Crypto Academy Week 7 Homework Post for @gbenga: DeFi Ecosystems and Projects/Protocols

DeFi graphics. Source: Swissborg

"Is this project or protocol a DeFi-based project? I wonder what kind of project is this, is there a particular ecosystem for things like these?"

Decentralized Finance

Professor @gbenga has recently posted an article circling around decentralized finance or DeFi ecosystems. Check out his article here. Specifically, he discussed yield farming DeFi ecosystems and protocols. For Crypto Academy's 7th week, he gave us a task to do the same: Discuss a DeFi ecosystem and protocol/project under it.

So, for today's write-up, we're going to talk about the DEX DeFi ecosystem and some samples of protocols using it.

Recap on DeFi

DeFi is an umbrella term for different financial applications that are running on cryptocurrencies or on the blockchain. It is short for Decentralized Finance. It has been designed to stay away from traditional financial systems that still require central authorities and intermediaries.

DEX graphics. Source: Ivan on Tech

What's a DEX?

DEX is also a shortened term, this one means Decentralized Exchange. DEXs are cryptocurrency exchanges that are operated in a decentralized way: with no central authority.

Unlike traditional exchanges that we became accustomed to throughout our years in the crypto space like Coinbase, Binance, Bittrex, Poloniex, etc; these new decentralized exchanges gives answers to the long-time crypto issue "not your keys not your coins" which pertains to cryptocurrencies that are kept (either long term or short term) in an exchange where you do not have the private keys. Not having your private keys means that you don't actually have your cryptocurrency assets - there are instances where this proved a big problem for traders or investors. Some examples are when your exchange account gets locked, or when the exchange gets hacked.

For DEXs, they just serve as a Bridgeway for you to trade or exchange your cryptocurrency to another crypto or maybe fiat (depending on the pair/market). All your cryptocurrencies stay in your wallet of choice (preferably a wallet where you keep your own keys), then you simply connect your wallet to the exchange without sending your assets over. Then the DEX will help facilitate the trade between users who are selling/buying for that cryptocurrency on that pair.

A DEX Project

There are many decentralized exchanges that are based on different DeFi platforms, some may be running on Ethereum, some on Eos, or maybe Tron, etc. I found this website called DeFi Prime where they list most (if not all) of the known DeFi project. You can even sort it out based on the platform and usage/ecosystem.

I'm going to introduce you to a decentralized exchange called SushiSwap.

SushiSwap graphics. Source: Sushi

This is a DEX running on the Ethereum blockchain that uses automated market-making. As a DEX, SushiSwap is considered run by the community since the community itself votes for all major changes to the protocol itself.

SushiSwap has different core products in its ecosystem, namely:

- SushiSwap Exchange

- SushiSwap Liquidity Pools

- And SushiSwap SushiBar Staking (xSushi)

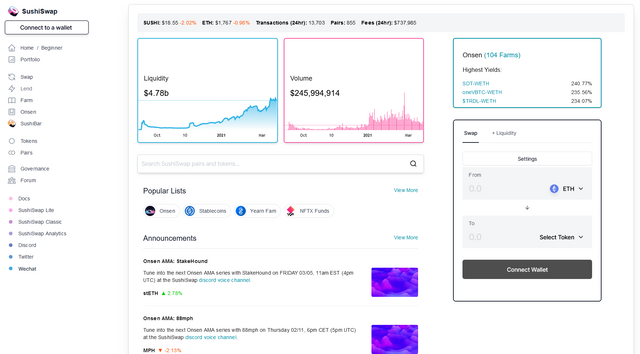

The SushiSwap App. Source: Sushi

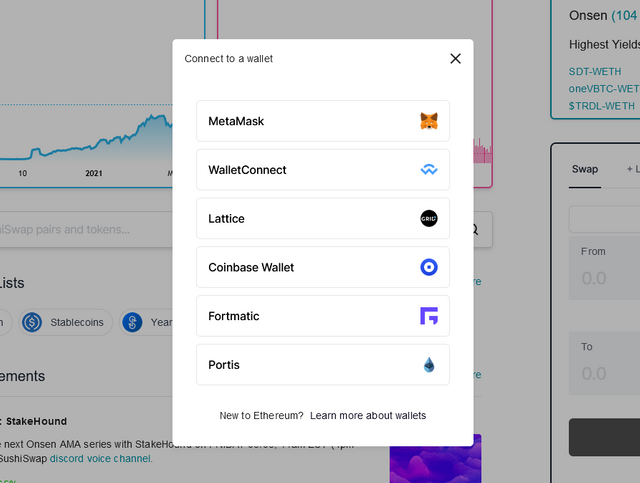

You can visit the Sushi app by going to https://app.sushi.com/. Once you are there, you can connect your ERC-20 compatible wallet. Just click on the Connect A Wallet buttons on that page.

Connecting a wallet in the SushiSwap App. Source: Sushi

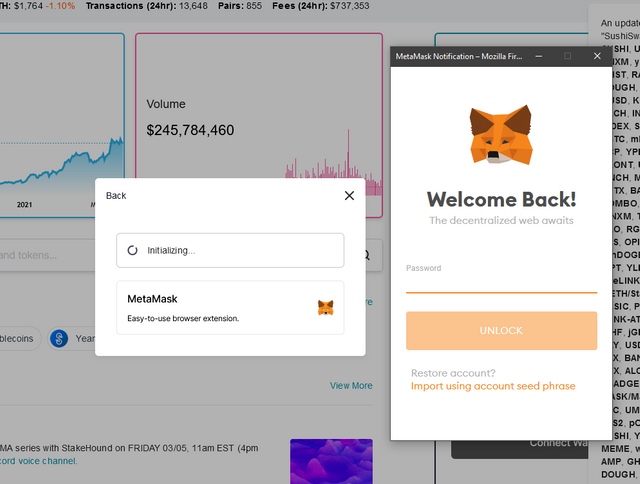

You can use a browser-based wallet like MetaMask, just like me.

Connecting a wallet in the SushiSwap App. Source: Sushi

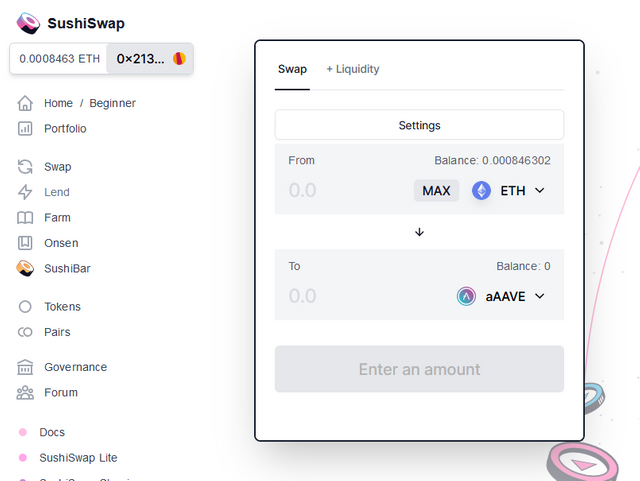

Once your wallet has connected (you need to select the wallet address and sign to connect it), you will be able to use the Sushi DeFi Dapp to process an exchange between the cryptocurrencies in their listed pairs by pressing on Swap.

Making Swaps. Source: Sushi

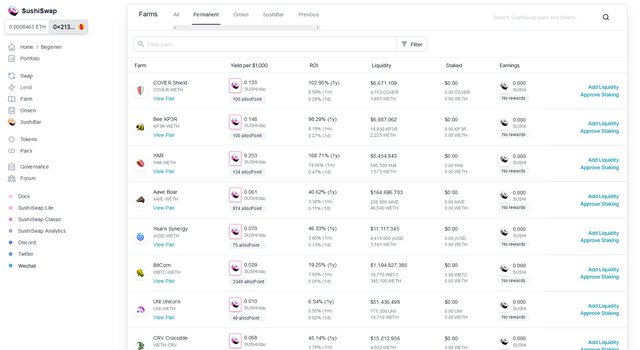

You can access the Liquidity Pools by pressing on the Farms button on the sidebar.

Using Sushi's Liquidity pools. Source: Sushi

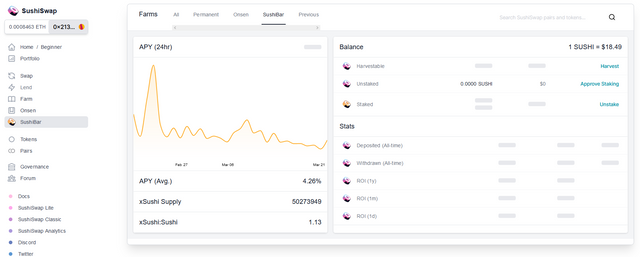

For the SushiBar Staking, simply click on SushiBar in the sidebar, it's easy to find it since it has a Sushi icon on it.

Using the SushiBar. Source: Sushi

SushiSwap is just one of the many decentralized exchanges that run on decentralized finance platforms. Other notable protocols under DeFi's DEX ecosystem are UniSwap, Oasis, IDEX, Bancor, AirSwap, and a lot more. This just proves that there are many people that need these protocols, as well as there are many companies or organizations that can provide DeFi projects like these.

Hello, Thanks for being a part of this week's class and participating in the assignment.

SushiSwap is still relatively new but then it has gained a lot of traction.

Question:

WHo founded Sushiswap, and do you think Sushiswap can do away with people's funds?

Rating 9

Thanks a lot for the review and feedback!

It was founded by Chef Nomi (it's a pseudo - we don't really know if it's a person or a group), along with other co-founders sushiswap and 0xMaki. Historically, they had an issue where millions of funds were taken out from the platform - this is from the pooling system they have - eventually, it was returned and they issued an apology. So it all boils down to trust and integrity. Bottomline though, if they would, they could - but everything is transparent in the blockchain so they can possibly be traced if ever they do an exit scam.