Starting Crypto Trading - Steemit Crypto Academy |S6W1 - Homework Post for Professor @pelon53

Overview

In the financial market, there are series of analysis a trader should learn and know before being able to trade the market and make some profits. It is not that knowing these analysis will guarantee a 100% win rate but being able to analyse the market can certainly increase the win rate or the probability of the trader becoming a successful trader. Amongst the few types of analysing the financial market, I am going to talk about just two as demanded by the homework.

1. Fundamental Analysis

Fundamental analysis is a way of trying to get some financial insight into the intrinsic value of an organization or a company. What traders do is that they try to know when the price of stock or commodity or the price of an asset is hovering below the intrinsic value of the company, they could decide to buy, and if the price of the asset is hovering above the intrinsic value, they sell.

There are several factors that influence the intrinsic value of the price of an asset. Some of these factors are economic factors, political factors, technological factors, etc.

Fundamental analysts investigates the events that takes place in some countries and how these events affects the economy of the world and then try to see if these events or happenings has caused any decline or any increase in the intrinsic value of an asset before they make investment or trading decisions.

Fundamental analysis is very important aspect of analysis because it really has drift on the demand and supply nature of the market and could really give traders or investors more confidence in making their trading decisions.

In the crypto market, fundamental analysis is also plays a vital role as it gives investors or traders more insights on what to buy. Let's take for example when some countries in the world announced that they do not want any form of crypto currency transaction in the country, it caused panic and many persons sold off their holdings and that really contributed to a decline in the prices of almost all cryptocurrencies and that was also an opportunity for other investors to increase their portfolio by buying more.

The efficacy of fundamental analysis is of great potential and better advantage to traders.

2. Technical Analysis

Technical analysis is simply a way of looking at charts to better time enteries. This simply means that technical analysis helps traders to ascertain when to trade.

Technical analysts mostly depend on price action to better time their enteries. Most of them are referred to as Price action traders

As price action traders, they make their trading decisions based on the way price reacts to the influence of the buyers and sellers in the market. Most technical analysts add some indicators to their charts to better time their enteries and also get a better confirmation.

The screenshot above shows how technical analysis is most times done with the application of support and resistance levels.

From my own personal perspective, I can say technical analysis helps a trader to ascertain when to buy while fundamental helps a trader to know what to buy.

Difference Between Fundamental Analysis and Technical Analysis

| Fundamental Analysis | Technical Analysis |

|---|---|

| Fundamental analysis helps a trader to decide what stock or asset to buy | Technical analysis helps to trader helps a trader to know when to execute a trading decision. |

| Long term investors rely on fundamental analysis to make their investment decisions | Short term traders rely on fundamental analysis to make their trading decisions |

| Fundamental analysis gives an investor insight into previous behavior of an asset and also the present behavior of the asset. | Technical analysis give traders insight into previous behavior of an asset alone. |

| Fundamental analysis gives traders insight into the economic outlook and intrinsic value of institutions or companies. | Technical analysis gives traders insight into the trading psychology or emotions of buyers and sellers. |

| Fundamental Analysis information are derived mostly from news of event happenings | Technical analysis information are derived from charts and indicators. |

3. Sell Order in the Cyprocuurency Market Using Support and Resistance

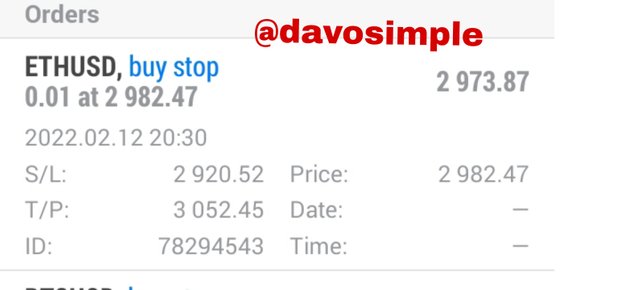

From the chart of ETHUSD above on a 1h timeframe, I noticed that price made some swing lows and then began to build up. I drew my resistance above the neckline and set my buy stop so that when price breaks above the neckline, it possibly will trigger my trade and the uptrend might continue.

4. Buy Order in the Cyprocuurency Market Using Support and Resistance

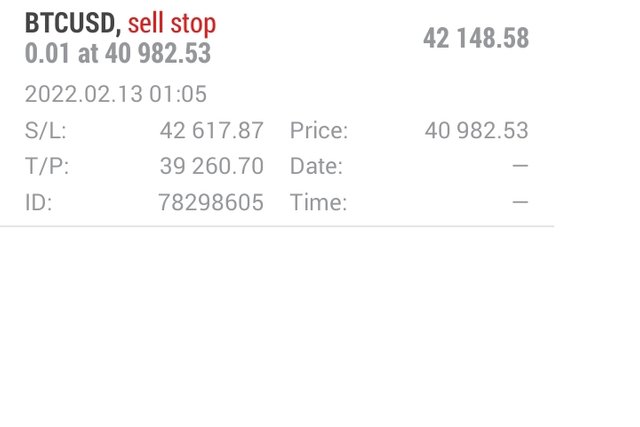

From the chart of BTCUSD above, on a 4h timeframe, I noticed that price made series of swing highs and then began to build up. At that point, I believe buyers and sellers were contesting on who will dominate the market. I drew my resistance below the neckline and then set my buy stop below the neckline so that my trade will be triggered when price breaks below the neckline.

5. Hanging man and Shooting Star

Hanging man is type of candle stich that is formed during an uptrend, signaling that the strength of buyers have begin to become weak. Traders use the formation hanging man to candle to prepare for a reversal during an uptrend. Infact traders take the hanging man candle as a reflection of the psychology of investors on the price of an asset.

The hanging man candle has a small body hung on a long lower wick.

Shooting Star

The shooting star candle is also reversal candle that is formed when the price of an asset opens, makes a significant upward move and then close somewhere close to the point it opened.

The shooting star candle has a small body and a longer shadow above the body with little or now shadow below the body. The shooting star candle is formed as a result of dominance by sellers over buyers in the market at a particular time.

Conclusion

Technical analysis and fundamental analysis plays vital roles in decision making of trading or investments. These two types of analysis if combined together can increase probability of a trader being more successful.

Even though there are differences that exist between this two, they serve as potential tool in becoming a profitable trader.

Images used in this post are screenshots taken from Mt4 app

cc: Prof @pelon53