Steemit Crypto Academy [Beginners' Level] | Season 3 Week 8 | Blockchain Rewards

Greetings yet again everyone and welcome to the 8th week of the 3rd season. If you’ve made it this far I’d like you to give yourself a little pat on the back. You’ve been doing great!

The past weeks have been really eventful. We’ve been able to learn a lot and done our best to produce good content on tasks given. In the academy, we look out for quality and reward hard work and actual effort.

Speaking of which...

This week we’re going to be looking at a topic I call Blockchain rewards. To keep it simple enough, our focus is on Bitcoin and Steem Blockchains. On this topic we would cover Mining, Bitcoin Halving, Inflation rate and supply for Bitcoin and Steem and other fun stuff.

Without wasting anytime let’s get into it.

Mining

When you hear the word “mining” what comes to your mind? Pickaxes, headlamps and Gold?

Well, that is probably where the idea for the term came from as it relates to bitcoin and other cryptocurrencies. The idea of Gold mining is to get some Gold of course. In crypto however, mining is not just getting coins. Nowadays if we hear the word mining we just think of new coins but the process is a lot more than that.

The Bitcoin Blockchain is an immutable, distributed digital ledger or database. On this database, everyday transactions in Bitcoin are stored and open to the public forever. The process of adding these transactions to the ledger is done by Miners.

So now we can say that Miners are people that verify transactions and add valid ones to the ledger (blockchain). What happens here is that transactions have to be verified up to the intended block size to make a whole block. For the SegWit upgraded network it would be 4mb of valid transactions while the regular network it would be 1mb.

But what do I mean by valid?

A valid transaction on the blockchain is one free of any attempt of double-spending

-an attempt to use a coin twice.

You can imagine the stress of checking the validity of tons of transactions, stacking them up to make up the block size of 1mb or 4mb for SegWit. But that’s not all.

After the transactions have been verified and the block is formed, it has to be added to the blockchain.

Recall that blocks on the Blockchain have their own unique hash. This Hash is what links the block to its predecessors all the way down to the Genesis block.

This new block needs its own hash in order to fit into the blockchain. To add the block a miner needs to show Proof-of-Work by discovering the right Hash. Miners compete with their systems to find this Hash. The faster your system, the more chances you have to get the right hash. This is where the special Bitcoin Application-Specific Integrated Circuit (ASIC) Miner comes into play.

Once upon a time a regular PC could be used to mine Bitcoins. However, as Bitcoin mining is designed to become harder eventually the ASICs were developed. These special tech devices compute hashes at different rates in the hopes of getting the right hash. Very sophisticated devices compute hashes at a hashrate of several Megahashes per second (MH/s).

Is all this struggle worth anything?

Of course these people get something in return. When it’s all said and done, the first miner to get the right Hash gets to add the block to the ledger. For the effort, the miner is rewarded with a block reward of brand new mined bitcoins and the transaction fees of all the transactions in that block.

In essence, miners volunteer to validate transactions in the blockchain while lending their computational power to the blockchain’s security and integrity.

Inflation and the Bitcoin Halving

Newly “mined” bitcoins add to the circulation of the already existing coins increasing the supply of the currency. An increasing supply would normally mean that there would be inflation. Let me explain...

One of the qualities of money or any currency is that it has to be relatively scarce. Too much supply would lead to inflation meaning that the purchasing power of that currency would reduce. Supply is key in the calculation of value and this does not only include money. Gold and other precious metals have so much value because of their properties and also because they are hard to get. Think about it, water has a lot more value in the desert. In essence, value reduces when supply increases.

Bitcoin’s supply increases everyday so it’s safe to say that the cryptocurrency experiences inflation. However, compared to fiat money, bitcoin’s inflation rate is quite small and frankly negligible. Since other fiat currencies experience inflation faster than Bitcoin, the value of Bitcoin would increase faster when compared.

Let’s assume that $1 could buy 1BTC some years back. The dollar which would experience inflation faster than the bitcoin would eventually not be able to match 1BTC. The purchasing power of the dollar reduces so more of it would be needed to buy 1BTC. In other words, 1BTC would be able to buy more dollars.

Bitcoin’s inflation rate stays so small and even reduces due to some factors. I mentioned three below:

1. Difficult mining: As mining difficulty increases, the inflation rate reduces and so the value increases.

2. The capped supply of 21 million Bitcoins: The supply of Bitcoin will not exceed 21 million. That’s a really small supply amount compared to the trillions of dollars in circulation.

3. Bitcoin Halving.

What is Bitcoin Halving?

The Halving is a phenomenon that occurs every 210,000 blocks on the bitcoin blockchain where the reward for mining a block reduces by half. This is a very effective way of reducing the inflation rate of Bitcoin.

The Bitcoin halving has occurred 3 times as of the time of writing this;

- 2012: Halved from 50BTC to 25BTC.

- 2016: Halved from 25BTC to 12.5BTC.

- 2020: Halved from 12.5BTC to 6.25BTC.

Instead of having 50 coins added to the circulation every time a block is formed, now 6.25 coins would be added. As you can see, the inflation rate has reduced because new coins would be added to the circulation much slower now.

Effects of Bitcoin Halving on Bitcoin

- Reduction in inflation rate.

- A following increase in the value of Bitcoin.

Effects of Bitcoin Halving on other Cryptocurrencies

The entire crypto community always looks forward to the Halving event. The reason for this is because of Bitcoin’s Market dominance.

Bitcoin dominance is the portion of the total crypto market capitalization that is occupied by Bitcoin. Bitcoin, as the most important cryptocurrency right now, makes up most of the market cap.

When a halving occurs, the supply or inflation rate of Altcoins are not necessary affected. Still, mainly because of sentiments, we can expect these altcoins to increase in value as BTC moves in an uptrend.

How many blocks until the next halving?

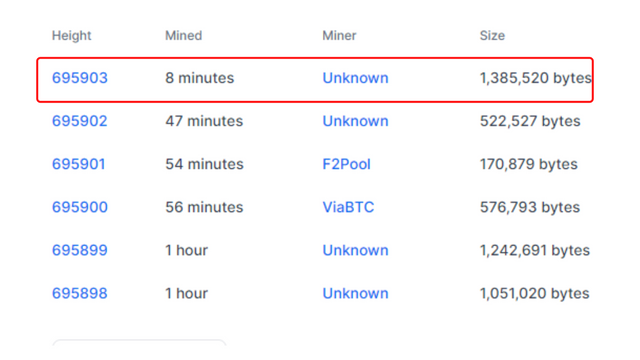

The screenshot above shows the block height of Bitcoin as of writing.

Bitcoin halves every 210,000 blocks. The next halving would be the 4th. Putting these into consideration we have;

Block height for the next halving = 210,000 x 4

= 840,000

Current block height = 695,903 blocks

∴ Number of Blocks until the next halving = 840,000 - 695,903

= 144,097 Blocks.

Steem Inflation Rate

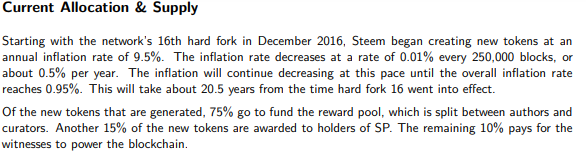

According to the Steem Whitepaper, the inflation rate of Steem is supposed to decrease steadily. The inflation rate was 9.5% as of 2016 and it reduces by 0.01% every 250,000 blocks.

This model is a good way of controlling the amount of coins that are in circulation and ensuring that Steem has some value.

How many blocks until the next Steem inflation rate reduction

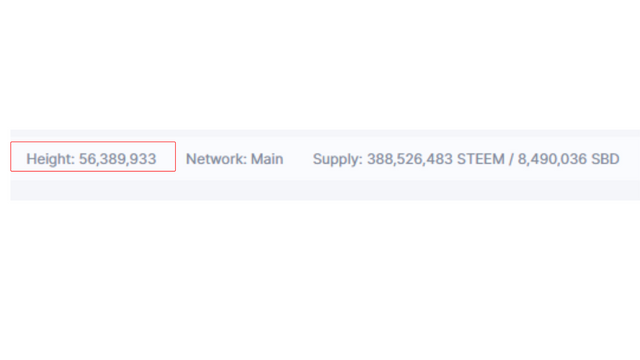

The screenshot above shows the block height of Steem as of writing.

The Steem inflation rate reduces by 0.01% every 250,000 blocks.

Current block height = 56,389,933 blocks

To find number of reductions so far:

56,389,933/250,000 = 225.55

There have been 225 reductions so far.

Take the next whole number to calculate the block height for the next reduction:

Block height for next reduction = 226 x 250,000

= 56,500,000

∴ Number of blocks until next reduction = 56,500,000 - 56,389,933

=110,067 Blocks.

Conclusion

Bitcoin mining has become really attractive these days with the heights the currency has attained. Although the process keeps getting difficult by the day, the rewards are a fair incentive for the work.

It was wise on Nakamoto’s part to make the currency deflationary for the sake of its success. The Bitcoin halving is a force to be reckoned with in the whole crypto universe.

Steem might be operating differently from bitcoin but the system is a smart one. Almost five years into it and it’s still serving the blockchain efficiently.

Homework

In your own words, explain mining and block reward.

What do you understand by the Bitcoin Halving?

What are the effects of the Halving on miners?

What is the current block height on the Bitcoin blockchain? How many more blocks before the next halving?(Screenshots and Full working)

Do you think Steem’s inflation rate reduction can affect other coins? Why?

What is the current block height on the Steem blockchain? How many more blocks before the next 0.01% reduction?(Screenshots and Full working)

Continuation of last week’s work:

What is the current value of BTC on the day you are performing this task? If you made a purchase of $2,500 then,

a.) how many satoshis would you have?

b.) what is the value of a satoshi for that day?

(Show full working and correct to 3 s.f)

(1 satoshi = 0.00000001 BTC)What is the current value of BNB on the day you are performing this task? If you made a purchase of $30 then,

a.) how many Jagers would you have?

b.) what is the value of a Jager for that day?

(Show full working and correct to 3 s.f)

(1 jager = 0.00000001 BNB)

(Screenshots of current value should be provided)

Rules/Guidelines

- This Task will run until 21st August 23:59 UTC.

- Your article should be at least 500 words long.

- Please try and understand the topic before performing the task.

- Make sure you post this assignment in the Steemit Crypto Academy Community.

- Use the hashtags #awesononso-s3week8 and #cryptoacademy among your first 5 hashtags and tag me @awesononso.

- Plagiarism and content spinning is not tolerated in the Academy. Repeat offenders will be blacklisted and banned from the academy.

- All outsourced images should be copyright free and properly referenced.

- Only students with a minimum of 125SP and a reputation of 50 are eligible to participate. You should also not be powering down.

My Comment section is open for any questions or suggestions.

Thank you.

Hello professor @awesononso, I submitted my homework answers in this post steemit-crypto-academy-or-season-3-week-8-homework-post-for-professor-awesononso-blockchain-rewards

Hello @awesononso,

Here is my Homework Post

It's such an interesting topic Prof, but my confusion is in the previous week continuity, truth be told the questions are confusing to me sir

Was wondering to he same thing.

Hello prof. @awesononso pls reply my question sir

Hey there.

On your question...

In the previous week I noticed that a number of people had not mastered the topic properly and that one lesson was not enough. I introduced the questions as a deeper type of practice for knowledge sake.

You are not supposed to make any coin purchase but just to assume you did and then answer the questions accordingly.

Ok sir

It's a little bit tough but let me get to work

Educative topic .

Nice one ... write up

Thanks my Prof for this week's topic, but on the last week continuation, are we to do it along with this week's task?

The last week continuation is just to improve the knowledge of the students on part of the lesson of that week. You should do them together as stated.

Hola profesor la semana pasada envié mi tarea pero por error mío en las etiquetas no se pudo corregir por usted acá el link Gracias

https://steemit.com/hive-108451/@sonimar/crypto-academy-s3-w6-unidades-de-medida-nakamoto-y-wei-dai

Checked.

Please repost as I instructed.

Please should I added the last week one, since I am just starting.

Yes you should.

Hola profesor @lenonmc21 mi tarea aun no se corrige ,aqui le coloco el link https://steemit.com/hive-108451/@mayrelisvasquez/steemit-crypto-academy-season-3-curso-dinamico-para-principiantes-semana-7-or-analisis-y-trading-con-los-indicadores-oscilador

Hola @awesononso me gustaría saber si puedo participar en esta formación.

Sure you can.

Saludos profesor @awesononso, yo no participe en su clase anterior. Para esta clase si puedo participar? Lo pregunto por la continuidad de la tarea de la clase pasada...

Espero su pronta respuesta!!

You should complete the task including the continuation of the last class. You can go over the previous lesson to try and understand that topic.

I hope you understand.