Crypto Academy Week 10 - Homework Post for [Professor @fendit] Homework post by @chinella

MAKE YOUR CRYPTOCURRENCIES WORK FOR YOU

By Prof @fendit

"Guidelines:

1.Introduction to risk aversion

2.What is my risk aversion, which products do I find most appealing, and why?

3.Fixed and Flexible savings, high-risk products, and launch pools.

4.A simple detail on setting my investment portfolio using Binance."

I will love to use this opportunity to thank our amiable prof @ fendit for this masterpiece on Making your cryptocurrencies work for you.

1. Introduction

Risk is described in financial terms as the chance that an outcome of investments will defer.

Risk consists of the possibility of losing some or all of the initial sum invested.

Aversion to Risk:

Everyone is exposed to threats every passing day – whether you are walking, driving, investing, etc. What differentiates us is our personality.

An investor's personality, lifestyle, age are some of the factors that greatly influence their aversion to risk.

These factors can be grouped into three main categories of investors’ aversion to risk.

The conservative tolerance to risk, the moderate tolerance to risk, and the Aggressive tolerance to risk.

The conservative tolerance to risk type of investors is willing to tolerate very low volatility. They feel very comfortable going for what the outcome is guaranteed.

The second category of investors falls under the moderate tolerance to risk. They do accept a higher amount of risk and volatility in their investment.

The third group of investors is the ones that accept the highest volatility of all. They set a very high return on investment.

2. What is my risk aversion, which of the products do I find most appealing, and why?

Going through all the types of investors' aversion to risk, I fall under the conservative tolerance to risk investors. I find the conservatives’ appealing with reasons being

1.I don’t have the heart to withstand unpleasant outcomes in my investment. Though life itself is risky, at least it’s a measurable risk. It's far better to take a baby step, than gradually into adult steps when you are a newbie. As a newbie in the cryptocurrency space, I would prefer to have a bite of what I can swallow.

2.What's important in investment is that you get a return on investment that is higher than your capital. It does not matter the rate of growth, what matters is that I am having profits and that’s the school of thought of the conservatives. The Japanese call it “kaizen”. Constant and never-ending improvement. Accumulation of wealth is a gradual process. Tiny drops of water make an ocean. I don’t mind how long it takes to full my portfolio but all I care about is constant gradual growth and steady gradual profits.

3. Explain in your own words, fixed and flexible savings, high-risk products, and launch pools.

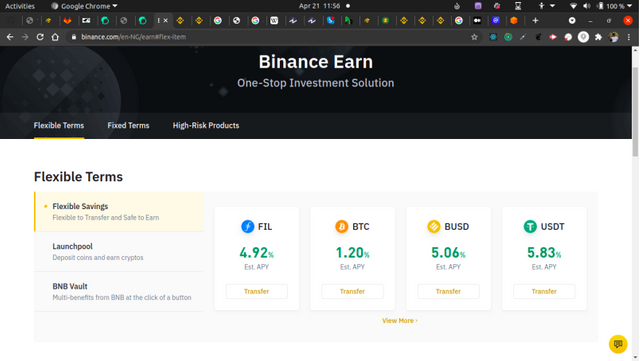

The motive of all investors is to be profitable. Binance Earn is a platform offered by Binance to investors to save and profit from their investments. Here I will be discussing the micro-services of Binance Earn.

We have three sub-groups in the Binance Earn One-stop Investment solution.

1.Flexible

2.fixed and

3.High-risk products

Under the flexible terms, we have the flexible savings, launch pool, and BNB vault.

I will be explaining in detail what flexible savings and launch pools are.

1.Flexible savings:

Binance flexible saving is like normal personal savings accounts we have in our various commercial banks.

A personal savings account is where we stake our money. The money deposited in the savings account can be withdrawn anytime by the investor. The profit margin of flexible savings is small and is based on current market conditions. The interest calculation rule is calculated and distributed daily based on the available flexible savings asset invested.

In a flexible savings timeline, the subscriptions are closed during 23:50 – 00:10 (UTC) daily. The interests are calculated the next day after the day of the subscription.

1.Launch pool.

Launch pool can be likened to cryptocurrencies farm. A crypto farm is simply a place to grow or earn new tokens for free.

The token invested in the launch pool is used to provide liquidity to a new token being worked on.

New tokens are earned over a mining cycle of 30 days.

Fixed terms

Under the fixed terms, we have

1.Fixed savings

2.Staking

3.Activities

4.ETH 2.0 Staking

Fixed savings

Just like our traditional bank accounts have fixed deposit account so is Binance fixed savings.

The binance fixed savings platform offers investors, especially the moderate tolerance to risk types.

The money invested is locked for a specific period of days. The return on investment is higher than the flexible savings type. Within the stipulated period, the assets invested can’t be withdrawn. Duration of investment spans across four categories, which are 7,14,30, and 90 days respectively.

High-Risk Products

This option is for the Aggressive to risk personalities. Under the high-risk products, we have the Defi, Dual staking, and Liquid swap.

Defi-staking:

Defi, which is Decentralized finance.

It has greatly increased the wealth creation of millions of investors worldwide. Before investing your crypto assets into this technology, one ought to understand the concepts behind it. Four factors are governing the Decentralized finance staking rewards.

These are:

1.Duration of stake

2.Assets staked by the user

3.The inflation rate and the

4.Network issuance rate.

Dual Investment:

The Binance Dual investment platform allows the investor to invest with particular crypto assets and earns profit on two assets.

These simple steps illustrate how it works

If you invest in BTC and the cost of your holdings increases so that your income exceeds the savings rate, you get better returns in USDT equivalent to your expectations plus the interest in USDT also. But if the reverses occur, you only get the money invested in BTC and the interest in BTC.

Let’s see how this works practically.

Mr. Ayomide invests 1 BTC at $56,000 in Dual Investment at an interest rate of 6% after 30 days.

The strike price is set to $60,000.

After the end of 30 days, one of two things will happen.

If BTC increases in value above $60,000, M.Ayomide will be paid the paid USDT60,000 plus an interest worth of USDT 360.

Calculation is 6% of 60,000 = 360.

Mr. Ayomide’s will be rewarded with USDT60360

if the value of BTC is below $60,000. He receives his 1 BTC and 6% interest.

6% = 0.06

Mr Ayomide will be given 1 + 0.06 = 1.06 BTC

Liquid swap

The liquid pool is a high-risk type of investment. It is composed of various liquidity pools and each liquidity pool contains two digital tokens or fiat assets.

The liquid swap has two types, the stable and the innovative investment.

The stable type is developed with a hybrid constant function (automatic market-making)system model to realize the transaction and pricing between two stable tokens and provide a low slippage trading.

The innovative investment is developed with a constant mean value (automatic market-making) system model to achieve transaction and pricing for two digital tokens or fiats.

4. Show and give details on how to set the investment you chase in Binance.

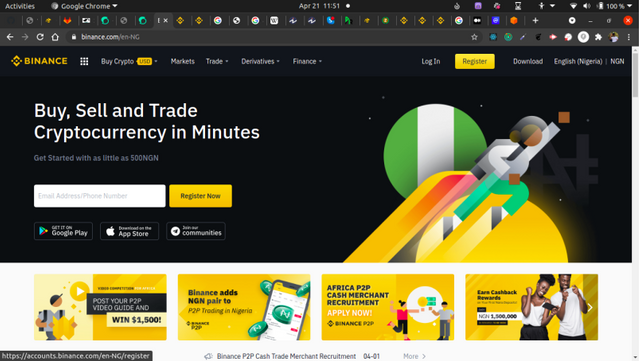

1.Log on to binance.com

2.If you have an account with Binance, you can go to step (7).

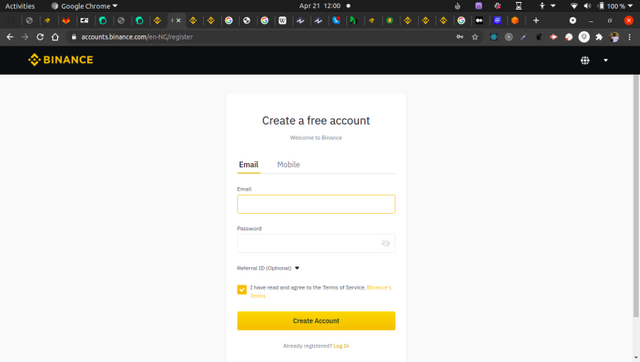

3.Click on the register button

4.You can create an account using your email or mobile.

5.Fill in your credentials and click on the create account button.

6.You will have to verify your account. Congrats.

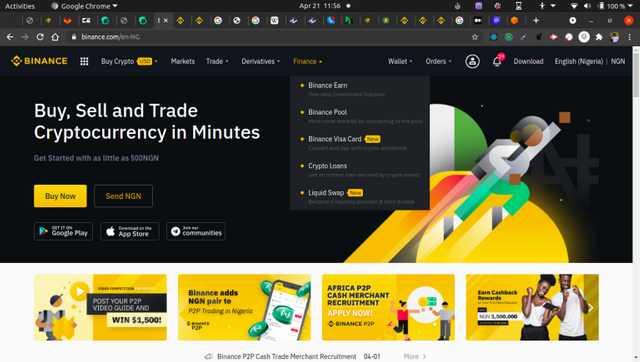

7.Click on finance, select Binance Earn in the drop-down box.

8.Click on flexible terms

9.Click on Flexible savings

10.select your preferred deposit/savings coin.

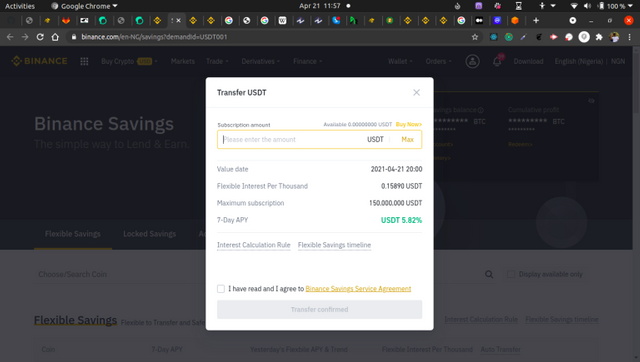

11.Click on transfer

12.Enter the amount of coin you want to deposited click on the I have read and I agree to Binance service.

13.Click on transfer confirmed.

I'm somehow disappointed by this. I was really enoying your post so far, till I found out that you were copypasting things from different websites.

https://www.binance.com/en-AU/support/faq/85d614205d334128b76c0275aba61ea6

And same happened with other parts of the post as well... I'm disappointed.

Good day Professor @fendit, I am deeply sorry for disappointing you, the definitions were really difficult for me to understand, so I thought explaining it as the original author would be best since I checked it through the plagiarism detector and it was still good to go.

I am still very sorry about this, It wont repeat itself again.

Thanks for correcting me.

It's always better to ask or give it some time for you to understand rather than copying someone else's work.

I know this is hard if you're not into investments, but we're all here to learn! Aside from the copied things, you had done a nice job, so please take this into account for next time! :)