Steemit Crypto Academy Contest Season 9 Week 3 - Steem Inflation

Hello everyone! I hope you are all doing well and enjoying life with the blessings of Allah Almighty. I am happy to take part in the exciting challenge hosted by SteemitCryptoAcademy community' Contest [EN/ES] Steemit Crypto Academy Contest Season 9 Week 3 - "Steem Inflation" / Steemit Crypto Academy Contest Temporada 9 Semana 3- "Steem Inflation" So, without any further delay, let's dive right in!

Inflation can be caused by various reasons , such as an increase in the currency supply, rising production costs, or changes in consumer demand. Central banks & governments often try to manage inflation through monetary & fiscal policies and tend to , such as adjusting interest rates or controlling government spending. The goal is usually to maintain a stable & predictable inflation rate that supports economic growth without eroding the value of money too quickly.

When it comes to most famous digital currency , cryptocurrencies, the impact of inflation is a bit different. Many cryptocurrencies, like Bitcoin, have a limited supply. For example, there will only ever be 21 million bitcoins currency existence. This scarcity is built into the design of the cryptocurrency & is often seen as a key feature. As a result of it , cryptocurrencies can be immune to the traditional forms of inflation found in fiat currencies.

However, it is most important to note that inflation can still indirectly affect cryptocurrencies. While the cryptocurrency itself may not experience inflation, its value can be influenced by numerous external factors, including inflation in traditional fiat currencies. For example , if there is high inflation in a country national currency, people may turn to cryptocurrencies as a store of value, leading to increased demand & potentially driving up their prices. This was observed in countries like Venezuela & Zimbabwe as per my research , where hyperinflation led to a surge in cryptocurrency adoption.

Why inflation occurs |

|---|

When new cypto tokens are created in an inflationary cryptocurrency like Steem, they are typically distributed to various stakeholders within the chain . This distribution mechanism often involves rewarding participants who contribute to the platform's growth, such as content creators, curators, & holders of a specific token like Steem Power.

The inflationary approach aims to incentivize participation & engagement within the cryptocurrency ecosystem. By gradually increasing the token supply, it helps to stabilize prices & maintain liquidity in the market. Additionally, the distribution of new tokens in chain provides an opportunity for users to earn rewards & actively participate in the growth & development of the platform.

By using a paragraph format, we can elaborate on the nuances & difficulties of inflationary cryptocurrencies, such as the distribution mechanisms, the purpose behind token creation, & the impact it has on the ecosystem as a whole. This allows for a more deeply understanding of how inflation works within the context of cryptocurrencies like Steem.

Explain the difference between deflationary and inflationary cryptocurrencies? And clarify what is the strategy followed by the Steem token and show how it works? |

|---|

Deflationary and inflationary cryptocurrencies refer to two different topic to managing the supply & value of a particular digital currency. Deflationary cryptocurrencies are designed to decrease in supply over time, leading to a scarcity of tokens & potentially increasing their value. On the other hand, inflationary cryptocurrencies aim to increase their token supply gradually, which can help stabilize prices & incentivize spending.

Steem, which was launched in 2k16, follows a unique strategy known as Proof-of-Brain. Steem aims to reward content creators & curators for their contributions to the platform. The Steem blockchain operates with three different types of tokens: STEEM, Steem Power (SP), & Steem Dollars (SBD).

STEEM is the primary currency & serves as a liquid token that can be bought, sold, and transferred. It is also used to impower the network's functionalities. Steem Power (SP) represents a long-term investment in the Steem network. By converting STEEM into SP, users gain influence & voting power on the platform. The more SP a user's holds, the more their vote impacts the distribution of rewards.

The Steem currency or token distribution mechanism involves an inflationary approach. New STEEM tokens are continuously created & distributed to various stakeholders in the network, including content creators, curators, & holders of Steem Power. The distribution of tokens is determined through a voting system, where users with more Steem Power have more benifits .

strategy followed by the Steem token |

|---|

1) Token Burning #burnsteem25 : Steem has implemented a mechanism called "burning," where a portion of the token supply is permanently removed from circulation to null . This reduction in supply helps create scarcity & potentially increases the value of the remaining tokens.

2) Decreasing Inflation Rate: While Steem token has an inflationary model, the rate of inflation gradually decreases over with time. Initially, the inflation rate was more higher, but it diminishes annually with time according to a predefined schedule. This decreasing inflation rate implies that the token supply grows at a diminishing rate, which can have deflationary effects on the overall steemit ecosystem.

3) Staking and Locking Mechanisms: Steem incentivizes users to lock their tokens & convert them into Steem Power (SP), which provides additional influence & voting power within the platform. By staking tokens, users reduce their liquid supply, effectively reducing the circulating token availability & potentially increasing token scarcity.

4) Reward System Adjustments: The Steem blockchain periodically adjusts its reward distribution algorithm based on community consensus & platform development. These adjustments aim to align the reward system with user behavior & ensure a fair distribution of rewards. Such adjustments and planning can have deflationary implications by reducing the overall token supply allocated for rewards.

In summary, although Steem primarily follows an inflationary model concept , it also incorporates certain deflationary elements such as token burning, decreasing inflation rate, staking mechanisms, & reward system adjustments. These elements contribute to creating scarcity, promoting long-term token holding, & potentially increasing the value of the Steem token. |

|---|

Calculate the Current Inflation Rate (the day of preparation for publication) |

|---|

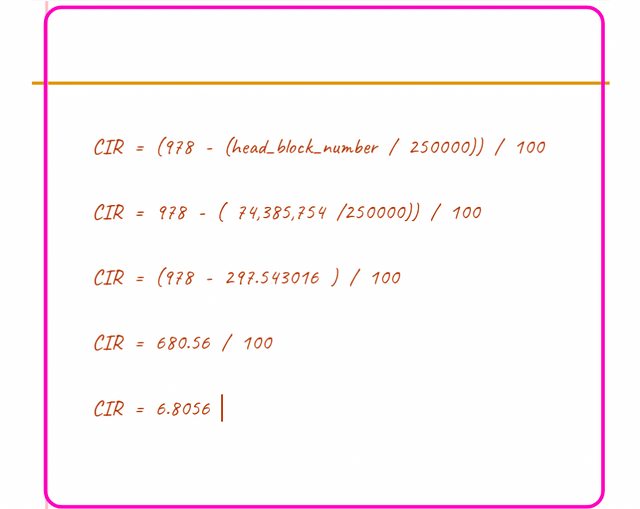

(978 - (head_block_number / 250000)) / 100

The "New Token Supply" refers to the number of newly minted Steem tokens within a mention period. This can be determined by the block rewards issued to miners or stake-holders during that time frame.

The "Total Token Supply" represents the overall number of Steem tokens in chain at the same particular time.

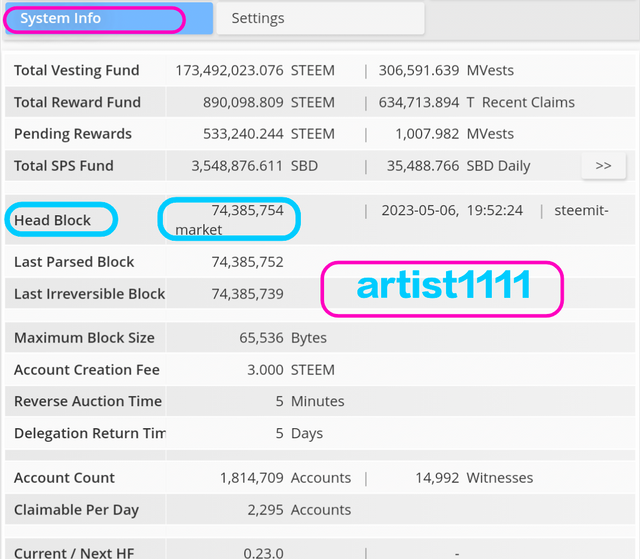

To calculate the inflation rate of our Steem tokem using the given formula, we first need to get the current header block number .. This information can be obtained from the steemworld.org tool by pressing to the System info tab and clicking on the Head Block section. In my case, the current header block number is 74385754.

Now, I am going to apply the formula to calculate the inflation rate at the given time. Plugging in the values, we have:

Inflation rate at time t = (978 - (74385754 / 250000)) / 100

| Current Inflation Rate | 6.80 |

|---|

By tracking the rate of inflation for the next few years, interpret how easy or difficult it will be to earn STEEM rewards, and would that push you to build your SP right now?🤔 |

|---|

Tracking the rate of inflation in steem for the next few years provides insights into the ease or difficulty of earning STEEM rewards. If the inflation rate remains relativelydown or stable, it suggests that earning STEEM rewards may be relatively easier. However, if the inflation rate rises significantly, it could become more challenging to accumulate STEEM token .

Considering this, it might be advantageous to build your STEEM Power (SP) sooner rather than get later. By increasing your SP, you can enhance your influence & potential for earning rewards in the STEEM ecosystem. With a higher SP, you have a greater stake & voting power, which can translate into increased rewards for your contributions.

Furthermore, building your steem power now allows you to benefit from compounding rewards over time. As the inflation rate rises up , the value of each STEEM token may be minimize , making it more important to have a higher stake to maintain your earning potential.

Overall, monitoring the inflation rate & taking action to build your SP can be a prudent strategy to secure a stronger position in the STEEM ecosystem & maximize your potential rewards.

Now I would like to invite @aaliarubab ,@waterjoe, @pelon53 and @malikusman1 for participating on this contest.

Goodbye, friends. It's been a pleasure getting to know you all and participating in this community. I will miss all of you , but it's time for me to move on. Take care and I hope to see you all again very soon , Best of Luck .

As the sun sets on the day

And the night falls softly in

We close this chapter, dear reader

But the story's not yet done

Tomorrow's pages wait, unwritten

As the sun sets on the day

And the night falls softly in

We close this chapter, dear reader

But the story's not yet done

Tomorrow's pages wait, unwritten

Greetings mate.

You did great on the topic of inflation being a monetary situation for describing the phenomenon where the supply of a currency exceeds its demand, hence, affecting its purchase power. You've clearly stated in a paragraph format how it affects even the cryptocurrency world.

You've also presented us with the differences between deflationary and inflationary cryptocurrencies, stating how STEEM is the latter with incorporated features of the former like the Burnsteem, Staking, decrease in the inflation rate, and reward system adjustments (which I am learning of for the first time).

You did well explaining to us users alike that it will only be of our Advantage to Power Up and save for the future as there will be better days ahead for us all.

Thank you for this knowledge shared and good luck in the contest mate. It's nice to have learnt from you.

Thank you for your time my dear ,

Brother also Remember to consider long-term saving strategies and take advantage of beneficial features like staking and rewards which i missed in my publication , however it is more advantageous in my point of view . Best of luck to you too!

hi dear @artist1111

inflation is something which make the economy of a country in the negative side and it can also impact the cryptocurrencies as you have explained it

when the supply of the items in the market is increased then we expect that the inflation rate decrease because the items will be available at low costs and purchased power of the money will be increases

you have also calculate the current inflation rate of the steem token and it is right that steem token will be difficult to earn in future because inflation rate will decrease and block rewards will also decrease

success in contest

Thank you brother for your time .

This is the reason why today economy of pakisan faces challenging time , yes of course as like solid currencies it can also impact the cryptocurrencies , However wise decisions may give something another positive directions . If we support and spread awareness about steem token burning , this is one solid step towards steem success .

I follow you, you follow me

You wrote very well. Yeah, Inflation is one of the normal thing we experience in economy of our society and not only in cryptocurrency.

You have explained the inflation in steem very well. I enjoyed the details explanations you gave in all the questions asked.

Yeah powering up now its a very good way of preparing for the future because in the future gaining steem rewards will be more difficult.

I wish you best of luck.