Yield Farming - Yearn Finance - Crypto Academy S5W3 - Homework Post for @imagen

Greetings Everyone,

Professor @imagen introduces us to Yield Farming and particularly the possibilities that Yearn Finance presents to yield farmers. I am glad to partake in the homework task and hope your enjoy reading my submission

Describe the differences between Staking and Yield Farming.

Staking

Staking is a concept adopted on blockchain networks that utilize the Proof of Stake(PoS) consensus mechanism to generate new blocks. PoS comes as a better alternative to the Proof of Work(PoW) consensus mechanism which offers less energy consumption and adequate transaction throughput.

The Pos mechanism requires users to vouch for the network by locking up their funds as collateral to secure the network in the process called Staking. Staking equals investing in a particular platform. Users who stake a high amount of the coin have the chance to become validators of the network and earn passive incomes.

For example, in the lecture presented by @wahyunahrul on the Audius platform, to become a node operator that acts as validators, one has to stake a minimum of 200,000 $AUDIO as collateral. This way, any mismanagement by node operators is settled with their collateral. No one would want that so operators ensure high security and value on their investment

Yield Farming

Yield farming involves depositing funds into liquidity pools to earn profits based on calculated annual percentage yield(APY). Yield farmers provide funds in the form of lending to Defi platforms.

Users benefit a percentage of the interest paid by borrowers of such funds in a liquidity pool. Much has already been said on the subject by the professor.

Difference Between Staking and Yield Farming

| Technology | Staking runs the Proof of Stake consensus mechanism on blockchain networks | Yield farming runs on automated market maker(AMM) protocol which powers autonomy on decentralized exchanges |

| Security | Users get to be validators of the network and directly responsible for its security. Security is tight since users risk losing their funds for any mishaps | Users entrust their security to the system and its protocols. Error in the coding or collapse of the platform can lead to loss of funds. |

| Time | Users receive timeframes within which funds are inaccessible until the time elapsed. Reclaiming of funds can take a while too. | Users can withdraw their funds anytime they want |

| Reward/Profit | Rewards are earned on block validation. Profits received are in the native token of the network. Profit % is fixed and varies depending on the amount staked. | Rewards are earned from the percentage of interest generated from liquidity pools. Profits can surge and decline with price changes of locked funds. |

| Risk | Risks are minimal in staking. Unlocking your funds to a lower price before staking is considerable. Payment of rewards can delay also. | Market is prone to impermanent loss which occurs when the price of assets deposited decreases after some time. Users also risk losing their funds to hackers and liquidating funds. |

Enter Yearn Finance. Fully explore the platform and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options). Display screenshots.

Yearn Finance

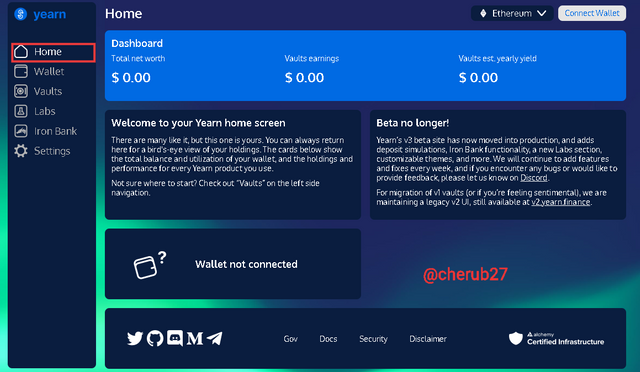

To explore the platform, visit Yearn Finance. There is a variety of menus to explore once the page loads. The first landing point is the Home.

The Home button displays the home screen of Yearn Finance. It gives a summary of all holdings(IronBank, Vault, Labs). The balance and wallets utilization is displayed if one's wallet is connected along with the total performance of all holdings on the platform. General platform notifications are also displayed here.

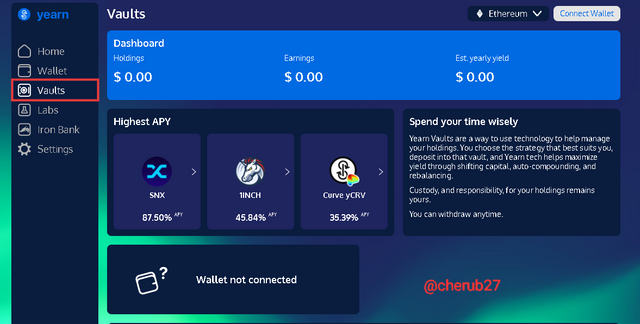

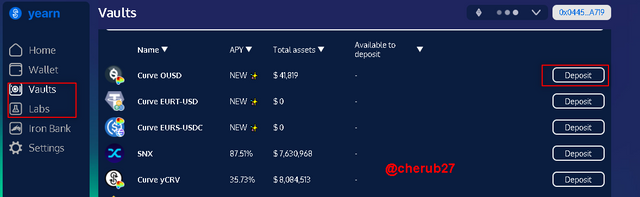

The Vaults menu has its dashboard which displays information on vault holdings. the vault acts as a saving account for one's assets. Once a user deposits funds, the system applies technologies and strategies to maximize yield on the assets. There are a lot of opportunities(assets) available to invest in. The assets with the current highest APY are displayed.

As the name suggests, the Labs menu introduces users to newly farming strategies that have been cooked up. Assets presented here are deemed unconventional, thus users are cautioned to make careful and critical research into the strategies before trading. Currently, only 3 assets are available to trade-in.

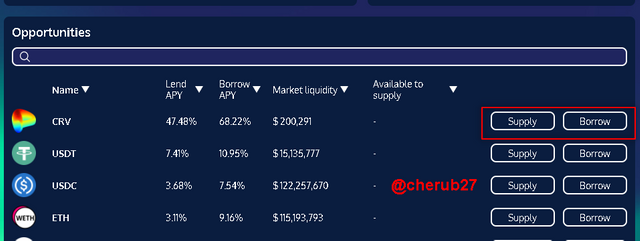

Iron Bank acts as an alternative to the Vault system which allows users to earn more crypto by lending to it. Iron Bank primarily provides lending services to users. Users can borrow from the Iron bank by locking up their assets as collateral

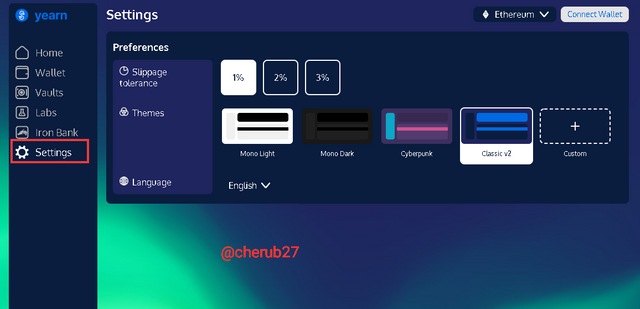

Settings allow users to feel at home through customization of the Yearn page. Users can change the Theme, Language, and Slippage Tolerance to a personal preference.

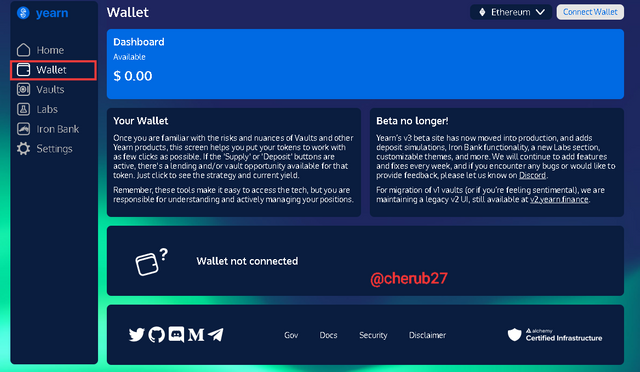

The wallet section estimates the total price of assets in a connect wallet on its dashboard. Users can connect their wallets here. Yearn Finance supports several types of wallets.

How to Connect a Wallet

- To connect your wallet, click on the Connect Wallet button at the top right corner of any menu. Yearn Finance offers products on Etheruem and Fantom networks.

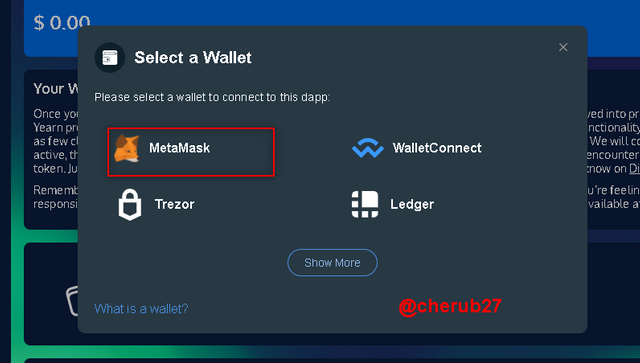

- Choose your wallet type from the list of wallets presented in the popup menu. I will go with Metamask.

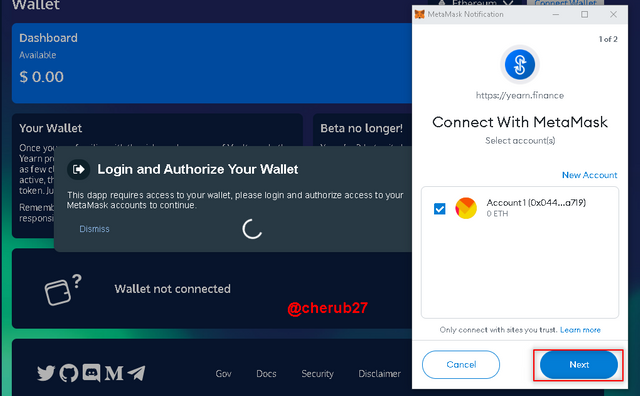

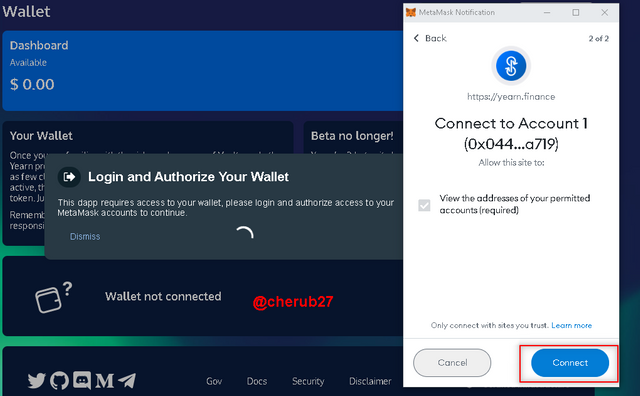

- Give the authorization to complete connecting by clicking Next followed by Connect in the Metamask window.

- Wallet connected successfully

Screenshot from Yearn Finance

How to Deposit an Asset

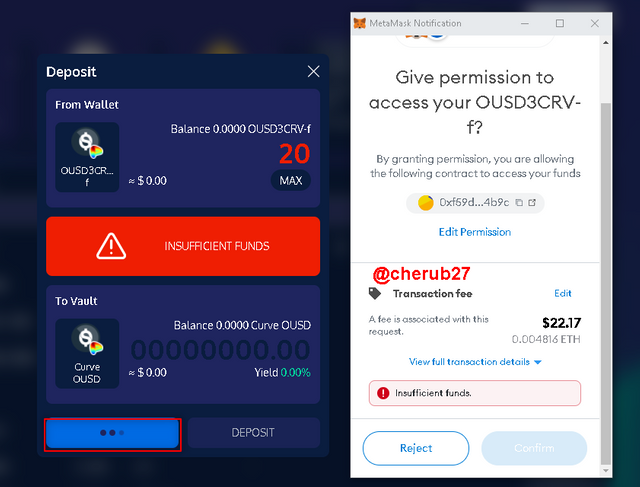

- Navigate to Vaults or Labs. Choose your preference and click on Deposit next to the vault chosen.

- Enter the number of tokens you want to deposit into the vault. Make sure to take into consideration the transaction fees in ETH. Click on Approve for first-timers and validate the transaction in Metamask.

- Once you're ready to withdraw your asset, select the vault that you would like to withdraw from and click the Withdraw button. Enter the amount to withdraw and confirm the transaction in your wallet.

How to Supply or Borrow and asset in Iron Bank

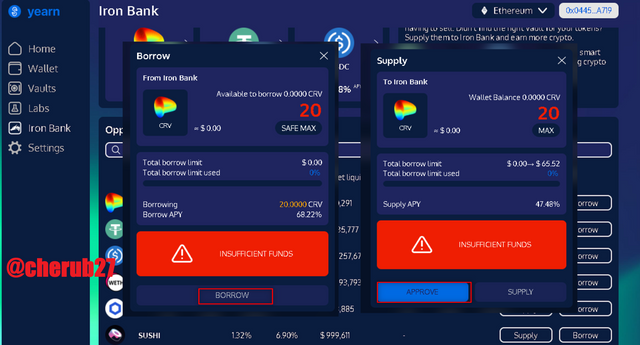

- Navigate to Iron Bank and choose an asset to Supply or Borrow by clicking on the Supply or Borrow button next to it.

- Enter the amount of token to supply or borrow and click on Approve/Supply or Borrow respectively to continue. Next, confirm the transaction in your wallet to complete the transaction

- Note that to borrow an asset, one has to first deposit an asset as collateral.

What is collateralization in Yield Farming? What is the function?

Collateralization involves the action of presenting an equally valuable asset to secure a loan. In the event of faltering to pay the loan. the asset which is the collateral is sold to repay the loan instead. This process cuts across investment platforms.

In yield farming, there is over-collateralization which requires borrowers to provide an asset in a percentage worth more than the loan. This is to safeguard against liquidation in the market due to price volatility. Some platform has a collateral factor that dictates the highest amount you can borrow on a particular asset and is strikes against the current price of the asset. Collaterals are locked up in the smart contract protocol and only released once the loan is paid off.

Collateralization and over-collateralization are necessary as it limits the liquidation risk faced by the borrowers in a volatile market, always keeping the risk of liquidation along average. This helps to protect the funds supplied by lenders on Defi platforms and keeps the trust and patronage on the platform intact.

At the time of writing your assignment, what is the TVL of the DeFi ecosystem? What is the TVL of the Yearn Finance protocol? What is the ratio (ratio) of Market Capitalization / TVL of the YFI token? Display screenshots.

For the TVL analysis, I visited https://defillama.com/

The Total Value Locked (USD) as of writing this post is $274.65b as shown in the screenshot above.

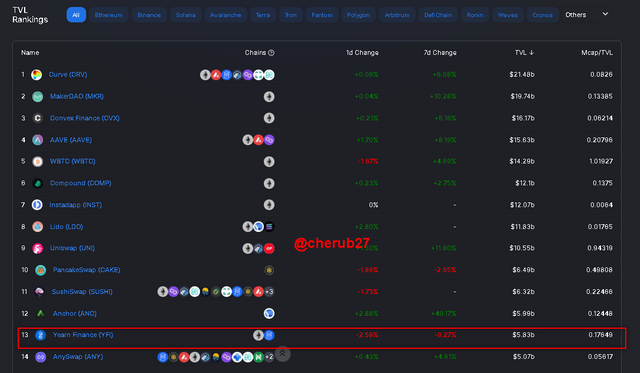

The TVL of the Yearn Finance protocol is currently $5.83b. Breakdown ( Ethereum: 5.62b Fantom: 205.94m) as seen in the screenshot above.

The ratio (ratio) Market Capitalization / TVL of the YFI token is 0.17649 as seen above.

As presented in the lecture, a token is said to be undervalued in most cases when the Market Capitalization / TVL ratio is less than one. From that analogy, with the ratio at 0.17649, the YFI token is said to be undervalued.

Though Yearn Finance currently lies 13th according to TVL rankings on https://defillama.com/, Its token's market capitalization is just a fraction of the total market capitalization which renders it undervalued.

If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment today? Explain the reasons.

According to the data acquired using the Date and Price range feature on the BTC/USDT Chart on (TradingView)(https://www.tradingview.com/), From August 1 to date, BTC has made a return of +40.68%

The return on YFI/USDT from 1 August to date is estimated at -9.39 as seen in the screenshot below.

Bitcoin: 40.68%

YFI Token: -9.39%

ROI on BTC:500 x 0.4068 = 203.4+ 500 = $703.4 in BTC asset yield.

ROI on YFI: 500 x -0.0939 = (-46.95) + 500 = $453.05 in YFI asset yield

Total ROI would be 203.4 - 46.95= $156.45

BTC would have been a better investment giving its mass adoption and current decline from a high at $64854 on 14 April. Many investors would be looking to catch the uptrend again, thus would create much buying sentiment in its market.

In your personal opinion, what are the risks of Yield Farming? Reason your answer.

In my opinion, the real risk in yield farming is falling prey to scams and hacking.

Once assets are locked in a pool, developers have control over the asset. The possibility of losing your funds is high if the developers tend to be scammers. Once the pool dissolves, that is the end. With it, it is always crucial to make your investment before investing in liquidity pools.

Due to the vision of providing a decentralized platform for its uses, the source code of Defi platforms is usually made public. This has attracted the attention of most hackers looking to capitalize on any error in the coding of these platforms. I would prefer to patronage Defi platforms already existent than jump into newly developed ones.

Aside from that, there is also the risk of liquidation due to price volatility. Once the loan price rises above the collateral, liquidation sets in. It is always good to monitor the market from time to time to be able to take measures against liquidation.

Conclusion

Yield farming presents itself as a lucrative venture to earn considerable passive income as compared to Staking which offers a fixed APY. It is a better alternative to traditional lending services and offers higher rates in comparison.

Yield farming services are yet to achieve their full potential with the growing advancement in blockchain technology. As you enjoy the profits from yield farming, always take into consideration the potential risks involved and take measures against them. Most importantly, know the developers behind liquidity pools to give you a bit of assurance on your security.

Thanks to professor @imagen for introducing us to the lecture on Yield Farming and the opportunity to explore the Yearn Finance platform.