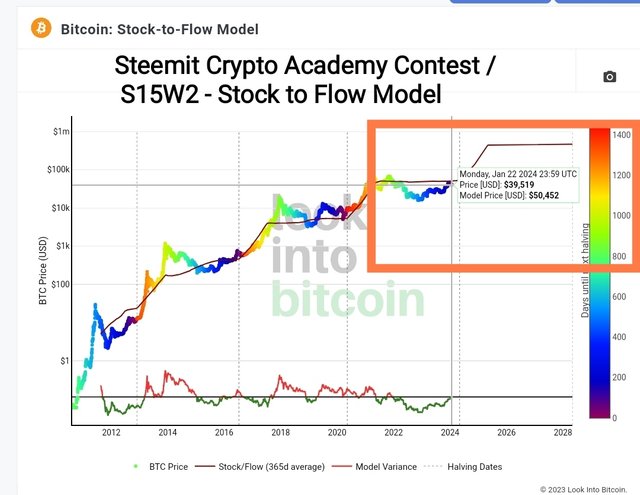

Steemit Crypto Academy Contest / S15W2 - Stock to Flow Model

screenshot from the link given in the challenge

The crypto ecosystem has several price for casting tools of which most Traders rely on dominance or movement by the market and others rely on technical analysis. Yet some rely on scarcity of supply. This scarcity of supply is on the stock to flow model as one of such resource. How?

They stop to flow model is very much correlated with bitcoin prices and it works on the principle of supply scarcity. If supply is low, prices tends to go up with increase demand. In this post a detailed write up would be spelt out on what they stock to flow model is, its functions, advantages and disadvantages.

Explain in your own words the Stock to Flow Model, what is its function? |

|---|

Stock to flow model commonly used in price commodities is a tool that helps us to measure how scarce a commodity is and predict the change in value of that commodity.

Formula for calculating stock flow ;

Stock to flow=Stock/Flow

Where;

Stock is the total amount of a resource that exist while flow is the additional amount of a resource produced on an annual basis.

Let's assume we want to calculate the stock flow of gold. Stock=270000 tonnes and flow is 3500 tonnes. Stock to Flow= 270000/3500.

= 77.

This means that it takes 77 years of mining gold to double the ones mine or held by people around the world. In the context of bitcoin, it has over 21 million coins making it an infinite resource commodity and the stock to flow model considers the fixed supply of the commodity that's why having is done in Bitcoin every 4 years to reduce the rate of newly created bitcoins by half.

If they stock to flow model ratio is high it indicates higher scarcity which impulse that the assets or commodity becomes scarcer relative to its new production, making the asset more valuable as there will be increased demand owing to this scarcity. This stock to flow model works majorly on scarce commodities like bitcoin gold silver etc as they are scarce which makes it fit for the model.

Bitcoin is the first commodity that have fixed supply which makes it scarce and exciting for investors. As the demand for this asset increases, the price increases as well. They stock to flow model treat bitcoin as being a scarce precious metal like gold with a store of value due to its retention value and relative scarcity. To Traders and investors, it is essential because it is used to identify where bitcoin will go in the future and also focuses on this supply schedule of Bitcoin.

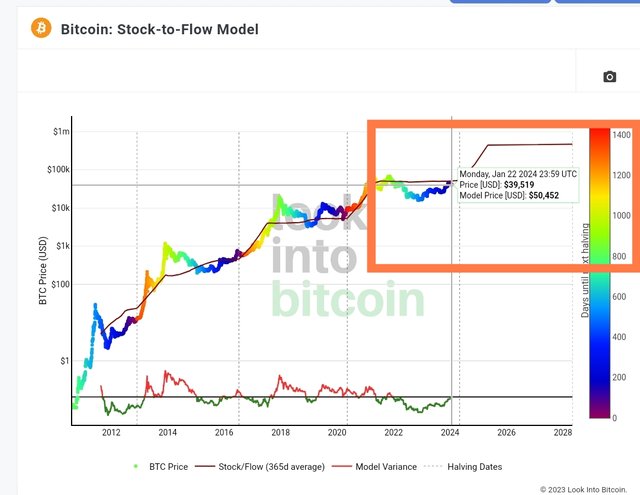

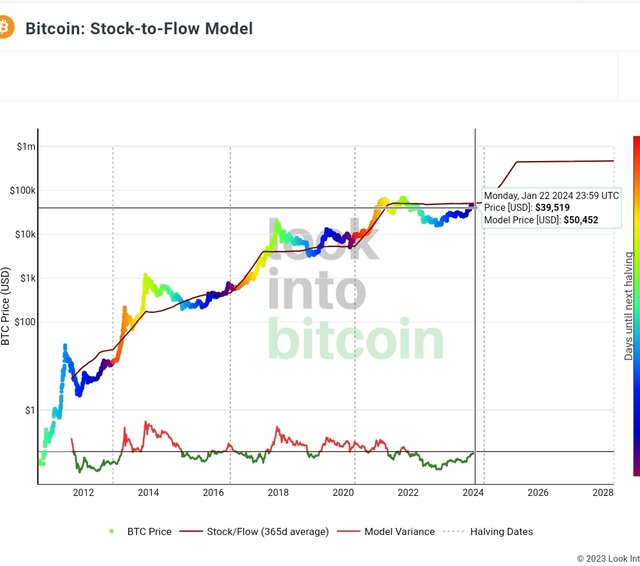

screenshot from the link given in the challenge

What would be the advantages and disadvantages of the Stock to Flow Model? |

|---|

There are advantages and disadvantages of this stock to flow model in Crypto. For the fact that it brings about scarcity which reduces the total supply and bring about increased demand should be alarming positively. The following are advantages of this model.

Scarcity in supply: the stock to flow model has actually brought about the scarcity of certain commodities by comparing their current supply in stock to the rate at which new units are produced which is the flow. It works majorly on this scale which leads to increase demand as well.

the model is called relating with the halving event that occurs every 4 years. Halving brings about a significant increase in price as we're all expecting the bitcoin halving in months to come. This halving reduces the total number of newly created bitcoins by half which increases the demand for the asset and reduces it supply. The S2F takes this halving into consideration as all investors and traders would benefit from the halving..This is another advantage

This model has made digital assets like bitcoin have this store of value as a gold and silver does. The scarcity involved due to increased price makes the coin valuable like gold as not all investors can actually afford it. It also makes it accessible to a wider audience due to the simplicity of the model and its calculation is straightforward and doesn't require much. You'll have to divide the current supply with the annual rate of production which makes crypto Enthusiasts understand the model better.

It has also encouraged long term investments and does contrast with traditional fist currencies influenced by central banks as the case may be.

Disadvantages:

There are certain manipulation risks in the market that comes as a result of this stock to flow model which can distort market dynamics. Activities like pump and dump is likely to be seen as the model might not address such risks fully.

External factors like economic, social etc can influence the financial markets and this model may struggle to account for these factors . The model too is less responsive to changing market conditions because it doesn't at times incorporate with real-time data leading to delay in predictions as well as inaccuracies.

The model focuses on S2F ratio and may overlook demand and macroeconomic indicators which essentially affect the price of assets. It also assumed that market are efficient and relevant in terms of prices.

Make an analysis of the Stock to Flow graph Stock to flow model |

|---|

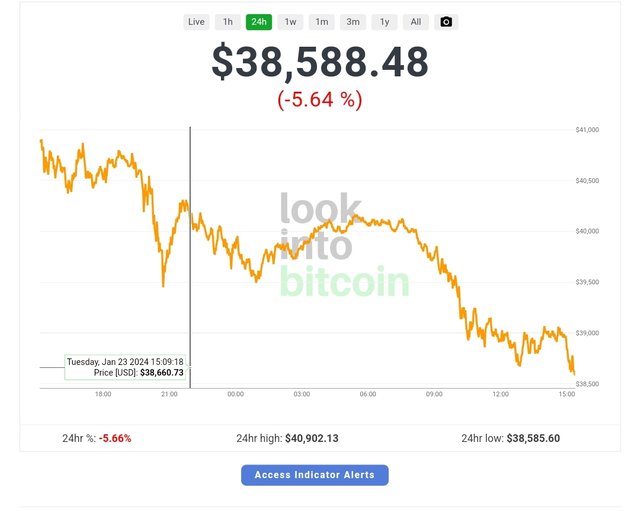

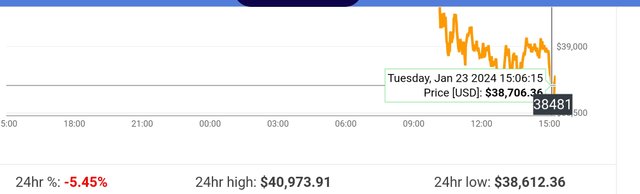

The analysis and making from here is dated 22nd January. The price of Bitcoin was $39,519 but the model predicted a much higher price which is $50k. The prediction is quite in accurate though but was expected. The gap between the model's prediction and the actual price of bitcoin make us think of factors that may have contributed to the decline.

|  |

|---|

If we're to retrace back to the Bitcoin ETF announcement early this year, will come to an understanding that before it approval they were certain visions or predictions made by investors if bitcoin ETF was approved. They saw bitcoin price to be $55,000 up, whereas if it were rejected it will dump to $38k. But it seems the reverse is happening which calls for questioning. To understand why bitcoin price has reduced badly even after the announcement of approval, go through this post ....Why bitcoin price is declining after approval of bitcoin Etf

Can this model be applied to STEEM? Give reasons why this Stock to Flow graph model can or cannot be applied. |

|---|

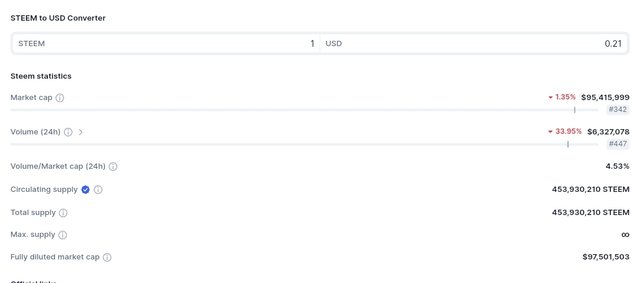

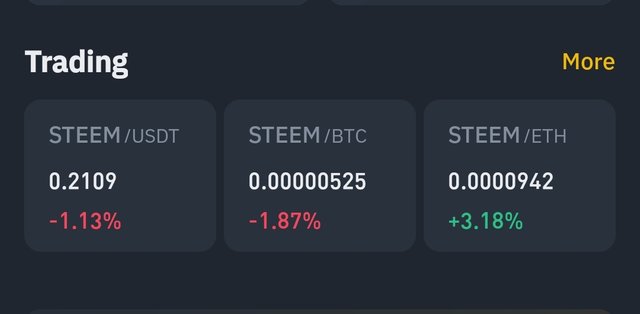

To answer this question, I'll give some factors that correlates with my answers. From the description of the stock to flow model and knowing steem as a cryptocurrency, I feel it's clear that STEEM doesn't follow this model why?

- Based on scarcity in supply, the S2F model takes in assets with limited supply of which we can see in the case of bitcoin which has a limited supply of 21 Million Bitcoin. Steem has a dynamic issuance mechanism which makes it difficult to fit into this model. It keeps making new coins unlike scarce assets like bitcoin which undergo Halving to reduce the number of new coins created every 4 years.

screenshot from my coinmarketcap

Unlike bitcoin where its value is marked by its scarcity, steem value is backed by its utility within the steem blockchain and are influenced by developments on the platform and user's engagement. The S2F model doesn't capture this utility backed by Steems steem's value.

The influence of community, development progress and governance aren't really considered in this model but steems value is influenced by these factors.

The volatile crytocurrency markets are wild rollcoasters . The steem coaster has turns that scarcity alone can't explain but also involve regulatory changes, tech upgrades and the likes of them which this model is not really good in predicting.

screenshot from my binance exchange

So in summary, we've seen the stock to flow model as an instrument used in scarcity of supply to measure how scarce a commodity is which leads to increased demand for the asset and adds value to the token as well just like some scarce assets we have asides bitcoin.

I invite @basil20, @goodybest and @whizzbro4eva

All screenshots are gotten from the link provided.

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

https://twitter.com/bossj23Mod/status/1749967785042592042?t=bK79mM5rRWxxpu8TSYtzvA&s=19

OMG 😱.

This analysis is fire.

You've indeed done justice to the topic and as well create room for learning people like me.

The Stock to Flow model is a huge crypto tool that helps analyze the scarcity of commodity and then know what perfect steps to take.

Tue advantages and disadvantages for provided is indeed powerful and so helpful to crypto traders enthusiasm.

Good luck to you sir, I'm looking forward to reading More content like this from you.

Yes....There are lots of predictions Carried out in the open market and like I said, this model works best on bitcoin as it focuses on scarcity in supply. Thanks for the comment.

@bossj23

In the crypto ecosystem, you explained to us that there are many prices of casting tools, most of which are dominated by market traders, and if we talk about it, it is a fact that the staff-to-flow model is included in the price items. And one thing you have clearly explained is that the rarer something is, the more its price and value goes up and up over time, making buyers, traders, and every other market. A working man benefits from this and you explained the stock flow calculation very well, it means that it takes 77 years for people around the world to double the amount of gold they have. You have clearly explained us every example in it other activities is great your post is appreciable and always keep up the hard work I wish you success.

Hello dear friend greetings to you, Hope you are having good days there.

The Stock to Flow model is a concept used to evaluate the present stock of any particular asset, such as BTC, against the flow of new production. We take the annual production of the stock. We can also use it for other commodity such as Gold, silver, and platinum. Using it for small pairs like Steem isn't a good or wise option according to me.

The best post dear, best wishes for the contest.

Thanks for this insightful Comment

Well my dear friend you have answered so well and the last question you are absolutely right we can't amplifier over it and and the reason you have given is just outstanding and it is representing and you are authentic content and you are hard work.best of luck

Appreciated

🙌🙌

Masha'Allah

Beautiful post...

Your comprehensive analysis of the Stock- to- Flow( S2F) model and its application to Bitcoin is estimable. Your insights into both advantages and disadvantages provide a well- rounded view demonstrating a solid understanding of the model's intricacies.

The comparison with the Bitcoin ETF announcement and the posterior price movements adds a practical dimension to your analysis showcasing an awareness of real- world market dynamics. Your evaluation of applying the S2F model to STEEM is perceptive emphasizing the unique factors that differentiate STEEM from assets like Bitcoin.

Overall your post is instructional well structured and exhibits a thoughtful approach to understanding the complexities of cryptocurrency markets. Well done!

Am waiting for your more post.