively easy to understand and understand for all beginners when they want to put their technical analysis into practice to help the SuperTrend indicator.

Formula

Up (Up) = (High + Low / 2 + Factor x ATR

Down (Down) = (High + Low) / 2 - Factor x ATR

Then we have the ATR that is important in the calculation because while the price range is higher it will be indicating higher volatility, while if the ATR range is lower it indicates that the volatility is lower.

2. What are the main parameters of the Supertrend indicator and How to configure them and is it advisable to change its default settings? (Screenshot required)

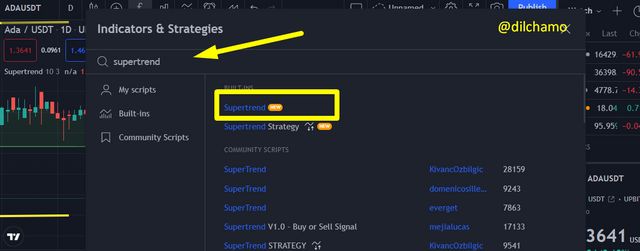

To apply the indicator to the asset chart I logged into tradingview and then We can search the super trend indicator from the indicators and strategies icon.

When the indicator is applied to the price chart it marks two sections as red and green to demonstrate the price trends.

There are three parameters in the supertrend indicator as:

- Time frame

- ATR length

- Factor

The default values are given for the ATR length and the Factor. The default ATR length is 10 and the Factor is 3.

I have changed the values in the below screenshot. I made the ATR length as 15 and the factor as 5. Then the whole chart changed.

The truth is that each change we make in the parameters gives us totally different results and from my point of view the best thing is to try as far as the trader can feel comfortable. I can see that in high time periods such as 4 hours it would be best to place a higher factor such as the 10-5 parameter and for fewer time periods such as 15 minutes if having a 10-3 parameter because there will be more reactions in movements faster. Clearly, the higher the reaction, the higher the false signals, but it is very difficult for that reason to simply be guided by an indicator and it is best to try to combine it with another technical analysis tool.

3. Based on the use of the SuperTend indicator, how can one predict whether the trend will be bullish or bearish (screenshot required)

Bullish trend

For a bull market, we will notice that the indicator's stripes will be green and will be below the price. This has to be followed by an upward movement where the price has an upward direction, so we will be able to identify the trend of an asset and it also helps us to look for only purchases taking into account that the market is strong in that direction.

We can see the ADA/ USDT chart as the price is in an uptrend since the bands are below the price following a green color in the upward direction of the asset, so we can easily identify that the trend is upward. Taking this into account, we as traders will be looking for purchases and taking into account that the green stripes in an uptrend represent a support for the asset.

Bearish Trend

For a bear market we are going to find the bands of the indicator above the price in a red color, indicating that precisely the asset is in a fall and thus we identify the direction of the price. Once we have identified this in the market, we as traders will be looking only for sales, because the asset is in a bearish direction.

We can visualize the ADA / USDT chart as the bands are above the price with a red color, which is indicating that it is in a bearish phase and that the price direction is down. Also, know that the bands above the price serve as a resistance in the market, and in this way we can identify the downtrend of an asset with the SuperTrend indicator.

Finally, I would like to say that this SuperTrend indicator has a great weakness in a consolidation market, as there can be many sudden signal changes and this causes us not to have a clear vision of where the direction of the crypto asset is going.

4. Explain how the Supertrend indicator is also used to understand sell / buy signals, by analyzing its different movements.(screenshot required)

With the SuperTrend indicator we will find many buy and sell signals but we must also bear in mind that these signals also serve to exit a position within the market. Well, we are going to find the direction of the price following a trend, where there comes a time that makes a change or reversal of the price to start a new trend, where we are going to generate a buy or sell signal and as I was saying it can also be an indication of closing a buy or sell position.

The good thing about the SuperTrend indicator is that it details the colors of the trend, so it is much easier for us to see where we have the buy or sell signal, because we simply have to wait for the trend that has a green color being bullish, turn red looking for a reversal and that would be a sell signal that we could be taking. In order to better understand these signals I will be showing a graph:

The SuperTrend indicator generates signals very easily to understand, but we must take into account that these signals can be false and that is why the trader must have a great reading of the chart to make his trading decisions. But to conclude we can say that it is only necessary to wait for a change from red to green or from green to red to find the buy and sell signals in the market. Likewise, these color changes are a possible reversal of the price and that is also a good sign to close an operation.

5. How can we determine breakout points using Supertrend and Donchian Channel indicators? Explain this based on a clear examples. (Screenshot required)

To find breakout points that indicate a buy or sell signal, we are going to be using the Donchian Channels indicator which is based on price volatility, having 3 lines that help us to visualize breaks and with the SuperTrend indicator now we are going to be having a filter to follow the trend of a crypto asset.

So what we are going to be looking for with the SuperTrend indicator and the Donchian Channels indicator will be a break precisely of the upper line of the donchian channel to get a buy signal because this would be a bullish signal, but we must bear in mind that the The breakout must be 2 consecutive candles for us to take a buy entry. Then for a sell signal we must wait for there to be a break of 2 consecutive candles below the lower line of the donchian channel, following the trend of the cryptographic asset and thus we would have a sell signal that provides us with an indication that the price will continue to fall active.

We have a signal to break the Donchian channel at its upper line, as we can see how the 2 consecutive candles manage to go above that level, which dictates a buy signal for a possible trend and we have the indicator SuperTrend that filters the bullish signal confirming the upward movement. And well we can visualize that once there was the break of the 2 candles in the upper line of the Donchian channel, an uptrend came.

6. Do you see the effectiveness of combining two SuperTrend indicators (fast and slow) in crypto trading? Explain this based on a clear example. (Screenshot required)

we are using a strategy of two SuperTrend indicators, but one with the standard setting of 10-3 which would be the slow parameter and another with the setting of 20-2 which would be the fast parameter. We will find the signal when the fast line of the Supertrend indicator crosses the slow line of the Supertrend indicator for a buy and then for a sell we have to wait for the two lines to turn red to find our bearish signal.

We can see in the ADA/ USDT chart how we find the buy signal using the two indicators, as we notice that the fast line of the SuperTrend indicator crosses below the slow line of the indicator, which can be considered as a confluence having two confirmations and thus take an entry into purchases with much more confidence waiting for the price direction to go up.

This strategy does have good effectiveness in cryptocurrency trading, because it allows us to have two confirmations when indicating a buy or sell signal and every merchant is always looking for confluences that help to have a better analysis. technician when making a business decision. I think that the option of using the indicator alone is not reliable and instead using this strategy of combining the same indicator but with fast and slow parameter settings gives a better effectiveness when operating in the markets.

7. Is there a need to pair another indicator to make this indicator work better as a filter and help get rid of false signals? Use a graphic to support your answer. (screenshot required)

the best thing will always be to combine an indicator with another indicator or any technical analysis tool that helps us find greater confluences that confirm the signals and be able to have a greater probability of success in our operations. In this case, I would be combining the SuperTrend indicator with the RSI indicator that identifies me over buying and over selling a crypto asset.

This strategy will be more effective using longer periods of time, which can be from 1 hour to 4 hours to have greater precision of the SuperTrend indicator and have a good signal from the RSI indicator which I always use for trend analysis that anticipates the market movement. We have to first the RSI indicator will tell us if the asset is overbought or oversold and if then the SuperTrend indicator confirms the signal of the RSI indicator we can take an entry following the direction of the movement.

8. List the advantages and disadvantages of the Supertrend indicator

Advantages

-It is an indicator that shows us easy-to-read signals and anyone with little experience can understand.

We can follow a great trend movement that leaves us a great profit in our trade.

It allows us to find trend reversals thanks to the crossing of the lines that change color.

Disadvantages

It does not work in any market situation, since in periods of range it does not generate reliable signals.

It works much better with another indicator, it is not the safest to use it only in the market.

In strong trends, it is more effective.

9. Conclusion

We have talked about an indicator that easily shows us the trend of a crypto asset, which identifies the direction of the market and can be used at any time in the market. We will be able to determine the upward trend of an asset when the SuperTrend line is below the price with a green color and a downtrend the SuperTrend line will be above the price with a red color.

https://steemit.com/hive-172186/@fareedsokhara/achievement-1-introduction-to-myself-by-fareedsokhara

Excelente post amiga 👏👏

hello @dilchamo @steemcurator01 @cryptokannon

its not good to you @dilchamo verify my post

https://steemit.com/hive-172186/@alihasnain8/79gfpb-achievement-5-task-2-by-alihasnain8-or-or-review-steemscan-com