Introduction to the Principles of Crypto Analysis - Crypto Academy S4W7 - Homework Post for @imagen

1.) What are the differences between Fundamental Analysis and Technical Analysis? Which is most commonly used?

When trading and analysing price action a lot of traders set their base on one of them,either the fundamental analysis or the technical analysis, but there are advantages and disadisadvantagesusing them.

Fundamental Analysis

Fundamental analysis looks at the economic factors known as fundamental whereby fundamental traders study the economic events, news flow, and company-specific to establish a cause and relation between market movements and economic development. In the crypto world, a special method is used to check the current value of the crypto asset by looking for special factors that make up the crypto, these factors can be inside or outside the project ecosystem. Fundamental analysis is used in the crypto world to check if an asset is has been reduced in its value or increased and also check the liquidity of the asset, even the distribution of the asset, all this information is really needed before a fundamental trader can make any trade.

The analysis that is being done by a fundamental trader is usually to check for the difference between the value of the asset before and now, if he finds out that the asset is being undervalued, he will do further analysis to check if the asset has the potential of increasing in its value, if yes, he will purchase the asset in view that the value will increase. In doing so, they consider some very important factor which includes chain analysis, financial metric and project analysis.

In project analysis, they ask some questions like what is the aim of the asset/project? who is the developer of the project? how reliable the asset is ? what is the future of the project? who are competitors of the project? while for the financial metric such questions like these are being asked: what is the liquidity of the asset? What is the market capitalization of the asset? What is the maximum supply? and many other questions. And lastly, the on-chain analysis asks some of the following questions. What is the number of Hash done so far with the asset? the total number of transactions done with the assets? The staking volume ? and so many more.

Technical Analysis

Technical analysis looks at the past price movement of a commodity ,index, currency or cryptocurrency, and uses that data to predict future price movement in that security which basically means technical traders prefer to study charts to evaluate price trends and patterns to help establish profit opportunities in the future. They believe that all the information that they need from the security can be found in its chart and believe that there is no reason to analyse company fundamentals for example, because they are already accounted for in the stock's current price. Now technical traders are not concerned about why something is moving because they believe that the trend and patterns on the are their signals

Technical Charting and analysis assumes that price movement is not random and that technology can be used to establish the underlying currents behind the price action which can then be used for determining entry or exit points. Because of this, support and resistance levels are two key elements of all technical analysis while indicators and oscillators such as moving averages, Bollinger bands, or the relative strength index are some common tools in a technical trader toolbox. The structure of the market and cycle is very important for the technical trader. Traders can not do without the chart pattern and there are various types of the chart pattern, as a competent technical trader, you need a very wide knowledge about patterns, candlestick patterns, support and resistance, trendline and so many more.

2.) Choose one of the following crypto assets and perform a Fundamental Analysis indicating the objective of the Project, Financial Metrics, and On-Chain Metrics.

• Cardano (ADA)

• Solana (SOL)

• Terra (MOON)

• Chiliz (CHZ)

• Polkadot (DOT)

I will be choosing the almighty Polkadots

Launched in 2016, Polkadot is the brainchild od=f Gavin Wood, an Ethereum Co-founder and creator of Solidity, the programming language used by ethereum. Polkadot is now run by Web3 Foundation and developed by Parity Technologies, both of which Gavin is a Co-founder. This is how the Polkadot works, the current blockchain landscape is at best fragmented, with multiple, independent blockchains all operating in isolation, As yet, there is no efficient way for these separate chains to operate and communicate with each other to share data, transaction or exchange value. Polkadot is working to correct this by providing for the first time- cross-chain interoperability. Polkadot will allow any blockchain: private and public, permissioned and permissionless as well as oracles and centralized apps to talk to each other and be connected in a trustless way under a single decentralized polka dot umbrella.

Project Analysis:

Polkadots has a sole objective which is to provide connections between several blockchains, which includes all the forms of transactions. This its objectives will bring all the blockchains together and give them a very good platform for any blockchain. With Polkadot, the blockchains can communicate effectively. The main rivalry of the Polkadot project is the Ethereum blockchain due to its speed, scalable and interoperability the project has. Polkadot scalability ability can be compared to that of the Solana and its ability to allow most blockchains to interact makes it outstanding.

DOT is the native coin of the Polkadot Project and DOT is used widely.

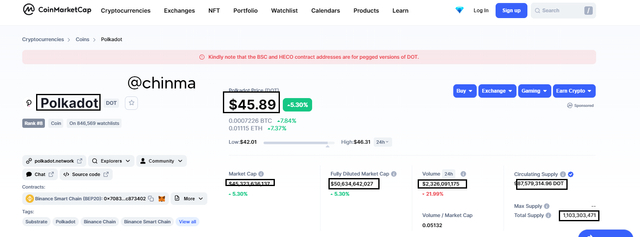

Financial Metrics

The price of Polkadot = $45.89

Position =#8

Market capitalization= $45,147,921,835

Volume = $2,330,223,373

Circulating Supply= 987,579,314.96 DOT

Total supply = 1,103,303,471

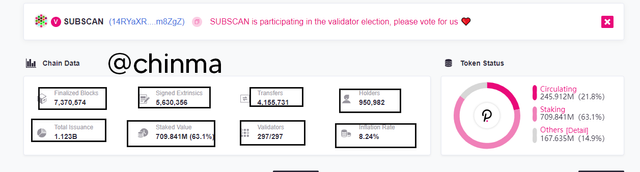

On-chain Metric

From the chart above we can see the following

Finalized Blocks = 7,370,596

SIgned Extinsics = 5,630,386

Transfers = 4,155,731

Holders = 950,982

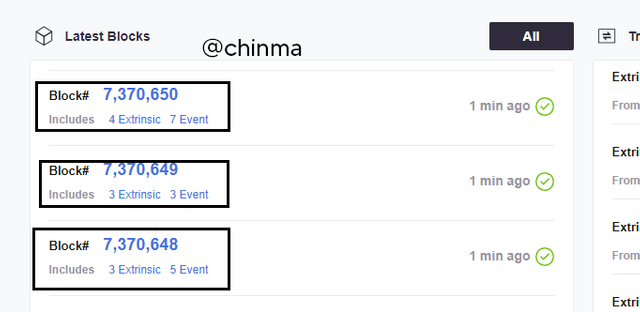

And also we can see that the total number of blocks at the time I took this screenshot was 7,370,650

From the chart above you can also see the detail of the last hash and even its parent hash.

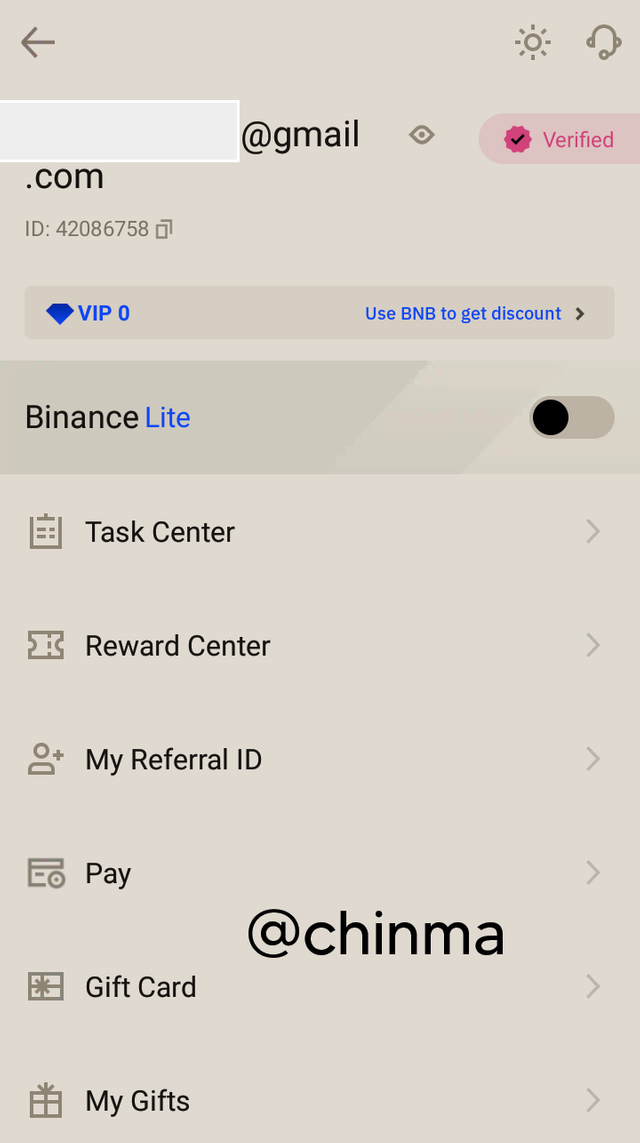

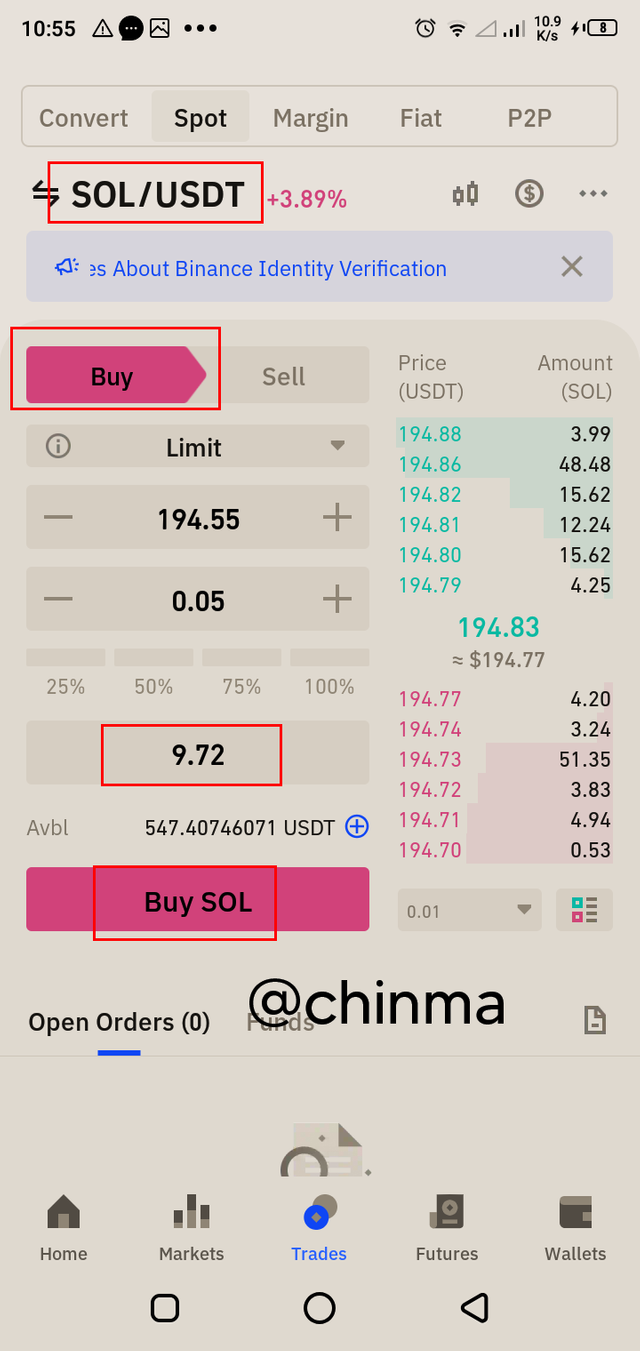

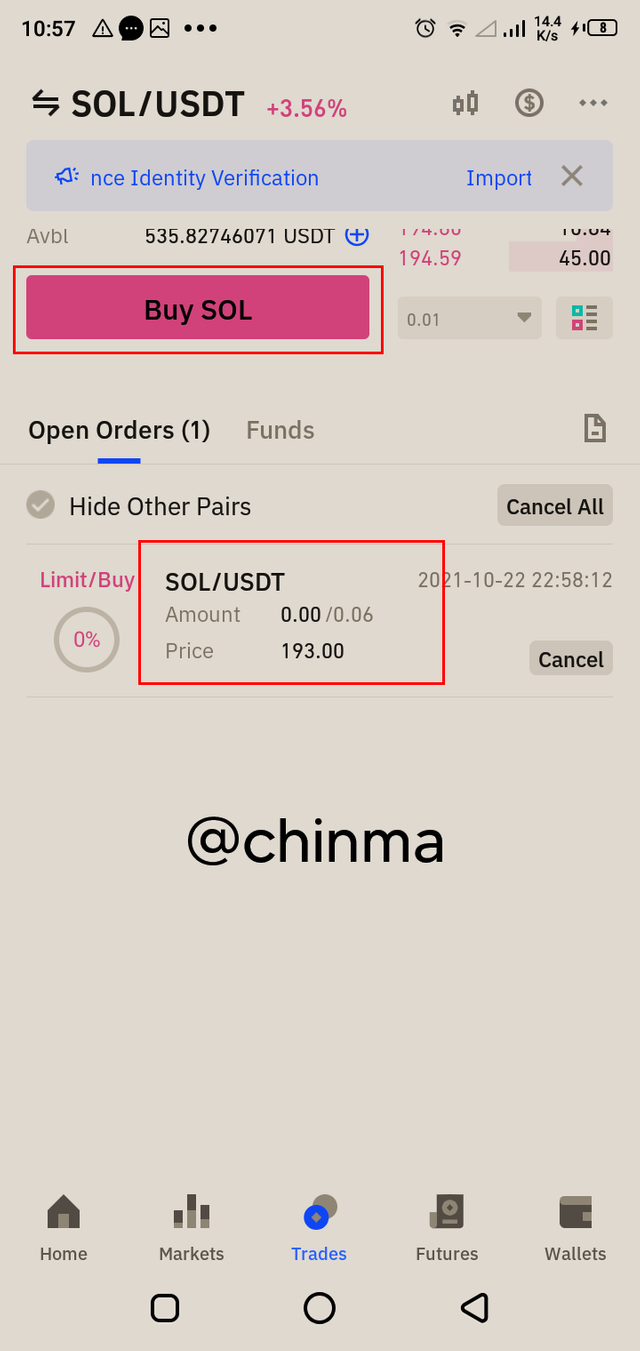

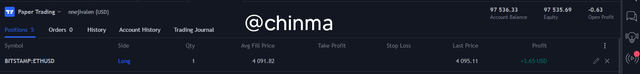

3.) Make a purchase from your verified account of at least 10 USD of the currency selected in the previous point. Describe the process. (Show Screenshots).

4.) Apply Fibonacci retracements to the previously selected asset with a 4-hour time frame on the platform of your choice. Observe the evolution of the price at 24 and 48 hours, did it go up or down in value? Look to identify resistance and support levels. (Show Screenshots at 0, 24, and 48 hours of purchase where the date and time are observed).

I observed that the liquidity of this coin is very low, due to it, the movement was really slow. Though I saw a major resistance, so I expected the market to reverse

At 24 hours it was still going up

but at this point it started to reverse

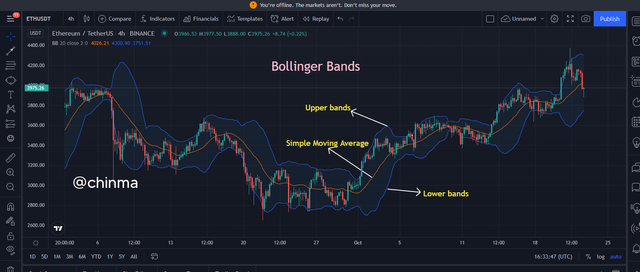

5.) What are Bollinger Bands? How do they apply to Crypto Technical Analysis? With which other tool or indicator do you combine Bollinger Bands to analyze a Crypto? Justify your answer.

Bollinger bands are a well-known technical indicator, which was developed by John Bollinger. It is used to determine the channel, trend of a market and it also measures the oversold and overbought region of the asset. It consists of 3 lines, the line in the middle is the simple moving average while the other 2 lines guarding the moving average are called the upper bands and the lower bands. It uses period and standard deviation to calculate the bands. The default settings are 2 and 20 standard deviations.it can be changed depending on the user’s choice.

From the chart we can see the Bollinger bands and every part of it showing it in detail.from the band you will notice that it is not uniform. The non-uniformity nature of the bands is due to the market volatility. Areas, where the bands become wider, indicate high volatility, and areas, where the bands are tighter, indicate low volatility in the market.

If the price crosses the middle bands upwards, it is an indication for a buy order while if the price crosses the middle bands downwards, it is an indication for a sell order. It can serve as a trend indicator.

the result is below

Both of the ways are good but it is depending the person using it. Master one and be good with it, you will be profitable.You should learn how to use the right tools in both of them, be it in fundamental analysis or in technical analysis.

Cc: @imagen

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.