Steemit Crypto Academy Season 3 || Week 8 - Beginner's Course || Understanding Tokens By @ansardillewali

This is the 8th week with lectures in Season 3 of the STEM Crypto Academy. My attendance on Professor @reminiscence01's Homework Task on Lecture 'Understanding Tokens' is here.

Q No-1 What is a token? What do you think? Give an example of five tokens and identify the blockchain on which it is built. (Give 3 different blockchains)

Tokens

Here we will talk about tokens. The cryptocurrency is a unique virtual currency in the world, created in the current blockchain. These casinos are blockchains, not their own. These tokens can be interpreted as digital assets running on existing blockchains. Here I explain to you what it means to those who create tokens on the platform there. And they allow the creation of new cryptocurrencies. And I also get their prices. Which is a good thing. When a new project wants to hit the market, it can be done in two ways. Which is the creation of a new blockchain.

As a token represents an asset or investor for a specific purpose in its blockchain. These tokens are created for the development of a corrupt currency project. Which is good And for investment purposes. Also used for trade, price buying and storage.

Types of Tokens

1-Utility Tokens

2-Equity Tokens

3-Security Tokens

4-Non-Fungible Token (NFT)

5-Reward Token

Tokens With Their Different Blockchain

| Tokens | Blockchain |

|---|---|

| Uniswap | Ethereum |

| BitTorrent | Tron |

| Thorchain | Binance Chain |

| Karma | Eos |

| WinkLink | Tron |

| Ftxtoken | Binance |

Q No-2 What's the difference between a coin and a token?

Friends, here I am telling you about coins and tokens. Because some people don't understand the difference between coins and tokens. And when they are buying coins. So those tokens are bought. And when you want to buy a token. So they buy coins. By the way, both of these are known as cryptocurrencies. And they often confuse people. Which are new here. By the way, these two are known as cryptocurrencies.

| Coins | Tokens |

|---|---|

| Coins can also serve as money. | And the tokens that are used have an order of use depending on the project platform. |

| Coins are also used to buy tokens | But those who have tokens cannot buy coins |

| And making coins is a very difficult task and only experienced people can do it | Tokens can be created very easily |

Q No-3 Describe the tokens and attributes of the different categories below.

Utility Token.

Security Token

Equity Token.

Non-Fungal Tokens (NFT)

1-Utility Token

Utility tokens are such tokens. Which users have created with the hope of developing a project on Blockchain in Blockchain. An application stands for the right to digital access to services and products. And they are not designed as other currencies.

2-Security Token

Security tokens are such tokens. Which are digital tokens as a digital exchange of traditional assets in the blockchain. And it's a token that represents a share in a foreign asset. And a business organization can provide security tokens. Holders of traditional stocks and security tokens are also entitled to receive profits from blockchain projects.

3-Equity Token

Activity tokens are such tokens. Who share the same policy with security tokens. And these and other tokens are just like traditional assets. But these tokens also contain some kind of documentation. And those who have activity tokens. They have property rights. And they can make a profit from it.

4-Non-Fungal Tokens (NFT)

Non-fugitive tokens are such tokens. There are those who offer special collector's pieces. And they are very special. These unique items cannot be exchanged with others. Because this unique item has its own price.

Token Features

Here are the features of the token. That you can get them. And you can trade with them. That means you can buy them. And can sell.

Q No-4 Make your own research and write extensively on any token you listed in question one. (Must include features of the token, the aim of the project, Use cases.

This is a great marketing platform. And it's based on Ethereum. Which allows its customers to lend all kinds of corrupt assets. And also allows borrowing. Which is great for consumers. And that happened in 2017. And it was first created as Athens. The developer's idea was to create such a market. Which connects the borrower and the lender. Therefore, this project was re-launched in 2020 by Aave.

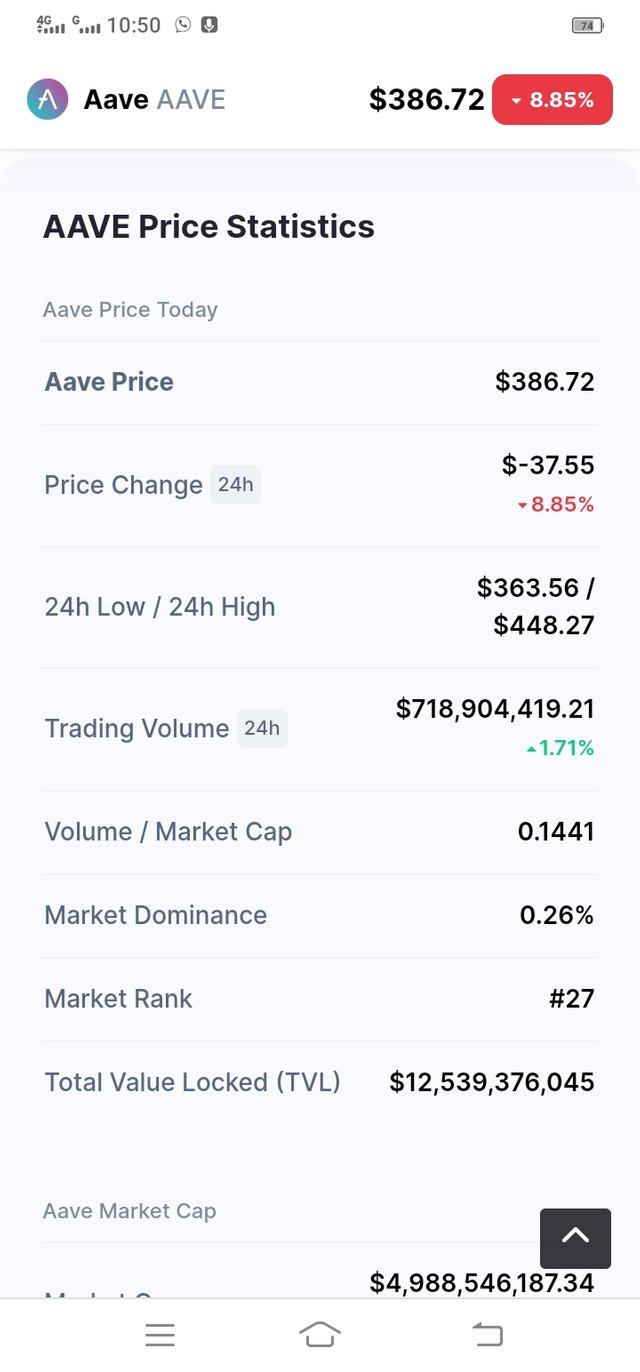

Today Aave Data

You can buy these coins from exchanges like Binnance, OKX and Coin Tiger.

Features:

And their feature is that they give people access to borrow from the corrupt currency of their choice.

How Does Aave Work?

Aave's work is something like this. That makes it much easier to borrow in different cryptocurrencies. And as the pool system says. Its borrowers will have to make a mandatory collateral deposit. There is more to it than that. Here I give you an example. If you want to get an ether loan of fifty dollars, you have to deposit another cryptocurrency worth more than fifty dollars. There is an algorithm. The guarantor of the borrower. Eliminates it automatically. And it's good for consumers.

The purpose of Aave

Here I will describe the objectives of Aave. Where people can achieve two goals. And when you invest in the pool. So it creates liquidity. Which he lends to other consumers. And lends interest in the form of liquidators.

Result

You need to have some experience to work here. And people who have plans to become investors or crypto traders. It is important for them to know the difference between the two terms token and coin. Because it will not be able to make a wrong decision. Which will cause him a lot of damage.

Thank you very much;

Professor @reminiscence01 for lecture.

Hello @ansardillewali , I’m glad you participated in the 8th week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Please try to write in simple terms and spend time to produce a quality content. Thank you for submitting your homework task.