Crypto Academy Week 14: Homework Post for @stream4u | Technical Details on Reverse Strategy and CoinGecko Review

Trading without a strategy is like playing cricket without a cricket bat. It is futile. In fact, it is better not to trade at all than to trade without having a strategy.

Created by me on PicsArt

Created by me on PicsArt

The crypto professor @stream4u has shown us an impressive trading strategy that would definitely boost your chances of making good profit in the crypto market.

This strategy is called Reverse Strategy. Never heard of that name? Well, that's because the name was invented by the crypto professor. I have read the homework post over and over again to understand this strategy so that I can explain it in my own words.

So what is Reverse Strategy? How does it work? How do I identify bullish and bearish reversals? Let's start by answering these questions.

Technical Details on Reverse Strategy

First of all, take note that every trend, whether bullish or bearish trend, have moments of market reversals no matter how brief they may be. There is no bullish trend that have a straight ascending line and there is no bearish trend that have a straight descending line.

It is at those moments where there is a price pull back or a price bounce that a reverse (upward or downward change in the direction of price) occurs.

How It Works

After a 24 hours circle is complete, traders sell exit their positions which causes the price of an asset to fall. On the other hand, other traders take advantage of this opportunity to enter new positions which then make the price to go up.

Opening Price: It is the price of a crypto asset at the beginning of the day.

High Point: It is the highest price of the crypto asset during the 24 hours circle.

Low Point: It is the lowest price of the crypto asset during the 24 hours circle.

Closing Price: It is the price of a crypto asset at the end of the day.

Buy Position

The goal is to avoid trading during the day and then wait for the chart to complete a day circle. Once the closing price of the previous day is similar to the opening of the new day we can enter enter a position.

- Profit Target

Once the price of the crypto asset reaches the previous high, that is a sell signal. We can decide to sell. However, if you can be patient enough to wait till the price crosses the previous high point, then we can sell at a higher level and make more profit.

- Stop Loss

In the reverse trading strategy, stop loss should be set at the previous low point. This will protect you from losing your money.

Bearish Reverse Strategy

A long bearish trend occurs when the price of a crypto asset experiences a 20% loss (or more) in the value of an asset. When this happens, traders will be looking for a price bounce to exit their positions.

Bearish Condition

- Closing price of the previous day must be equal to opening price of the new day.

Screenshot of CRV/USDT pair showing a bearish reversal strategy

Screenshot of CRV/USDT pair showing a bearish reversal strategy

Bullish Reverse Strategy

A long bullish trend happens when the price of a crypto asset experiences a rise in value of 20% (or more). When this happens, traders will be looking for a price pullback to enter new positions.

Bullish Condition

- Closing price of the previous day must be equal to opening price of the new day.

Screenshot of ETH/USDT pair showing a bullish reverse strategy

Screenshot of ETH/USDT pair showing a bullish reverse strategy

From the above charts, we can see that there is always an opportunity to make profit in the market. However, it is important to be careful when using these strategies. Also, use stop loss to minimise risk.

Review of CoinGecko

Screenshot from Google Play Store

Screenshot from Google Play Store

What is CoinGecko?

CoinGecko is a website that has a list digital currencies (cryptocurrency). It monitors the price, the amount traded in a day, and where you can buy coins. It also provides other information about a cryptocurrency that can be used for sentimental analysis, fundamental analysis, and technical analysis.

You can find information about the coin's developers, the projects they are currently working, a chart of the cryptocurrency's value in the market and social information about the coin.

TM Lee and Bobby Ong co-founded this platform in Malaysia seven years ago. Now, it is one of the largest and popular site that provides data about cryptocurrencies.

How CoinGecko Can Be Helpful to Me in Crypto Market

In my opinion, CoinGecko can be very helpful in performing various analysis on a coin. For instance, I want to know if investing in SWIPE will be a good investment decision, I can use CoinGecko to do following:

- Provides Developers Info of Cryptocurrencies

CoinGecko can be utilised to find out information about the people that developed SWIPE. This is a very important criterion for fundamental analysis because some developers has a history of inventing a cryptocurrency that does well.

For example, some co-founders of Ethereum blockchain have gone on to create other coins that is currently doing very well in the market. One of them created Cardano, Polkadot and Kusama. These are well-respected coins that are of good value.

- Updates on Partnerships on a Coin

There is a feature on CoinGecko that provides the news update about cryptocurrencies. This feature is especially useful because it tells us if a coin just had a partnership with other respected companies. And as we have noticed, when something like this occur the token's price usually jump up.

- Gives Basic Data on Crypto

It also gives the basic information about the volume of transactions that a crypto have, the circulating supply, total supply and maximum supply. This information helps us to know if the coin is undergoing inflation or whether the coin is underpriced.

There are other fundamental analysis that can be done by using coin CoinGecko. Let's us now see another form of analysis that we can use CoinGecko for.

- Helpful for Technical Analysis

In addition to all the useful ways one can use CoinGecko, there is also technical analysis. You can find a chart on CoinGecko that shows a cryptocurrency current price. This information can be analysed to find entry and exit points in a chart of a crypto.

Exploring CoinGecko Features

Screenshot of me downloading CoinGecko App

Screenshot of me downloading CoinGecko App

For the sake of this review, I have decide to download the CoinGecko App and review the features available on it.

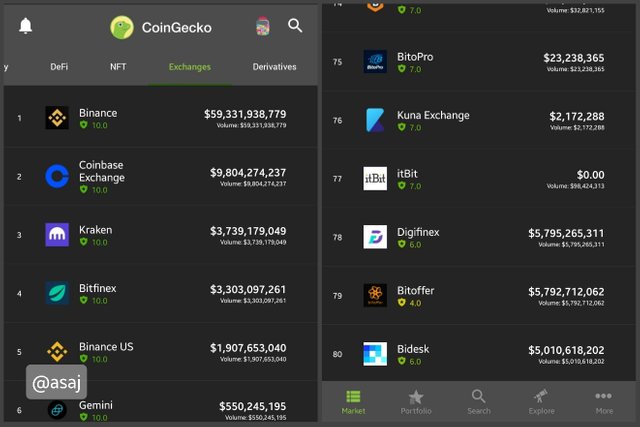

- Top Exchanges

Screenshot from CoinGecko App

Screenshot from CoinGecko App

I like this feature a lot because it ranks exchanges not just by the volume of trade but also by the trust score. CoinGecko can show you the top exchanges where you can buy crypto based on the amount of ongoing trades in the exchange. It also ranks exchanges based on the level of trust. This is especially useful for newbies who have little knowledge about the crypto space.

CoinGecko calculators a Crypto Exchange Trust Score by analysing;

- Exchange's API coverage

- Liquidity of the cxchange

- The operation scale of the exchange

- Trade volume

- Depth and spread of the orderbook data

- Number of visitors to the exchange's website

- How secured is the exchange

- Activity of support and dev team

- History of the exchange (passed events)

These are nine important criteria for which the trust of exchanges listed on CoinGecko is based on. These are essential criteria because a website that have been hacked before is likely to be hacked again.

For this reason, I appreciate the the Trust Score a lot.

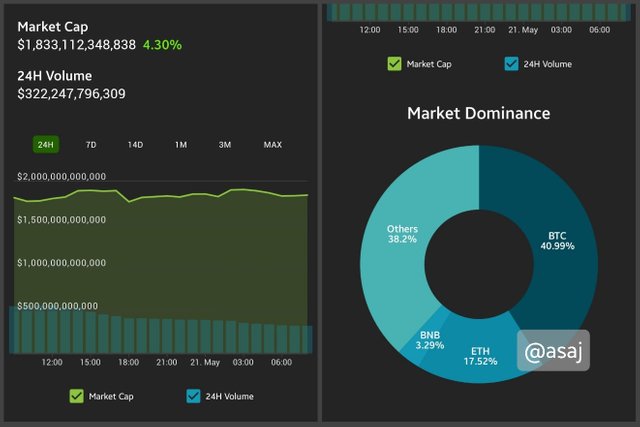

- Market Dominance of Cryptocurrencies

Screenshot from CoinGecko App

Screenshot from CoinGecko App

CoinGecko gives us the market dominance of coins in the crypto market. Market dominance represents the level of total value a particular coin have against other coins in the market. It can also be used to discover the current condition of the crypto world, whether we are in an altcoin season or a Bitcoin season.

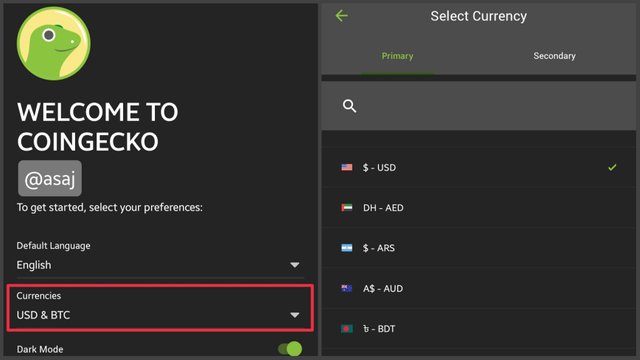

- Currency Toggle

Screenshot from CoinGecko App

Screenshot from CoinGecko App

As soon as you launch the CoinGecko App, you are welcomed and asked to choose a primary and secondary currency. In the screenshot above, I have chosen US dollars as my primary currency and BTC as my secondary currency.

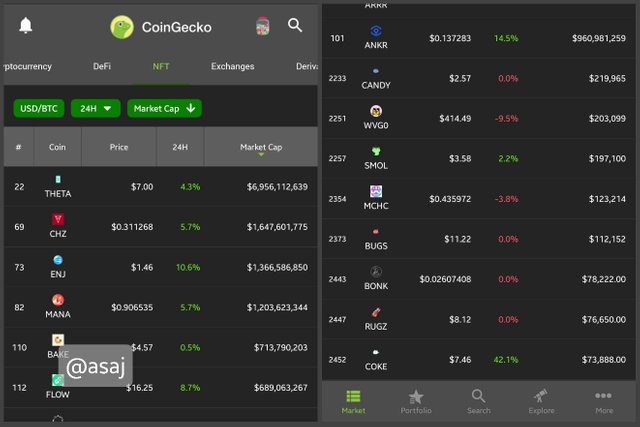

- Top 101 Coin by Market Cap

Screenshot from CoinGecko App

Screenshot from CoinGecko App

Market Capitalization is an integral aspect of a cryptocurrency. It is also know as the market cap. It tells us the total value of circulating supply of a specific coin. The CoinGecko App has a toggle at the top right corner of the screen that can be used to rank coin in ascending or descending by their market capitalization.

- Global Market Capitalization

Screenshot from CoinGecko App

Screenshot from CoinGecko App

In case you were wondering what the total market capitalization of cryptocurrencies is, worry no more. CoinGecko shows how much value the top coins in the crypto market has as at the time of checking it. When I checked, I discovered that the global market cap is currently $1,813,673,738,916.

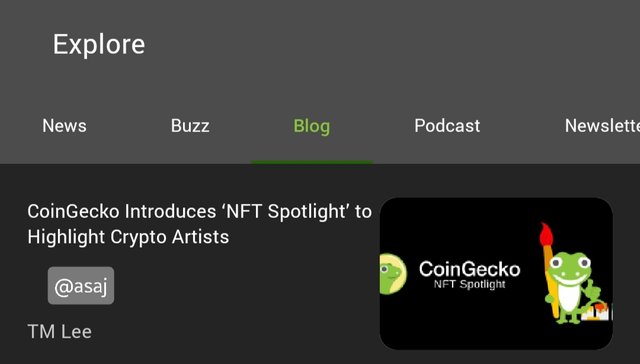

- CoinGecko Blog

Screenshot from CoinGecko App

Screenshot from CoinGecko App

On the explore section of the CoinGecko, there are various options to get information. The Blog section serves as a place to learn about CoinGecko. There several articles you can read to understand an aspect of the CoinGecko's feature. It also gives users recent partnerships and developments that have been enabled on the website.

- Top DeFi Coins

Screenshot from CoinGecko App

Screenshot from CoinGecko App

The word DeFi stands for decentralized finance. If you are looking for the top DeFi projects, simply go to CoinGecko and see for yourself. There are several DeFi projects in the market. Some of them may not succeed. So in other to increase the chances of investing in a successful DeFi project, CoinGecko App has listed them using the total value of the circulating supply of the DeFi (Market Cap of the DeFi).

- Top NFT Projects

Screenshot from CoinGecko App

Screenshot from CoinGecko App

NFT (non-fungible tokens) projects has enjoyed a good run of media publicity. Many users are interested in NFT projects as a result of the media spotlight. Before taking a step into this fuzz, have a look at the top NFT cryptocurrencies on CoinGecko.

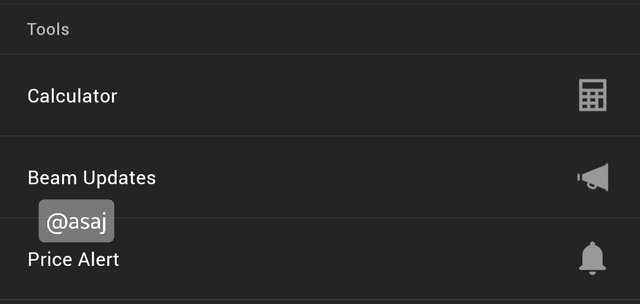

- Tools

Screenshot from CoinGecko App

Screenshot from CoinGecko App

The tools section on CoinGecko App has three features; namely, calculator, beam updates and price alerts. You can use the beam updates and price alerts to monitor any cryptocurrency of your choice. While the calculator can help you convert the value of one currency to another.

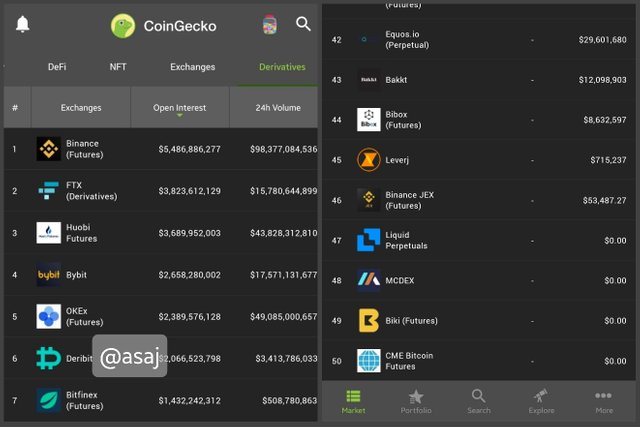

- Top 50 Derivatives

Screenshot from CoinGecko App

Screenshot from CoinGecko App

This has to do with futures on exchanges. CoinGecko ranks the futures based on the open interest in an exchange. In the screenshot above, we can see that Binance occupies the number one spot, while FTX takes nimber two.

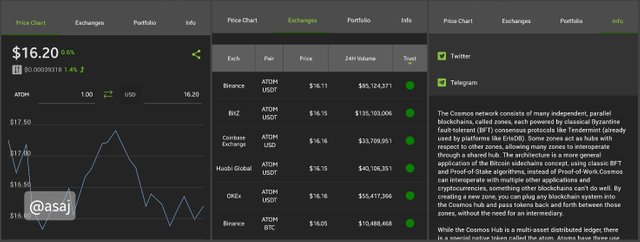

- Research Feature

Screenshot from CoinGecko App

Screenshot from CoinGecko App

Perhaps you are about to invest in a coin and you decide to conduct some research before making any move. CoinGecko provides just what you need to conduct the research. Once you click on a coin, you will find price charts, exchanges the coin is listed on, info that can help you with fundamental analysis and a portfolio section where you can keep track of your investment in the coin.

Weekly Price Forecast for Swipe (SXP)

Screenshot from coinmarketcap.com

Screenshot from coinmarketcap.com

| Price | $2.54 |

|---|---|

| Circulating Supply | 91,581,302.00 SXP |

| Market Cap | $232,618,679 |

| CoinMarketCap Rank | No. 166 |

| CoinGecko Rank | No. 214 |

Swipe (SXP) is a fascinating cryptocurrency. It is backed by a solid team of developers who know what they are doing.

My Thoughts on SXP

Swipe was created by Joselito Lizarondo, and he is the current chief executive officer of the startup. It was created to solve a problem in the cryptocurrency space. The goals of Swipe are:

- To make payments online by using the Swipe wallet,

- To give debit visa cards to users where they can store the utility token SXP and use it as they wish with an 8% discount on each transaction,

- To enable users to convert cash to cryptocurrency right inside their wallet without using an exchange.

These are grounding-breaking features that would be very helpful to users. I can't think of any other cryptocurrency platform that have all thesee features combine on its network.

Why I Like to Predict SXP Price

If I say I like predicting SXP price, that would be an understatement. The truth is, I love it. Why? I love predicting SXP price because my prediction about the coin is usually right. I have made profit from Swipe several times.

Here is one example of when I was right about SXP.

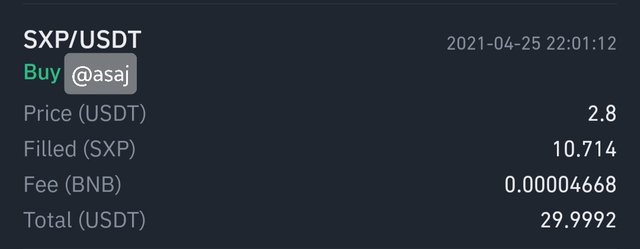

Screenshot of my entry position on Binance

Screenshot of my entry position on Binance

I noticed that Swipe had a resistance at $2.8 price level. And it hadn't fall below that resistance since it went above it. So I set a buy order at that price level.

On the 25th of April, SXP price briefly touched the $2.8 resistance level, so my buy order was activated and I acquired a position. Six days later, I got 100% profit on my investment. Six days!!!

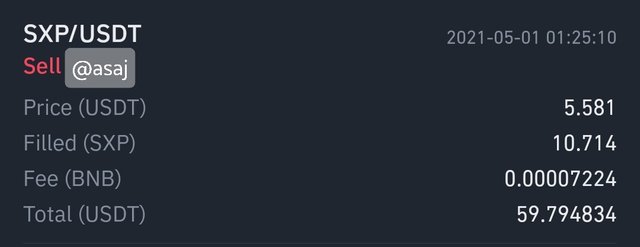

Screenshot of my exit position on Binance

Screenshot of my exit position on Binance

I invested $30 and recieved $60 in six days. My only regret was not investing more. It was actually because my liquid USDT was tied down by other crypto investment.

Technical Analysis of Swipe (SXP)

- SXP Support Level

Fig 1: Screenshot of SXP/USDT pair on Binance

Fig 1: Screenshot of SXP/USDT pair on Binance

For the past three months, SXP has maintained a support level (minimum price level) of $2.8 dollars. There are other mini support levels in the graph but we will be focusing on the one I have drawn on the chart.

This support level shows that investors have only exited their positions until the price reaches $2.8 and then traders start buying back their positions.

- Reason Why SXP Fell Below Support Line

However, it can also observed that SXP has finally given in to the sell pressure and has fallen below the $2.8 support level for the first time in three months. The fall in SXP price was caused by the massive dump in the price of BTC 3 days ago (May 19th, 2021).

Fig 2: Screenshot of BTC/USDT pair on Binance

Fig 2: Screenshot of BTC/USDT pair on Binance

The highlighted section in the chart above is proof that BTC crash caused SXP to fall below the support level

- SXP Turns Support to Resistance

Let's take a second look at the SXP/USDT pair chart again

Fig 3: Screenshot of SXP/USDT pair on Binance

Fig 3: Screenshot of SXP/USDT pair on Binance

From the chart above, SXP have turned the previous support level to a resistance level. This happens a lot in the crypto world. And it sometimes indicates that SXP may breakout soon from the resistance as the price succumb to the buying pressure. We will confirm this later on with RSI.

- Reverse Strategy on SXP/USDT Chart

Fig 4: Screenshot of SXP/USDT pair on Binance

Fig 4: Screenshot of SXP/USDT pair on Binance

From the chart above, it can be observed that there is a bullish reverse strategy and a bearish reverse strategy on the one day chart of SXP/USDT pair. After the 24 hour circle is complete, here will be a good time to enter a position.

SXP Price in a Week's Time

My prediction is that SXP will break the resistance and the price will rise to $4.4 in a week's time (28th of May, 2021).

- My Reason for this Prediction

Fig 5: Screenshot of SXP/USDT pair on Binance

Fig 5: Screenshot of SXP/USDT pair on Binance

SXP is currently in the oversold region of the RSI (Relative Strength Index). Whenever a coin reaches it oversold region, it means there might be a price bounce very soon.

However, if Bitcoin dumps to $30k or $25k, my prediction is that SXP will dump to $1.7. This is because Bitcoin value have an impact on the price of Swipe, as we saw earlier in our technical analysis.

Final Words

This week’s task has been another educative one from the crypto professor. We have learnt about the reverse strategy and how to identify the different types of reverse strategy.

There are two types of reverse strategy; namely, the bullish reverse strategy and the bearish reverse strategy. A bullish reverse strategy have a green candlestick right after a red one on a 1-day chart. A long bullish reverse strategy have 20% rise (or more) in the value of the crypto asset.

As for bearish reverse strategy, we can see a red candlestick right after a green one upon completing a 24 hours circle. While a long bearish reverse strategy have a loss of 20% or more.

CoinGecko was also reviewed in this article. We talked about the various features of CoinGecko. I used the CoinGecko App to review the platform because everyone else was reviewing the website. No one was talking about the CoinGecko App. We see the Top Derivatives, Top DeFi, Top NFT, Top Exchanges, Market Dominance, CoinGecko Blog, and other important features in the platform.

Conclusively, we analysed Swipe's Coin SXP. And predicted that SXP price will rise to $4.4 in one week time. This is not an investment advice but an educational article. I have definitely learnt something new: The Reverse Strategy.

Hi @asaj

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Hola @stream4u, thanks for taking the time to explain the reverse strategy. I had a good time doing the assigned task, wish you comfort in your work.

Hmm... interesting, I think this information about how to create an investing app