[Trends] - Crypto Academy / S5W3- Homework Post for @reminiscence01".

a) Explain your Understanding of Trend Reversal. What is the benefit of identifying reversal patterns in the Marke ?

Trend simply means the prevailing direction or movement of a price within the market at a point in time. We all have a tendency to understand that the market moves in waves; Once the custodian area unit within the market, they will try and push the price up, and sellers may also wish to push the market down. If the custodians overcome them, the price would appear to be moving significantly downwards, so there is a situation where, shall we say, the prevailing trend is up.

In the same approach, once sellers push the price down and a tactile effect of patrons is felt within the market, the price appears to be moving significantly downward, so the prevailing trend is a downward or pessimistic trend. . , So, in short, the trending market area converges in 2 phases: Upward/Bullish and Downward/Bearish trend. Once the price moves from low to high in a very clear direction, i.e. from a low concentration of price to a high concentration of price, that market is said to be in a very bullish trend. On the other hand, once {value|value| AN of quality value} moves from a high concentration of value to a low concentration of value, that market is alleged to be in a very pessimistic trend.

Importance of specific reversal patterns within the market

It is not enough to understand that the trending market is bullish and pessimistic. An honest trader should be able to install them. And that they will establish them only when they understand their way or pattern. It is pertinent to understand that the trend will not continue, there will be a time within the market when a specific trend will reverse, i.e. it will revise. Which is named as trend reversal.

Once a trend reversal has occurred, traders use area unit multiple identities to understand it. However, these patterns must be learned so that traders can take profits after the trend is closed. Trend reversal is important to protect traders from entering the market once they do not envision entering. Specific reversal patterns can modify the United States knowing that a specific trend is at the point of revision, and knowing that the United States can wait to be part of the new trend.

When you see a reversal pattern in the market, you will undoubtedly make additional gains than losses. This often results in you not getting caught in the market after the trend-riding area unit, as you would have taken profit, and become part of the new trend. Therefore, the importance of identifying or isolating reversal patterns cannot be overemphasized.

b) How can a fake reversal signal be avoided in the market? (Screenshot needed).

The patterns we use in forecasting price movement do not appear to be 100% accurate, so care must be taken to avoid trade selection backed false signals. As we learn within the lecture, we are able to use several strategies such as market break, trendline break, double prime and double bottom formation, yet divergence to spot trend reversals. Wherever we see this pattern type, there are square measure cases, although there will be no reversal thanks to the fact that this reversal of the pattern was simply spurious. During this case, we do not want to rely only on patterns, however we do want to include technical indicators to validate confluence or settlement before making a call. I will be able to hunt down the RSI indicator within the chart below to illustrate this.

As we know, the RSI uses thirty fields consisting of seventy associate degrees to indicate whether a plus is overbought or not. Associate degree plus one that is overbought {expected|expected|affiliated degree} is predicted to reverse to the downside and a plus that is oversold is predicted to reverse. In the screenshot above, we see a double prime structure type on the STEEMUSDT chart, indicating a reversal. However, this reversal is not valid. Let the US state make a case for it. We are able to see that when the primary top of the structure was built, the RSI was stone-broken that exceeded seventy, indicating that STEAM was overbought and, therefore, STEAM was very downstream. Reverse in retracement. But when the second prime is formed, the RSI does not show oversold, which suggests that there will be no trend reversal.

Give a detailed explanation on the following Trend reversal identification and back up your explanation using the original chart. Do this for both bullish and bearish trends (Screenshots required).

a) Break of market structure

The economic structure for an optimistic trend reflects the cost of building higher peaks and lower lows. It simply means that the price is making higher highs and lower lows than the previous highs. This means that the bull zone unit is still accountable and is driving the trade higher. Failure to realize new highs signals a clear phase within an optimistic market structure, indicating that the bulls are losing power and taking over the sector unit market. Let us consider the bottom of a market structural break within an optimistic trend that led to a reversal from optimistic to negative.

The price area unit was unable to provide another low level at the top of the 1-hourly ETHUSDT chart. What's more, the latest low objective of the structure extends all the means of the previous low objective, and this is often where the arrow stops. The new bottom may not be below the previous low during an optimistic market structure. As a result, the continuation signal is broken, and the downside trend reverses.

The economy price touch to the downside trend is really supported and shows a lower low. Price should make higher highs and lower lows than previous highs and lows. This means that the bears have taken over the management of the market and sector units and are forced to reduce costs. Failing to discern lower highs and lower lows indicates a clear phase within a negative market structure, indicating that bulls are taking over the unit market. Below is a look at the negative market dynamics leading from a pessimistic to an optimistic reversal.

One hour shubusdt chart the value is unable to trace the lower lows. A pessimistic market breaks out once the price breaks below the next low. This indicates that the market's bull zone unit takeover management which is an upward reversal is at hand.

b) Break of Trendline.

A trend line can be a line that follows a selected trend. This is the purpose where the value is returned once the pool is returned. The price cannot go down the road as the trend continues, however once it does, the trend reverses.

An optimistic trend is a support that prevents prices from moving up as custodians gain the market. It is drawn on the bottom of the candles. Once this support line is broken, the plus has changed direction to travel in an extreme downtrend.

A pessimistic trend is a resistance that prevents the price from moving up as excess individuals sell after the price rises and closes on the road. It is drawn at the highest level of the candles. Once this resistance line was broken, the plus changed direction to travel in an associate degree uptrend.

Divergence

An optimistic split and a pessimistic split are therefore 2 styles of divergence.

Bullish Divergence:-

During an optimistic divergence price makes lower lows, while our analytical signal opposes price action by touching higher highs, indicating that selling is declining and buying power is increasing as bulls take control of the market. are trying. This gives traders the possibility of an associated upward turnaround for their entry and the option to acquire the asset at a lower price and sell at a profit once reversed.

The RSI and price are trading higher on the 4-hours XRPUSDT chart, while the RSI is forming higher lows as price makes lower lows. It means the absence of convergence, which means that a pattern is in the opposite direction. We see that this happens when divergence lasts for a long time.

bearish divergence:-

Our signal turns lower, indicating that buying momentum is weakening and deflationary pressure is building up as bears seek to take control of the market. This means that a trend reversal is unfolding, and in addition to learning from a worsening situation, traders use this signal to exit with a profit before it worsens.

Price movement and the RSI are at the top of the 1-hour ETHUSDT chart as the RSI is actually forming a support while the price is moving higher. This suggests that buying pressure is easing and professionalism is on the rise, meaning the bears are taking over the market and the optimistic pessimists are ready for a reversal.

d) Double top and Double bottom

double top :-

Double Top has its own way of detecting trend reversals in the market. A double top notch occurs in an optimistic market. It gains a new high once, while not breaking the previous high. This reflects weakness within the custodian forces and that in itself could not push the price higher than the previous high.

To be double top , these criteria must be met

• The price should not exceed the previous high.

• The price of the new high should not exceed the previous high.

The image uploaded below shows an associate degree example of a double top notch on a chart.

double bottoms

Double bottoms is the exact opposite of double topnotch. While the double topnotch occurs during an optimistic trend, the double bottom occurs during a pessimistic trend. In double bottoms, Worth fails to make a brand new low that is below the previous low. This means that the previous low has been re-examined. This chart pattern indicates a trend reversal from a pessimistic trend to an optimistic trend.

For a double bottom to be valid, the latter conditions must be met.

• The new low should not be higher than the previous low.

• The price of the new bottom should not be less than the previous low.

The image uploaded below shows an associate degree example of a double bottom on a chart.

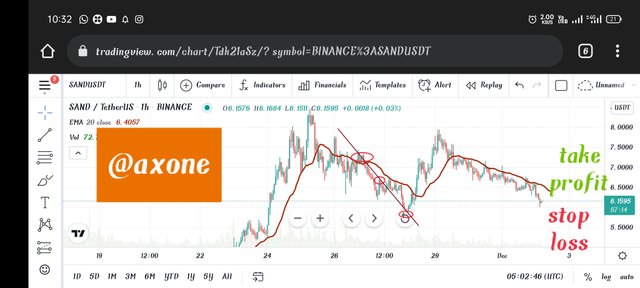

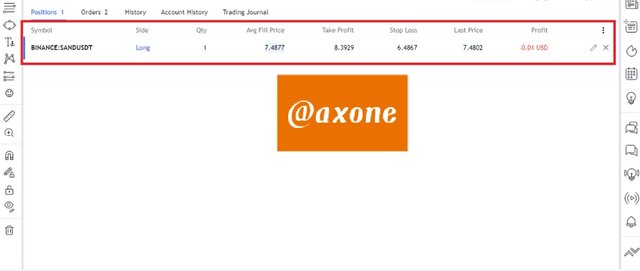

place a demo trade using any crypto trading platform and enter a buy or sell position using any of the above mentioned trend reversal/continuation pattern.

There is a break above the line structure on the 1-hour QNTUSDT chart, and a trend reversal has been detected while it is still early. Worth was unable to make lower lows and instead made higher highs, meaning the bulls are managing the square measure market and have turned pessimistic for a positive reversal.

It opened a long position with a stop loss at 197, which is just below the recent breakout when the trendline break signal sees a change from a pessimist to an optimistic one. I decided to take advantage of the 213 greenback.

Conclusion:-

A trend reversal pattern is the identification that a selected trend is close to reverse. They help give the North American country the opportunity to trade a replacement trend for the need to profit from the current trend and presence that is forming. It is important that every dealer is aware of how to accept them so that they can position themselves for the opportunity within the market. During this work, I have actually mentioned about four identities (Market Structure Breakdown, Trendline Breakdown, Divergence, Double High and Low).

.png)