In-depth Study of Market Maker Concept - Steemit Crypto Academy | S4W6 | Homework Post for @reddileep

![AddText_10-15-05.42.16[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmTpdQaJMJr2yAphY1XHcbNTY62FsMavWetwTjyP2ScNgK/AddText_10-15-05.42.16[1].jpg)

Define the concept of Market Making in your own words.

A market of a crypto asset deals with the act of buying and selling. In buying or selling one may choose to place an order to sell using the current market price offered in that moment, this type of order is called a market order. One may also decide to place an order with his price at which he is ready to sell or buy an asset.

Market making is the process by where an individual creates tow limit orders in the market of a particular asset. These limit orders are; a buy limit order and a sell limit order where he gives his bid price to be slight lower than the current order with the highest bid where he also gives his ask price to be slightly higher than the best selling order.

This process gives liquidity to the crypto market other same time giving profits to market markers.

Explain the psychology behind Market Maker. (Screenshot Required)

Crypto assets gain their value based on the demand and supply available at the time. In a market where the liquidity is very low transaction are very slow or at times to difficult to make. Market makers as stated earlier give so much liquidity to a crypto market by setting up their own bid and ask price which where there is a difference between the two prices. Other traders gets the liquidity from these market makers and try to transact between these prices. When these orders are matched by other traders they are then filled.

Market markers also make profit from the difference between the buy and sell orders otherwise known as spread. That is a market maker will create a buy limit order at $200 and create a sell limit order at $210. Being market makers the psychology behind this act is to provide liquidity in the crypto asset and make transactions faster.

Explain the benefits of Market Maker Concept?

• Minimizes price volatility; the crypto market is highly volatile and hence can have a huge price swing within a second. But with the market makers in the market with these limit orders the volatility is checked or it is reduced which is a good thing to small traders.

• Gives liquidity in the market: an asset with high liquidity means that finding matching orders are very fast and smooth and those with less liquidity experiences prolonged delay in finding matching orders. The market maker concept has the ability to provide liquidity to markets which is a positive thing.

• Makes an asset attractive: trading with an asset with high liquidity is very convenient and attractive. It brings more investors on board and this helps to maintain the price or increase the price of an asset.

• Trust in asset: when market makers are present in a crypto asset it makes investors get trust and confidence in the asset and as a result increases the chances of huge investment.

- Explain the disadvantages of Market Maker Concept?

• VULNERABILITY OF SMALL TRADERS. The fact that market makers have control I the market, they can decide to set up bid and ask prices that will see their spread increase and hence increasing their profit. This can be a threat to the small traders in the market.

• Possible market collapse. There is no governing body that regulates these market makers so they can decide to exit the market as to when they wish and this can lead to a collapse of market.

• Not suitable for small traders. This type of trade is not suitable for small traders because profit margins are not much hence demands a lot of capital in order to make much profit.

Explain any two indicators that are used in the Market Maker Concept and explore them through charts.

MOVING AVARAGES

Moving is a very good technical tool that traders make use of to make decisions in the crypto market. The moving average consist of two lines that give signals based on price movement, the signals are given when these two lines cross over. With the power market markers have in the market they try to manipulate the market by pushing the market down and when traders panic they buy at the those prices which benefits them

Below is a chart of with moving averages where the market makers used the indicator to cause people do sell out of panic.

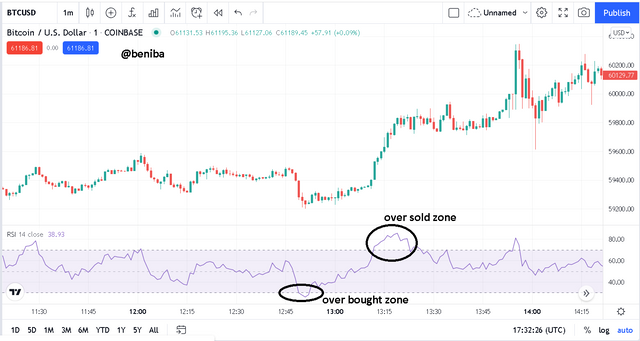

RSI

This is a technical analysis that is also identifies overbought and oversold zones where they all imply trend reversals. The indicator has ranges 0 to 100. When the indicator is passed the 70 mark they it is said that the asset is in the overbought zone and hence a uptrend will occur soon and when it is below the 30 mark it signifies an over sold and hence a down trend will be experienced soon.

CONCLUSION

The prices of cryptocurrencies depend on the demand and supply of the asset. I know that apart from whales market makers also have a great impact the price movements. These market makers makes use of analysis using technical tools and also use open book orders. Thanks to @reddileep for such a lecture.