Steemit Crypto Academy [Beginners' Level] | Season 4 Week 3 | The Bid-Ask Spread (Part II)

Hello Ladies and Gentlemen, Boys and girls. Welcome to the 3rd week of the 4th Season of the Crypto Academy!

Last week we had a successful class with a lot of good entries. The enthusiasm for last week was massive and it was very encouraging to me.

For this week, we would advance in what we have already introduced. On the Part two of this class, we are going to the exchange starting with The Order Book.

The Order Book

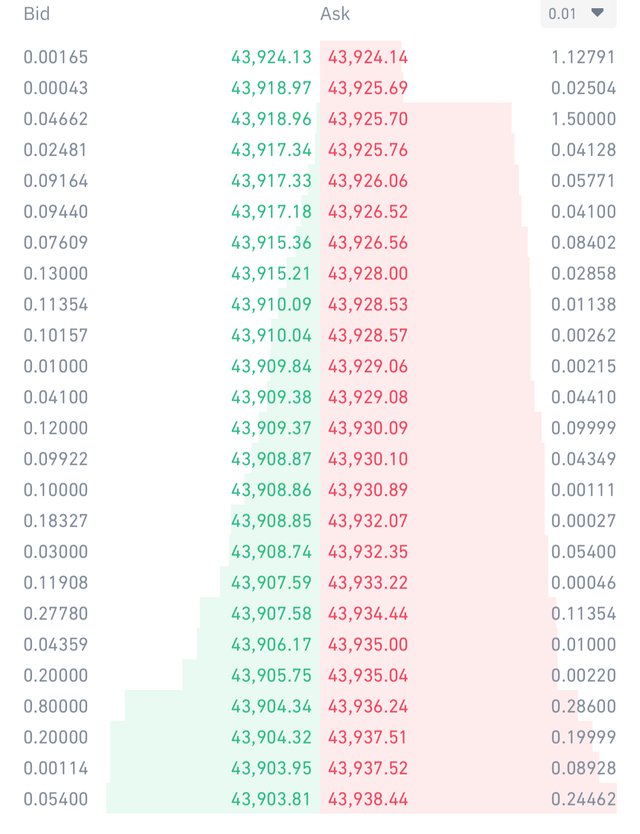

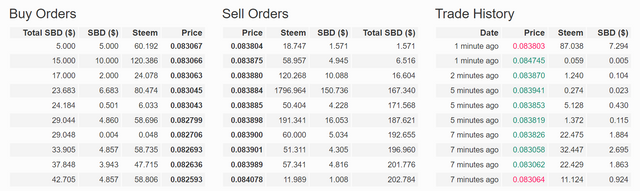

The order book is simply a list of every open order for a particular asset pair. In the case of exchanges, the order book is electronic and is arranged by price. It displays the number of buy and sell orders for a particular asset. Given this, the order book has a bid side and an ask side.

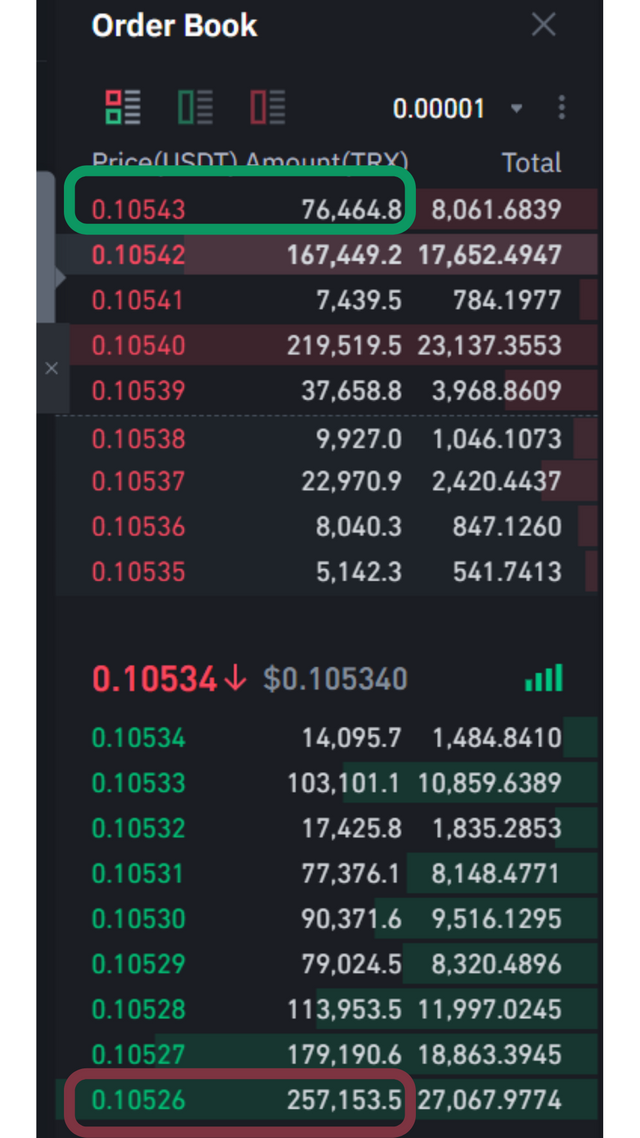

The green side from the image above is the bid side. The side contains all the buy orders and the information associated with them. We can see columns for the bid prices, amount and the total cost (Amount x Price). The highest bid price is always at the top

The Red side is the Ask side which is made up of Sell orders. Just like the bid side, there are columns for prices, amount and the total. The Lowest ask price is always at the top of the order book.

The order book is a very important tool used in exchanges today to enhance the transparency of crypto transactions. Apart from that, this tool can be used for the following;

1. As a Liquidity indicator: Just as we mentioned in the last class, the bid-ask spread is a measure of liquidity in the crypto business. Although not very ideal, this spread can be calculated just by looking at the order book and the prices therein.

2. To determine a prevalent market direction: Mainly examining the Amount column, we can determine whether a market is bullish or bearish in the short and long run. More orders on the bid side would indicate a high enthusiasm in the market and so a potential price increase. The opposite would be the case for more orders on the ask side.

3. To determine support and resistance levels: In very simple terms, a support is a price level that an asset seems not to go lower than. At that point, the price always hits it and begins to rise again. A Resistance is a price level that an asset seems not to go higher than. At that point, the price hits it and begins to fall again.

Coming to the order book, because support and resistance levels are hard to break, there would be more orders at that price level. For bid orders to gather at a particular level, it would mean a support exists at that level. For ask orders to gather at a particular level, it would mean a resistance exists at that level.

Market Makers and Limit Orders

In the last class, I briefly mentioned the Market Makers. It is necessary to bring up the concept again for this because these people are very important in the crypto market.

You see, the order book is filled with orders that are waiting to be filled up. Different orders are collected from different price levels and grouped accordingly. These types of orders are called Limit Orders.

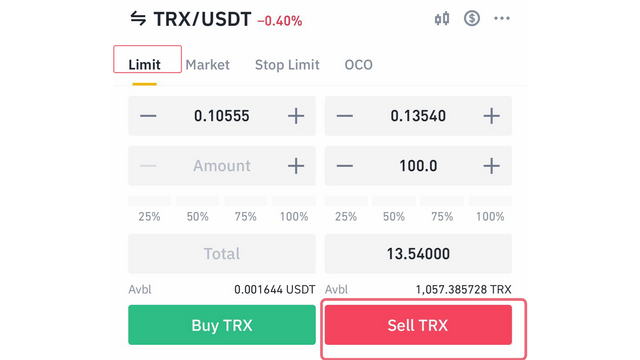

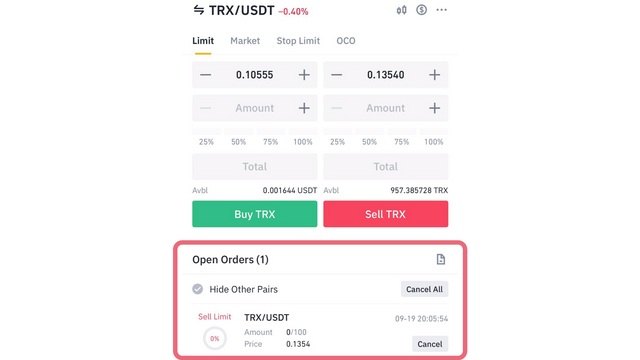

A Limit Order is one that is placed for a particular amount of an asset to be bought or sold at a specified price. Once placed, they are arranged on the order book until they are filled. A person that places this type of order is called a Market Maker.

A Market Maker is someone that quotes their own price in a market. These people do not have to have their orders filled at the current market price because the specify their preferred price level to the exchange. They are the ones that buy at the Bid price and Sell at the Ask price.

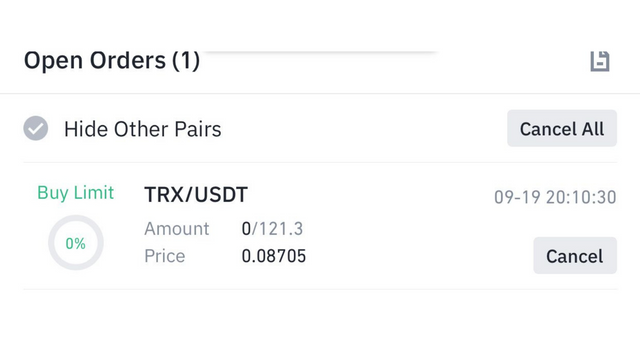

In the illustration below, I act as a market maker placing Buy and Sell Limit orders with the TRX/USDT pair;

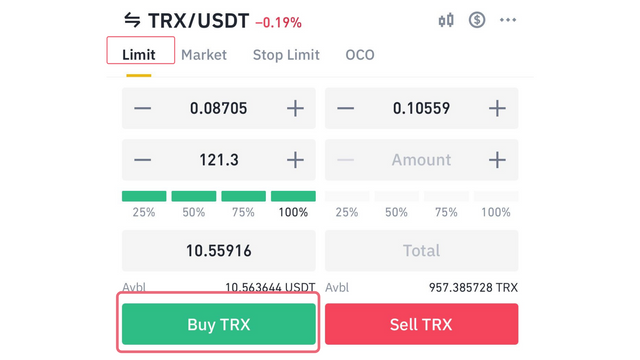

Market Takers and Market Orders

Another type of order that can be initiated in a market is called the Market order. As the name goes, this type of order is one that is filled instantly and at the current market price.

The people that initiate this type of order are called Market Takers. They are called Market Takers because they literarily take the market as it is without a say on the price. In order words, they do not haggle. So, they buy at the Ask price and Sell at the Bid price.

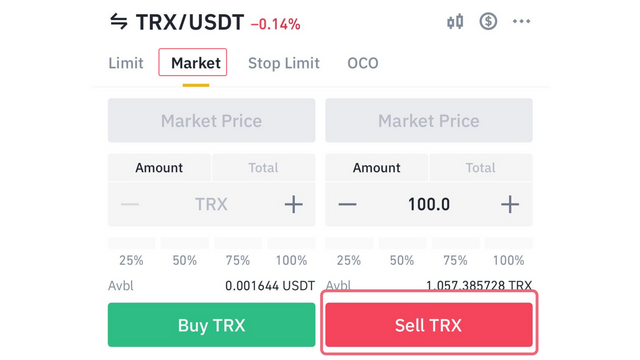

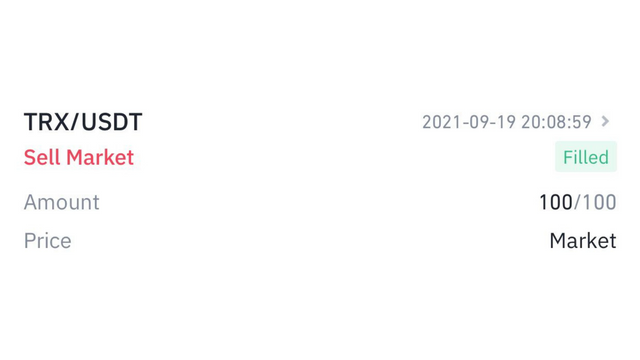

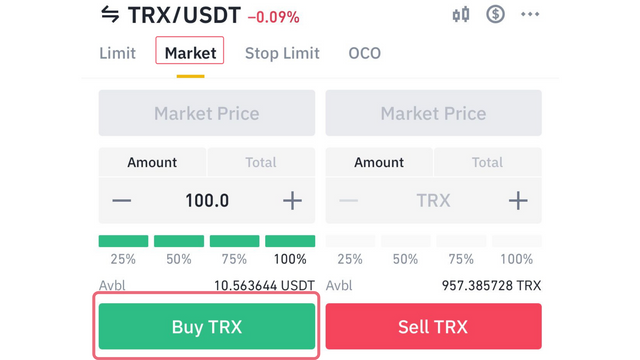

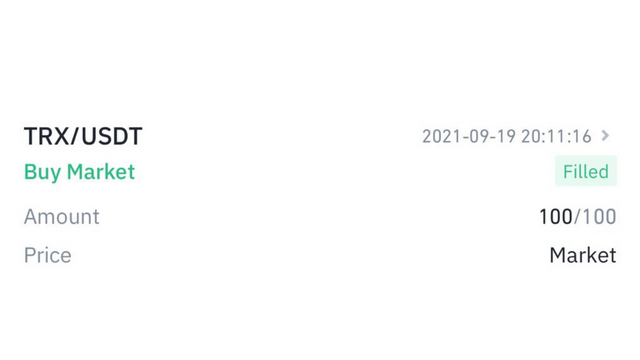

In the illustration below, I act as a market taker placing Buy and Sell Market orders with the TRX/USDT pair;

The Relationship between Makers and Takers

As I mentioned in the previous class, the Limit orders initiated by the market makers provide liquidity for an asset. A lot of Limit orders would mean a lot of standby orders at any price level. This would mean that there would be a ready market for the Market Takers and Market orders can be filled easier and more efficiently. Now, market takers come in with their market orders and are matched to the limit orders. Once matched, these market takers accept the price of the market makers and both orders are filled. In a statement, market makers provide the liquidity while market takers take the liquidity.

The Steemit Market place

For those of us that have been on this platform for a while, we should be familiar with the Steemit Market place. The Market place is where we go to to exchange steem for SBD and vice versa. To access the Market, -Go to The Steemit wallet, -Click your Steem or SBD balance, - Click on "Market". You should see this;

If you scroll down you would find the order book.

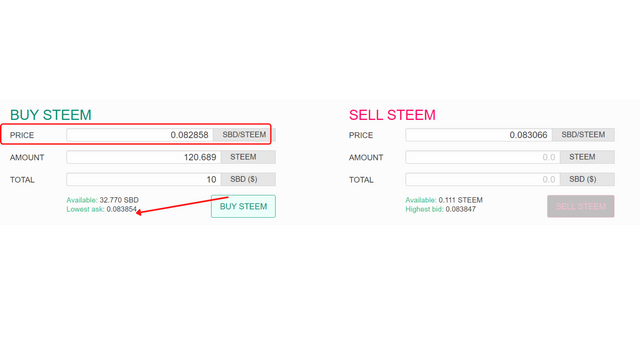

The Market place is actually very straightforward, there are areas to buy and sell steem with and for SBD. For this demonstration, I will be buying Steem.

The Market place does not have an outright mention of market or limit orders but we can choose to accept the lowest ask for a buy order or set our own.

Setting the Ask price

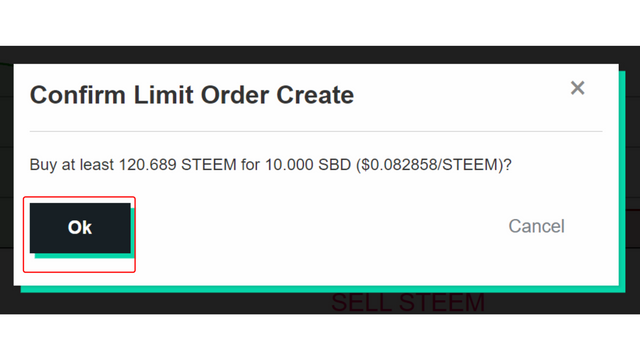

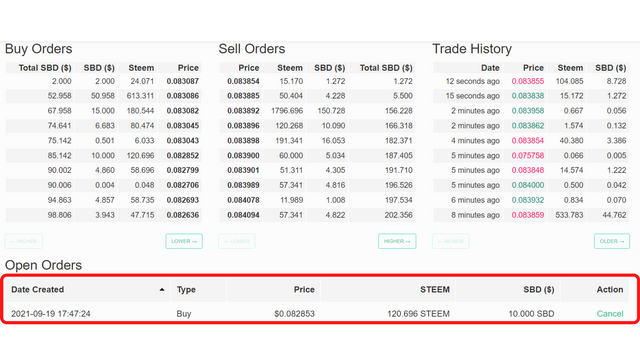

From the image below, I ignored the Lowest ask of 0.083854 and set it to 0.082858.

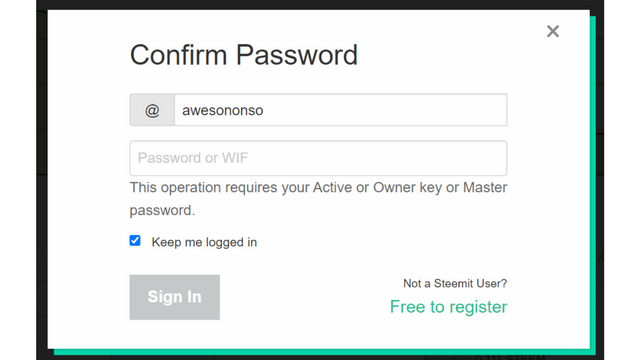

I confirmed the Limit order and signed in with my Active Key.

Doing this means that I have set the limit that I want my order to be filled. I specified the price of SBD to Steem I would like to trade. The order is the recorded in the order book as shown below.

Accepting the Lowest Ask

In this case we accept the rate given. There are two scenarios that can occur in this case - the order is either filled immediately or it is not.

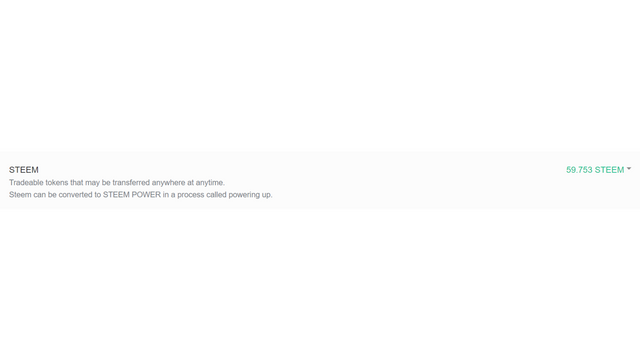

When the order is filled immediately it means that the lowest ask was maintained throughout the transaction as shown below;

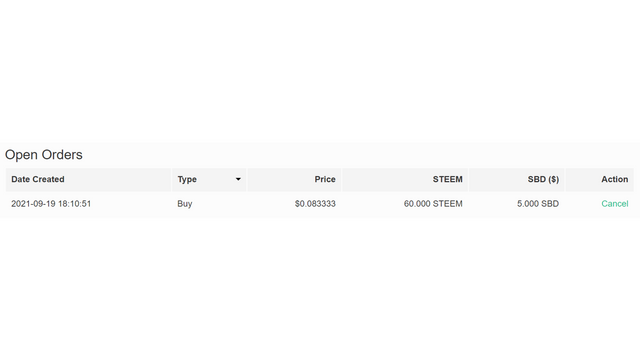

However, when the order is delayed, it means that the lowest ask had changed during the transaction period. In the illustration below I accepted the ask price of 0.083334. After placing the order, the ask price changed to 0.083827.

Because the ask price had changed, the order would be added to the order book until that ask price is attained again.

The Mid-Market Price

To end this topic, I will like to introduce this concept. To recap, the Bid price is the highest price a buyer is willing to pay for an asset while the ask price is the lowest price a seller is willing to sell their asset for.

The Mid-Market price is simply the middle value of the ask and bid price. It can also be called Mid-Market Rate or Mid price. It is calculated by taking the Median of the Bid and Ask price.

Mathematically;

Example;

The highest bid of TRX/USDT is 0.10543USDT and the Lowest ask is 0.10526USDT as shown below;

The Mid-Market value would be = (0.10543 = 0.10526)/2

=0.21069/2

=0.10535 USDT.

Conclusion

The Order book is a simple tool that is mostly overlooked by newbie traders. Having the knowledge of how this exchange component works can really improve one's crypto game.

It is also important that we understand the concept of Market Makers and Market Takers as we delve into trading. The market order is good for traders that do not mind the market price while the Limit order gives us more control in our executions.

Homework

Define the Order Book and explain its components with Screenshots from Binance.

Who are Market Makers and Market Takers?

What is a Market Order and a Limit order?

Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

Rules/Guidelines

- This Task will run until 25th September 23:59 UTC.

- Your article should be at least 300 words long.

- Make sure your username is on the screenshots provided.

- Please try and understand the topic before performing the task.

- Make sure you post this assignment in the Steemit Crypto Academy Community.

- Use the hashtags #awesononso-s4week3 and #cryptoacademy among your first 5 hashtags and tag me @awesononso.

- Plagiarism and content spinning is not tolerated in the Academy. Repeat offenders will be blacklisted and banned from the academy.

- All outsourced images should be copyright free and properly referenced.

- Only students with a minimum of 200SP and a reputation of 55 are eligible to participate. You should also not be powering down.

- Your homework title should be The Bid Ask Spread (Part II)- Steemit Crypto Academy- S4W3- Homework Post for @awesononso

My Comment section is open for any questions or suggestions.

Thank you.

Hello professor, thank you for this useful information. Also, I don't want to be arrogant, but I found a very small mistake in your article.😇😇😇

Hey.

It depends on the preference set. For a normal horizontal order book, it would be top.

Please check the post again. I added another image.

I've never seen it like that. Thanks for the explanation. With all due respect, I'm going to ask you one more thing. Is there something wrong with the mid-price calculation, too? 0.10543 is not the lowest ask price..

You're right! I've corrected it. Thanks for being very observant.

I appreciate it.

That's what these courses are for. First we learn, then we do homework. I noticed that while I was doing my homework, I wanted to point out one thing about calculation. it is still not true I think. That's the highest ask and lowest bid, not the highest bid and lowest ask.

Thank you, Professor.

The image below was used to replace the image in the last calculation. The values were also changed. Please check that section if you had gone through this lesson before this comment was posted.

Good evening Prof. @awesononso.

This art is not quite clear sir.

The Mid-Market value would be = (0.10534 = 0.10526)/2

=0.21069/2

=0.10535 USDT.

That is the calculation on the lesson, I can't find the "0.10534" on the image.

Pls, the buy order at the market place is not going through.

Also, pls, is it highest ask price plus lowest bid price?

Am not cleared on this question 7 @awesononso

Greetings professor, excellent explanation of this class.

Good morning Prof

How about someone that doesn't own a binance account.

You can easily download one and register now. It will be of great help to you. More to the point, every user on steemit is expected to own an account where they can transfer their earnings into. So I will urge you to kindly download the Binance Exchange App now.

@lukman1

Not every user uses the binance exchange bro

Wooow thank you professor for such a wonderful lecture

Thank you very much Prof. @awesononso for this interesting lesson.

I will plead with you to decrease the Buy Market order of the TRX/USD (Maybe at least $5) so that some of us can partake.

Thank you.

Hey.

The minimum amount for a trade on Binance is $10. I made it $15 for more leverage.

Okay.

Thanks for the clarification

great lesson can't wait to submit my task

Hello professor what about us that do not have SBD currently.

You need to have at least 1SBD to perform the task. It is mandatory.

Okay. Thanks for the response.

Help professor, what about us that has no money in our binance app? What do we do

hello friend, i have followed you on steemit, please be kind enough to follow me as well. lets make steemit a great community together. thanks & regards