Crypto Academy Week 13: Homework Post for @yohan2on | The Scalp Trading Style

In the 1880s, a French mathematician discovered something that would change the world decades and centuries to come. His name was Henri Poincaré and his discoveries later became the foundation of what we know today as chaos theory.

Created by me on PicsArt

Created by me on PicsArt

The theory was based on one fundamental principle; finding a pattern in the irregularities of a system. Many years later, this theory became applicable in weather prediction, pandemic crisis management, cryptography, stock market, crypto market, and lots more.

Although no one can predict accurately the future prices of an asset due to the randomness, multiple complexities, and irregularities of the market; in an attempt to find the hidden patterns, man created charts and indicators for analytical purposes.

As a result, we can find trends in the somewhat chaotic movements of crypto asset prices. We can call it deterministic chaos because cryptos, despite having an unpredictable behaviour, follow a deterministic principle. So when you zoom out the chart of a crypto asset, the pattern emerges; an opportunity to be exploited.

Scalping traders take advantage of this opportunity and in turn get rewarded for it. Even when the market is red or in a downtrend, there is profit to be made if you follow the deterministic principle. And various scalping strategies have been created to exploit the crypto market loopholes.

Today, we will be looking at one method of scalp trading; the finger-trap scalping.

Finger-Trap Scalping

Finger-trap scalping involves making small profits from performing short-term trades as the prices of an asset changes. That is why this strategy is also known the short-term momentum scalping.

What You Need

As mentioned earlier, there are no guarantees when trading in the crypto market. The only guarantee is that you will definitely lose money if you trade recklessly. To increase your chances of success you need the following:

- Two moving averages: 8 EMA and 34 EMA;

- 1 hour chart: To determine the trend of the market;

- 5 minute chart: To identify entry and exit points;

- The stamina to perform many trades;

- A tight stop loss mechanism;

- A good entry and exit strategy.

While most of the points mentioned above is self-explanatory, the last point is a bit vague. Unfortunately, the success of our trades is dependent on that last point. This begs the question; how do I know the right time to enter and exit a trade?

Well, let us attempt to simplify it.

First and foremost, create a demo account on MetaTrader to practice what you are learning. You can create an account on MetaTrader by simply downloading the app from an App Store.

Launch the MetaTrader app to create a demo account

After creating the demo account, we can proceed to the next step.

How to Do Finger-Trap Scalping

Trading XRPUSD Pair

1. Add 8 EMA and 34 EMA to the Chart

While some scalpers are quick to use the 5 minutes chart as their entry chart, I don't feel that is a good idea. I believe the data on a 5-minute chart is not sufficient enough to perform good technical analysis. Don't be in a haste to lose money. Else, that's what would happen.

In the chart below, I have added 8 EMA (green line) and the 34 EMA (black line) to the 1-hour Ripple / US dollars chart. EMA stands for Exponential Moving Average.

Screenshot of XRPUSD pair on MT5 with 8 and 34 periods EMA line

Screenshot of XRPUSD pair on MT5 with 8 and 34 periods EMA line

What is Exponential Moving Average (EMA)?

EMA is a technical indicator that shows the moving average of the price of an asset; in this case, crypto asset. Its formula is designed in such a way that there is greater emphasis on current price changes. For that reason, it responds quickly to recent changes in price than a simple moving average.

There are several types of EMA. It includes 10-period EMA, 20-period EMA, 200-period EMA, and lots more. A trader's choice of EMA is often dependent on the trading technique he or she chooses to use.

For finger-trap scalping the 8-period EMA and 34-period EMA is usually chosen. Note that the shorter the period, the quicker the EMA line will react to a change in price. With that in mind, notice how quickly the green line is responding to a change in price in the XRPUSD chart above. It is quite faster than the black line.

Due to this fact, the 8 EMA is also known as the fast line and the 34 EMA is known as the slow line. Having said that, let us take a second look at the chart.

2. Find the Strongest Trend in the Market

This presents another reason to avoid using the 5-minute chart as an entry chart. The high degree of chaos in a 5-minute chart makes it overwhelming to find the the strongest market trend. So use the 1-hour chart to determine the strongest market trend.

Screenshot of XRPUSD pair on MT5 indicating a downtrend

Screenshot of XRPUSD pair on MT5 indicating a downtrend

In the chart above, we can see a declining line of resistance which indicates that this is a bear market. Knowing the strongest market trend matters a lot because it can help you assess the level of risk. In a bullish market, you can go a bit long with your trades and the damage wouldn't be severe.

For bearish market, this is not an option. The risk is simply too high. Since finger-trap scalping is all about making short trades, it makes perfect sense to use this strategy in a bearish market.

Now, we check for bullish and bearish market criteria.

3. Check for Bullish and Bearish Market Criteria

In finger-trap scalping, to know the right time to enter or exit a trade we must change the time frame to 5 minutes.

Screenshot of XRPUSD pair on MT5 (5-minute chart)

Screenshot of XRPUSD pair on MT5 (5-minute chart)

After changing the time frame to 5 minutes, I have a vital principle. The principle varies depending on the market condition. If the conditions are not met, I will not enter that trade.

Conditions that must be met in a bullish market

The candlestick prices must be crawling above the 8-period EMA line and then the 8-period EMA line must be moving on top of the 34-period EMA line. So the lines must be in this order;

- Candlestick price

- 8-period EMA

- 34-period EMA

Note: The lines can intercept briefly but generally it must meet these conditions.

Conditions that must be met in a bearish market

In a bearish market my conditions are in reverse.

The 34-period EMA must move above the 8-period EMA and then the 8-period EMA must trail above the candlestick prices. These lines must follow the order below;

- 34-period EMA

- 8-period EMA

- Candlestick price

Note: As usual, the lines may intercept briefly but generally the condition must be met.

Bearish market condition has been met in XRPUSD pair!

I have went ahead to zoom in on the 5-minute to show that my bearish market condition has been met.

Screenshot of XRPUSD pair on MT5 (5-minute chart)

Screenshot of XRPUSD pair on MT5 (5-minute chart)

These conditions are created to protect me from market trend reversals, even though there are other mechanisms I also use to protect funds. I will talk more about safety measures later.

Now, let us identify the entry and exit points!

4. Identify the Entry and Exit Points

Having met my bearish market condition, I will be using the 8-period EMA as a resistance level. Each time the candlestick touches the 8 EMA, that is my signal to sell.

And each time the candlestick pulls back from the 8 EMA, that is my signal to buy.

Screenshot of XRPUSD pair on MT5 (5-minute chart)

Screenshot of XRPUSD pair on MT5 (5-minute chart)

In the chart above, the green circles indicate entry points and the red circles indicate exit points.

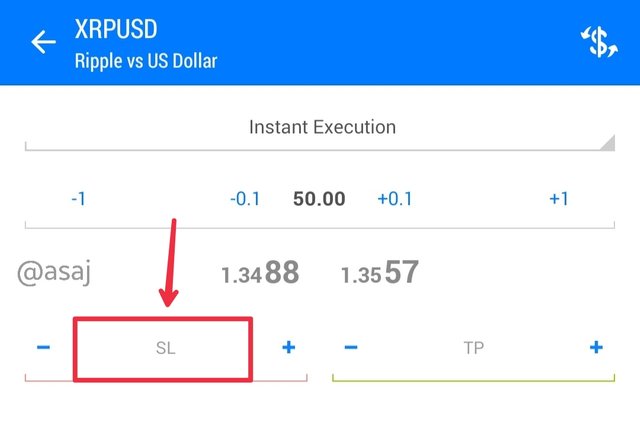

5. Setting a Stop Loss (SL)

Setting a stop loss helps to limit the risk of loss in a single trade. However, since there is usually a price pullback before the price of a crypto asset moves upward, it is advisable to set a stop loss that isn't too tight.

For instance, I bought Ripple at $1.3488, if I set a stop loss at $1.3486, that will be considered too tight. That is just 2 pips away from the purchase price. A stop loss at 7 pips below the purchase price would be a better move. It would give the trade room to breathe.

Yes! You don't want to set a stop loss that would be triggered easily, but at the same time, don't set stop loss that is too wide. A good range would be between 5 pips to 10 pips below the previous swing-low in a bearish market.

6. Setting a Trailing Stop Order

While stop loss is a good mechanism to minimise risk, it has its drawbacks. It doesn't maximise profit.

A trailing stop order solves that problem. Unlike the normal stop loss, a trailing stop moves upward as the market moves in favour of the trader. Trailing stops can even move to the entry price of a trade, thereby helping the trader to break-even. Break-even is a point where no loss or profit is made. Lets see an example.

For instance, I set a trailing stop at +1 pip each time the candlestick moves to 10 pip and my entry price is $1.3488. At the point of entry, my trailing stop would be $1.3478.

If the candlestick moves to 1.3498, my trailing stop becomes $1.3479. The candlestick could move to the extent that my trailing stop becomes $1.3488 which is also my entry price level.

This usually happens when there is a market trend reversal.

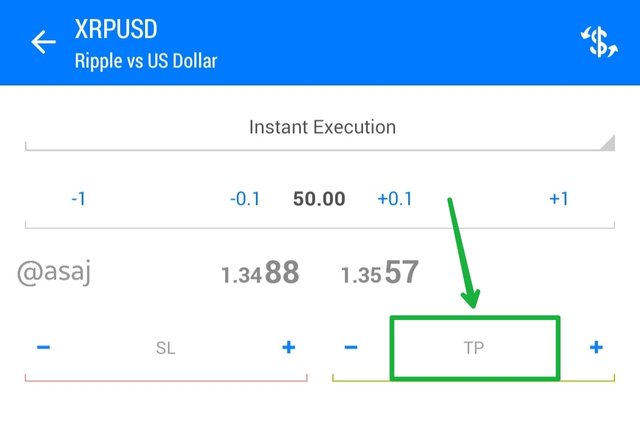

7. Setting a Take Profit (TP) Order

Since we are looking for short-term gains with finger-trap scalping strategy, we can set a take profit order at 15 pips.

Using a take profit order has its merits and demerits. It can help a trader lock in profit opportunities before it is missed. However, it could also lead to missing out on higher profit levels.

Trading XMRUSD Pair

I have chosen a rather complicated trading pair as the second example; the Monero / US dollars pair.

Screenshot of XMRUSD pair on MT5 (1-hour chart)

Screenshot of XMRUSD pair on MT5 (1-hour chart)

- I have added the 8 EMA and 34 EMA

- I am using a 1-hour chart to determine the strongest market trend

- The 1-hour chart tells us it is a ranging market

- It fails my bullish and bearish market criteria

I actually do not like what I am seeing in the chart above. It is a ranging market which indicates that the market could go any way.

You know that feeling you get when you are about to date someone and the person has an inconsistent attitude. That's the vibes this trade is giving me. Yeah! Mixed signals! That's a red flag.

The level of uncertainty in this market is higher than my risk appetite. I will be adding an indicator to help me filter the noise of the candlestick.

This brings us to step eight.

8. Using CCI for Confirmation

As mentioned earlier, we determine entry and exit points using the 5-minute time frame. I have added the Commodity Channel Index (CCI) to the 5-minute chart to confirm that this is not a good time to enter a trade.

Screenshot of XMRUSD pair on MT5 (5-minute time frame)

Screenshot of XMRUSD pair on MT5 (5-minute time frame)

The Commodity Channel Index (CCI) is a momentum oscillator that helps us to identify market extremes. Each time the CCI crosses the 100 mark, it shows that the asset has been overbought and a price pullback will soon occur.

We see this happen in the previous trend at point K which led to a price pullback at point M. Now we see another extreme at point L, which means a price pullback is imminent.

9. Do Not Rely on the Crossovers of 8 EMA and 34 EMA Lines

Many scalpers use the line crossovers of 8 EMA and 34 EMA as an indicator to buy or sell. While this may work on some occasions it usually gives late signals.

Screenshot of XMRUSD pair on MT5 (5-minute time frame)

Screenshot of XMRUSD pair on MT5 (5-minute time frame)

In the chart above, the crossover of the fast and slow line at point P is a signal to buy to some scalpers. Well, that signal came late. CCI gave an earlier signal when the CCI line touched the -100 mark and bounced upward from point N.

10. Patiently Perform as Many Trade as You Can

The beauty of finger-trap scalp trading lies in the volume of trades. Since you are making small profits in short trades, a higher number of trades can increase your capital gains. Even so, you have to be careful. Do not make rash decisions because it will come back to bite you.

Relax when you are tired. Better yet, you can write a few lines of code that can execute trades for you, by setting some conditions that must be met before an execution is made.

Time to put your python and javascript skills to work. Don't know how to code? You can learn it. I believe nothing can stop you, provided you put your heart in it and believe in yourself.

Note: Make sure to test whatever you have learnt in a demo account so as to build your confidence and skills before using real funds. As always, be careful.

Merits of Finger-Trap Scalping

Making profit in a bear market: Finger-trap scalping give traders the opportunity to make profit even when the market is in a downtrend. This is done by making short-term trades and selling in the slightest gains. This is interesting because one would normally think that only loss can occur in a bearish market.

Reduces the risks of suffering a strong market fall: By engaging in finger-trap scalping, there is lesser possibility of being affected by a strong market fall because all you are doing is short trades. Besides, trailing stops order got your back.

Maximises profit with compounding interest: The profits gotten from multiple trades at short intervals will surpass the profit from long trades. This is as a result of the compounding interest that is gotten and reinvested during price swings.

It gives traders a certain level of control: Leaving your investment and hoping for a favourable market trend can be a long wait. However, performing short-term momentum scalping can give you more control on the outcome of your investment.

Final Words

As the name implies, finger-trap scalping is like the old bamboo-weaved children's puzzle that was popular back in the 80s. The only way to leave the trap is to push. Same applies to the short-term momentum scalping (finger-trap scalping).

When using finger-trap scalping method, you have to be observant, relaxed, and push on with strategic decisions in order to avoid the trading trap. There's no going back. The only way out is forward.

Despite it took quite an amount of my time, I really enjoyed doing this task given by professor @yohan2on. It improved my knowledge on the finger-trap scalping strategy. Hope you had a good read.

Hi @asaj

Thanks for participating in the Steemit Crypto Academy

Feedback

This is excellent work done. Well done with your research and for the practical demonstration of the scalp trading style using the finger trap strategy.

Homework task

10

Thank you @yohan2on for taking the time to go through my task. I wish you comfort in your work.