Crypto Academy / Season 3 / Week 3 - Homework Post for professor @allbert

Introduction

In investing, it is of great importance to understand the basis of an asset, why it is needed, and how valuable it remains over time, this evaluation process is done through fundamental analysis.

Fundamental analysis is a process of evaluation that studies to know the actual value of an asset through quantitative and qualitative data available about the asset.

In cryptocurrency investing, investors study the white paper of the crypto asset which is a written document that contains the details of the project, highlighting a problem the developed technology can solve, and the application of the technology in real-life instances.

This helps investors determine the actual value of a crypto asset and its sustainability over time. Fundamental analysis is combined with other forms of analysis (Technical and Sentimental) to making an investment decision.

Question 1

Select two Crypto, perform fundamental analysis and based on your fundamental analysis explain why you chose them.

Source

For this demonstration, I will choose XRP (Ripple) and Binance Coin

XRP Coin

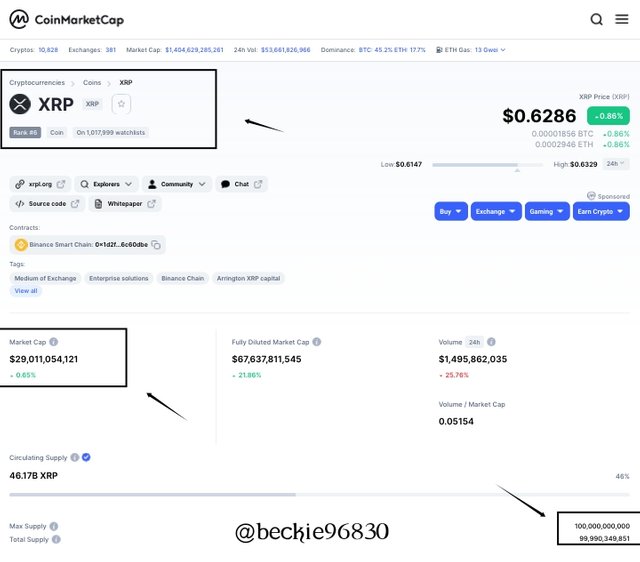

XRP is a cryptocurrency developed from Ripple technology and is ranked 6th on Coinmarketcap website with great potential. XRP has a market dominance of 2.07% in the crypto space, a market cap of $29.0B, a circulating supply of $46.17B XRP, and a Total supply of $100B XRP, which means that about $53.83B XRP can still be created.

The Ripple (XRP) white paper stated that its technology was developed to tackle the problems associated with international transfers between banks, which is a real problem that needs to be improved by creating a better solution.

The Ripple technology is also known as (protocol consensus algorithm) is a network of payment handling systems built around the XRP cryptocurrency to enable faster processing of international transfer of funds against the traditional international transfer that takes 2-3 business days.

Although the technology has not been adopted by financial institutions, it proposes to use XRP as a central coin against currencies. ex. To transfer US Dollar to someone in Britain using the ripple technology will require a conversation between USD and XRP, converting its equivalent in XRP to GBP. This is implemented and regulated through Unique Node List, which is a list of trusted members within the network that validates transactions and keeps records distributed in the network.

Binance Coin (BNB)

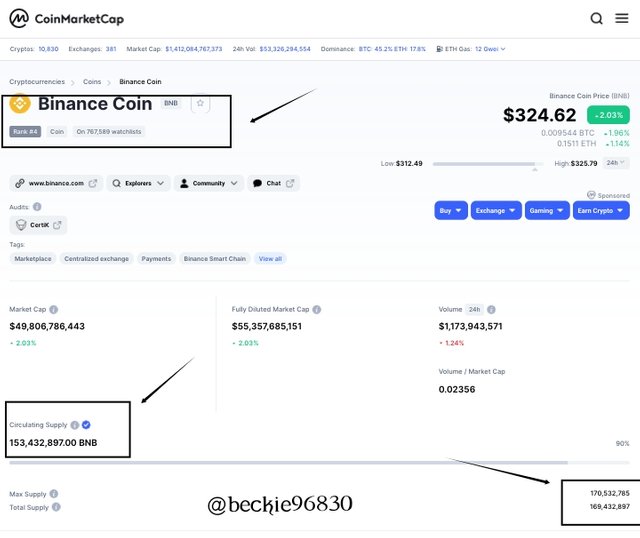

Binance Coin (BNB) is a cryptocurrency developed by Binance corporation, it is ranked 4th on Coinmarketcap website. Binance Coin has a market dominance of 3.53% in the crypto space, a market cap of $49.8B, a circulating supply of $153.4M BNB, and a Max supply of $170.5M BNB, which means that about $17M BNB can still be created.

Binance Coin was created to tackle the issues associated with transaction fees ok the Binance exchange platform. This allows users to get rebates on fees paid through BNB for transactions involving moving funds from the exchange to a crypto wallet.

Binance developed the Binance chain to support the use of Binance coin (BNB), which uses a consensus mechanism to maintain and regulate transactions through a multi-layer nodes system, they include Validator Node, Witness Node, and Accelerator Nodes.

Why I chose them

From the fundamental analysis conducted above, XRP (Ripple) and BNB (Binance Coin) both have:

Project Use Case

XRP through the ripple technology tackles the problems encountered by the current banking system on issues of international transfers by making XRP a central cryptocurrency in their networks.

Binance coin through Binance Chain tackles issues associated with transaction fees for moving funds from the exchange to private wallets.

Stability

Binance coin and XRP have maintained a value range of price backed by their projects, indicates the true value of the coin and stability of price.

Sustainability

The market numeration of xrp and Binance coin backed by projects and goals indicates a sustainable coin over time and the probability of an increase in market dominance percentage.

Investing opportunity

XRP project is still under evaluation with great potentials, this provides a nice investing opportunity as the coin value is at $0.6286. if the project is endorsed and implemented, this will increase the valuation of the coin massively.

Question 2

Investing in XRP

For this demonstration, I chose Binance exchange, and I will buy XRP coins using USDT.

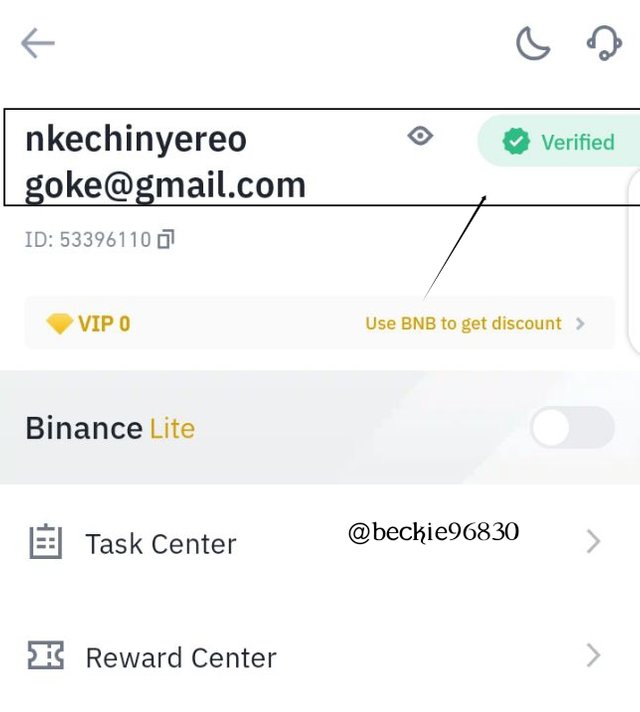

First, open Binance can and show proof of verification.

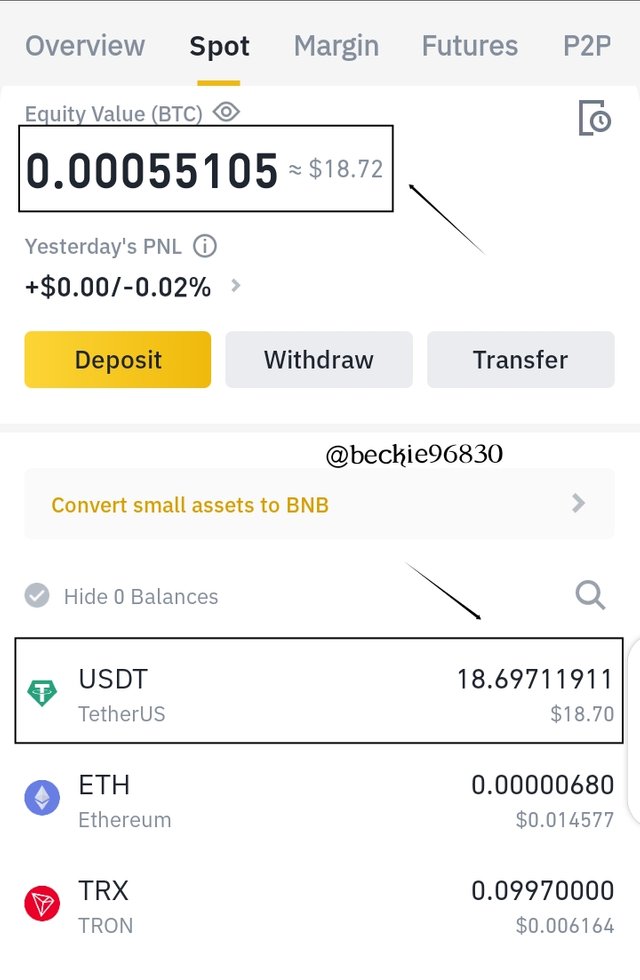

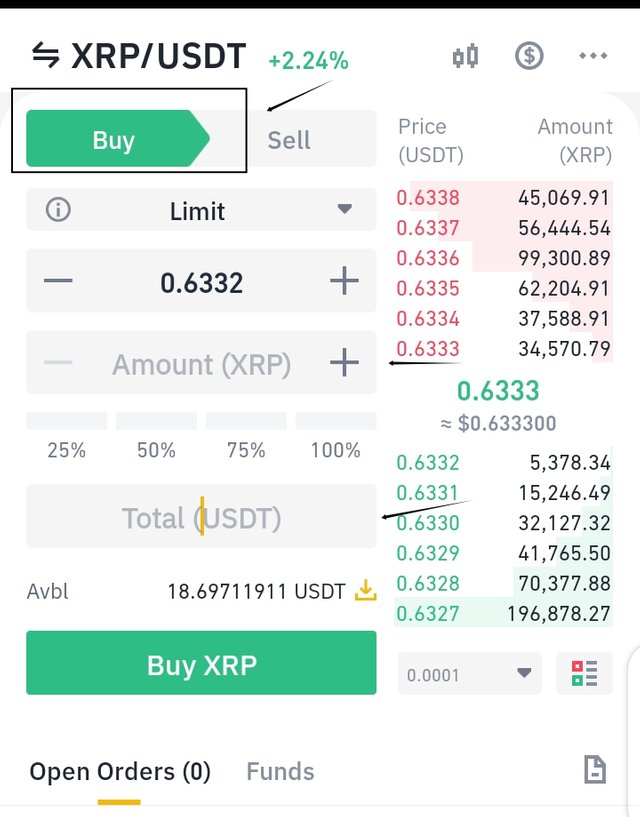

I choose to buy XRP coin using USDT, as shown I have $18 in my account.

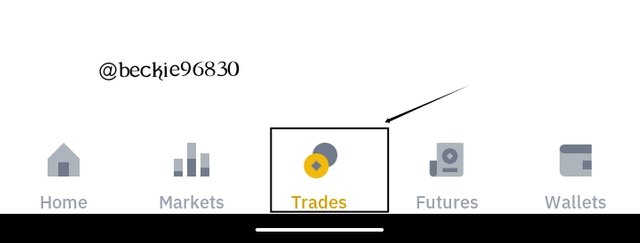

To buy XRP using USDT, choose the trades option at the dock of the Binance exchange app.

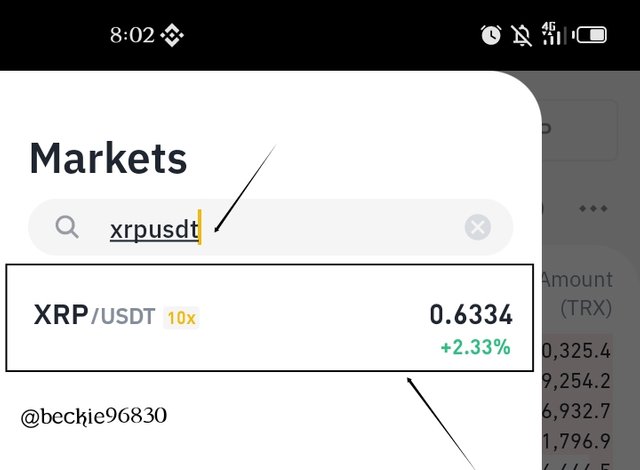

Next search for the crypto coin, in this case XRP/USDT and click on it.

Next, choose the buy option and put the amount of XRP to buy, or the USD equivalent of XRP to buy, and click buy XRP.

If successful, the prompt below will show.

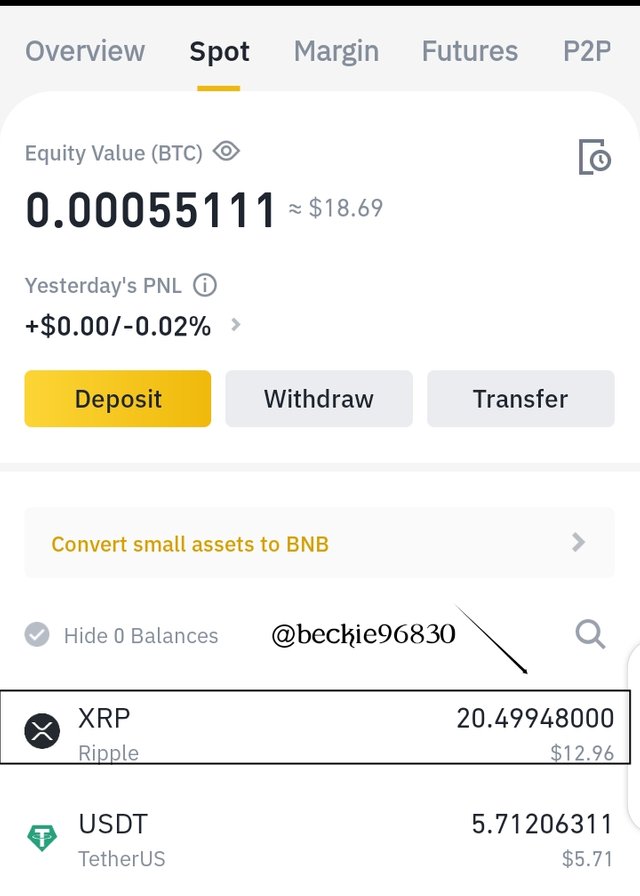

Go to XRP wallet to confirm coin purchase.

Investing Using DCA

Dollar-cost averaging is an investment strategy that requires less technical skill, where an investor divided the total amount to be invested into a small amount invested periodically over a specified time.

This aims to reduce the cost-effectiveness of taking trade positions in the crypto market often caused by the inexperience of the investor.

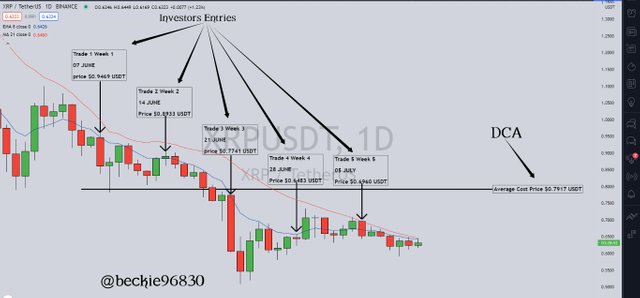

Case 1 XRP/USDT

Let's assume an investor has $1000 to invest using the DCA strategy over 5 weeks:

Illustrating the image above, if the investor invests $200 each week at varying prices.

| Cost | Week | Price (USDT) | Units (xrp) |

|---|---|---|---|

| $200 | week 1 | 0.9469 | 211.22 |

| $200 | week 2 | 0.8933 | 223.89 |

| $200 | week 3 | 0.7741 | 258.36 |

| $200 | week 4 | 0.6483 | 308.50 |

| $200 | week 5 | 0.6960 | 287.36 |

The investors total shares of XRP coin acquired with $1000 using Dollar-cost averaging is 1289.33 XRP, whereas if the investor, invested $1000 in the first week, the share value (number of XRP) would be 946.9 XRP.

This improved the share by 342.43 XRP worth $271.10 at the average price of $0.7917. The investor gained more shares using the DCA strategy, this can only be beneficial when the price of the asset (XRP coin) increases.

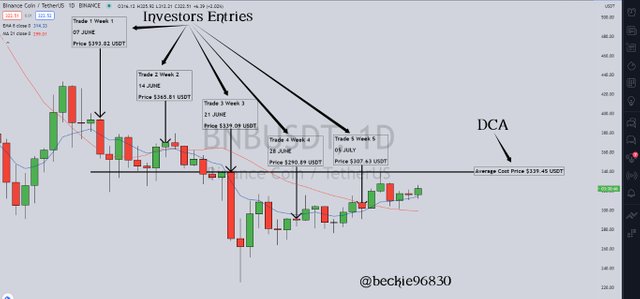

Case 2 BNB/USDT

Let's assume an investor has $10,000 to invest using the DCA strategy over 5 weeks:

Illustrating the image above, if the investor invests $2000 each week at varying prices.

| Cost | Week | Price (USDT) | Units (BNB) |

|---|---|---|---|

| $2000 | week1 | $393.82 | 5.08 |

| $2000 | week2 | $365.81 | 5.47 |

| $2000 | week3 | $339.09 | 5.90 |

| $2000 | week4 | $290.89 | 6.88 |

| $2000 | week5 | $307.63 | 6.50 |

The investors total shares of BNB coin acquired with $10,000 using Dollar-cost averaging is 29.83 BNB. Whereas if the investor, invested $10,000 in the first week, the share value (number of BNB) would be 25.39 BNB.

This improved the share by 4.44 BNB worth $1507.16 at the average price of $339.45. The investor gained more shares using the DCA strategy, this can only be beneficial when the price of the asset (BNB coin) increases.

Conclusion

Fundamental analysis using the crypto white paper plays an important role in the process of building a crypto portfolio, through detailed analysis on the possibilities of performance and sustainability of the underlined crypto asset over a specified time.

Crypto assets should be analyzed using fundamental analysis and technical analysis to provide a balanced perspective on the outlook of the market in cases of potential investments.

The dollar-cost averaging investing strategy provides investors access to more shares of an asset in a downtrending market condition this increasing value per cost. In contrast to this, the dollar cost averaging investing strategy reduces the share per cost in an up-trending market.

Thank you professor @allbert for this wonderful lesson.

Happy Sunday... Please are you on discord, I need your help with something. How can I connect?