Crypto Academy : Season 3: Week 4 - Homework Post for @cryptokraze

INTRODUCTION

There are a lots of trading concept in crypto ecosystem, and different traders with different trading strategy. However, the concept of dynamic support and resistance is very important be a trader who understands it very well can get in trades at the beginning of new trend which gives the user a better advantage to ride on the trend as such can maximize profit.

THE CONCEPT OF DYNAMIC SUPPORT AND RESISTANCE

Generally, support and resistance are one of the most popular concept in crypto space because most all traders has the idea on how it works. Most traders believe support and resistance level are very essential levels that always signifies the price level of assets on a chart respectively. That's the levels that always serves as barrier preventing price movement not fall below and rise above are refer as Support and Resistance respectively.

Moreover, some traders always marked it as an horizontal line on the chart most especially when the market is ranging, and the price movement has respectively tested like twice or above or respectively an unseen diagonal level very precisely. When the price level of an asset fails to moves in a horizontal arrangement within the support and resistance levels, and observe changes frequently once there is a trade move is known dynamic support and resistance.

Furthermore, we can use an indicator known as "Exponential Moving Average" to determine the trend and is basically take place within the dynamic support and resistance. Therefore, once the price hits on the EMA acting as support and resistance, the price went up and down respectively. As such, once the price hits on the EMA acting as support and resistance, there's always uptrend or downtrend transition.

The more price of an asset moves on a chart, the more EMA moves, the term is called dynamic support and resistance. I believe the chart can clarify us better, so let's check it out.

DYNAMIC SUPPORT ON CHART

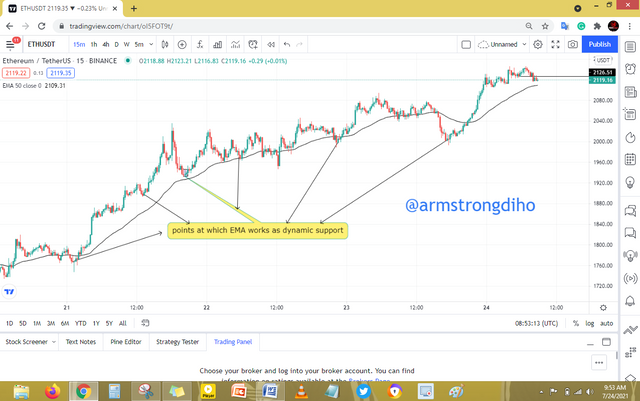

Let's take an example of dynamic support with ETH/USDT chart on 15Mins timeframe.

From the image shown above, we can see different points marked at which the price of ETH/USDT touched the EMA that's acting as dynamic support. Once the price hits on the EMA acting as support, the price went up. As such, once the price hits back on the EMA acting as support, there's always uptrend transition.

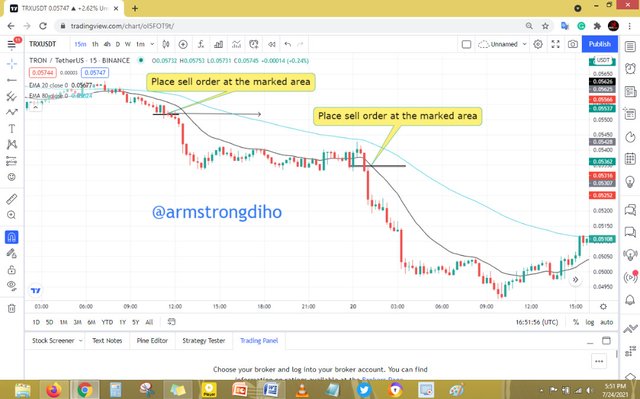

DYNAMIC RESISTANCE ON CHART

Let's take an example of dynamic resistance with ETH/USDT chart on a 15Mins timeframe.

From the image shown above, we can see different points marked at which the price of ETH/USDT touched the EMA that's acting as dynamic resistance. And once the price hits on the EMA acting as resistance, the price went down. As such, once the price hits on the EMA acting as resistance, there's always downtrend transition.

USING EMA 20 & 80 TO SHOW DYNAMIC SUPPORT AND RESISTANCE

When two EMA is combined, it gives a user a clear picture to determine new start trend within the dynamic support and resistance. However, I will be using EMA 20 and 80 to demonstrate dynamic support and resistance.

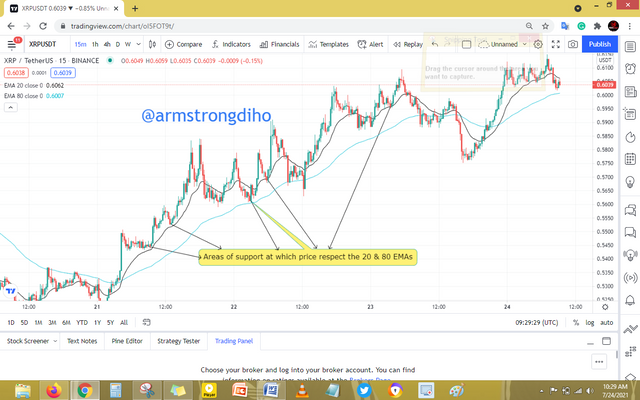

DYNAMIC SUPPORT WITH EMA 20 & 80

From the XRP/USDT chart in 15mins timeframe shown above, we can see how the support respected the EMA 20 & 80. The support significantly do not break the EMA 80 lines where I marked, while others rise and broke some point of the EMAs.

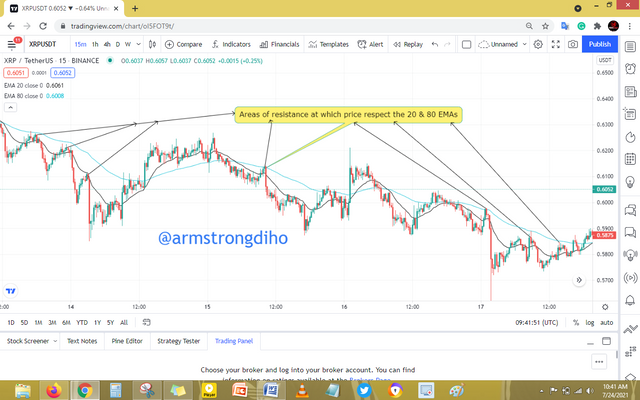

DYNAMIC RESISTANCE WITH EMA 20 & 80

From the chart of XRP/USDT in 15mins timeframe shown above, we can see the areas marked shows that the resistance respected the EMA 20 & 80. The resistance significantly break some of the EMA 80 line, while others couldn't.

TRADE ENTRY AND EXIT CRITERIA FOR BUY AND SELL USING DYNAMIC SUPPORT AND RESISTANCE

From the chart I explained above, it is very obvious that sometimes the price level reversal without hitting the EMA, but sometimes it breaks and hit the EMA before reversal occurred. It is always advisable that every trader should have a trading plans for entry and exit both buy and sell trades. However, using dynamic support and resistance the following below are the plans on entry and exit both buy and sell trades.

TRADE ENTRY CRITERIA

BUY TRADE

✓ Add two 50 and 100 exponential Moving Average on your chart to get clearer picture of a valid entry position for a buy trade.

✓ It is good to wait for the price to be above both of the EMA 50 & 100 most especially EMA 50 to have a well valid buy setup.

✓ After you might have wait for the price to hit or the EMA 50, don't rush still wait to observe the next candlestick. Immediately the it cross over, you can enter the trade.

✓ Always know to get a valid buy setup, it requires patience. So a good indication of a buy entry is to wait for an upward movement after it might have hit or cross the 50 EMA.

✓ It recommended that when we enter the trade early, gives us more advantage to get more than one buy entry

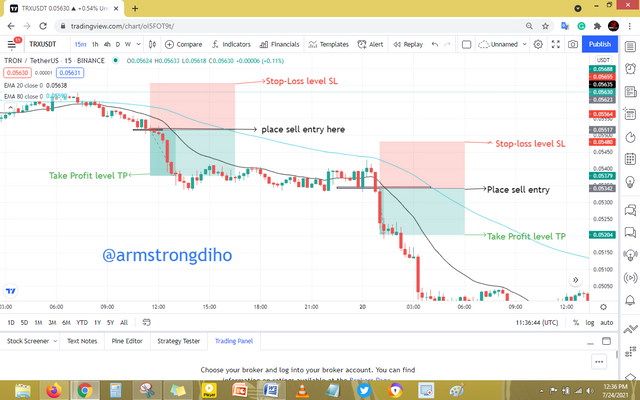

SELL

✓ Add two 50 and 100 exponential Moving Average on your chart to get clearer picture of a valid entry position for a sell trade.

✓ It is good to wait for the price to be below both of the EMA 50 & 100 most especially EMA 50 to have a well valid sell setup.

✓ After you might have wait for the price to hit or the EMA 50, don't rush still wait to observe the next candlestick. Immediately the it cross below, you can enter the trade.

✓ Always know to get a valid sell setup, it requires patience. So a good indication of a sell entry is to wait for a downward movement after it might have hit or cross the 50 EMA.

✓ It recommended that when we enter the trade early, gives us more advantage to get more than one sell entry.

TRADE EXIT CRITERIA

BUY

To understand how to exit a buy trade is very important because it helps to minimize risk. That's is to say that setting a stoploss (SL) is a must should in case the trade is not in our favour, and applying a good risk to reward ratio (RRR) then makes it profitable.

✓ Buy entry should be above the EMA 50 for the entry to hit quick, but note that the stoploss( SL) should be set below the EMA 100.

✓ The stoploss is good and important, but risk to reward ratio is also vital because it gives us a clear picture about our possible gain and loss. So it's recommended by the Prof., to use 1:1 risk to reward ratio. Although different traders with different risk to reward ratio just as I prefer 1:3.

✓ Take profit should be set as well should in case the the trade favour's us. Let it be set above the entry.

✓ Automatically, once the price hits the stoploss (SL) or Take profit (TP), the trade will exit. This is the reason why both SL & TP is very important to set.

SELL

To understand how to exit a sell trade is very essential since it helps to minimize risk. This means that setting a stoploss (SL) is a must should in case the trade is not in our favour, and applying a good risk to reward ratio (RRR) then makes it more profitable.

✓ Sell entry should be below the EMA 100 for the entry to hit quick, but note that the stoploss( SL) should be set above the EMA 50.

✓ The stoploss is good and important, but risk to reward ratio is also vital because it gives us a clear picture about our possible gain and loss. So it's recommended by the Prof. to use 1:1 risk to reward ratio. Although different traders with different risk to reward ratio just as I prefer 1:3.

✓ Take profit should be set as well should in case the the trade favour's us. Let it be set below the entry.

✓ Automatically, once the price hits the stoploss (SL) or Take profit (TP), the trade will exit. This is the reason why both SL & TP is very important to set.

Place 2 demo trades on crypto assets using Dynamic Support and Resistance strategy.

I carried out my analysis using tradingview before using a demo App to place the trade. One this demo App, used a Stoploss as my trade exit. I did one demo trade using the dynamic resistance for the buy trade.

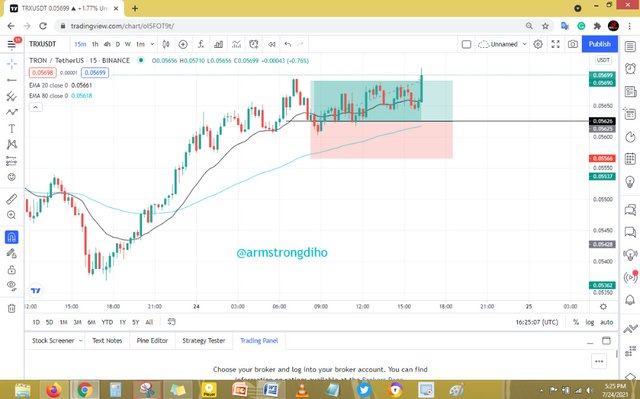

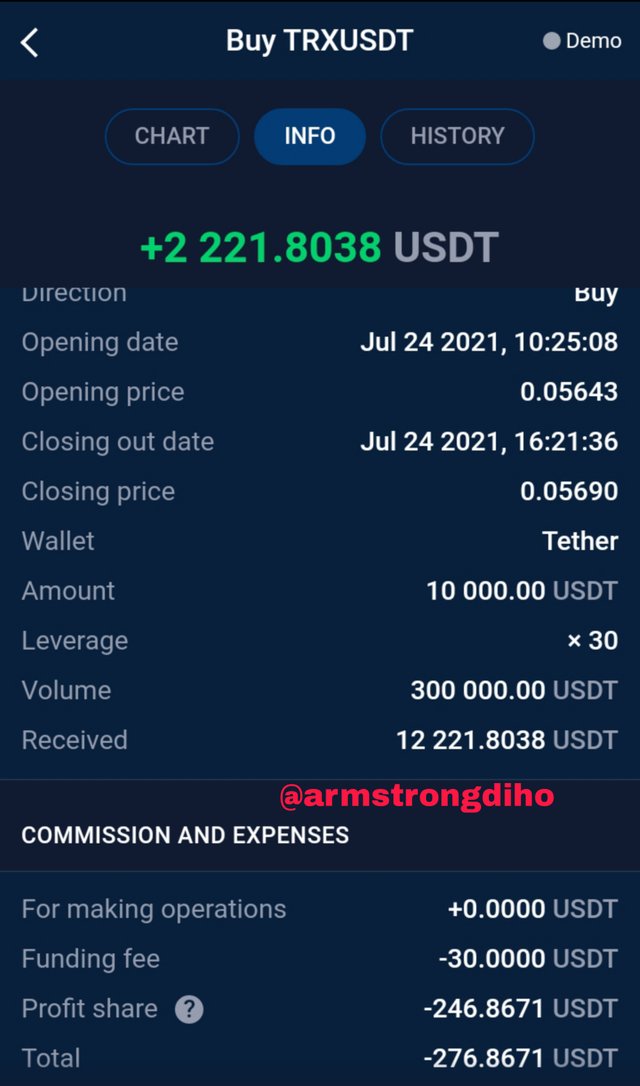

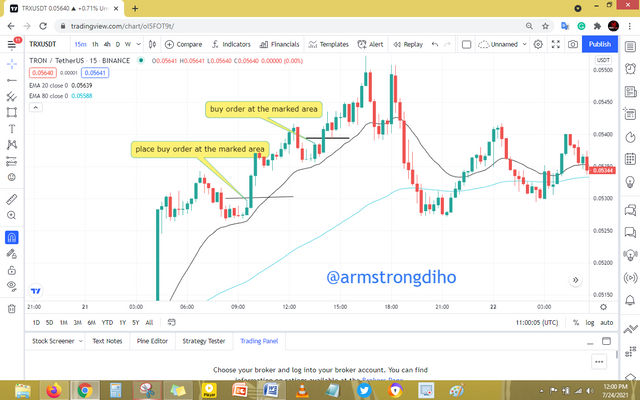

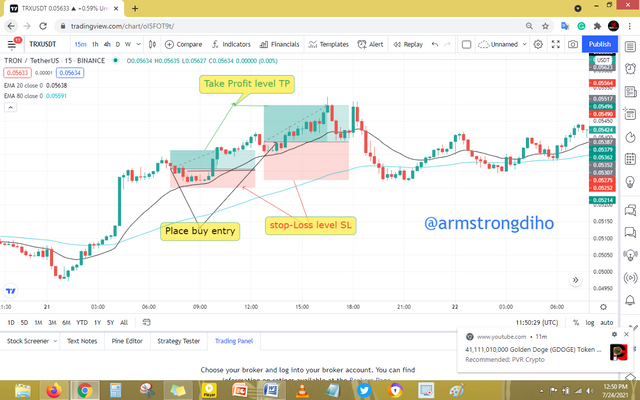

TRX/USDT : 20 & 80 EMAs in 15mins

Firstly, I studied the how the price movements were rising and the buy entry was at the next bullish candle above the other candle that touched on the EMA 20, which gave me a clearer chance to identify the trend early. After it might have rise, there was a reversal, immediately it hits my entry, bounce up came back again hits my entry before a massive move that hits my take profit (TP). I set my stoploss below the EMA 80 as my exit criteria.

Here is the Trade detail;

| Trade type | buy trade |

|---|---|

| Entry point | $0.05625 |

| Take profit | $0.05690 |

| Stoploss | $0.05566 |

Detail trade info. from the stormGain demo App

CONCLUSION

In crypto ecosystem, trends are very important, as such identifying trends early gives traders chance to ride on it most especially price action traders. Previously, we have really learnt about some basic strategy to identify trends like MSB, BRBS and there are all other concept like the dynamic support and resistance.

However, dynamic support and resistance is an important concept users can apply to identify trends early and also ride on them. Although, one can not mark out trends on charts without the help of an indicator called Exponential Moving Average (EMA). Moreover, the basic strategies for entry and exit for both buy and sell should be well applied.

Furthermore, its ideal to have a good EMAs combination and proper timeframe (TF) that will suit your trading. 50 & 100 EMAs with a lower TF provides more valid setups but really requires quick trading decision.

Frankly, the lecture was good, but to place a trade using dynamic support and resistance was the difficulty I encountered. As such, I was unable to place the second trade.

Thanks Prof. @cryptokraze I really enjoyed your lecture.

THANKS FOR READING THROUGH

Cc:

@cryptokraze

Dear @armstrongdiho

Thank you for participating in Steemit Crypto Academy Season 03 and making efforts to complete the homework task. You got 7.5/10 Grade Points according to the following Scale;

Key Notes:

We appreciate your efforts in Crypto academy and look forward for your next homework tasks.

Regards

@cryptokraze