Hot or Not? These Are the Most Popular New Smart Contracts

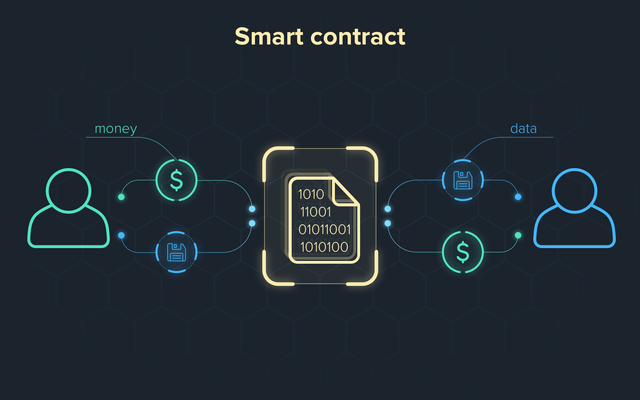

Smart contracts can be used to do practically anything, whether that be locking up tokens and allocating staking rewards, automatically carrying out trading strategies, simply controlling and keeping a record of token holders, or innumerable other use cases.

By tracking the activity of smart contracts, it can be possible to tease out new trends and hot projects, see where the smart money is moving, identify lucrative opportunities, and potentially avoid risks that others might miss.

In line with this, we took a look at the most popular newly deployed (7-day) smart contracts using Nansen’s hot contracts tool.

Here’s what we found:

Ethereum

This week’s top Ethereum smart contracts include:

SushiSwap’s OHM-WETH pool recorded $52 million in inflows in the last week. The sudden increase in volume traded through this pool in recent days has also led to a dramatic uptick in fees, increasing yields for OHM-WETH liquidity providers.

GnosisSafeProxy, a smart contract associated with the Gnosis Safe digital asset management platform, currently holds more than $21 million in RADAR tokens.

The Sipher Staking Pool smart contract now has a total of $13.7 million worth of SIPHER tokens staked, representing roughly a quarter of the token’s circulating supply.

The SIPHER-WETH liquidity pool contract on Kyber Network also joins this week’s hottest smart contracts. Around $5.5 worth of SIPHER and Wrapped ETH (WTH) has since been added to the pool.

In case you’re wondering what the token millionaire contract is, this is a wallet that controls more than $1 million worth of tokens. Since these are not associated with any known service, they will be omitted from the article.

Polygon

This week’s top Polygon smart contracts include:

Bloktopia’s 360-day token staking contract. The hugely popular VR-based metaverse project Bloktopia opened its BLOK token staking pools this week. In total, just north of $6 million worth of blocked was locked in the 360-day staking pool.

Bloktopia’s 90-day token staking contract. Bloktopia's 90-day staking pool proved to be less popular among BLOK token holders. Just over $2.4 million worth of BLOK is currently staked.

Binance Smart Chain

This week’s top Binance Smart Chain smart contracts include:

A smart contract associated with the recently launched League of Ancients (LOA) game has transferred more value than any other new BSC smart contract in the last week. It appears to be a distributor contract passing vested tokens to early investors

TrustPad’s 60-day IDO staking contract also made the list. Some 31.4 million TPAD tokens have now been staked and are earning a 45% yield. Nonetheless, TPAD has lost a third of its value in the last two weeks.

Avalanche

This week’s top Avalanche smart contracts include:

By far the most active new smart contract on Avalanche this week is associated with Roco Finance, a recently launched DeFi ecosystem. The contract now controls more than $10 million worth of ROCO, indicating it may be associated with a staking option.

The Trader Joe Pool: KITTY-WAVAX, also rapidly grew in size over the last week, with over $1.3 million in deposits.

Why Look at Hot Contracts?

As a cryptocurrency enthusiast or avid investor, you’re likely trying to find the next hot project. Tracking inflows to newly launched smart contracts can be one way to see what the smart money is doing — after all, early birds often catch the worm. Doubly so in the breakneck cryptocurrency market.

Nonetheless, it’s important to note that money moving into a new smart contract isn’t always a bullish indicator. Staking contracts often pay high yields while the token price collapses, liquidity pools don’t always generate a net profit due to impermanent losses, and large-scale investors don’t always strike gold.

With this in mind, we recommend doing your due diligence before following the money.