SEC-S18/W6 | Mastering the Break Retest Break (BRB) Strategy

Hello everyone! I hope you are all doing well and enjoying life with the blessings of Allah Almighty. I am happy to take part in the exciting challenge hosted by SteemitCryptoAcademy community . So, without any further delay, let's dive right in! Shall we ? ........, Okay , Okay😊! .

Explain in detail the concept of the Break Retest Break (BRB) strategy. How can this strategy be applied specifically to trading the Steem token? |

|---|

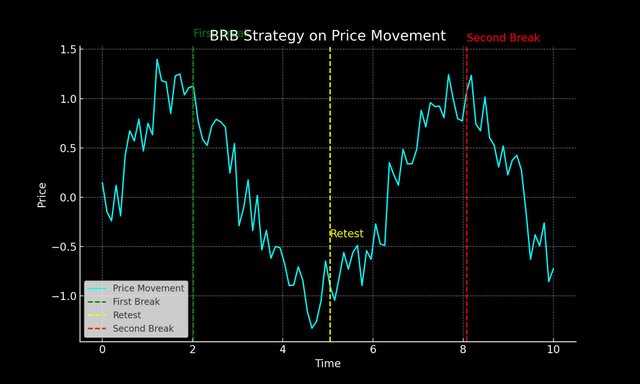

The Break Retest Break (BRB) plan is a trading way that assists traders to benefit from market trends. First, you find when the price breaks a major level. This "break" shows a possible strong trend that way. Following this break, the price frequently pulls back to the past level.

This is the "retest" step. It confirms the trend's strength and offers a safer entry for traders, cutting risk.

Graph overview: C:C @artist1111 Graph overview: C:C @artist1111 |

|---|

After the price retests and holds, it breaks out again. This confirms the trend continues. Entering here can bring more profits.

Using the BRB strategy helps find entry and exit points in trading. Traders make better choices, cutting losses and gaining more by following this method.

The BRB strategy can be efficiently used when trading the Steem token. This goes as follows:

Monitor a strong price action wherein Steem breaks out of a key level of resistance or support. This initial "break" suggests, therefore, that there is a probable trend.

Next, at this point, watch price as it pulls back to the broken level. This "retest" phase is crucial in confirming the strength of the trend. If Steem holds this level, it tells you that the trend is robust.

Once the price breaks out once more from this retested level, it confirms the continuation of the trend. This second "break" is what prompts you to enter the market seeking potentially higher profits.

The BRB strategy also enables the identification of the best entry and exit points using Steem, hence minimizing the risks of trading and maximizing the gains. This will enable the trader to take advantage of trends in Steem price movements that have already been established.

By diligently applying the BRB strategy, traders can better navigate Steem’s market dynamics, making more informed and profitable trading decisions.

What are the specific entry criteria for a position using the BRB strategy? Include specific technical indicators and market conditions for the Steem token. |

|---|

There are saveral point we must need into account , first take a look of tradingView 2h chart .

TradingView TradingView |

|---|

In applying the BRB strategy on the TradingView chart of Steem, we shall be very keen on market movements and technical indicators.

First Break: Note the initial steep takedown around the 19th. That sharp decline below the support level at 0.2000 speaks of a break in the market, possibly leading to a downtrend.

Retest—After the initial break, the price starts recovering and then goes back up toward the 0.2000 level; this is the retest phase between the 20th and 21st. Here, the previous support level broken is tested again as resistance.

Confirm Break: The price could not hold above the 0.2000 level after the retest and had dropped lower, confirming the continuation of the downtrend. This was confirmed around the 23rd with further drops in price, which further cemented the bearish bias.

Entry Point: The best ideals to initiate short would be just after the confirm break around the 23rd, wherein price fails to hold above the retested resistance and continues its downtrend. Setting a stop-loss just a tad higher than the retested resistance level would set the risk effectively at about 0.2000.

By considering these conditions and technical indicators pointing in the right direction, a trader could incorporate volume to confirm the strength of breaks and retests, the RSI to measure momentum, and moving averages for additional trend confirmation. In this regard, the BRB strategy will help optimize entry and exit decisions with respect to the Steem token. Structured in this way, it minimizes the potential risk and maximizes possible gains within such volatile market conditions.

Describe the exit criteria for a position based on the BRB strategy. What signals or conditions should be present to close a position in profit or loss? |

|---|

The BRB (Breakout, Retest, Breakout) strategy involves identifying key support and resistance levels and monitoring price action around these levels to determine entry and exit points. To describe the exit criteria for a position based on the BRB strategy using the provided charts, let's analyze each chart and identify the relevant signals or conditions.

TradingView TradingView |

|---|

2-Hour Chart Analysis

In the 2-hour chart, the current price of DOT/USDT is $5.833. The chart shows a period of consolidation with several attempts to break above the $6.000 level, followed by pullbacks. For a position based on the BRB strategy, an exit criterion for profit would be if the price successfully breaks above the $6.000 resistance level and sustains above it, indicating a bullish continuation. Conversely, a stop-loss could be set just below the recent support level of approximately $5.700 to minimize potential losses if the price breaks down.

TradingView TradingView |

|---|

Daily Chart Analysis

In the daily chart, the current price is also $5.832, indicating a downtrend from a peak of around $12.000 earlier in the year. The price appears to be forming a base around the $5.800 level, which could act as a support zone. For a profitable exit, the trader would look for a breakout above the next significant resistance level around $6.500, followed by a retest and continuation of the uptrend. If the price fails to hold above $5.800 and breaks below $5.700, it would be a signal to close the position to prevent further losses.

TradingView TradingView |

|---|

3-Day Chart Analysis

The 3-day chart shows a broader perspective, with the current price at $5.832. This chart highlights a significant downtrend from the peak around $12.000. The price has found support around the $5.700-$5.800 range. For a profitable exit, the BRB strategy would require the price to break above the $6.500 resistance level, confirm the breakout with a retest, and continue higher. A stop-loss should be placed below the support level, around $5.700, to safeguard against a deeper pullback.

Conclusion

In summary, the exit criteria for a position based on the BRB strategy using the provided charts are as follows:

- Profit Exit: The price must break above and sustain beyond key resistance levels ($6.000 in the 2-hour chart, $6.500 in the daily and 3-day charts) with a confirmed retest and continuation of the uptrend.

- Loss Exit: The position should be closed if the price breaks below critical support levels ($5.700) to prevent significant losses.

Monitoring these levels and the price action around them will help in making informed decisions on when to exit a position profitably or to minimize losses.

Provide a detailed example of a BRB trade on the Steem token. Include entry points, exit points, and the reasons why you chose these points. Use graphics to illustrate your example. |

|---|

To describe the exit criteria for a position based on the BRB (Buy the dip, Ride the trend, Book the profit) strategy, let's analyze the added charts and current prices. The charts show the price movements of STEEMUSDT over 6-hour intervals.

TradingView TradingView |

|---|

The following signals or conditions should be in place within the BRB strategy for closing a position for profit or loss:

Buy the Dip: Identify a pronounced drop or dip in price, which forms a buying opportunity. Now, looking at the charts we are provided with, we notice a deep dip around June 19th, when the price dropped dramatically from about $0.2200 down to below $0.1800. This could imply an ideal entry point for the BRB strategy.

Ride the Trend: The next step is to ride the trend upwards after entering the position at the dip. The price starts recovering from its sharp drop in the charts back up to the $0.2000 range. Technical indicators like moving averages, RSI, or MACD should be used to confirm this upward momentum of the trend. In this case, it has stabilized and is showing signs of upward movement, a trend reversal.

Book the Profit: This would be the final step, closing out the position to book profit once it hits a predetermined target or when the price shows signs of reversal, such as optimal highs. In this case, looking at the charts, the price has reached around $0.2000 by June 25th, which could be taken as a target level in respect of previous resistance levels. A signal to close the position would be when technical indicators are giving overbought signals or when they are starting to consolidate/reverse.

In setting a stop-loss order at predefined levels, it will help in controlling risk and cutting losses. If further slips below threshold, say below $0.1800, thus failing to hold at the dip, this would trigger a stop-loss and exit a position, preventing further losses.

In summary, the exit criteria for the BRB strategy involve:

- Entering a position at a significant price dip.

- Riding the upward trend while monitoring technical indicators.

- Exiting the position at a target profit level or when signs of reversal or overbought conditions appear.

- Setting stop-loss levels to minimize potential losses.

How do you manage risk and capital when using the BRB strategy? Discuss risk management techniques and how to set stops and limits for Steem token trades. |

|---|

To manage risk and capital with the BRB strategy, you must plan carefully. I personally do start by deciding how much money you are willing to invest. Don't put all your money into one trade. Diversify your investments to spread risk.

.webp) BRB Strategy BRB Strategy |

|---|

Now, if you see a huge price dip, that becomes your opportunity to buy. But make sure you're always cautious. Only invest a little bit of your capital in any single trade. This will make sure you don't lose too much.

Riding the trend amounts to watching out for the price increase after buying. You can do this through tools such as moving averages or RSI to verify the trend. If the price keeps going up, then you can maintain the trade.

SL: Placing stop-loss levels is very critical. A stop-loss is a price point at which you will sell to prevent further losses. For example, if one is buying at $0.1800, place a stop-loss slightly below that, say at $0.1700.

TP: Take profit by putting a target price at which one will sell to lock in gains. For example, if one wants to acquire a profit of 10% with the buying price at $0.1800, one should place a sell order at $0.1980. This locks in profits.

Above is the BRB strategy graph showing the main things regarding risk and capital management. The green line indicates the price trend, showing the dip and the subsequent rise of the price. The yellow point marks the ideal Buy point at the lowest dip.

The red dashed line indicates the stop-loss levels. Stop-loss at $0.1700 can ensure that loss is minimized in case the trade goes against you. By this, you will be out of the trade if the price goes further down, thereby protecting your investment.

The cyan dashed line indicates the take-profit levels. With a take-profit target set at $0.2100, you are assured that when the price reaches this level, your gains will be locked in and you will book some profit.

The magenta point marks the sell point at which one exits the trade for take-profit. This point is very important in maximizing gains and securing profits once the price trend reaches your target.

This means setting very clear stop-loss and take-profit levels, using technical indicators, and maintaining discipline in risk management and exploiting market opportunities eloquently.

kind Regards

@artist1111

Adieu, folks!

May the winds of fortune

carry you to greatness!

May the winds of fortune

carry you to greatness!

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Nice post. Retest phase is very important to confirm the breakout or its fakeout. However, BRB strategy require understanding support and resistance level.

Thanks for reading my post! The retest phase is indeed crucial. Mastering support and resistance levels is key for the BRB strategy.

Oh yes! We support ANY quality post and

good comment ANYWHERE and at ANYTIME

Curated by : @𝗁𝖾𝗋𝗂𝖺𝖽𝗂

Thank you my friend for support .

I really agree that with any strategy and with supporting indicators we must still set a stop-loss. But sometimes when the results obtained are greater, it also feels like the trader's emotions are being played with, the stop-loss that we initially used, we ignore and in the end, even though we use a strategy, this doesn't mean anything.

It is important for us to understand trading science because this will help us a lot in the world of trading.

Nice to read your publication, good luck for this contest friend.... 👍👍👍

Thanks for reading my post! Emotions can indeed play tricks, but sticking to a strategy is crucial. Good luck to you too! 👍

You have presented the break retest and break very thoroughly. Definitely very important for us. We think it will be a learning experience for many.It is very important to use stock loss when starting any trade, here you have mentioned and shown the entry and exit. Good luck to you.

Excelente amigo, tienes una redacción muy concreta cuando del tema se trata, directo al grano.

Esta metodología es nueva para mí, cada vez más interesante armar el rompecabezas que le da sentido a todos los desafíos previos. Comenzar a tradear no es tarea fácil y hay que estar muy pendiente de las señales que nos dan indicios del próximo movimiento en el mercado.

Gracias por compartir.

Thank you my friend for your time to read my post .

Thanks for your appreciation .

¡Mucha suerte y feliz día!