Steemit Crypto Academy | Season 2: Week7 || Exchange order book and its Use and How to place different orders? by @darwinking

Source

%20(1).png)

%20(1).png)

What is meant by order book and how does the crypto order book differ from our local market? explain with examples (the answer must be written in your own words, copy paste or from another source will not be accepted)

We understand that the traditional order books have helped the ecosystem to understand better about the records or orders that are carried out through a written or printed paper but they do not have much margin of classification since these are worked only from the supply and demand of the day and the fixed % in terms of the laws of the country where they are negotiating since it is a trader with the buyer the buyer will always want to buy cheaper than what the trader is selling therefore they have to reach a mutual agreement between them.

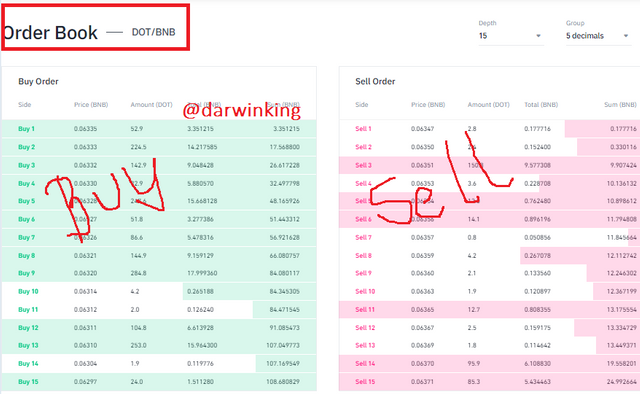

The cryptographic digital order books there are movements that can be studied according to the graphs of the pairs that we are reviewing for example I have DOL/BNB then we will see the offers and demands that exist within the order book usually there is always a gap between sales and purchases.

I will discuss the main characteristics of each of the traditional and cryptocurrency books.

MAIN CHARACTERISTICS:

•The traditional order books do not have the volatility of a market because the prices are fixed for a very long period of time, this leaves us without enough room for negotiations.

•In the crypto market there is something called volatility that moves according to the market trend, this means that following the demand of the asset the value will be fluctuating above them, there are no fixed prices, so here you can apply analysis and strategies to follow to be a winner.

•Traditional market, is a centralized system full of hierarchs and leaders who give orders and set stable prices.

•Cryptographic Market: the masses place the price everything works under a system of interconnected blocks called nodes that interact with each other to create a very practical ecosystem for all investors.

•Placing stop loss orders in traditional markets is impossible, but in cryptocurrencies is of total vitality is like the brakes on today's cars. to protect our assets.

•In the crypto market we can perform any analysis and practice stop losses to protect ourselves from volatility.

%20(1).png)

Explain how to find the order book on any exchange through a screenshot and also describe each step with text and also explain the words given below (answer should be written in your own words).

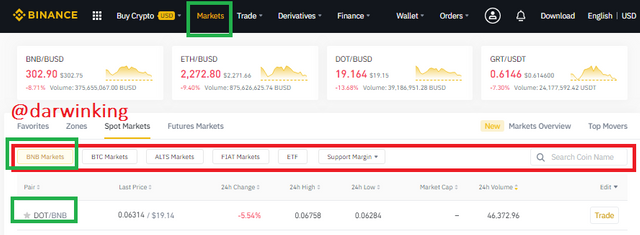

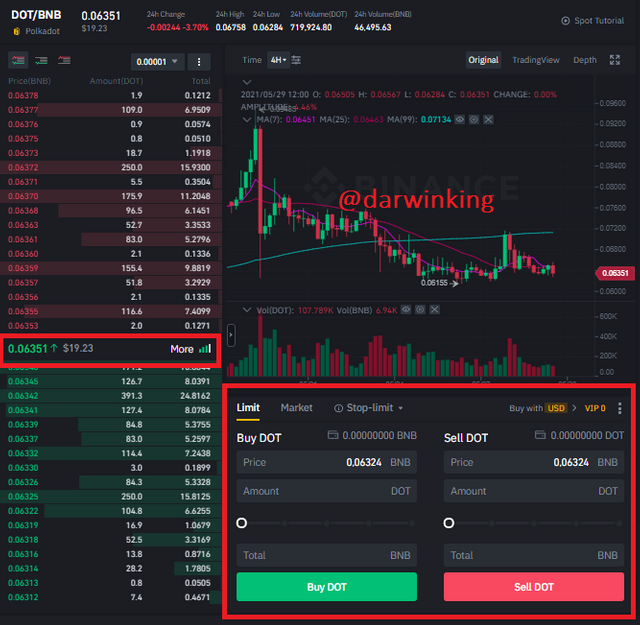

In the trading explanatory guide that I am going to talk about below I am going to make it as clear and simple as possible for this example I am going to use Binance Exchange in spot market

•1 We open the Binance website and log in.

•2 Then we go to Markets

•3 Select spot markets

•4 Select the pair of your choice and click on trade.

BINANCE EXCHANGE

Once you enter trade go to more and you will see the DOT/BNB order book.

BINANCE EXCHANGE

CONCEPTS:

Trading pair:

They are assets that can be traded by exchanging one for another depending on the investor's interest in owning one of the assets at the right time for example take DOT/BNB these I can exchange if I have DOT and I want BNB I can buy the BNB with DOT at a cheap price and then I can sell it more expensive to make profit.

Supports:

supports are the floors or point of arrival of an uptrend to downtrend usually reach these points and hold usually revolve to continue falling or create a range to later make uptrend change. usually supports are old resistances or previous highs that when reached and surpassed create a support with a significant volume of purchases and sales many of the trading like to enter these supports if they have significant purchase volume because they know that when they go up they get profits.

Resistances:

are points of previous historical highs that usually loses interest and the price falls or changes trend for some circumstance or reason remember that cryptocurrencies are totally volatile and usually usually usually have waves. resistances are usually also as an exit point and profit taking as in them the price usually stops to make a fall range or a bullish range.

%20(1).png)

Example of resistance and support.

BINANCE EXCHANGE

Limit order:

The limit order are orders that we have to take into account in a transaction usually we place sell or buy orders at the price that we have in mind that we will benefit buy low and sell high these limit orders serves both for profit taking and to protect us from significant losses, if for example I buy DOT at 0. 01BNB then I will put my stop limit at 0.015 to earn some profit then when the price rises from 0.01 bnb to 0.015 bnb this will execute and trigger the buy thus earning the 0.005bnb profit on that trade this may take some time to execute.

Market order:

This oden is connected to the current market price i.e. if on the chart the price says 0.01$BNB = a 0.02dDOT then I give it to buy 0.01BNB I just place the amount of BNB I wish to buy at the moment and if I possess the balance in equivalent DOT this will execute it instantly thus obtaining the 0.02DOT here is not measured in waiting time it is instantly.

%20(1).png)

3

Explain the important future of the order book with the help of a screenshot. In the meantime, a screenshot of the verified profile of your Exchange account should appear (the answer should be written in your own words)

BINANCE EXCHANGE

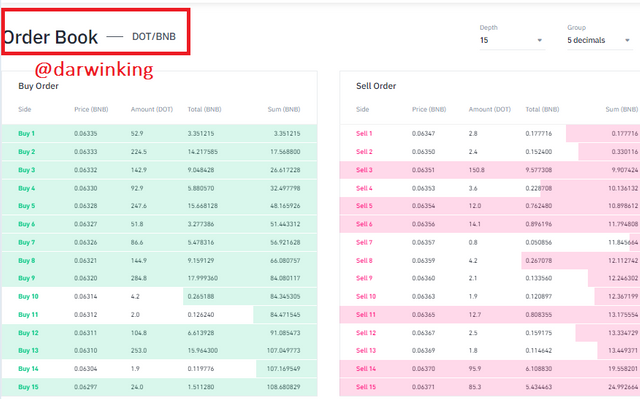

The most important thing about the order book

It keeps a record of purchases and sales of the selected pairs along with other details such as market cap, time, history, range, supply capacity gaps, sales per day and per hour etc. here I will be demonstrating how it works.

On the green side we will find the buy orders this means that the bid is lower than the ask price no one likes to lose so this is why we will analyze a little more.

On the red side we will find the sell orders as I said before the sell orders are higher than the buy orders so there is a gap but there is always one or the other who accept the adverse prices to gain some liquidity over time if they see potential or if their strategy requires it.

BINANCE EXCHANGE

Order to buy

It is very easy to buy just follow these instructions:

in the blue part indicates the price in $ dollars state unidences in the part of buy dot and sell dot appear in pairs.

if you want to buy DOT using BNB you must select the amount of BNB that you must change to Dot ie the amount of Dot you want will determine the BNB you are going to spend. in that case if everything matches you click on BUY DOT and ready you buy the dot at the price you stipulated in the price box.

On the contrary if you want to sell the DOT and get BNB you must select the price you like the most and put the amount of BNB you want to get in this case if everything matches you click on sell Dot once the time runs and the price reaches the agreed price the operation will be fulfilled thus obtaining the BNB.

BINANCE EXCHANGE

DOT / BNB EXCHANGE MARKET

In this market you only have to select the "Market" box and then select the amount of Dot you want to buy or sell only that you don't need anything else then you click on buy or sell DOT it will automatically run at the price that is set for example I want to buy 20 DOT and I click on buy just the value of each DOT will cost $24.27 or the equivalent in BNB instantly.

BINANCE EXCHANGE

How to place buy and sell orders in Stop-Limit and OCO trades? Explain through screenshots with verified trading account that you can use any verified trading account (the answer must be written in your own words).

It is very important to place stop limit orders but more important to place an OCO order usually we always use to analyze the market and place stop loss but we don't know in which points we should place them for this we should look for the resistances for market exits and get profit and supports to exit the market if these are broken by the trends so protect our capital.

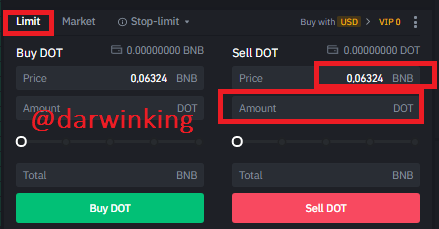

Limit orders:

Limit orders are usually placed in orders that we only want that as soon as it reaches that price is executed the purchase or sale of the asset that we are operating that is to say that we buy on average at a price well below the current or we can expect oversold to buy low points and then sell at high points in resistances to take profits by placing only a simple and common limit order. here we will delimit the amount of coins we want to sell and the price we want to be based on profits. according to our technical analysis.

BINANCE EXCHANGE

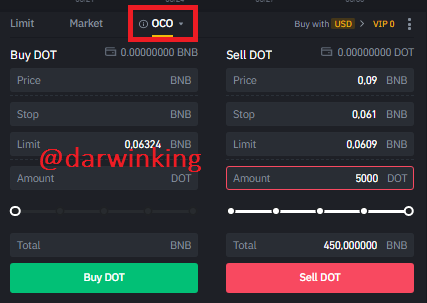

OCO Order

the oco orders we are going to implement a method for more security that the limit order sometimes the operations are not fulfilled if not that they jump therefore we must make sure in the best way placing an oco order.

in this picture we see several windows

Price: is where we are going to place the highest value we want to sell.

Stop: It will help to protect us from the bear market, this always usually goes below some nearest resistance.

Limit: We will place a lower price than the previous one in case there is a jump and this can grab and make the operation.

Amount: amount of DoT or tokens to be sold.

Total: is the amount of BNB that we will receive in this case.

BINANCE EXCHANGE

%20(1).png)

How does the order book help in trading to make profits and protect against losses? Share the technical point of view, which helps to explore the answer (the answer should be written in your own words showing your experience and understanding).

this chart helps us to buy sell analyze the current market we are going to work in see the history and thus make decisions of entries and exits of a market also it is one of our best tools to be complemented by a technical analysis in Japanese candlestick charts to achieve total success in charting it is important to always leave psychology aside and focus on analysis the order books applied in the digital system is very important for the whole ecosystem.

Place the prices where we want to make a profit and protect ourselves with the stop limit and stop loss to take profits always stay with the system or strategy that we like the most. usually we see the features and functions that has as the system stop limit , OCO , among others that are very good all.

%20(1).png)

Conclusion:

In this research work we learned how to use the OCO Stop limit, we also learned the fundamental concepts of Resistances and Supports as they are formed that are and how we will use them for our benefit also talk a little binance perform several informative guides where we can appreciate how to perform each operation. many new users are unaware of these terms therefore it is my duty to teach anyone who wants to learn and be part of this great digital ecosystem many thanks to all who make these tasks possible thank you teacher.

%20(1).png)

Cc:

@steemitblog

@steemcurator01

@steemcurator02

@yousafharoonkhan

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

you did not place the stop limit order , in limit order screenshot look your order placement is incompplete

last question is very much short , need more technical reivew that how order book help to gain profit , so there are many feature that need to mention in this regards

If you look at feature in the order book, you will see a lot of technical and simple advance feature. You have not searched for futures in detail. it is very much important to explore the order book to use the feature that will help you in trade

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 5.6