Dark Pools in Cryptocurrency - Crypto Academy / S5W8 - Homework Post for @fredquantum

Hello wonderful people, how are you today? I hope you're having a fantastic week. I'm ecstatic to be a part of this unforgettable lecture. In this article, I'll share my experience with Dark Pools in Cryptocurrency

1. Discuss Dark Pools in Cryptocurrency in your own words. How does the dark pool works?

The idea of dark pools is not unique. Even before the emergence of cryptocurrency, dark pools were in operation. A dark pool is basically a private location or venue for conducting financial transactions away from the common public's gaze. It was just a question of minutes until the notion of dark pools was brought into the crypto sector due to their anonymity characteristic.

Crypto dark pools are effectively alternative private exchange platforms for swapping crypto assets from the main exchange venue. These Dark pools allow traders to place huge crypto orders while staying secret to the general public. In essence, we can think of it as a distinct exchange platform for whales and big participants in the cryptocurrency industry.

How Crypto Dark Pools Work

Most crypto dark pools operate by permitting investors to submit large limit orders. Limit orders are transactions that the trader places at a predefined price. Limit orders would usually show on the exchange's public order book; however, dark pool requests do not display on the public order book. In this instance, the order book is considered to be distinct and hidden. This conceals whales' objectives from the general public, preventing users from making a fast investment decision that could disrupt the marketplace. As a result, whale orders would be filled at a lower cost.

Whenever investors execute these huge orders, they are compared to orders that are priced the same. Since huge quantities of the item being purchased, the placement and matched of these orders is referred to as Block Trading. Because the dark pool is intended for larger transactions, there is always the lowest threshold necessary to place transactions. Slippage is prevented since bids are completed at a specified price. Furthermore, while using dark pools, investors see only their own trades and not the bids of others in the pools.

2. Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

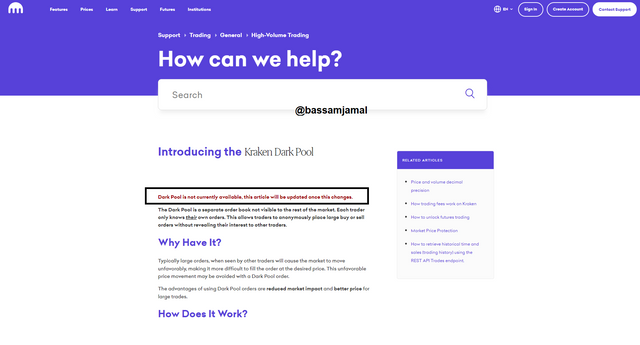

Kraken is a renowned marketplace that provides dark pool functionality. Kraken is a cryptocurrency exchange based in the United States that was founded in 2011. The exchange is credited with being the first to provide the dark pool service in 2016. The Dark Pool began with only Ethereum, but Kraken plans to create a Bitcoin dark pool in 2021.

Traders must meet specific criteria in order to execute bids in Kraken's Dark pool, which I will discuss in the next section. If all of the criteria are completed, the trader can post a limit price on the Kraken dark pool site for a charge. This limit order is then compared with others at a similar price point.

Market trades are not permitted since there is no order book in which traders can monitor the actual price, and these orders are susceptible to slippage. Because the transaction is not registered in the order book, the practice of mirroring these limit orders is known as crossings or cross trading.

Because of the confidentiality and the fact that trading fees are the same for each pair, it is impossible to determine whether a trader is a market maker or a market taker.

The Kraken Dark pool is currently unavailable at the time of writing.

3. What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

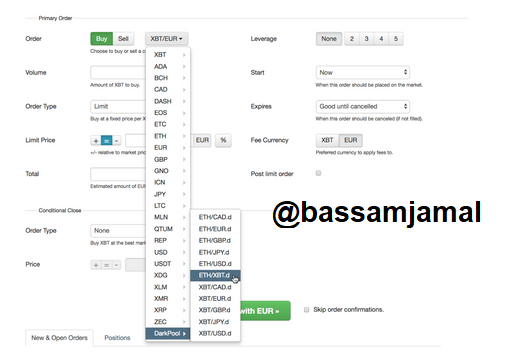

As previously stated, the assets now permitted by the Kraken Dark pool include Bitcoin and Ether. These items' pairings are as follows:

BTC

- BTC/CAD

- BTC/EUR

- BTC/GBP

- BTC/JPY

- BTC/USD

ETH

- ETH/CAD

- ETH/EUR

- ETH/GBP

- ETH/JPY

- ETH/USD

Requirements

As previously stated, the assets now accepted by the Kraken Dark pool are Bitcoin and Eth. These are all the prerequisites for participating in the dark pool, as per Kraken;

- On the exchange, individuals must have been authenticated up to the Pro Level.

- Investors can only execute limit orders because market orders are not permitted.

- A BTC pair order specifies the minimum deposit of about $100,000.

- The minimum order value for an ETH pair is around $50,000.

Fees Attracted in Kraken's Dark Pool

Fees for the Dark Pool are calculated by a user's 30-day transaction volume. According to Kraken, the more a person interacts on the exchange (dark pool and otherwise), the lesser the fees they will spend on the dark pool. Fees typically vary from 0.20 percent to 0.36 percent.

4. For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

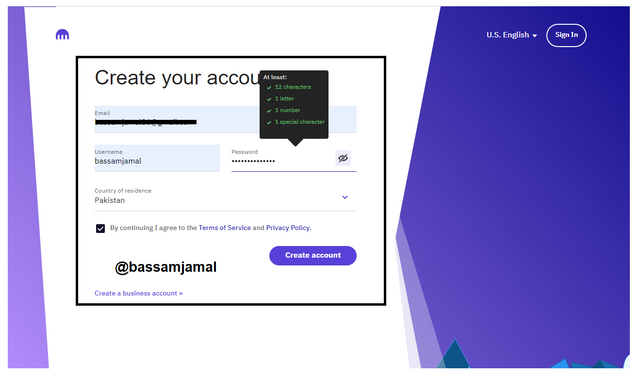

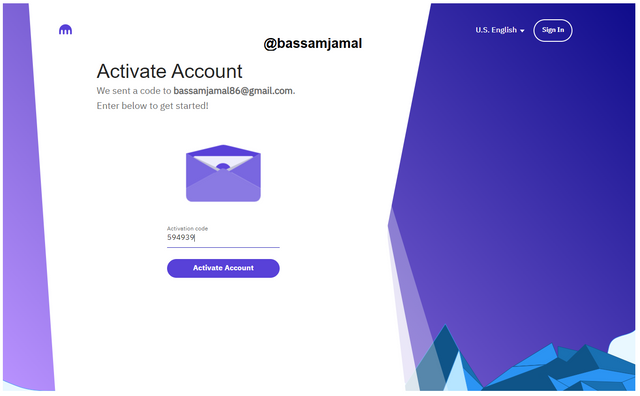

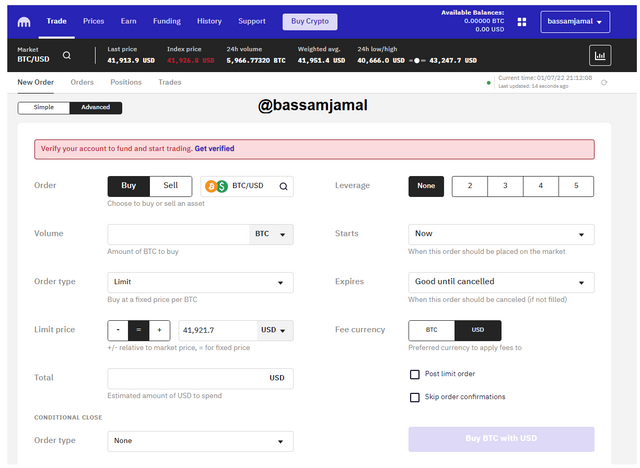

It is rather simple to execute a block trade on the Kraken platform. To begin, we must register an account on the exchange, that I have done the following;

Follow the procedures underneath to execute the deal;

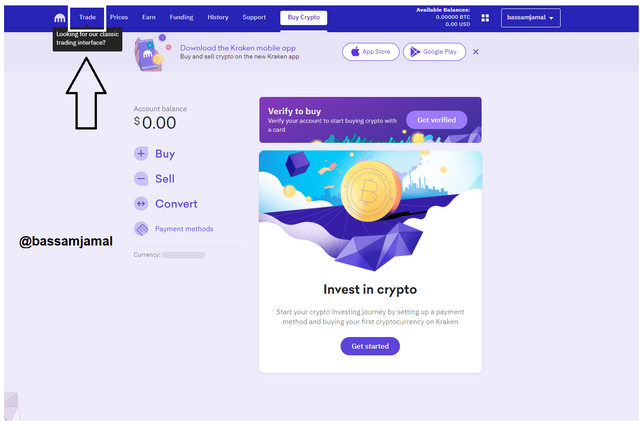

- After logging in, select the Trade tab.

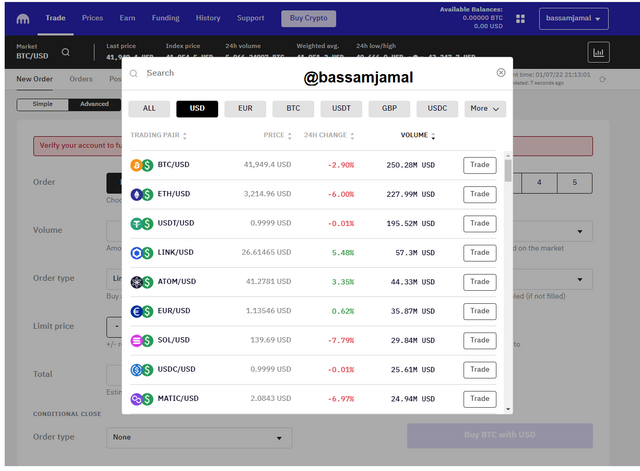

- Navigate to the Advanced tab within New Order. Next, to locate the dark pool pairings, click the Pair search function. The dark pool pair must be categorized as Dark pool.

- We cannot see this possibility since the Dark pool is presently inaccessible on the Kraken exchange. The picture beneath depicts what and it used to seem also when the dark pool was accessible.

5. What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

A Decentralized dark pool is, in principle, the very same principle as a conventional centralized exchange dark pool, with a few practical modifications. A decentralized dark pool enables firms to confidentially place large-scale transactions without the interference of a 3rd person. This means that orders submitted and performed through a decentralized dark pool are not only largely undefined but also to any broker or middleman. As a result, decentralized dark pools are entirely secret.

Unlike traditional decentralized trading methods, a decentralized dark pool does not rely on liquidity pools to complete deals. This sort of dark pool is based on Atomic swaps, which are peer-to-peer exchanges between blockchains. This function facilitates trades here between pairing that would otherwise be inefficient because the trade is between 2 parties at a specified price. As a result, slippage and any residual marketplace impact are avoided.

When you make the purchase, it is split down into so much smaller bits that are ready to be paired. Following that, other nodes receive these parts and strive to complement them. Matching parts are saved, but mismatched ones are ultimately matched until the order is processed. The fees linked with the operations are given to the networks that fulfill these operations.

Zero-Knowledge Proofs

Zero-knowledge proofs, also known as Zero-knowledge protocols (ZKP), allow a person participating in a process to offer proof of that activity without necessarily divulging critical transaction data. It is an authentication protocol in which credentials are not shared, preventing them from ever being taken. Private discussions and transactions are safe, private, and secured since information may be confirmed with ZKPs without revealing data to anybody other than the persons concerned. Private transactions can be published to the blockchain while remaining private because ZKPs establish a means for effective transaction confirmation without disclosing any confidential information utilized in the operation. The verifier can demonstrate to the second party the veracity of a claim, the validator, without exposing any more details other than the veracity of the supplied assertion In short, decentralized dark pools are non-centralized dark pools; to acquire participation in such platforms, you do not have to submit personal data and information about yourselves such as a home address, birth date, and etc.

6. State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

The Ren Protocol is a very well program that provides a decentralized dark pool. Ren Protocol was established in 2017 as the Republic system by Taiyang Zhang and Loong Wan but was changed Ren Protocol in 2019.

The Republic Protocol Whitepaper states that the Ren (Republic) protocol is a decentralized dark pool project that really was among the first to use atomic swaps in the Dark pool paradigm. Whenever an order has been placed in the Dark pool, it is subdivided and dispersed to a network of Dark nodes via Shamir Secret Sharing. For the remainder of the procedure, this protocol launches two Ethereum smart contracts, The Registrant and The Judicial.

After it order has been split and spread across the dark nodes, the Registrar prohibits it from being reassembled by organizing the nodes in such a way that attempting to do so would be incredibly hard. The nodes then undertake a variety of computations in order to match the pieces with those of other order. The Judge uses Zero-Knowledge Proof to verify the calculations' correctness without exposing any knowledge regarding them. After the components of two orders have been appropriately aligned, and Atomic Swap for the crypto assets is launched.

According to my study, after Republic Protocol was rebranded as Ren Protocol, their attention switched to compatibility. There are presently neither any projects that provide a decentralized dark pool in an appropriate manner.

7. Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

Cryptocurrency exchanges are venues where anyone can sell or purchase crypto. Dark pool cryptocurrency exchanges are those that control access to their order books, i.e. there is no transparency.

A centralized cryptocurrency exchange acts as a middleman between both the seller and the buyer. Kraken, Coinbase, and other centralized exchanges are examples. Decentralized exchanges, on the other hand, do not require a third party because they allow users to use the peer-to-peer capability. This enables its users to conduct peer-to-peer transactions even without the requirement of a middleman. For instance, Blocknet and AirSwap.

Cryptocurrency centralized and decentralized dark pools are block transaction types that take place on both exchanges, with the main distinction being that one is centralized and the other is decentralized. A third party is involved in the centralized exchange dark pool. It differs from a decentralized exchange dark pool in that it does not need the existence of a third party. There is some disagreement on which dark pool marketplace is safer. It is vital to note that the decentralized dark pool provides its members with a higher level of secrecy.

There is a requirement for third-party assistance during the functioning of a centralized dark pool. However, no third-party involvement is required for the operation of a decentralized dark pool. Another difference between centralized and decentralized systems is that on a decentralized platform, you can execute flawlessly an order by just using a verified address, whereas, on a centralized platform, you must use a stop-limit order instead of an address.

8. Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

According to CoinMarketCap, on November 3rd, 2021, there was selling off of 246 BTC (valued around $15 million at the time) on Coinbase. This sell-off was executed via a market order, causing Bitcoin's price to decrease from $62,500 to $60,000.

I'd say the whale put a market order since he understood that other investors saw a limit order on the order book, they'd start selling off and his transaction would be canceled. Even though the drop was close to the end due to a big number of buy limit orders at the 60k level, it demonstrates how significant sales can move the economy. The enormous sell-off alone might deplete the market capitalization by millions of dollars. When normal traders notice such transactions in the order book, they start selling off their holdings as well, leading the value to plummet even further.

The whale should've used a dark pool to complete the trade. If a dark pool had been employed, the whale would've had the opportunity to put a limit order at a suitable price point. Other investors will not see the limits, thus there'd be no panic selling. The investor's order would have been fulfilled at his leisure, and the price of BTC would have not dropped as precipitously.

9. In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

Whenever institutional traders require substantial volumes of securities to be exchanged, such enormous orders are likely to have a significant impact on the market. Imagine a firm chooses to sell worth of shares; the likelihood of the stock price collapsing when these equities are exchanged on a public market is considerable. This leads to poor price implementation on the investment's path, as well as increased market instability.

Considering the volume of the trades done in dark pools, we would ordinarily anticipate such transactions to influence the cost of the item according to their own. A massive sell deal of, say, 5000 BTC would vastly outpace the smaller purchases we see on exchanging order books, which is generally meant to cause supplies to exceed demand, causing the price to decrease. When using a dark pool, meanwhile, a large sell order is fulfilled when it is paired with a buy order of the same size. This equalizes the dynamics of supply and demand and hence has no effect on the pricing.

10. What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Advantages

Since Limit orders are filed at a price determined, the Dark pool helps to avoid slippage.

The Dark pool facilitates direct transactions among assets that would otherwise be illiquid.

The utilization of the dark pool conceals whale intents from the general population. This would dampen sentiment and avoid large price swings.

The usage of dark pools provides traders with an additional level of security.

Disadvantages

Modest merchants are unfairly disadvantaged by the utilization of the dark pool. This is due to whales having the ability to submit orders at a price point that differs from the market rate and have them implemented at that level.

If whales start using dark pools, the liquidity in the public market will suffer substantially.

There is a lack of openness because the order book is hidden.

Conclusion

The dark pool is highly beneficial, as seen by its applicability in the financial markets. Despite the fact that the innovation has been demonstrated to be valuable, it is still not very practical in the crypto realm. I feel that a handful of improvements can be done to make the notion completely operational in the crypto arena. Considering that bitcoins have the secrecy function, this dark pool approach would greatly enhance this characteristic.