[In-depth Study of Market Maker Concept]-Steemit Crypto Academy | S4W6 | Homework Post for @reddileep

QUESTION 1

ANSWER 1

So in simple words market making is the algorithm through which brokers and dealers Provide liquidity in a special type of Market and the people who run this algorithm or process are called as market makers .

Keypoints

A Market Maker may be a single person or member of group that do selling or buying for its own account.

Market makers generate depth and liquidity to the market and get profile themselves from the difference of bid- ask spread .

The most common market makers are brokers House who provide sell and buy ideas for investors.

So by understanding the concept it is clear that market is designed in a manner that the money of small investors worn to big traders .

Also If we understand the proper pattern of buy and sell of these market makers on time then we get huge amount of profit .

QUESTION 2

ANSWER 2

Psychology behind market maker is very simple as we learnt in the given article most of the people think that crypto market is working over Irregular order of sell and buy , but there is some people who takes decision by its own manner and control this order .

Let we understand this psychology with a fabulous example

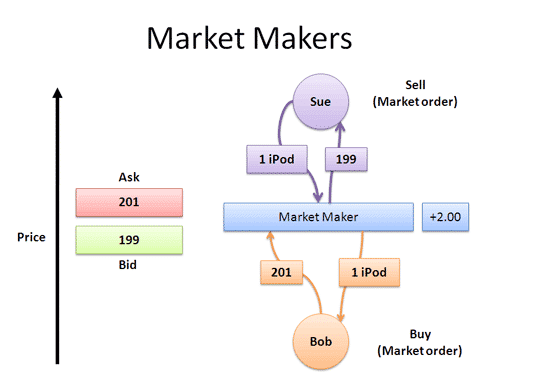

Suppose buy order is 500$ which is fixed by a Market Maker and then he makes a sell order little bit higher suppose 510$ , Now other market traders make buy and sell order between these two prices .

This means by his own sell and buys these market makers supply liquidity to the market and get profit From this bid and ask .

Also another group of peoples called market manipulators , they provide very large amount of liquidity , these manipulators are very dangerous who always want to export money from small investors .

So it is very important to understand this psychology behind the mind of the Market Maker to get profit .

QUESTION 3

ANSWER 3

Some of the benefits are given below :-

It play very large amount of contribution in maintaining the price of new cryptocurrenies by giving huge bid and ask prices means keeps the liquidity of Market continuous.

If we get an accurate idea or information that when these market makers change buy or sell order on time , then we make a huge amount of profit by entering and exiting From the market quickly .

Number of participants inside any particular Cryptocurrency or coin can be increased my this concept , In simple words if Market makes makes the coin price higher then the number of investors increases .

It increases the price of any coin at upper level.

Example :- If current price of any coin is 7$,

then market maker can make its price upto 12$

by maintaining ask and bid price .

QUESTION 4

ANSWER 4

Some of the disadvantages of Market making concept are given below :-

In this digital currencies world many of the Market Maker provides liquidity for very short interval of time which leads loss to the small traders.

If traders don't know the concept of Market makers properly then all the investment money of small investors gone in the hands of Market makers and the traders lose their money .

Many Market makers are also misconduct the traders means they make the sell at large scale and due to this many small traders or investors are afraid and feedback very quickly , then they again purchased the coin at very lower price , which also leads loss to the small traders in the crypto world.

QUESTION 5

ANSWER 5

1. MOVING AVERAGE (MA)

Moving average is a special kind of indicator in market making concept used to indicate the

Average closing price of Market in a definite time period .

Traders are usually using it because It can be a better indication Market momentum at this time.

Commanly there are two moving average indicators which used are used in present days

Simple Moving Average (SMA) and another one is Exponential moving average (EMA) .

The only difference between them is that SMA don't give any weighting but. EMA gives weighting in current price.

2.TDI Indicator

TDI is the only indicator which have ability to read sentiment, volatility and momentum of the Market at same time , and the best thing in this is that it provides the qualities of many indicator in single one which is the holy grail for which we are looking for.

In Simple word through this article I learnt that increase and decrease in order of buy and sell are not random or coincidence there are some individuals ho regulates this order according to them and named as market makers .

These market makers provide liquidity to the market and as a normal trader if we identify them on time then we get huge amount of profit

So it is very necessary that we have to a brief knowledge of Market maker concept before investing in cryptomarket.

So I would like to thank professor @reddileep for such and amazing and knowledge post because through this appreciatable post I get all the basic knowledge about market maker concept and psychology behind it .