SEC S16-W5 || Navigating the STEEM Token

Navigating the STEEM Market: The Power of Sentiment Analysis

In the ever-evolving landscape of cryptocurrency, the STEEM token stands out as a beacon for content creators and investors alike. As we dive into the intricacies of the STEEM market, we aim to harness the power of sentiment analysis on social media platforms to shed light on its dynamic environment. This exploration is not just about numbers and charts; it's a journey into the community's heart, where every tweet, post, and comment paints a broader picture of the market's pulse.

I always support definitions which will give a clear understanding of a specific topic, so I first start with giving definitions and then to other things.

First of all

What is sentiment analysis?

DEFINITION : Sentiment Analysis is the process of computationally determining whether a piece of writing is positive, negative, or neutral. In the context of cryptocurrencies like STEEM, it involves analyzing social media posts, comments, and overall online discourse to gauge public opinion about the token.

Sentiment analysis offers a proactive approach to understanding market dynamics, enabling traders and investors to anticipate shifts and make informed decisions. It also helps project developers gauge community response to new features or updates.

How can we take advantage of sentiment analysis in real time

Enhancing Trading Signals with Sentiment Analysis

A Fusion of Art and Science: Combining sentiment analysis with technical indicators creates a more holistic trading strategy. For instance, a graphical analysis might show a potential bullish breakout in the STEEM price chart. When paired with a surge in positive sentiment on social media, this signal's reliability strengthens, offering traders a clearer call to action. It's where the art of reading social nuances meets the science of technical analysis.

it's like when the price drops coz of something( price drops for various reasons right), here comes the sentiment. if sentiment is positive in social medias, most of the people think it's the best moment to buy, so it boosts the market cap and helps the coin to maintain balance

if sentiment is positive, it acts a balance and helps the coin to recover faster than usual.

The Ripple Effect of Community Sentiment

Understanding the Mood Swing: At its core, the sentiment around the STEEM token on platforms like Twitter and Reddit offers a real-time glimpse into the community's mindset. Positive news, successful projects, and engaging community interactions can foster an upbeat atmosphere, potentially uplifting the token's value. Conversely, negative sentiment can trigger doubt, leading to sell-offs. Analyzing these emotional undercurrents provides clues not just about the community's perception but how it sways the token's price movements.

Anticipating Market Shifts through Social Media Trends

Catching the Wave Early: Emerging trends on social platforms act as the canary in the cryptocurrency mine. A sudden spike in discussions around STEEM, whether due to an update, a new application, or a notable endorsement, can prelude significant market movements. By keeping a finger on the social pulse, investors can anticipate shifts, positioning themselves advantageously before these waves hit the broader market.

Social Media Trends

Definition: These are patterns of discussion or interaction observed on social media platforms, indicating a rising interest or popularity in a particular topic or product.

Real-Time Data Use: Monitoring tools like Google Trends or Social Mention can identify sudden increases in search queries or discussions about STEEM, signaling an emerging trend.

Example: A viral Reddit post discussing STEEM's potential for decentralized blogging could lead to increased discussions across platforms, indicating a positive trend.

Advantages: Early identification of trends allows investors to position themselves advantageously before these trends impact the broader market. It also enables the community and developers to align their efforts with what's capturing the public's interest.

Navigating Volatility with Informed Insights

Steering Through Stormy Seas: The cryptocurrency market is notorious for its volatility, where fortunes can shift in a heartbeat. In such an environment, sentiment analysis becomes a lighthouse, guiding investors through choppy waters. It allows investors to gauge the mood and make informed decisions, reducing the likelihood of knee-jerk reactions to market fluctuations. Recognizing when fear or euphoria is driving the market can help in timing entries and exits more effectively.

Gaining a Strategic Edge with Continuous Monitoring

Staying Ahead of the Curve: In the dynamic STEEM market, resting on one's laurels is not an option. Constant monitoring of trends and sentiment on social media furnishes traders with invaluable insights, offering a strategic advantage. It enables them to sense shifts in community engagement and sentiment, adjusting their strategies to capitalize on emerging opportunities or mitigate potential risks.

As we embark on this analytical journey, it's crucial to remember that sentiment analysis is but one piece of the puzzle. The STEEM market, with its rich ecosystem and community-driven initiatives, demands a multifaceted approach to truly grasp its potential and pitfalls. By integrating sentiment analysis with technical analysis, market trends, and fundamental understanding, investors and enthusiasts can navigate the STEEM waters with greater confidence and insight.

In conclusion, the realm of sentiment analysis opens up a world of possibilities for those keen to understand and anticipate the STEEM market's movements. It's an adventure that requires curiosity, adaptability, and a keen eye for the subtleties of human emotion and digital interaction. As we continue to explore this fascinating intersection of technology, finance, and social dynamics, the potential for innovation and investment in the STEEM ecosystem seems boundless. Let's stay connected, keep our fingers on the pulse of social media, and harness the collective wisdom of the community to thrive in the vibrant market of STEEM.

THAT'S IT .

That's all? "hell no.." i won't leave you all without technical analysis.

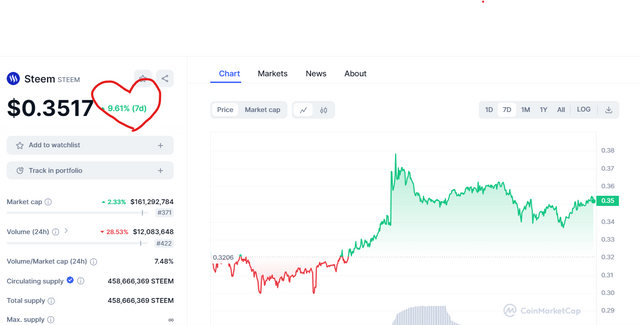

when i saw the STEEM coin charts it's all positive, In a single day, we observed a +2.21% uptick. This momentum doesn't stop there; over a week, it's up by +9.49%, and a month shows an impressive +37.16% increase. +82% in a year (almost a double returns and no bank will give this much returns in a year)

i do not send all photos it will be clumsy so, i am uploading sreenshot 7day view

And hey, if you're into the whole 'ranking' scene, STEEM's not just a random player. It's sitting pretty at rank 371 out of a whopping 9249 active cryptocurrencies. Not too shabby, right? It's like being in the cool crowd in a vast world of crypto, showing just how much of a punch STEEM packs in the grand scheme of things.

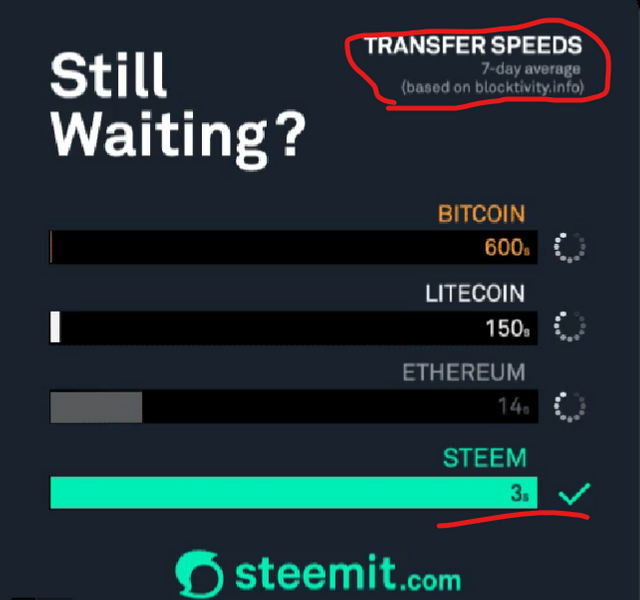

Steem outpaces the competition with a lightning-fast block time of just 3 seconds, leaving Bitcoin (600s), Litecoin (150s), and Ethereum (14s) in the digital dust. This speed is a game-changer for applications needing real-time interactions, making Steem a standout in the crypto race. It’s the speedy Gonzales of the blockchain world, making it perfect for social media and instant transactions.

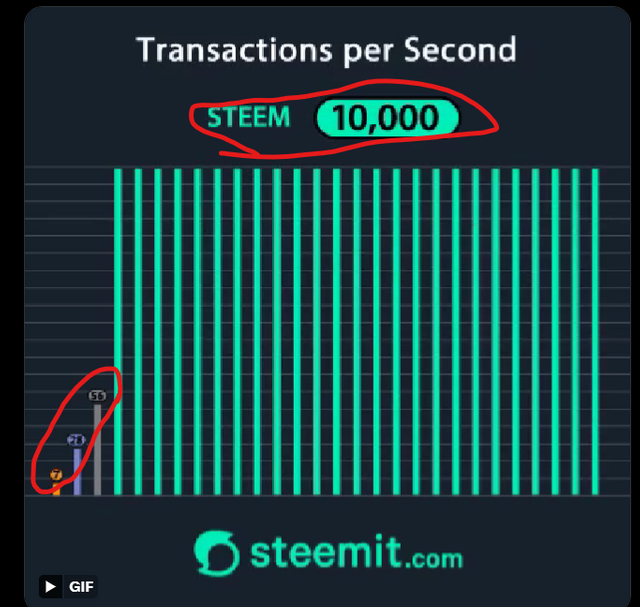

Steem blows the competition away with a staggering 10,000 transactions per second (TPS), leaving Bitcoin (7 TPS), Ethereum (28 TPS), and Litecoin (56 TPS) far behind. This impressive capacity ensures Steem's network remains nimble and efficient, ideal for its bustling social media ecosystem and beyond. It's not just fast; it's built for volume, too, showcasing why Steem is a frontrunner in blockchain scalability.

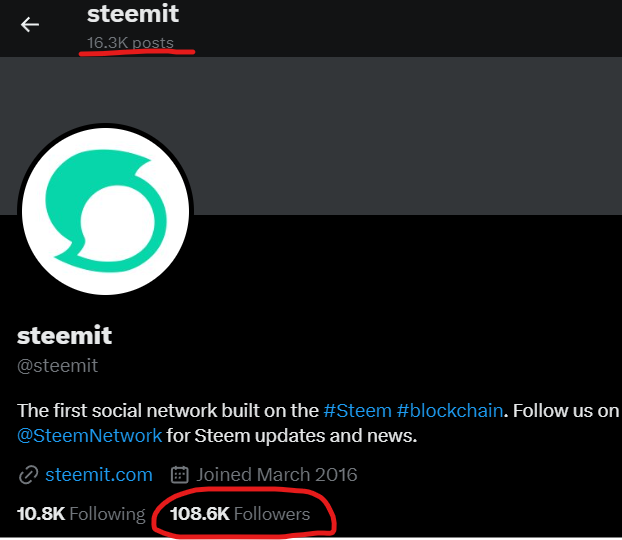

With 108.6K followers and a whopping 16.3K posts, Steemit's Twitter profile is a bustling hub of activity, showcasing its vibrant community engagement. This significant online presence hints at Steemit's potential to spark trends and create market buzz. With each update, Steemit demonstrates its capacity to rally its substantial follower base, hinting at the platform's latent power to influence and rejuvenate its market position through social media.

Analyzing the Numbers: A Technical Perspective

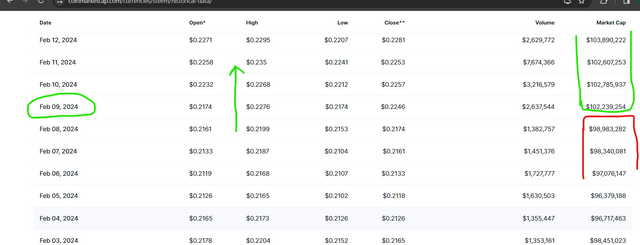

Steem's journey through 2024 has been marked by noteworthy milestones and figures. From the beginning of the year, it was clear that Steem was on an upward trajectory. A pivotal moment came on February 9, when it crossed the $100,000 market cap threshold, a clear indicator of growing investor confidence and market validation.

The price analysis reveals a steady upward trend, with the value increasing by 82% over the year and showing a bullish pattern in the last four weeks. Such momentum was underscored on March 20, 2024, when Steem recorded its highest volume of $18,031,978 over the past two months – a clear sign of vibrant trading activity and heightened interest among investors.

Why Steem Might Just Be Your Next Big Bet

Here’s the thing: Steem isn’t just another coin. It’s got some serious tech under the hood. Imagine a world where the stuff you post online could earn you real money, not just likes. That's what Steem is all about. It's fast, too – like, lightning-fast compared to Bitcoin and even Ethereum. We’re talking 3 seconds to get a transaction sorted. It's like choosing between a sports car and a horse cart for a race.

Now, let's talk growth. Steem has been showing off some serious moves, with its value climbing up by over 82% in a year. And there was this one day in February when it just decided to leap past the $100K market cap mark. Imagine jumping from the couch to the moon in your growth journey. That’s Steem for you.

Steem: A Quick Overview

Steem is revolutionizing the web with its blockchain platform, aiming to be the foundation for Smart Media Tokens (SMTs) and a hotspot for dApp development. It's unique for its "Proof of Brain" (PoB) consensus mechanism, which rewards users for creating and curating valuable content, aligning cryptocurrency incentives with human capital.

Key Advantages:

Zero transaction fees through a Resource Credits system.

Rapid block confirmations in just 3 seconds.

Enhanced security via time-delayed vesting of tokens.

Multiple user permissions for increased security.

Plans to introduce Smart Media Tokens.

Low barrier to entry, making it user-friendly.

A growing ecosystem of dApps already utilizing Steem.

Technical Brief:

Currency: STEEM, with SBD as its stable coin.

Consensus: Delegated Proof-of-Stake (DPOS).

Inflation: Starts at 10% annually, reducing to 1% over 20 years, driving the PoB mechanism.

Steem is the first blockchain which introduced the "Proof of Brain" social consensus algorithm for token allocation.

Proof of Brain Explanation:

PoB is Steem's innovative way to distribute tokens. Users earn rewards by posting quality content or by curating (voting on) the content of others, which ensures that valuable contributions are recognized and compensated. This model promotes engagement and quality content creation, leveraging the wisdom of the crowd to determine the distribution of rewards.

ALL POSTIVE ABOUT STEEM? no no...

Alright, Let's Chat About Steem's Silent Power

here's the thing,

last active posts about steem in facebook is 2020

last active posts about steem in reddit is 2020

last active post about steem in twitter officail account is 2020 december

You might think, "Well, that's it, Steem's had its day." But hold up, because here's where it gets interesting. Even with the social media silence, Steem's been doing its thing, quietly racking up an 82% profit over the year. It's like that quiet kid in class who ends up surprising everyone.

Now, let's daydream a bit. Imagine if Steem got back into the social media game, started buzzing with updates, engaging the community. The sky's the limit for where it could go with that kind of momentum.

Other social media blockchain impact on steemit

Oh, and here's a little nugget for you – if any of our blockchain social media buddies like Audius, Mirror, Minds, you name it, hit a home run, it's not just good news for them; it's a win for Steemit too. Why? 'Cause Steemit isn't just part of the squad; it's the OG, the trailblazer that paved the way for everyone else. So when one platform gets a boost, it shines a spotlight on the whole concept, including Steemit.

if anyone one of those raise, it will raise steemit too coz steemit is no1 introduced social media app through blockchain.

THAT'S IT from me, thanks for reading i may not give reply to every one because of lack of resource credits and i also take this moment to make a huge shoutout to the squad, @hamzayousafzai and @khursheedanwar. It's not just about diving deep into the crypto world alone; it's the peeps who ride with you, challenge you, and light that fire under you to dig deeper, learn more, and share it all. These two? Absolute legends in my book for pushing me to gather all this intel on Steem and sparking that challenger spirit in me. It's all about that community vibe, supporting each other, and growing together. Big love to my crypto comrades! 🚀💥

Disclaimer: This content is provided for educational purposes only. While it may also be useful for trading, it's crucial to conduct your own analysis before making any investment decisions.

Thank you,

@cryptomylife.

Greetings friend,

Combining sentiment analysis with technical indicators creates a more complete trading strategy. Let me borrow your words, it is like blending art and science. For example, if the STEEM price chart shows a potential bullish breakout and there's a surge of positive sentiment on social media, it's a stronger signal for traders to take action. When the price drops, sentiment plays a big role. If people are positive on social media, it's seen as a good time to buy, boosting the market and helping the coin recover faster. Understanding the sentiment on platforms like Twitter and Reddit gives us a real-time look into the community's mindset. Positive news and community interactions can uplift the token's value, while negative sentiment can lead to sell-offs. It's all about catching those emerging trends early on social platforms.

You've indeed provided an absolute knowledge on the topic at hand, all the best pal and good luck as you move on.

that's what i do

it's the actual definition of sentiment analysis

if sentiment analysis is not meant for profits then for what?

@cryptomylife what a thorough exploration of sentiment analysis in the STEEM market! Your insights into the power of social media sentiment combined with technical analysis are truly enlightening. I appreciate how you have presented the complexities of the cryptocurrency landscape in such an accessible way. Best of luck in the contest

yeah! Thank you so much.

Your comment is a lot to me.

@cryptomylife, your article is a wonderful presentation of the importance of social media sentiment analysis. Thanks for presenting your information and analysis continuum in a humble version!

Hey @danish578! 🌟 Your words are like a turbo-boost to my day! Thanks for the shoutout. Buckle up, we're in for a wild ride! 🚀💫 Let's keep the energy soaring! 🎉

Greetings friend,

Analyzing sentiment on social media helps us understand how people feel about STEEM. Positive sentiment attracts investors and can give us confidence in the project. By tracking sentiment trends, we can make better decisions about buying, selling, and holding STEEM. Social media platforms like Reddit and Twitter are great for analyzing trends and understanding consumer behavior in the STEEM market. It's a valuable tool for businesses and researchers. Good luck in the contest

i appreciate your COMMENT

thank you so much

Your thorough expedition of view evaluation in the STEEM market is praiseworthy. Incorporating belief evaluation with technological signs as well as social media sites fads provides investors important understandings for browsing market characteristics. Constant tracking encourages financiers to make educated choices in the middle of the cryptocurrency's volatility making certain a calculated side.

Than you