DEX, CEX, Popular Exchanges and Trading Cryptos- Steemit CryptoAcademy Season 4: Homework Post for TAsk 7

Hello there❗❗❗❗❗👋👋👋👋👋👋

It's a @cosai99 with the next homework post for Task 7 in Steemit CryptoAcademy Season 4, Introductory Course. In this task, we will talk about the technology that enables good cryptocurrency flow in the blockchain. We will talk about how users receive and send out assets to other users and some tools used. This will grant us a fair understanding of the dynamics of how the value of crypto is determined and what factors come into play. This lecture was facilitated by @imagen and reviewed by both @nane15 and @dilchamo.

Let's dive in🚓🌫

Overview of DEX, CEX, Popular Exchanges, and Crypto Trading💵📤💵📥🔐✔

From the economic view of money, money has to have the ability to circulate. This is termed the Flow of Money. This is only achieved when money is exchanged with goods and services, through purchases and sales. This allows people to accumulate money and gain some sort of wealth. If money doesn't circulate, it disrupts the concept of Demand and Supply and hence shifts from the equilibrium and this cannot be tolerated by any economic system as this will cause the entire system to collapse. Money must flow in and out of the system to satisfy the theory of Demand and Supply, as observed by economists as the social behavior of people. This places a value on money and is hence recognized by people as a fair token to trade with.

This same concept applies to cryptocurrency since crypto is a form of money. There must be a flow of crypto in the blockchain to determine the level of Demand and Supply of the crypto so the price can be dictated easily.

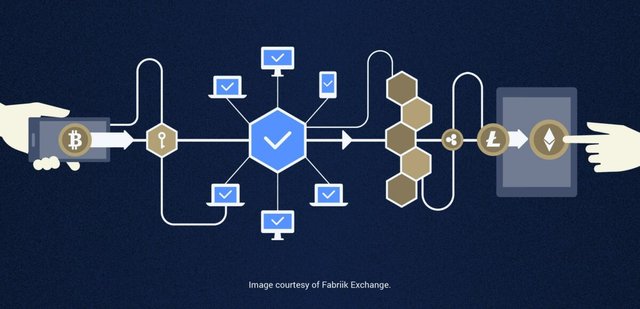

Just like the way we have banks to help with transactions to facilitate the flow of cash in the system, we have technologies called Exchanges to help with the flow of crypto in the blockchain network.

Image Source

Today, we will delve into the world of exchanges for a better understanding and learn how to fully utilize the tools available.

QUESTION 3

Explain in your own words what an Exchange is.

An exchange or,Cryptocurrency Exchange, is an online digital platform that facilitates the trading(sales and purchase) of cryptocurrencies between a buyer and a seller for other assets including other fiat and digital currencies. These platforms act as an intermediary between the buyer and seller and thus make money through commissions and transactions fees. The exchange can be viewed as that takes the bid-ask spreads as the commission fee or, as the matching interface, simply charging fees. The transaction is usually between two users(P2P) and is handled by these exchanges. The exchanges accept payments such as credit card payments, wired payments(conventional bank transactions with cash), and payments in the form of cryptocurrencies.

Simplification of Exchnages

The distinguishing feature of these exchanges is the ability to possess Cryptocurrency Wallets to keep crypto tokens, pretty much like bank accounts. The people responsible for managing these exchanges are known as Digital Currency Providers(DCP). They handle the maintenance of these exchanges and keep the tokens but do not administer tokens to any user.

Exchanges may be done over the internet by transacting with digital currencies and money electronically or * by "brick-and-mortar"( that is conventionally or physically) using a traditional payment method.

It must be noted that exchanges may have bank accounts all over the world and thus gave rise to bank payments options. This also allows users to withdraw money from their ATMs with ease anywhere in the world.

We mentioned Fiat currency but never explain so then what it is. So what is Fiat Currency?

Fiat currency is the currency that is issued by the government, that isn't backed by the value of any other commodity like gold or silver. Here, a decree by the government is what places value on the currency but not the material used to make the currency. In relation to crypto, it can be the physical cash value in Dollars or Euros Or Pounds that a crypto token has in equivalence. These can also be other tokens used to purchase another crypto.

We also mentioned the term bid-ask. Let me explain properly.

It should be noted Exchanges work with order books, an electronic journal that records orders placed by users.

The Bid is the purchase order made by users at a certain fixed price.

The Ask is the sales order placed by the users at a price they are willing to sell at.

Now, we should know that there are two types of exchanges namely, Centralized Exchanges(CEX) and Decentralized Exchanges(DEX)

Centralized Exchanges

These work like the traditional or conventional methods of transaction, like the banks. They normally hold total authority over the transactions carried out by users. Meaning the form the third party when transactions between 2 users are carried out.

Image Source

Here, users put their trust into these exchanges to monitor and handle all transactions and also keep their crypto safely.

Due to the fact that CEX has a whole range of crypto, it possesses a Fiat Wallet that can contain fiat funds for purchasing various crypto.

CEX is ideal for first-time users since it offers more options to new users and is user-friendly.

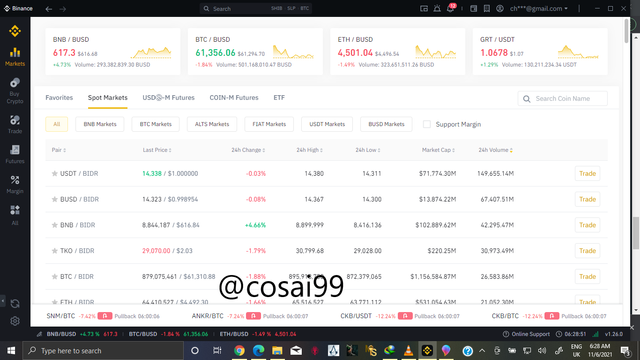

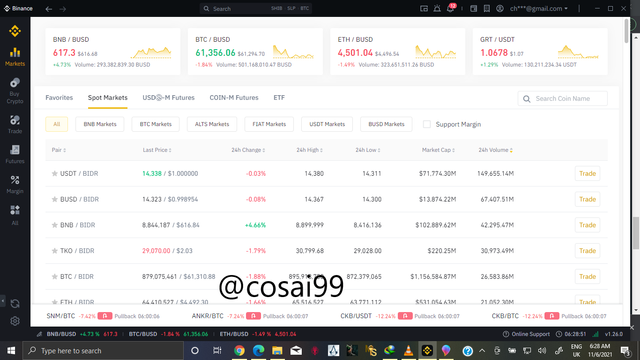

Examples of CEX include Poloniex, Bitfinex, Kraken, Bitstamp, Houbi Global, Binance,etc.

.png)

Typical example of the Interface of Binance

Feautres of a typical CEX.

In general, there are some key features in CEX that users can explore to their own advantage. Some of these include:

Market

The market option of the CEX displays the various prices of many many crypto that is available on the platform. Also, The latest price, the market cap, the volumes of the assets available and highest and lowest price in 24hrs are all displayed.

.png)

Here, users are at ease to trade any crypto they wish to buy with accurate information.

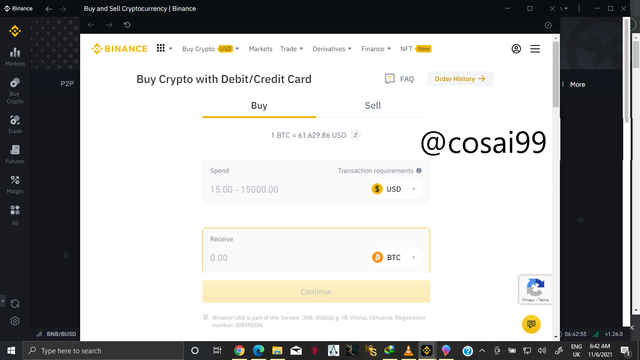

Buy Crypto

Some CEX may call it differently but they all work the same way. This is the section where users trade their crypto to cause the flow of crypto in the network. There are 2 options, P2P Trading and Express Trading, and Bank Payments.

- P2P Trading

Here, the transaction occurs between two people in close quarters. No one knows when the transaction takes place except for the 2 Users and the DCP in charge of managing the CEX. Here, you either accept bids or asks in the order section.

.png)

Buy crypto Section in P2P

.png)

Sell crypto Section in P2P

- Express Trading

Here, you can place ask and bid orders for people to come and trade with you. Pretty much like an auction.

.png)

Ask Window

.png)

Bid Window

- Credit/Debit Card Pay Option

This allows you to pay with your credit card or make bank payment with fiat currency to purchase crypto

.png)

Trade Option

Here, you can place an order in the market to trade with your crypto from your spot wallet to gain other Crypto, Say BTC for STEEM. You can also see the fluctuations in price of the various cryptocurrencies in the market in a form of a graph.

.png)

- Future and Margin Leverage Trading Options

Margin trading is a kind of leverage trading which allows user to trade via borrowing funds and to ain profits by an interest rate. This means that users place orders on the spot order market to gain funds to use and in return gain interest on the borrowed funds after calculation of interest accumulation on the next hour and pay back the borrowed funds at a specific time. To control risks, users can either choose the Cross Margin mode, where users can distribute the excess margin gains(your interest) into margin wallets to satisfy the margin requirements set, Or Isolated Margin mode, to put into separate orders to account for any excess that may occur.

Future trading is a kind of leverage trading that users allocate crypto into their futures wallet and predict the market fluctuations for a set period of time. Here, their crypto is used as collateral and used as a basis to maximize their capitals(crypto) invested in the future trading. Here, users can choose to predit either Long run or Short run.

.png)

Margin And Future Trading

In Binance you can get that option in there together with their market charts.

.png)

Future Trading in Binance

.png)

Margin Trading in Binance

Decentralized Exchanges(DEX)

These type of exchanges do not centralize transaction authority in one person but then all the users sign their own transaction. Here, the exchange serves as platform just to facilitate trading between two people and also match trading pairs. It creates the atmosphere for users to find prospective buyers on the blockchain with little difficulty without completely giving out a lot of information.

This type of exchange is good for people who are already well-versed in trading with crypto.

Examples include Justswap, Uniswap, Sushiswap, Sunswap, Tokenlon, etc.

These come as a form of dApps in the blockchain.

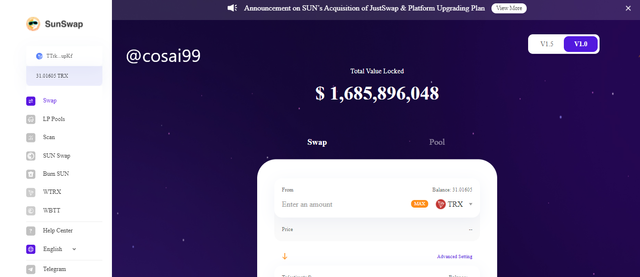

.png)

Sunwap, A type of DEX in a form of dApp in TronLink Wallet

Differences between a Wallet and an Exchange.

| Wallet | Exchange |

|---|---|

| Wallet is part of the exchange where funds or crypto are stored till there are used in a transaction. It works just like an ordinary wallet which can safeguard the tokens obtained in a safe and secure place in the exchange. | Exchange is the online platform which enables users to send and receive crypto via orders placed in a bid-ask mechanism. This allows users to also trade to obtain other crypto with fiat currency. |

| A wallet allows you full control over your control over your private keys as you are able to sign transactions that you initiate. | An exchange may not allow access to your private keys, as seen in CEX. The access might only be granted to a central body after you have entrusted the security and safeguarding of your private keys for transactions to be initiated and completed. |

| Crypto wallets do not offer services like selling, buying and trading but only just to store crypto. | Crypto Exchanges do offer services like selling and buying(P2P and Express trading options) and also trading options like Margin and Future leverage trading. |

| A wallet is unable to aid you to convert your fiat currency into other crypto. | An Exchange is capable of providing you with options of converting crypto from your fiat currency. |

| A wallet does not provide an atmosphere to match buyer and sellers of crypto when such is needed. Due to this, wallets do not offer any significant contribution to the flow of crypto in the blockchain network. | An exchange is capable of being a platform to match and find buyers and sellers of crypto. This generates a flow of crypto in the network and hence placing a value on the crypto as it follows the demand and supply of crypto. |

Mention the advantages and disadvantages of DEX and CEX.

| Advantages of CEX | Disadvantages of CEX |

|---|---|

| CEX has a user friendly interface. This allows users who are new to the blockchain to freely initiate transactions without so much worry since the transactions are signed by the DCP maintaining the CEX that you use to initiate the transaction. Features of the CEX are very easy to use compared to DEX and hence may offer guidance to users during the first time of usage. | The CEX has a Know-Your-Customer (KYC) policy which allows you to know all the details of the buyer and seller and hence all information regarding the users including the name, country, card details, .etc. These may be confidential to users and can easily be used o access the wallet of users. |

| CEX has a high trading volume compared to DEX. This is because of the fact that in CEX it has a lot of other crypto aside the native tokens possessed by users. Also, this is due to how user friendly the platform is like so people are much more drawn to use CEX. Hence, this allows users to trade with other crypto aside the native token and hence increase the supply of many crypto at once. | CEX does not grant total access or authority to users over the private keys. Here, the CEX will request users to entrust the exchange with the private keys for them to handle and control the transactions. So users do not have full authority of the transaction once initiated. |

| CEX has a high level of liquidity. This is due to the fact that you can possess several crypto assets in your CEX wallet and can convert them into fiat currency like USD or Pound. The ability to convert crypto into fiat currency that can be spent is termed Liquidity. SInce this is the case, users can liquify a lot of crypto at once since they possess a lot at a time. | There is a high risk of losing tokens as it is prone to hacking. If someone uses information stored on the exchange to hack your wallet there is a chance that they can even change your private keys and prevent you from initiating transactions, They may also change your passwords to log into your account. Hence, if you lose your keys, you lose your tokens. |

| The trading time in CEX is relatively faster. This is because the algorithms used in CEX can process thousands of transactions per second in real-time. | Since there is a central body supervising trades, there is a low resistance against censorship. So, third parties can interfere with transaction processes at any time. |

| Most CEX are connected to bank accounts. This enables users to freely make transactions into their exchanges without freely breaking any set rule or regulations set by the bank. This also in turn allows floe of fiat currency in the system also in result enhancing the flow of crypto. | In CEX, there's increased potential of manipulation. Since there is a third party, the order book can be manipulated by cutting transactions andcreating fake volumes to entice people to trade with the exchange. Even the price of tokens may be manipulated. |

| Due to the fact that there is an open display of information, there is a level f transparency and hence users can know who they are entering into a transaction with. | There is an increased potential for downtimes. If thee are technical issues with the exchange, it will be promptly shut down and users may not be able to trade for some time. |

| Advantages of DEX | Disadvatanges of DEX |

|---|---|

| DEX offer a higher level of anymonity and privacy in contrast to CEX. They do not expose the identities of users during a transaction so users' information are safeguarded. Other than the username, password and crypto wallet, users are not required to reveal anything to otherside parties. | DEX has a lower trading volume as it only accommodates the native token of the blockchain network. It does not even use fiat currency. |

| Due to the high level of privacy, there is a high level of security in the exchange. Also, hackers have little to use to hack into your account and steal your tokens. | There is low liquidity in DEx. This is because of the absence of fiat currency and alternate crypto aside the native token of the blockchain. This restricts convertibility of tokens and limits users to the transaction of native tokens. |

| DEX has a high resistance to censorship. This is due to the fact that the authority over transactions is broken down and granted to users rather than a central body. Hence, there's very little interference when transactions are initiated. | Time to execute transactions is relatively slower because of the achieving of consensus in the blockchain and confirming deposits on the blockchain. This often causes congestion of transaction orders and hence delays the execution of orders. |

| Due to the absence of a cenrtralized orderbook there is a lesser potential for manipulation. Hence, all information regarding prices of tokens, market volumes and so on are of high accuracy and can be trusted. | DEX face a problem called Scalability Trilemma. This is when the decentralized is incapable of maintaining decentralization, scalability and security without compromising any one of them. Hence, without engaging in on-chain and off-chain trade, this problem will persist and go against the ideals of creation of DEX, unlike CEX which accommodate the 2 types of trading. |

| In DEX, there is lack of monopolistic environment. This is due to the absence of a central body governing the transaction process and hence no one can dictate how transactions should occur. Here, simply, everyone is their own boss. | There is lack of support in DEX. This is because the system is generally crafted to fit the criteria of well experienced users and hence may not see the use of supporting users in the blockchain. If any problem is faced by the user, it is the responsibility of the user to diagnose and rectify the problem. So, this is unsuitable for new users. |

Have you used an Exchange before? tell us about your experience.

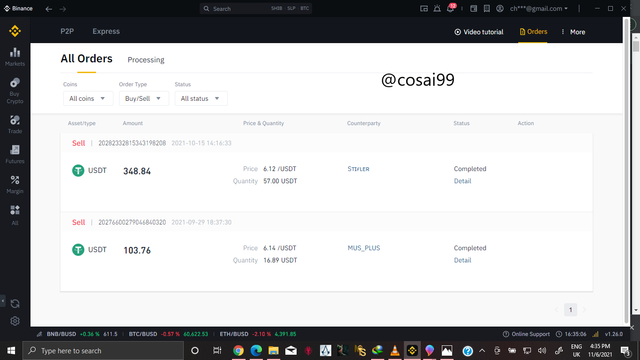

Yes I have used an exchange and infact still using it, more specifically Binance, a CEX. As stipulated, it was very easy to use and took less time to get used to, It was convenient for me as getting ready buyers and sellers was quick as transactions were completed within 15 minutes. Below are the orders I have completed

.png)

To be honest, I have had an amazing experience exploring Binance.

Conclusion

So today we have really explore exchange systems and how trading crypto occurs. Also, we have taken a look at the pros and cons of each system and extensively explained them. To conclude, We have explored DEX and CEX and now I hope we have an idea of how to explore the tools available on each.

Thank you for your time @imagen , @nane15 , @dilchamo

Please do not use the #club5050 tag unless you have made power-ups in the last month that are equal or greater than any amount you have cashed out.

Sorry for using it and thank you for the word of caution