Crypto Academy Week 14- Homework Post for Professor @kouba01| Cryptocurrency Trading with MACD Indicator

I'm thankful for the chance to gain from you sir @kouba01. I truly like it that your exercises are centered around how to distinguish signals for a decent exchange. Thank you kindly for giving these vital exercises.

What is the MACD indicator simply? Is the MACD Indicator Good for Trading Cryptocurrencies? Which is better, MACD or RSI?

What is the moving average convergence/divergence (MACD)?

is a specialized examination marker that intends to recognize changes in an offer value's energy. The MACD gathers information from various moving midpoints to assist brokers with recognizing potential freedoms around help and opposition levels.It shows the connection between two moving midpoints of a security's cost. The MACD is determined by deducting the 26-time frame outstanding moving normal (EMA) from the 12-time frame EMA

The MACD marker is comprised of three segments:

- The MACD line, which estimates the distance between two moving midpoints

- The sign line, which recognizes changes in value force and goes about as a trigger for purchase and sell signals

- The histogram, which addresses the contrast between the MACD and the sign line

Important Point

- Moving normal union dissimilarity (MACD) is determined by taking away the 26-period dramatic moving normal (EMA) from the 12-time frame EMA.

- MACD triggers specialized signs when it crosses above (to purchase) or underneath (to sell) its sign line.

- The speed of hybrids is additionally taken as a sign of a market is overbought or oversold.

- MACD assists financial backers with understanding whether the bullish or bearish development in the cost is reinforcing or debilitating.

The Formula for MACD Is:

12-Period EMA − 26-Period EMA = MACD

Is the MACD Indicator Good for Trading Cryptocurrencies?

Base on my experience with Crypto Nothing is 100% Guaranteed. I will say MACD Indicator is Good for Trading Cryptocurrencies because it helps to identify good entries and exits point for long period of time. Why I say long period of time is because we normally see more false signals on the Short period of time as the result of choppier behaviour. This is also why the MACD is not as effective in Fluctuating environments. In Summary MACD is use to spot when to buy and Sell.

The MACD estimates the connection between two EMAs, while the RSI estimates value change comparable to ongoing value highs and lows. These two pointers are frequently utilized together to give experts a more complete specialized image of a market.

The RSI intends to demonstrate whether a market is viewed as overbought or oversold according to late value levels. The RSI ascertains normal value gains and misfortunes throughout a given timeframe.

I think MACD is better because measures the relationship between two EMAs. And it is more trustworthy.

How to add the MACD indicator to the chart, what are its settings, and ways to benefit from them? (Screenshot required)

Adding MACD Indicator to the Chart

Steps

- Using Tradingview Chart

- Click on the indicator icon at the top of the page.

- After that, the indicator landing page shows up.

- You can easily access an indicator by using the search bar.

- Now on the search bar, type MACD.

- All the available MACD indicator will pops up,

- Click on the first one "MACD".

MACD Settings

To view the settings for MACD indicator

- Move your pointer to the MACD indicator where you have MACD.

- An horizontal bar would extend.

- Select the settings icon.

- Upon selection a box would open showing you the settings available

- From the picture below, we have three numbers which are the key settings of the MACD indicator.

- The fast length is the number of periods used in the faster-moving average which in this case is 12 by default.

- The slow length is the number of periods used in the slower-moving average which in this case is 26 by default.

- The signal smoothing represents the number of bars used to calculate the moving average of the difference between the fast length and the slow length. The default settings for this is 9.

- Now on the MACD chart, we have two lines and a histogram. These two lines are not moving averages, rather the MACD line and the Signal line.

NOTE

- By default the MACD line is blue and

- The signal line is yellowish.

- The histogram has green and red colours by default.

How to use MACD with crossing MACD line and signal line? And how to use the MACD with the crossing of the zero line?

I will like to talk about how to interpret the crossing of the MACD and Signal line, MACD crossing over zero is considered bullish, while crossing under zero is bearish, when MACD diverts up from under zero it is considered bullish. At the point when it diverts down from over zero it is considered bearish When the MACD line crosses from underneath to over the sign line, the pointer is considered bullish. The further underneath the zero line the more grounded the sign. When the MACD line crosses from above to beneath the sign line, the marker is considered bearish. The further over the zero line the more grounded the sign.

MACD with intersection of Zero line

Intersection of the MACD and the zero line is another fascinating thing to keep an eye out for as this can likewise give pattern inversion signals. The zero line addresses the midpoint of MACD. At the point when the MACD crosses over the zero line, this demonstrates a purchase signal and an inversion of cost to the potential gain and this intersection relate to the intersection of the 12 time frame EMA over the 26 EMA.

Essentially, when MACD crosses underneath the zero line, this shows a sell signal which relates to the intersection of 12 period EMA beneath the 26 time frame EMA. Brokers can likewise utilize this intersection for a sell opportunity

How to detect a trend using the MACD? And how to filter out false signals? (Screenshots required )

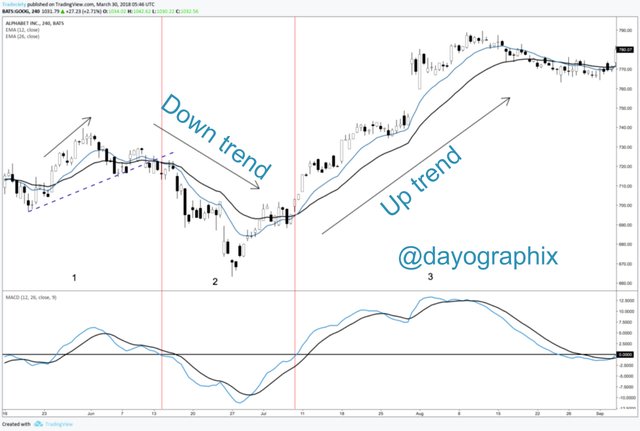

How to detect trend using the MACD

The MACD pointer can be utilized to identify patterns on the lookout. The difference and assembly of MACD line and sign line can be utilized to recognize solid patterns on the lookout. At the point when the MACD line veers away from the sign line in the wake of intersection above it, it demonstrates a solid bullish pattern on the lookout. Essentially, when the MACD line unites to the sign line, this shows depletion of pattern. The graph beneath shows how MACD can be utilized to identify solid patterns on the lookout. MACD indicator can be used to determine trends. it can detect trends using the histogram chart.

Detecting / Filtering false MACD signals

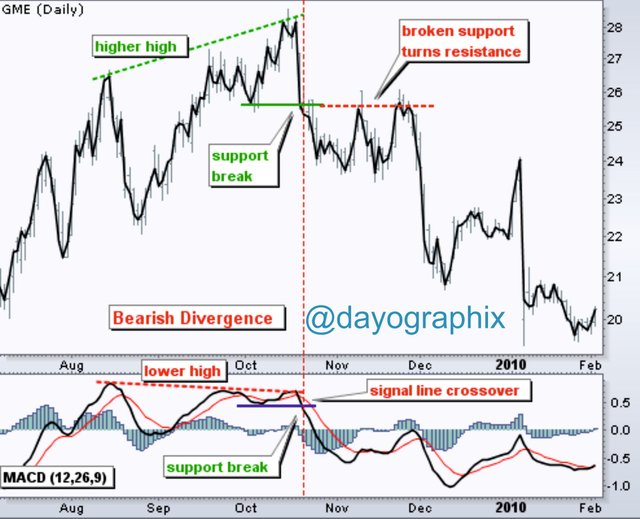

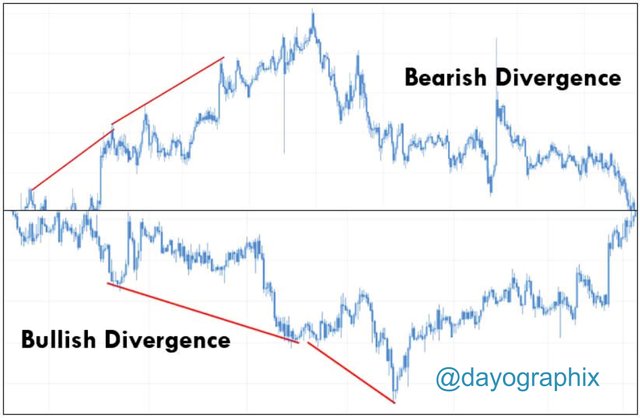

From the diagrams introduced, on the off chance that you set aside some effort to examine them cautiously you'd have seen there were times the fundamental outline was showing something other than what's expected from the MACD marker. A large portion of the occasions you'd notice it is marginally comparable however then it is extraordinary. We call this dissimilarity. Difference is the point at which the primary graph is showing something else from what the MACD marker is appearing. There are two kinds of disparity.

- Bullish Divergence

- Bearish Divergence

A bullish divergence happens when costs tumble to a new low while an oscillator neglects to arrive at an extraordinary failure. The present circumstance shows that bears are losing power, and that bulls are prepared to control the market once more—regularly a bullish uniqueness denotes the finish of a downtrend.

Bearish divergence is when there is an increment in cost and it's appeared on the primary outline however then the MACD marker shows in any case. You'd notice cost is expanding however then the MACD pointer is somewhat showing a reduction in cost.

How can the MACD indicator be used to extract points or support and resistance levels on the chart? Use an example to explain the strategy. (Screenshot required

From the Chat above, there was an inversion as the MACD line crossed over the sign line to frame a depressed spot. This depressed spot can fill in as a space of help when next value approaches it. Following two days of cost switching starting there, cost returned precisely on the space to retest the help. From the MACD diagram, we saw a cross of MACD line over the sign line as cost retested the help. Essentially, there was a cross of MACD over the zero line which showed that cost will invert at the help. Furthermore, from that point onward, we saw cost dismissed at the help and keep going up.

The Chat above shows how we can utilize MACD to remove opposition focuses on the graph. Notice how cost switched after MACD line crossed underneath the sign line, a high point was made on the outline which fills in as an opposition point. A couple of days after the fact, cost returned to retest this opposition region and there was an inversion. Additionally, notice how the MACD line crossed beneath the sign after cost retested the zone once more. This shaped an obstruction point and saw value turn around the other way.

Review the chart of any pair and present the various signals from the MACD. (Screenshot required)

I will Review TRX/UDT Chart

We know at this point that when the MACD gets over the Signal line it is recommending that you should purchase. However, with the little candles appearing on the Histogram you realize that the energy isn't solid. With the ascent in energy you acquire certainty that it is a happy chance to purchase.

Later on the green bars become lighter showing that the energy is dropping thus you ought to anticipate an opposition. You stand by to affirm whether the Signal line gets over the MACD line which gives you certainty cost would fall. By then you sell. At that deal you would have made a great deal of benefit.

The pattern proceeds and afterward you can apply a similar strategy. Note that there are times you could make a ton of benefits not sitting tight for the sell signal after the purchase signal. Make your own examination and find a procedure to suit you.

CONCLUSION

All in all, MACD is a decent marker that can help distinguish pattern inversions and openings on the lookout. Yet, the achievement pace of utilizing this marker will be high whenever combined with other specialized apparatuses like candle investigation, outline examples, backing and opposition. This can assist with sifting through bogus signs and furthermore know when the marker is slacking.

Much thanks to you @kouba01 for this brilliant Lecture.

Hello @dayographix,

Thank you for participating in the 6th Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 6/10 rating, according to the following scale:

My review :

A generally accepted article with answers lacking in addressing important aspects such as the role of the MACD indicator in identifying resistance and support points. Try to dig deeper into the answer.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01