Exchange Coins - Crypto Academy S5W1 - Homework Post for @imagen

Hello Professor @imagen, I'm grateful for the opportunity to be once again able to participate in your homework tasks. Here is my homework post, I hope you like it.

1.) Perform a complete analysis of the currency of some exchange. Not allowed: BNB, KuCoin, Cake and Uniswap.

Huobi Token (HT)

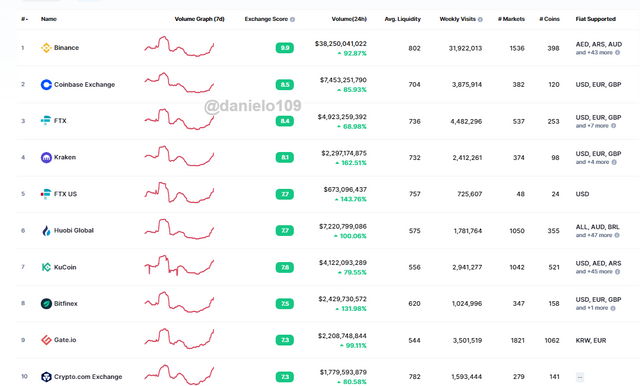

Huobi Global is among the top 10 Exchanges listed on CoinMarketCap in terms of 24h Volume and average liquidity.

Huobi Global is said to be the "leading global Bitcoin and cryptocurrency service provider". This exchange platform was founded in 2013 by Leon Li to provide a market/platform to economise digital assets.

Huobi Token (HT) is the native token for the Huobi Global exchange platform. HT is an ERC-20 token (built on the Ethereum Blockchain). It was created to provide a flexible market, reduce commissions for trading activities and allow token holders to participate in the decision making of the exchange through votes which allows them to earn rewards. HT holders also gain discounts with the Huobi loyalty program.

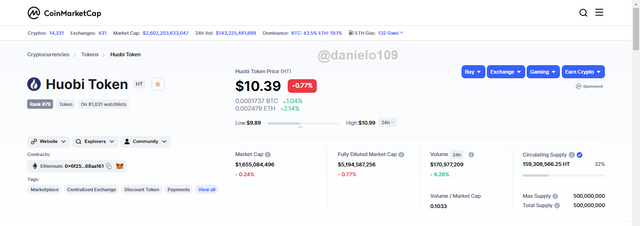

Huobi token was launched in January 2018. It has a maximum supply of 500 million HT. Out of the 500million, 60% has been allocated to users and 40% to the company. At the time of doing this homework, the circulating supply of HT was 159,308,566.25 HT. It had a market cap of $1,655,084,496 and a 24H trading volume of $170,977,209.

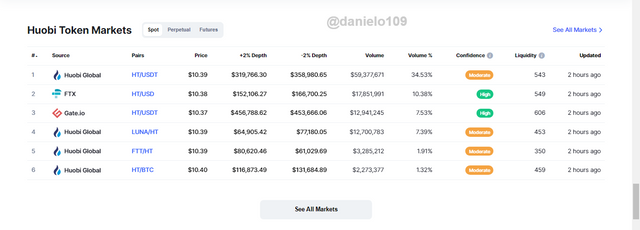

HT is ranked #79 on CoinMarketCap. It has a price of $10.39 which was equivalent to 0.0001737 BTC and 0.002479 ETH. The contract address of HT is

0x6f259637dcd74c767781e37bc6133cd6a68aa161. It has various markets mostly on the Huobi Global exchange and some on other exchanges like FXT, Gate.io, Binance, BitMart, JEX and many others.

The HT is very secure. The Huobi network has put in place mechanisms such as the Security Reservation and anti-DDoS protection with a distributed architecture to secure the funds of users. It also uses a multi-sig cold wallet to store 98% of the HT. Cold wallets are wallets that are more secure as compared to hot wallets. They store assets offline to prevent hackers from accessing them.

Huobi Token recorded its all-time high 6 months ago at a value of $39.81. Its all-time low was 3 years ago at $0.8897.

What benefits do you gain for holding HT?

Investor Protection: Huobi Global exchange has an investor protection program that compensates investors for financial losses which could be incurred in the cause of time.

Low Transaction Charges: Holders of HT can perform trading activities at lower costs.

Easy Trading on Huobi Global: HT has a lot of markets on the Huobi Global exchange. This allows holders to easily trade their HT for other assets easily.

Rewards and participation in decision making: HT holders are allowed to vote during the decision making of the exchange. Holders can also earn rewards with their votes. They also receive bonuses and new assets with listings of new assets.

2.) Make a purchase equal to at least US $ 10 of the currency you explained above. You must make some movement with that currency within the exchange that created that currency. Show screenshots and explain in detail the steps to follow. Example: transfer of funds, Staking, participation in a Launchpad, trading in futures, etc. Indicate the reasons why you chose that option (operation) on that platform.

Houbi Pro

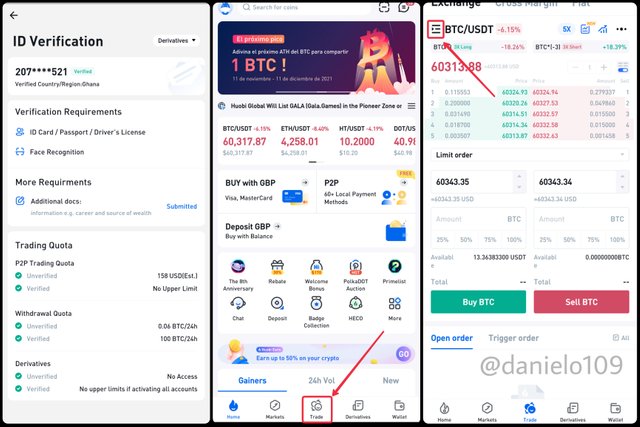

I downloaded and completed my verification on Huobi Global just recently. Verification needed a passport, ID card or drivers license. I created an account years ago when a friend introduced me to crypto. I didn't comprehend what he tried to explain and so I left the account dormant.

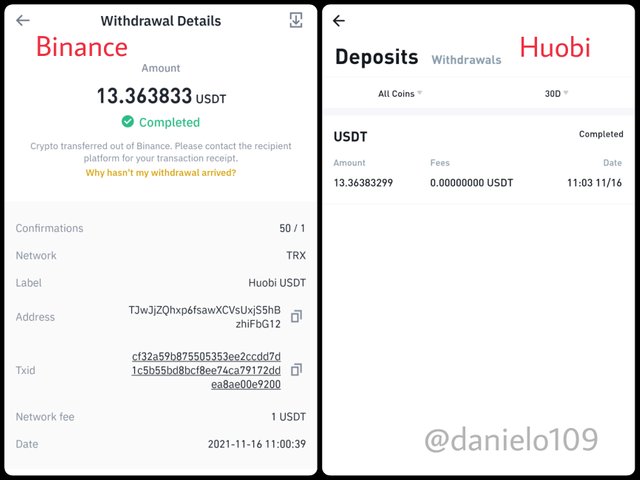

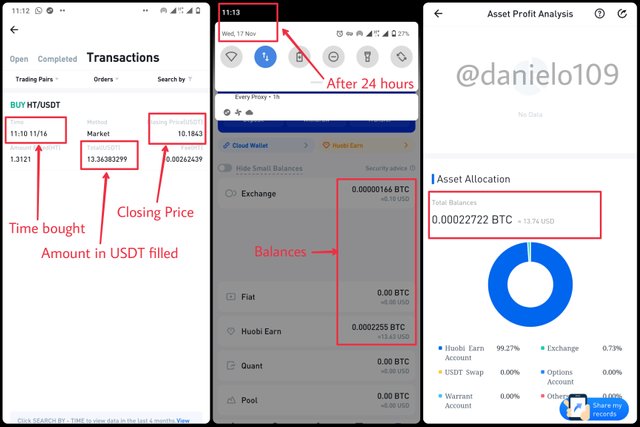

I had USDT on Binance and so I withdrew it and deposited it to Huobi Pro. I transferred 14.36 USDT. The fee charged was 1 USDT and so the amount received was 13.363833 USDT. You can see that from the image above.

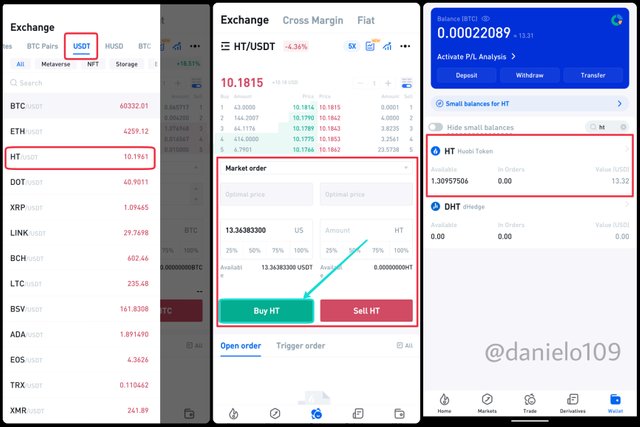

The image above shows my verified Huobi Global account. To purchase Huobi Token (HT), you first click on trade to enter the trade menu. Next, click on the button next to the trading pair as indicated in the image above.

Since I had USDT only, I clicked on USDT to view all the USDT pairs listed. You can choose to search the token pair in the search. I selected HT/USDT.

Next, I inputted the amount of USDT I wanted to use to buy HT, selected a market order for the trade to be executed instantly and I clicked Buy HT. The process was successful.

I received 1.30957506 HT.

Financial Services on Huobi Global

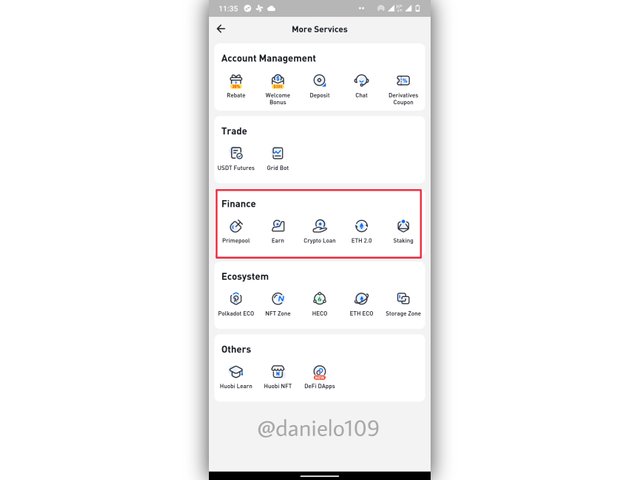

Huobi Global has some nice offers for first-time users. Since a created an account long ago I wasn't eligible for most of the offers. I decided to check the other financial services they offered to users. This included the Primepool, Earn, Crypto Loan, ETH 2.0 and Staking. These can be seen from the image below.

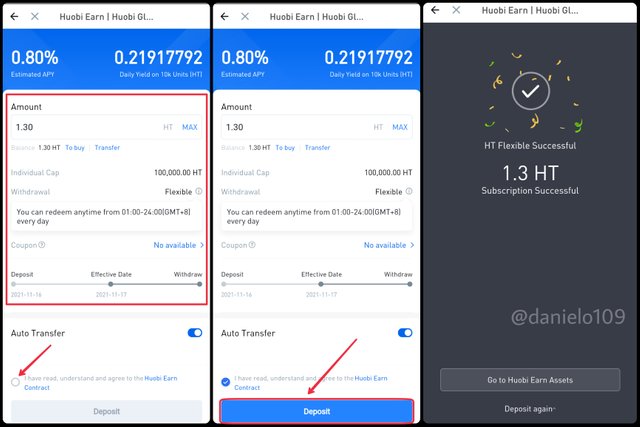

I chose the Earn service for this task because it was the only service that allowed the use of the HT which is a requirement for this question.

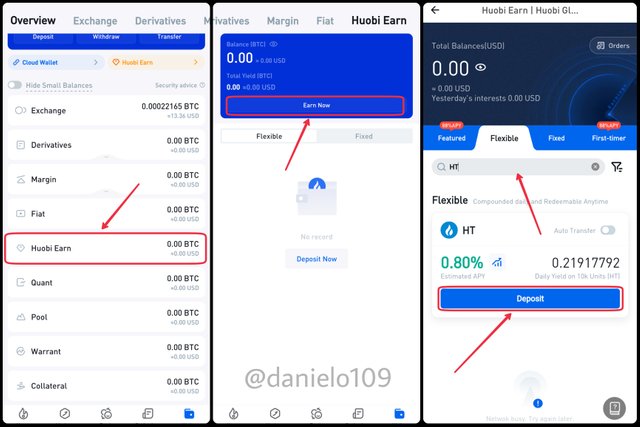

You can access the Earn service from the wallet section. Click on Huobi Earn and select Earn Now.

Over here there are options like featured with 88% APY, First-timer with 88% APY, fixed and Flexible. The earn feature allows you to lock up your assets for a period of time and earn interest based on the APY percentage.

I chose Flexible. This option allows users to lock up their assets and have the freedom of withdrawing at any point in time. The APY is 0.88% which is less than the APY for the Fixed deposit of HT that is 3% APY. I chose the Flexible because I might need the funds deposited at some point in time which might be earlier than the fixed period given.

I searched for HT and clicked on Deposit.

I inputted the amount of HT I wanted to deposit and I clicked on the check. I clicked on deposit to complete the subscription.

The subscription of 1.3 HT was successful as you can see from the image above.

3.) Show the return on investment in time frames of 0, 24 and 48 hours from the moment you bought. Take screenshots where you can see the price of the asset and the date of capture.

Return on Investment

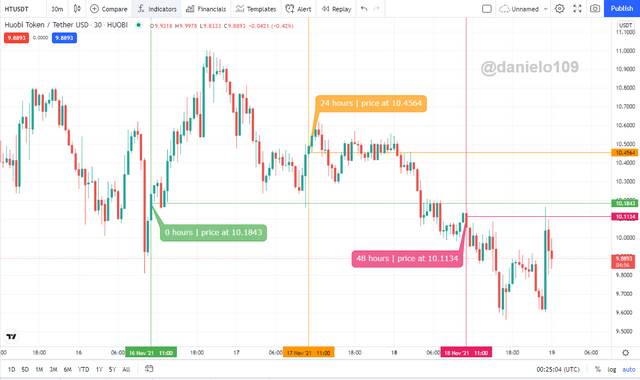

I bought HT at 11:10 am on 16/11/2021. At that time the price of HT was 10.1843. The image below shows the price movement of HT from the time I bought to 24 hours and 48 hours.

The amount of HT I bought was 13.3638 USDT. After 24 hours the price moved from 10.1843 to 10.4564 USDT. You can confirm the amount bought and closing price from the image below. My total balances were all in HT and it was 13.74 after 24 hours.

My total balance moved from 13.36 to 13.74 in USD. This shows that my return on investment was 0.38 USD after 24 hours.

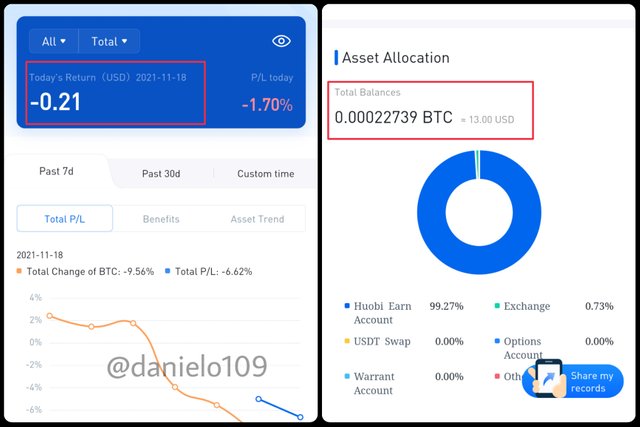

After 24 hours I activated the P&L analysis to easily determine the returns on investment. After 48 hours, the price of HT had dropped to 10.1134 USDT. I checked the P&L and it showed a reduction in the price of -0.21 USD. The total balance was 13.00 USD. You can view the date and P&L from the image below.

3.1) Has the asset's price acted independently or does its price strictly follow the correlation with Bitcoin?

Huobi Token Correlation with Bitcoin

Bitcoin remains the most dominant cryptocurrency. Its price movement has a significant impact on most altcoins.

Let's take a look at the HT/USDT and BTC/USDT charts below. I marked the charts from the point I bought to after 24 and 48 hours.

As you can see from the charts above, there is a correlation in the price of the asset with the price of bitcoin. Within 0 to 24 hours, there wasn't a strong correlation in price. But after 24 hours the asset's trend became bearish with the fall in the price of Bitcoin.

HT wasn't the only token that fell in price on 18/11/2021. Many other coins such as BNB, ETH and DOT also experienced a fall in price with the fall in the price of BTC.

This shows that Huobi follows the correlation of BTC but not strictly because there are times there is a similar but not strict correlation.

4.) What are futures trading?

Futures Trading

Futures trading on Huobi global can be found in the derivative section. Futures allows users to take positions, either long or short and gain profits or losses instantly.

Points to note in futures are, it is a form of contract with an expiration date. The trader buys (long) or sells (short) at a predetermined price and is compelled to close the position when the contract expires.

Futures can be very profitable. They are high-risk products and so I wouldn't advise people with low-risk tolerance to try them. As we all know, cryptocurrencies have high volatility. This makes them very risky.

In futures trading, one takes a long position if he predicts the asset is going to rise in price and a short position if the asset is going to fall in price. This requires good technical analysis. In the case where the prediction is right, the trader gains profit with the increase in the rise or fall of the asset. A greater increase in the rise of the asset when you take a long position would lead to greater profits.

Should the price of the asset go against the direction you predicted, you would run at a loss. Traders have the advantage of closing positions any time to reduce losses or take whatever profits they have made.

Futures Trading on Huobi Global has 5 types of orders for traders. These are limit order, trigger order, post only, ICO and FOK.

I prefer using limit orders. This allows me to set a Stop Loss and a Take Profit after making an analysis and allows me to stick to my trading plan.

It is important to note that you need to deposit funds to a specified wallet to trade futures. On Huobi, you transfer funds from other wallets like the spot wallet to your derivatives wallet and on Binance you transfer your funds to your futures wallet.

Most exchanges inform you about how risky futures are and warn you about the liquidation of your assets. They have a gauge to show you the level of risk of the position you've taken and also give you the liquidation price. On Huobi, you reach liquidation when the risk is -110%. This will cause you to lose all your asset used to take the position.

5.) What is the margin market?

Margin Market

Margin in simple terms allows traders to borrow capital from their exchange or broker to take larger positions in a trade. It is a double-edged sword. Thus, depending on how the trade turns out, you can make more profits or incur more losses.

To use margin, traders are supposed to deposit funds as collateral. The amount of funds you deposit is also used in the calculation of how much funds you can borrow. With this, users can leverage their assets and make more profits.

Margin should be used when the accuracy of one's predictions are very high. This is because it increases the risk of the position one takes. Also, interest is charged on the borrowed funds. The interest increases with the increase in time taken to repay the borrowed funds.

Binance Futures makes use of margin. Traders can leverage their assets x20 at the start, and up to x50 after 6 months of trading. The higher the leverage the greater the risk. Traders are given the liquidation price and allowed to add margin to reduce the level of risk by increasing or decreasing the liquidation price based on the position taken.

6.) What happens to the cryptocurrencies of an exchange when they suffer from a hack or it turns out to be a fraud? Present at least 2 real-life examples.

Crypto Scams and Hacks

Crypto scams have become very common and something to be cautious about when investing in new cryptocurrencies. This is because anyone at all can create a cryptocurrency with its liquidity pool without any regulation or strict checks from authorities as to whether it is legit or not.

Most exchanges give warnings to users when they are about to purchase a new cryptocurrency. Traders are warned about the probability of fraud so that they do not blame the exchange in the case where a cryptocurrency turns out to be a fraud.

For this reason, it is important to perform a thorough fundamental analysis of an asset before making a purchase.

Exchanges have suffered attacks from hackers who intend to steal the funds of others. They mostly search for bugs and take advantage of the bugs to hack and steal funds from exchanges.

When a cryptocurrency turns out to be a fraud or is hacked, exchanges try to trace the addresses the funds were moved to and try to recover the stolen funds to the owners. Some exchanges promise a 100 or 50 per cent reimbursement of funds in the case of hacks or fraudulent activities.

A recent example of cryptocurrency fraud is the Squid Token. This cryptocurrency was created based on the South Koren Netflix series. This series was very popular and so the coin was continually increasing in price after its creation. It increased by thousands of per cent before its market cap went to 0.

The developers also provided a good whitepaper with interesting details about the cryptocurrency. For investors who checked the whitepaper, I'm sure the details lured them into making an investment because they provided a good project. It's quite unfortunate it turned out to be a scam.

This coin was listed on Binance, one of the most popular exchanges. The developers of the Squid Game token made off with an estimated amount of $3.38m. The funny thing is even after confirming it's a scam, people were still buying with the hope of it rising again.

Binance after the rug pull started hunting down the fraudsters. This action is no guarantee that the perpetrators will be found though but it is worth the try. Binance is currently banned in the UK for not being able to prevent this scam.

An example of a hack on an exchange is the Poly Network hack. This hack was due to a flaw in the Poly network. This flaw was exploited by a hacker to seize $600m. This hacker is currently working as Poly Network's chief security advisor.

He said that the funds were taken to keep them safe and cause attention to the bug. This act was purposely to prevent a bad hacker from running off with the funds. He was rewarded with $500,000 for finding the bug. This act caused Poly Network to start a $500,000 bug bounty program. This program is to encourage researchers to find bugs.

The hacker has currently returned all the stolen funds and is said to have added extra funds as compensation. For his good act, people have been sending donations to him every now and then. He has saved the lives of many with this.

Conclusion

Exchanges have provided a platform where we can buy, sell and perform financial activities to earn. The native token of an exchange provides good benefits and advantages for use in its exchange.

The dominance of Bitcoin should be taken into account when making an investment in a token. I'd advise traders to keep a tab on BTC and include it in analysis before taking a position in a trade.

Margin is also a great way of making greater profits with less capital. Traders should use it wisely with good prediction skills.

Exchange hacks are possible with flaws in their security. Most exchanges have very tight security to prevent hacks. They also have external wallets. These wallets are more secure for holding huge funds which are not intended to be used soon. In the case of a hack on an exchange, funds stored in an external wallet can't be accessed by the hacker which makes you safe.

Finally, It is very important to make good research before investing in a cryptocurrency especially when it is new.