Stability in Digital Currencies- Steemit Crypto Academy- S4W5- Homework Post for @awesononso

Explain why Stability is important in Digital currencies.

The cryptocurrency market is in constant fluctuation. It is not uncommon for cryptocurrencies to lose up to 80% of their value in a day. The question remains, how does this affect digital currencies? First, the instability of the market affects the prices of digital currencies by causing people to buy or sell them at an alarming rate which leads to bubbles and crashes in value. Second, because price fluctuations are so common it has caused many people who were involved with crypto for long periods of time due to its potential upside have lost money. Lastly, because cryptocurrencies are unstable they are not considered real tender similar to traditional fiat currencies that have their own stability inherent in them which can lead into problems when trying to complete transactions with them.

The instability of the market and digital currencies affects them in many ways. First, it causes people to invest and divest into cryptocurrencies at a rate that is almost unrealistically high. This can lead to the creation of bubbles and crashes in the market. Second, because price fluctuations are so common it has caused many people who were involved with crypto for long periods of time due to its potential upside have lost money. Lastly, because cryptocurrencies are unstable they are not considered real tender similar to traditional fiat currencies that have their own stability inherent in them which can lead into problems when trying to complete transactions with them.

The instability of the market and digital currencies affects what we do with them as well. First, because digital currencies and blockchain technology can be both volatile and unpredictable people want to use it as a currency rather than a store of value like gold or fiat currency which is not as volatile as traditional currency. Stability in the digital currencies is important because of the following reasons:

Given the volatility of the cryptocurrency market, many digital currency related businesses are struggling to survive. The other business owners are also struggling to compete with theft by hackers and security holes. Many people are disappointed in the lack of safety that is found in cryptocurrencies.

There are different approaches to solving the volatility of electronic currencies while trying to achieve financial stability at the same time. This includes issuing a new currency which will solve certain problems while maintaining stability i its price and value by coming up with a new digital currency whose value will be determined by supply and demand. Another approach would be to tie the value of the currency to something else, like our fiat currency. An example of this is someone buying USDT which is Tether’s digital token that is pegged to the US dollar. This means that if you hold 100 USDT then it equals $100. A third approach which can also be used in conjunction with other approaches is supply control which can be achieved by centralizing supply amount in order to have more control over the price of the cryptocurrency.

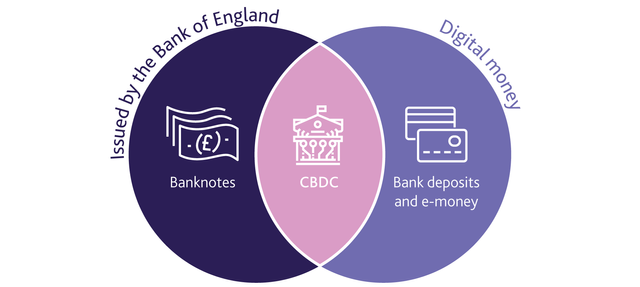

Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

Central Bank Digital Currencies are becoming a part of our lives as more and more countries are experimenting with this new type of money. In the future, Central Bank Digital Currencies may play an important role as a way to combat climate change as well as some other social issues. While it’s not known what that might look like yet, Central Bank Digital Currency could have substantial effects on how we handle money in the very near future.

One of the main benefits of Central Bank Digital Currency is its ability to cut down on the amount of paper money in circulation. Central Bank Digital Currency would be stored electronically, which would open up a number of possibilities for reducing the amount of paper money floating around the world. Additionally, Central Bank Digital Currencies could reduce corruption in financial institutions.

Another benefit that’s important to consider with Central Bank Digital Currency is that it eliminates risk at an individual level. One of biggest social issues today is that people are just not saving enough money. If they do save, their savings are in vulnerable places like banks or investment accounts where they can be lost through fraud or other reasons beyond their control.

| Advantages | Disadvantages |

|---|---|

| Faster, cheaper and safer payments | It will challenge existing monetary policy |

| Increased economic growth | It will also challenge the current concept of the fiat money and a free economy |

| Financial inclusion for disadvantaged populations | It may be a cause of destabilization in an economy, if not implemented properly |

| Seamless, efficient and interoperable cross-border payments within the region and Increased credit availability for small businesses | It may encourage tax evasion and black money generation in developing economies |

| Decentralized ledger technologies (DLT) for secure value transfer over the internet | Consumers may be too frugal with CBDC to increase economic activity |

| Robust identity management systems to increase trust in financial services | Human error by individuals or small groups may have a negative economic impact on an economy if misused |

| Taxation will be automated through a method of value addition-value elimination | It is difficult to predict the future of digital currencies because they are relatively new |

Most countries are still in the experimental phase when it comes to Central Bank Digital Currencies. They are just beginning to figure out the logistics of how it would work integrated into their current economies. It’s also unclear how governments will want to use this new type of currency. Some are testing it as a way to help poorer citizens receive financial services, while others are testing it as a way to combat inflation within their economy. Central Bank Digital Currency is certain to play an important role in the future, but at this point there is no way of knowing what that role will look like.

Explain in your own words how Rebase Tokens work. Give an illustration.

There are many different types of Rebase Tokens. The most basic of them are Rebase Tokens that are not auction able, meaning that the supply of them are fixed at the time they were created. This can be done using a simple process called "Blockchain PoW". Block PoW is a way of adding new cryptocurrency to the blockchain by setting aside a certain number of coins to produce new tokens. The new tokens will be used as part of the PoW algorithm, thus creating more blocks for the chain and thus increasing its minting rate.

When this happens, you can see that the supply of coins in that blockchain will exponentially increase. This is done in every cryptocurrency. When blocks are generated in the network, coins are generated and added to the supply in exchange for maintaining the blockchain in its current state (Cryptocurrencies). A Rebase Token can also be listed on exchanges, thus making its price fluctuate like any other cryptocurrency. If it "ticks up" on an exchange, it will be produced less frequently (decreasing supply). If it "ticks down" on an exchange, its production rate will increase (increasing supply to match demand for it).

The Rebase Mechanism has the unique ability to "adopt" by using an algorithm. This algorithm basically tells the token to adjust its supply based on outside factors. For example, if there is a large influx of demand for the tokens, they will be produced more often to match this demand. If there is a decrease in demand for it, then supply is cutback so that less of it is floating around on exchanges and more people are willing to buy them at a cheaper price. This type of production is referred to as Elastic Supply. It is not controlled by humans or miners that change the supply arbitrarily, but it follows changes in price across exchanges that are created by large numbers of individuals.

A very popular example of a rebase token is Ampleforth represented as AMPL.

AMPL tokens are used for all transactions. Therefore, the price of AMPL is determined by supply and demand. For example, if people want to buy shares in property C but have run out of AMPL tokens, the price of AMPL will increase so that they can purchase more from people who want to sell them. If the price of AMPL drops too low then there won’t be enough tokens in circulation for investors to buy property A or C with it. For investors who are looking to minimize risk, AMPL is a great token. The rebase process eliminates volatility which means that the value of the token will stay the same no matter what happens with the price of Ethereum.

A summary of how Ampleforth tokens work:

-Investors purchase tokens that have a fixed dollar amount. For example, an investor might need $20 worth of AMPL for 20 shares in property A and $200 worth of AMPL for 200 shares in property C.

-The investor credits their account with a certain amount of AMPL tokens. For example, the investor might have $100 worth of AMPL in their account.

-The investor sells shares in property A and buys shares in property C with the amount of AMPL they have.

-When a temporary sell order goes through, the Ampleforth contract sends out new tokens to temporary holders (who are also known as rebase tokens). These new tokens are used to pay for shares in properties A and C.

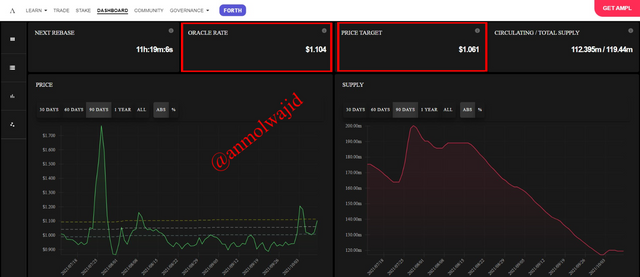

Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

To calculate Rebase percentage:

AMPL's rebases can be calculated with the formula; Rebase % = {[(Oracle Rate - Price Target) / Price Target] x 100} / 10Source

Rebase % = {[(Oracle Rate - Price Target) / Price Target] x 100} / 10

={[(1.104 - 1.061) / 1.061] x 100} / 10

=0.4052%

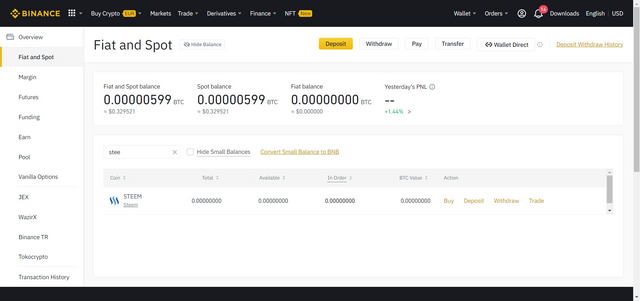

Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

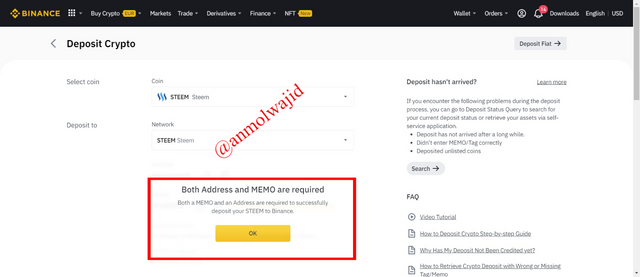

Login to the Binance account and on the dashboard search for Steem. And click on the Deposit button.

When clicked on the Deposit button, we will be navigated to the a new page which will ask the user to add a memo and address of the account. Clicking on the OK button will show the form content.

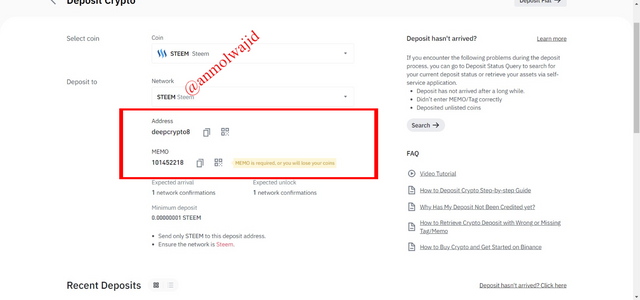

Memo and the account which will connect the Steemit wallet to this Binance account was copied and 25 steem was transferred.

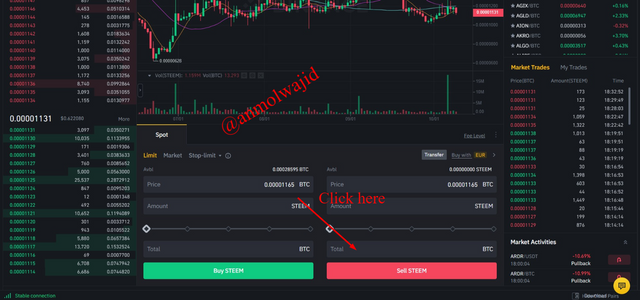

Go to https://www.binance.com/en/trade/STEEM_BTC

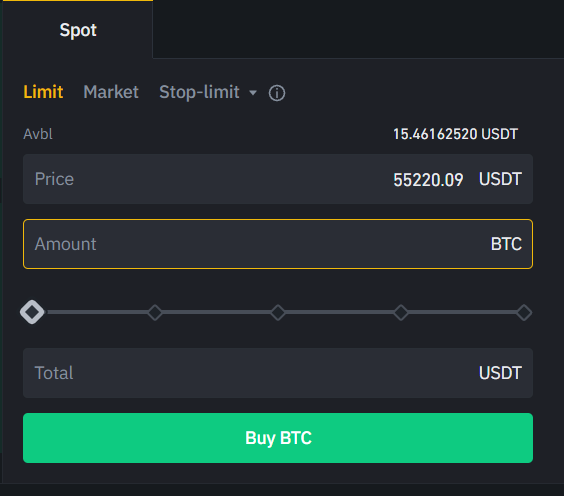

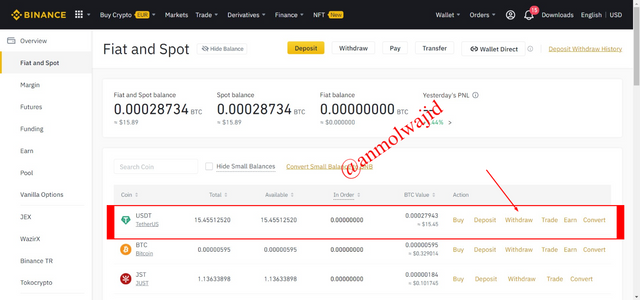

Go to wallet>> Fiat and Spot. Click on trade and Select BTC/USDT

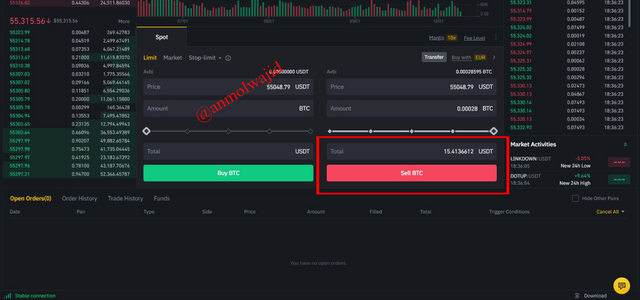

The screenshot below shows the proof of 15$ of the transaction.

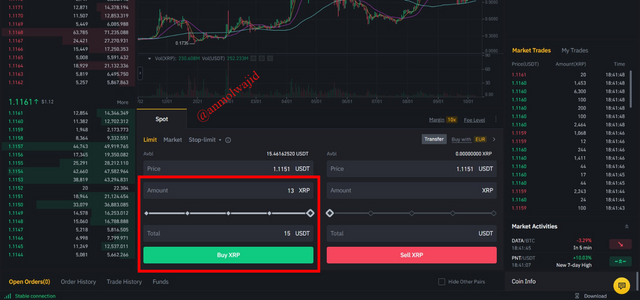

Go to trading page of XRP/USTD on https://www.binance.com/en/trade/XRP_USDT we will make a trade of 15 dollars.

This resulted in the completion of the practical part of the task.

Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stable coin over fiat money transactions? (Give Screenshot of the transaction).

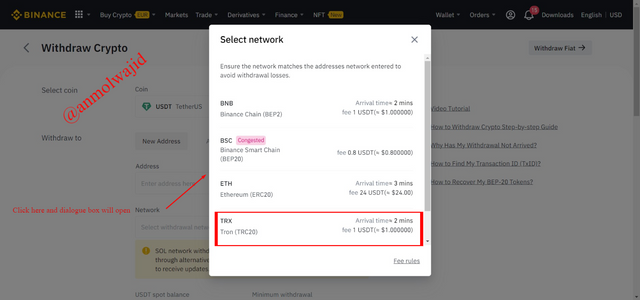

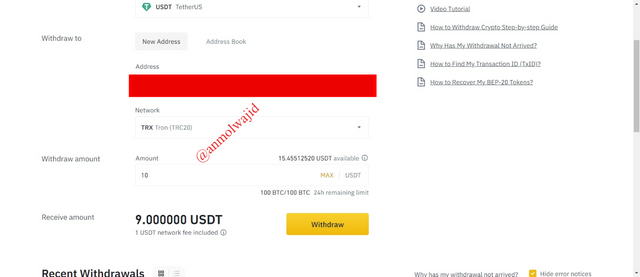

Navigate to Wallet >> Search for USDT and click on the withdraw button.

In network we will choose TRX

Address of the received is added into the Address field, and then amount to be transferred is also added into the form.

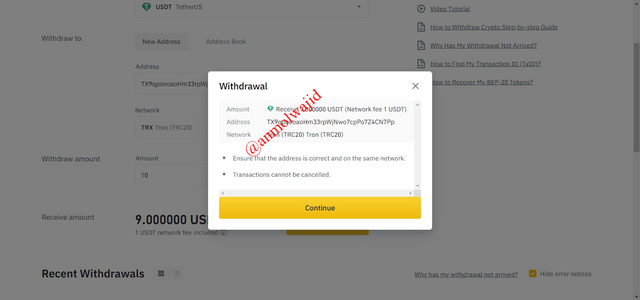

Clicking on the withdraw button will show a popup and user is shown some terms and conditioned to be selected.

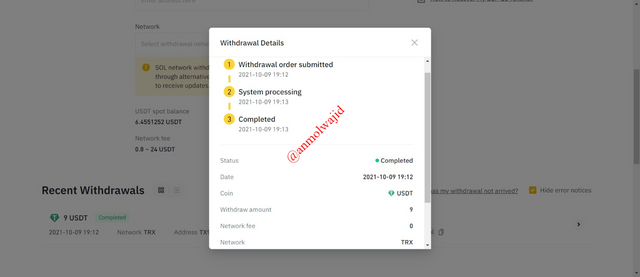

To confirm transaction we need to enter the email and phone verification codes. These codes when send and added into the form will complete the whole process of transaction. As the result token will appear in recipient wallet after one network confirmation.

We're living in a digital world where your phone can order you a ride from an app, get your coffee from the convenience store, and pay for it via Apple Pay or Google Wallet. These mobile transactions are convenient and easy-to-use for all parties involved. So what's the downside of using mobile payments systems?

One word: volatility. As we've seen in recent years, currencies like the Euro and US dollar fluctuate wildly with geopolitical events - which means that consumers aren't able to buy goods or services with certainty due to currency fluctuations. This uncertainty makes both sides nervous about spending money without checking exchange rates first - which then leads to slower transactions speeds than we would otherwise see in such systems today.

To understand how this can be solved, we need to look back in history. Before the euro, there were thousands of currencies in use in Europe. Each country had their own way of tracking inflation and pricing goods and services that could lead to confusion among consumers - which ultimately led to slower transactions times at retail stores. It wasn't until the euro was introduced that most businesses agreed on prices across the continent. This meant that transactions were much faster, and consumers could spend more freely without thinking about the cost of goods or services due to fluctuating exchange rates with other currencies.

In today's digital world, there are various cryptocurrencies that have been introduced to solve this same issue of currency volatility. The best-known examples are Bitcoin and Ether, but there are a host of other newer, lesser-known currencies in use today. Across the board, the goal is to make currency transactions faster and more standardized - with a single currency able to be used in a single currency wallet for doing shopping or paying bills across all these cryptocurrencies without worrying about currency fluctuations. These currencies would also benefit from reduced transaction fees since it doesn't matter if the value changes after the transaction since the coins or tokens have been transferred from one wallet or account to another.

Hello @anmolwajid,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You should always stick to the topic and provide relevant facts only.

Your explanation of rebase tokens is not very clear.

You did not perform the transaction for question 5.

Your answer to question 6 is also very unclear.

Thanks again as we anticipate your participation in the next class.