Crypto Academy Season 03 - Week 06 | Advanced Course - Trading Liquidity Levels The Right Way

Steemit Crypto Academy Season 03 is providing an excellent opportunity to new steemians who want to start their journey in Crypto world and advanced steemians who want to take their crypto journey to another level. If you are taking part for the first time in this season, you must check the previous weeks lectures to get some great knowledge.

This week I am going to share a very important trading strategy that will help you make decisions easier on crucial market levels. Trading Liquidity Levels the Right Way will make your trading more logical and remove the confusion you face on important market levels. I will explain different aspects of trading liquidity levels and students will be able to understand the following from this lecture;

- The Concept of Liquidity Levels

- What are Fakeouts and Why traders are trapped in Fakeouts

- How to Trade Liquidity Levels the Right Way

- Avoiding Fakeouts using Liquidity Levels trading strategy

- Examples of Liquidity Levels Trades on Crypto Assets

The concept of Liquidity Levels

In trading market, liquidity is referred to a level where significant trading activity happens in form of filling many orders. There are important levels where buyers or sellers have placed pending orders in hope that the market will reach those levels and their orders will be triggered. Similarly, there are important levels where traders have put their stop losses in case the market goes beyond those levels and they cut their losses. These levels are often referred to as Liquidity Levels because they provide the liquidity for the market to fill these orders.

I am showing you Bitcoin daily chart and marking a few of the important liquidity levels. One of the key things to know about an important liquidity level is to see a significant or quick reversal from a certain level often displayed by Pinbars or hammers candlestick patterns.

What are Fakeouts and Why traders are trapped in Fakeouts

Whenever price reaches some important liquidity level, there are chances that it will be manipulated by the Institutional money to take out the retail traders stop losses. Normally, retail trades placed their stop losses above or below these liquidity levels. So Big Financial Institutions will inject volume in the market and will make the price break those levels.

This will make retail traders think that price has broken that level and they will enter in the same direction price is moving. In reality, this price move is taking out the stop losses of retail traders, placed above or below these levels. After taking their required liquidity, the institutions will reverse the price movement by injecting volume in opposite direction. This will result in quick reversal of the price movement and the initial movement will be called Fakeout.

Most of the retail traders are now trapped in their orders that they placed by seeing the early fast move on the apparent break of those liquidity levels. They simply are just hoping the price will continue the movement again but that will not happen because Financial Institutions have made their money by moving the price and then bringing it back to the original level.

How to Trade Liquidity Levels the Right Way

Now, I will explain that how you can avoid getting trapped in these fakeouts and trade these liquidity levels the right way. Here you will need to have one more look at my previous two courses where I have explained trading the market structure break and trading the BRB setups.

The reason why I am saying it is because there will be 2 possibilities when the price reaches these liquidity levels. The price will reverse from these levels or it will break these levels to continue the move. I have explained both these strategies in my previous lectures.

1 - Market Structure Break (MSB) Strategy to Trade Reversal

2 - Break Retest Break (BRB) Strategy to Trade Continuation

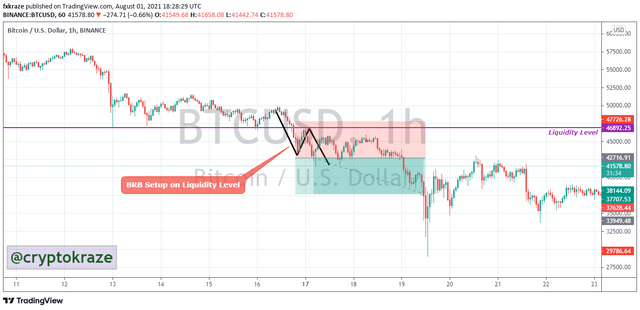

Now, the right way to trade these liquidity levels is to wait for the formation of a proper MSB setup to confirm the reversal. Then you should be taking trade according to the criteria of MSB strategy. In another scenario, you should wait for the formation of proper BRB setup and take continuation trade according to the criteria of BRB strategy.

You can mark the liquidity levels on higher time frames like daily or H4 charts and to confirm the setup you should move to lower time frame like 1 hour or 15 minutes. I am showing you the bitcoin chart with examples of MSB trade and BRB trade on liquidity levels.

Avoiding Fakeouts using Liquidity Levels trading strategy

If you just follow these 2 strategies (MSB and BRD) on these liquidity levels, it is very easy to avoid the fakeout because you will not enter into any trade on simple break. Instead, you will be waiting for Break Retest and Break setup and then enter in the market. Most of the time market will continue its trend when formed BRB setups.

If you see that price has given a fakeout then you should be ready to look for MSB setup to trade the reversal from that level. In this way, you can trade in both scenarios and will have clarity in mind about the trade you are taking. Trading the liquidity levels using MSB and BRB setups will make things easier for you and getting trapped in fakeouts will be a old memory.

Examples of Liquidity Levels Trades on Crypto Assets

I am sharing examples of the Liquidity levels trades on crypto assets for both scenarios i.e. reversal and continuation.

Final Words

Liquidity levels are the important areas in market where most of the traders gets their orders filled.

You can avoid getting trapped in the fakeouts created by Financial Institutions by trading these liquidity levels the right way.

You should be using MSB strategy criteria to spot a reversal from the liquidity levels and trade according to MSB strategy criteria.

You should be using BRB strategy criteria in case of clear break from the liquidity levels and trade according to BRB strategy criteria.

If you just follow these two strategies on the liquidity levels, your confusion about getting into the trades will be cleared and result in a massive improvement.

Homework Task

1 - What is your understanding of the Liquidity Level. Give Examples (Clear Charts Needed)

2 - Explain the reasons why traders got trapped in Fakeouts. Provide at least 2 charts showing clear fakeout.

3 - How you can trade the Liquidity Levels the right way? Write the trade criteria for Liquidity Levels Trading (Clear Charts Needed)

4 - Draw Liquidity levels trade setups on 4 Crypto Assets (Clear Charts Needed)

Rules

Your homework post should have at least 300 words. You can write more but I want you to be specific about your answers and do not write super lengthy paragraphs.

You must give more importance to make great and clear charts instead of making your task extra lengthy.

I want to see your clear understanding of the strategy and not a super lengthy essay.

You must post your homework post in SteemitCryptoAcademy Community.

Plagiarism of any kind will not be tolerated and result in severe actions against the offenders.

Create your own charts and use only copyright-free images/charts with proper reference if you have to use them.

You can submit your homework post by 07th August 23:59 UTC. Any post submitted after the deadline will not be entertained.

You must include #cryptokraze-s3week6 and #cryptoacademy among the first 5 tags.

Members who are doing power down will not be considered for evaluation and grading.

To be eligible for participating in Advanced Tasks, you must have 60 reputation and minimum 500 SP.

Discords : FxKraze#2451

@steemitblog

@steemcurator01

@steemcurator02

Thanks for the wonderful lecture professor @cryptokraze. Here is my homework.

Really, it's an important topic. The trader should not be trapped in fakeouts.

I'll submit the homework task. Thanks for this lecture.

Greetings Professor @cryptokraze. This is my Homework:

https://steemit.com/hive-108451/@oppongk/crypto-academy-season-03-week-06-homework-post-for-professor-cryptokraze-trading-liquidity-levels-the-right-way

Hi Professor,

The session was really amazing and I enjoyed completing the assignment. Here is my assignment please review

https://steemit.com/hive-108451/@amar15/assignment-crypto-academy-season-03-week-06-or-advanced-course-trading-liquidity-levels-the-right-way-cryptokraze

Hello professor here is my assignment link

https://steemit.com/hive-108451/@vhenom/crypto-academy-season-03-week-06-or-advanced-course-trading-liquidity-levels-the-right-way

Powerful content

Hi professor here is my assignment entry https://steemit.com/hive-108451/@mccoy02/crypto-academy-season-03-week-06-advanced-course-trading-liquidity-levels-the-right-way

Greetings Professor @cryptokraze thank you for teaching us every week, without a doubt every time you challenge us and demand us to give the best of us in each task. Below I attach my participation to the activity.

https://steemit.com/hive-108451/@madridbg/crypto-academy-season-03-week-06-or-advanced-course-negotiating-liquidity-levels-in-the-right-way

Sir i have 500 + Sp but i have delegated 50 to someone so am i eligible ?

yes you are eligible.

Sir your post is 6 days old but time is already over... Can i make it today ?

Hey professor @cryptokraze, in the previous lecture of MSB you told about the neckline that:

But in your chats it doesn't look like the case here of in MSB.

May you please help me with the positioning of a neckline with a screenshot of MSB strategy that you used in this homework task?

Thank you.

Marking of the neckline should be the last clear swing high. But you should see if we have got a good higher low before marking the neckline.

Thank you for replying 😂, but I got confused and unable to do your homework.

It's okay

Thank you.