Steemit Crypto Academy | Season 3 | Week 5 - Homework Post For Professor @yousafharoonkhan

Hello professor @yousafharoonkhan, I would like to present to you my homework post about the Death cross, Golden cross, and How to use Binance P2P trade that you presented to the steemians.

Define Death Cross and Golden Cross in your own words. And what is the significance of DC and GC in trade? And what effect do these two have on the market? (in your own words.)

Death Cross:

A death cross is a general term used to describe when a short-term moving average over a given interval crosses underneath its long-term moving average. There is no specific rule about what time frame you should look out for either line but a common approach is to compare the 50-day moving average versus the 200-day moving average.

Some traders consider a death cross to be a signal that a major market sell-off is coming, that is, across suggests that short term momentum or index is slowing down and turning into a long term downward trend. Death cross usually confirms a market contraction that has been occurring for a while and when they confirm that a downtrend is occurring, they don’t always signal that further drops are coming.

Golden Cross:

A Golden Cross is a pattern that emerges on a financial chart when a short-term moving average, which mirrors new prices, increases over a long-term moving average reflecting the longer-term trend. This technical pattern is indicative of the likelihood for prices to take a bullish turn, even more so if a cross is complete by high trading volumes. The aim is to make use of the golden cross as a gauge to acknowledge the interchange into an uptrend and to trade this shift on the market.

There are three stages to the golden cross, that is, before the cross is formed, there is a downtrend in the price movements then a new trend emerges whereby the short-term moving average takes over the long-term moving average which is the intersection, and finally, there must be a continuation of the uptrend, and the short-term moving average must act as a support level for any pullbacks in price.

How many days moving average is taken to see Death cross and Golden cross in the market for better results and why?

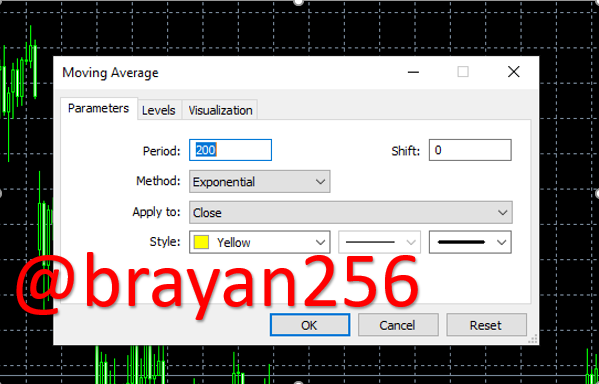

Both long-term, as well as swing traders, can use golden and death crosses to identify trends and potential entries and exists and you only need to know how they function. A golden cross emerges when an index’s 50-day moving average crosses over its 200-day moving average. The new average price is higher than its longer-term average price, so it’s often regarded as a bullish signal that could show the prolongation of an uptrend. A death cross is just the reverse arising when the 50-day moving average crosses beneath the 200-day moving average, making it be considered a bearish signal.

Fact that both the golden and death cross commonly use 50- and 200-day moving averages, some traders have separate interludes according to their time frame. The key is having short-term and one long-term average to compare a more recent average price to a longer-term average price. Therefore, the shorter the moving average time frame is, the more sensitive it is to everyday price movements, which could lead to false-positive or quick back-and-forth reversals called whipsaws.

How to see death cross and Golden cross on the chart.

I will be showcasing how you can see both the death cross and golden cross on the BTCUSD pair.

Explain Death cross and Golden cross on the chart, (screenshot necessary).

Death Cross:

The Death cross shows on a chart when an asset's short-term moving average crosses beneath its long-term moving average. The death cross goes against many short-term chart patterns, for example, the Doji because it is a long-term index that conveys extra weight for investors concerned about locking in gains prior to a new bear market formation. Any rise in volume normally comes with the emergence of the death cross.

An example of what a death cross will look like.

In this case, the red line is the 50-day moving average and the yellow line is the 200-day moving average. When the smaller period moving average line moves below the longer period moving period average line, we will get a death cross. It is quite evident once you apply it on the chart for a longer-term period which will show you an indication of where the market is moving for the longer term.

Golden Cross:

The golden cross is a bullish breakout pattern devised from a crossover necessitating an asset's short-term moving average, for instance, the 50-day moving average immersing its long-term moving averages like the 200-day moving average which is also known as a resistance level. The golden cross shows a bull market on the horizon and is strengthened by rising in high trading volumes as the long-term index carries extra weight.

An example of what a golden cross will look like.

In this case, the yellow line is the 200-day moving average and the red line indicates the 50-day moving average. So when the smaller time moving average crosses above the longer-term period moving average, a golden cross will be formed.

What is Binance P2P and how to use it?

Before trading cryptocurrencies, you need to buy cryptocurrencies first and on the Binance Peer-to-peer platform, you can buy cryptocurrencies using multiple fiat currencies in various payment methods. Therefore Binance P2P is a peer-to-peer trading platform where Binance provides escrow services and matches traders who want to buy and sell cryptocurrencies, that is, if a trader transfers his or her fiat money to Binance P2P to buy cryptocurrencies, it will keep the virtual currency on the Binance platform and not until they get a confirmation from both the traders according to the original agreement that was sent in the order then they can release the cryptocurrency to the buyer.

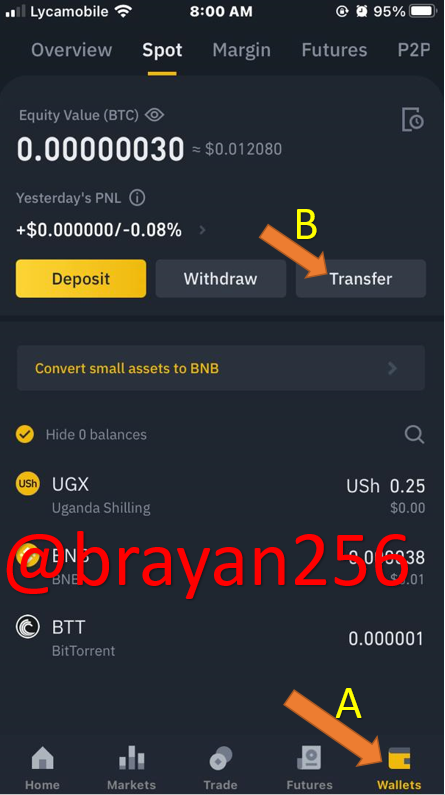

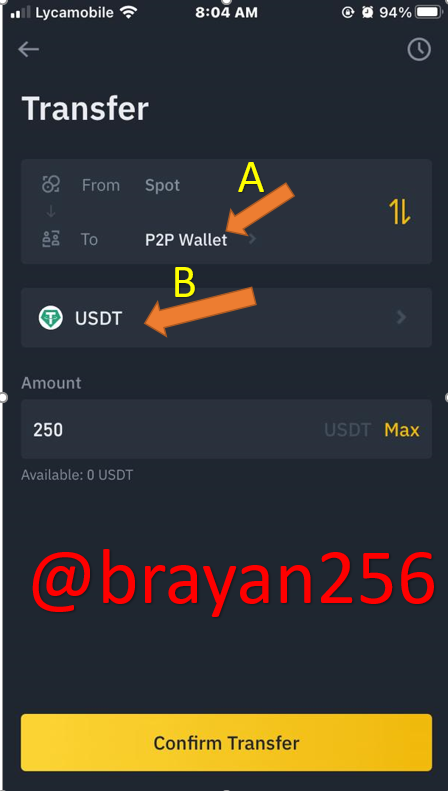

How to transfer cryptocurrency to P2P wallet?

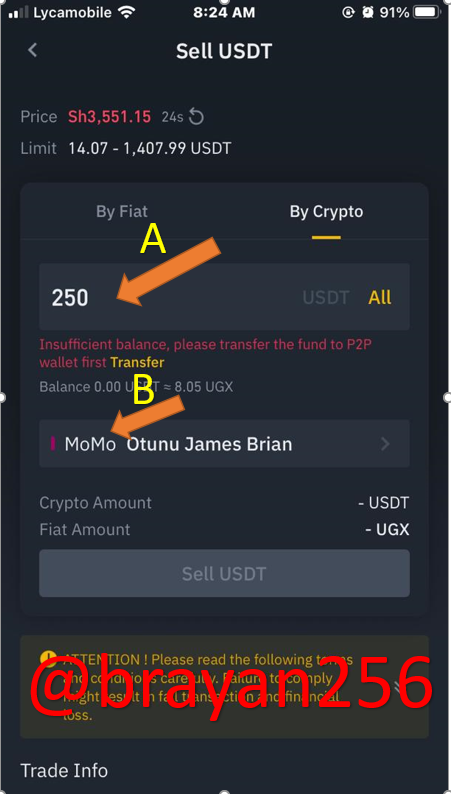

Before making any transfer to your P2P wallet, you will need to have deposited some cryptocurrency in your spot wallet. The merchants don't trade all types of cryptos but it will depend on your location what cryptos the merchants in the P2P platform deal in. So in this case, the merchants in my country only deal with USDT, BUSD, BTC, BNB, DIA, AND ETHER. Let say you want to transfer USDT which was deposit in your spot wallet to your P2P wallet.

How to sell cryptocurrency in local currency via P2P (any country or coin) (screen short necessary to verify account)

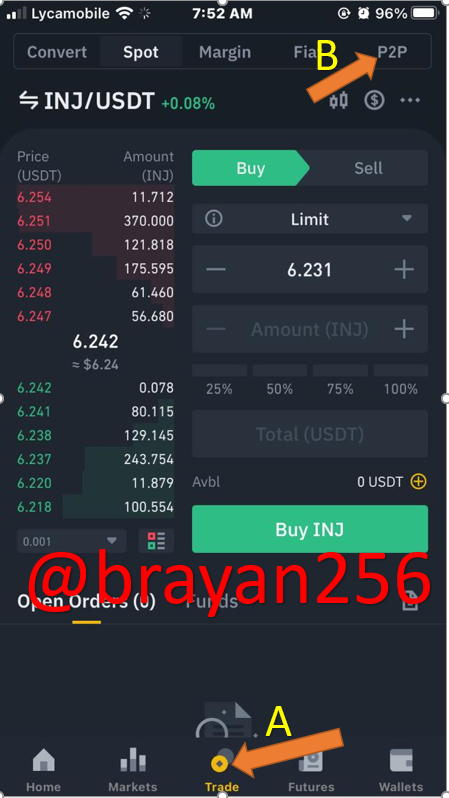

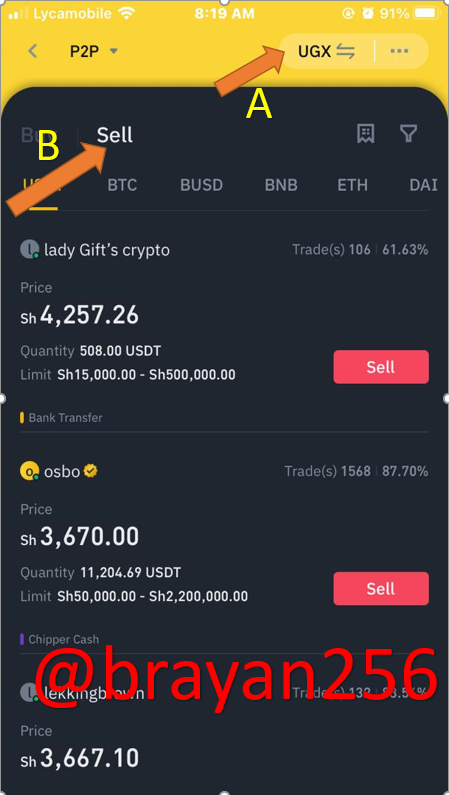

First and foremost when you open the Binance App (pro version), click on trade at the bottom (shown in A) then select P2P at the top right corner (shown in B)

What are the things to keep in mind during P2P trade and describe its four advantages and disadvantages? (own words).

Advantages of P2P trading.

Disadvantages of P2P trading.

Therefore I would like to take this opportunity to thank professor @yousafharoonkhan for such an amazing lecture which has acknowledged me more about death cross and golden cross plus how to use Binance P2P platform.

Respected first thank you very much for taking interest in SteemitCryptoAcademy

Season 3 | intermediate course class week 5

thank you very much for taking interest in this class

Well done bro!

You have been curated by @yohan2on, a country representative (Uganda). We are curating using the steemcurator04 curator account to support steemians in Africa.

Keep creating good content on Steemit.

Always follow @ steemitblog for updates on steemit