Steemit Crypto Academy Contest / S22W3 [SUMMARY] : Dynamic Risk Management In Crypto Trading

Introduction

Dear Steemians,

Welcome to the third week of Season 22 of the Steemit Learning Challenge: “Dynamic Risk Management in Crypto Trading.” From December 30, 2024, to January 5, 2025, participants were invited to explore a foundational yet frequently underrated element of trading success: risk management. While many focus on profit-making strategies, minimizing losses and preserving capital are equally critical for sustainability especially in volatile markets like Steem/USDT.

This competition encouraged participants to analyze various risk management techniques, propose innovative practices, and illustrate how disciplined approaches can protect portfolios even under adverse market conditions. By sharing insights on tools such as volatility indicators and discussing real-life examples, entrants revealed strategies that help traders balance risk and reward with greater confidence.

In this report, we will highlight the essential aspects of this week’s theme, recognize exceptional contributions, and provide a snapshot of the overall quality of submissions.

Participation Statistics

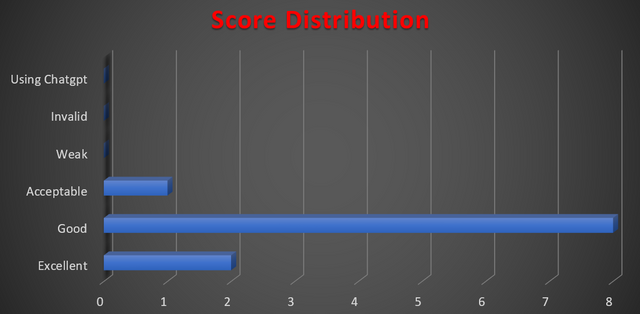

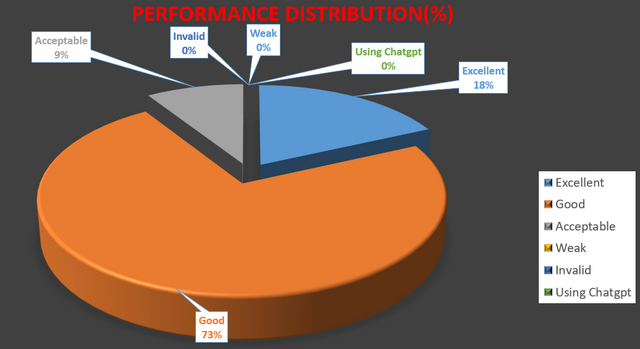

We are delighted to report that 11 valid entries were received for this competition, reflecting consistent engagement and a shared commitment to refining trading methodologies. Here is the breakdown:

| Total Entries | Valid | Excellent | Good | Acceptable | Invalid | Plagiarized |

|---|---|---|---|---|---|---|

| 11 | 11 | 2 | 8 | 1 | 0 | 0 |

- 2 entries earned an Excellent rating, demonstrating exceptional depth, clarity, and practical insights in applying risk management concepts to the STEEM/USDT market.

- 8 entries were rated Good, reflecting solid analysis, sound recommendations, and thorough explanations of risk management principles.

- 1 entry was rated Acceptable, meeting the contest’s basic requirements but leaving room for more detailed exploration and refinement.

- 0 entries were invalid or plagiarized, showcasing the community’s ongoing dedication to authentic, high-quality content.

Performance Evaluation

The overall standard of submissions was high, with participants effectively demonstrating how disciplined risk management can bolster long-term trading success. Key highlights included:

Position Sizing and Stop-Loss

- Authors emphasized placing stop-loss orders at strategic levels and adjusting position sizes according to personal risk tolerance, ensuring that a single adverse swing does not deplete the entire portfolio.

Risk-Reward Ratio Calculations

- Many used historical Steem/USDT data to show how calculating expected returns against potential losses (e.g., a 1:2 or 1:3 ratio) guides traders in selecting viable setups and filtering out high-risk trades.

Volatility Indicators

- Tools such as Bollinger Bands and ATR (Average True Range) were frequently cited to manage position sizes and refine stop-loss placements, especially in rapidly shifting market conditions.

Adaptable Strategies

- Several participants created flexible trading plans capable of navigating sharp price fluctuations and calmer phases. Strategies often adjusted leverage or tightened risk controls during volatile periods.

Real-Life Lessons

- Real or hypothetical scenarios highlighted the perils of poor risk management—sometimes featuring significant losses—and proposed practical steps (like daily review sessions and journaling) to prevent repeated mistakes.

Top 4 Winners

The following participants stood out with in-depth coverage, clarity, and innovative perspectives on risk management:

| Ranking | Username | Article | Score |

|---|---|---|---|

| 1 | @luxalok | Link | 9.4/10 |

| 2 | @mohammadfaisal | Link | 9.0/10 |

| 3 | @nafeela | Link | 8.9/10 |

| 4 | @steemdoctor1 | Link | 8.8/10 |

@luxalok earned the highest score this week, 9.4/10, for a detailed presentation that integrated advanced tools, real market data, and clear examples illustrating how to adapt risk management strategies in the face of market turbulence. @mohammadfaisal, @nafeela, and @steemdoctor1 also delivered outstanding work, reinforcing critical risk management principles and demonstrating how those practices could be effectively implemented for STEEM/USDT.

We encourage all participants to review these submissions to gain inspiration for further refining their own strategies.

Conclusion

This third week of Season 22 has underscored the indispensable role of risk management in creating and maintaining profitable trading strategies. In volatile markets, a well-structured risk framework can be the deciding factor between enduring success and catastrophic loss. The articles submitted this week have collectively offered valuable insights, underscoring that disciplined approaches and continuous learning are the keys to weathering market unpredictability.

Looking forward, we encourage participants to:

- Continue Evolving: Keep researching new risk management trends, tools, and techniques to stay ahead in rapidly changing market conditions.

- Refine Discipline: Implement routines such as regular trade reviews, journaling, and psychological check-ins to maintain consistent decision-making processes.

- Share Knowledge: Contribute to the community by discussing experiences, highlighting best practices, and offering constructive feedback to peers.

Congratulations to our top contributors and a big thank you to everyone who participated! Your dedication to understanding and applying risk management principles not only enriches the Steemit Crypto Academy community but also paves the way for more sustainable success in cryptocurrency trading.

Stay tuned for more challenges as we continue exploring advanced facets of crypto trading!

@luxalok, @mohammadfaisal, @nafeela, and @steemdoctor1 many many congratulation guys. It’s your hardwork that pays off. Keep doing your best like this. Congratulations once again dears.

Thank you dear for this warm congratulation.

Thank you brother!

Thankyou!

Thank you so much for selection and congrats to fellow winners as well 🎊

Дякую! ☀️