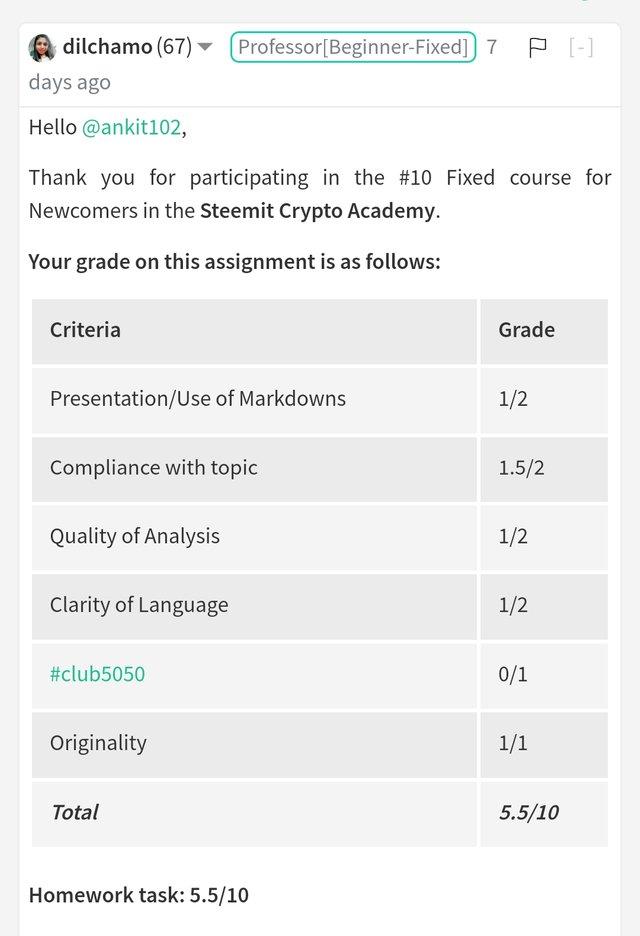

REPOST - [Candlesticks Patterns] - Steemit Crypto Academy Season 5 - Homework Post for Task 10

This is a repost of my previous task. Here is the LINK

1a) Explain the Japanese candlestick chart? (Original screenshot required).

b) In your own words, explain why the Japanese Candlestick chart is the most used in the financial market.

c) Describe a bullish and a bearish candle. Also, explain its anatomy. (Original screenshot required)

a) Explain the Japanese candlestick chart? (Original screenshot required).

screen shot by trading view app

screen shot by trading view app

The Japanese holder chart was fictionalized in the 1700s by one of history's most prominent producing traders named Munehisa Homa. They were jointly known as Sokyu Honma. The Japanese holder chart is one that is most commonly employed in the trading world.

Homa understood the necessary demand and provided change and combined the fact that emotion plays an important role within the setting of cost. Therefore, he wanted to track the sentiments of the market players and this was the lead for the institution of Japanese candles.

Japanese candlestick chart square measure cost supported will likely not confirm movement in the previous pattern. Even as anticipated by Homa, mercantilism is usually influenced by the trader's sentiments and therefore the Japanese candlestick chart is able to show these sentiments.

The holder chart simultaneously shows four key price points within a selected time frame. Open Worth, Shut Worth, Low Price and High price. These price points are seen throughout the chart for the amount that the dealer has set.

The candlesticks square measure are depicted with completely different colors with each color having a singular meaning that reflects the sentiments of a trader.

Japanese candlestick charts include a time frame that can be changed forever by the trader to make it an acceptable platform for future predictions on costs.

One of the popular exchange wallets or platforms that you will see primarily those using Japanese candlesticks include Binance and Houbi.

The general color that reads mercantilism uses square measure green and red. Red is employed whenever there is a decline in the chart whereas Green is employed whenever there is a rise in price in comparison.

b) In your own words, explain why the Japanese Candlestick chart is the most used in the financial market.

It helps traders anticipate their next moves by giving them reliable visual historical show charts to understand though quality behavior and helps them position themselves to buy/sell or hold once .This makes it easy to spot market patterns.

The Japanese candle holder area unit is straightforward and simple, even for beginners, via an order-to-order color that shows the uptrend and downtrend of a selected quality which I will refer to in a later question. I will make a case

The Japanese candle holder is packed with essential information that contains details about the high, low, open and close of a selected quality which provides traders with a reliable idea on how to execute their investment plans. Which means you will be able to see the direction of the market easily.

The Japanese candle holder can also be combined with various auxiliary indicators to get the most results. Once you mix 2 or more indicators it makes the result extra correct then the basic cognitive process in an indicator that may not be 100 percent correct.

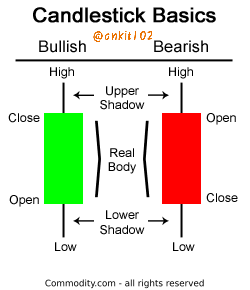

c) Describe a bullish and a bearish candle. Also, explain its anatomy. (Original screenshot required)

source

source

Bullish Candle:-

screen shot by trading view app

screen shot by trading view app

The price fluctuations in the market will increase or decrease. It is the bullish candle holder that indicates the growth character of the price movement at the end of the monetary market.

The bullish candle holder informs the North American nation that the market is no longer under the management of sellers, and consumers can take charge of the market.

This still predicts an increase in costs in the future. It can go completely with such a huge amount of different shades.

People I'm quite aware of inexperienced and white. Although the color doesn't matter much. The most important essential factor is that you understand the chart only after seeing an bullish candle holder.

The closing price for bullish candle holder is usually higher than its corresponding gap price for any amount of time. The optimist points each closing and high cost at the candle's high and each opening and low cost at the candle's low.

- High price

As the name indicates; It shows the best prices in your optimistic price chart for any specific amount of time. This is generally going to be an equivalent as the closing value or above.

Low Price

It shows very cheap prices in an optimistic price chart for any amount of time you have. This can either be enough for or under the open price. Each of them is set on the lowest part of the candle holder.Close price

For any specific amount of time you have, the shut value is the expiration of that exact candle. This is the last noted price of the candle. It is found at the highest level of an optimistic candle holder and is high or low enough for a higher price. For an bullish candle, the close value is above the open value for a certain amount of time.

- open price

This is the starting price for the candle holder chart to start its graphing for the specified time frame. For an bullish candle, it is consistently under the closing price.

Bearish candle

screen shot by trading view app

screen shot by trading view app

The Bearish candle stick is one of all bearish patterns that indicates the autumnal character of a price movement. It refers to a decrease in the price movement of an asset within the monetary market over an amount of time.

For this berish pattern, unlike the optimistic one, closing price is often lower than the gap price. With regard to its 'anatomy', the open and high cost square measure at the highest level of the holder and each closed and low cost square measure at the rock bottom of the holder.

- Close price

It is found at the bottom of the cliff of the Bearish candle stick. This is the tip value for any set amount of time you have. The closing price is less than the open price.

- Low Price

It is found with the shut value on the bottom of the holder. This is the all-time low indicated on the pessimistic price chart for a given specific time frame. This is often enough or less than the closing price.

- High price

It shows the best price quality within the monetary market for any time frame. It is found at higher levels of the Bearish candle stick. This difference may be more or less than the value.

- opening price

This marks the beginning of the price chart. Found on top holder with high price. It is beyond harm forever. They are often used to confirming price movements in highly bearish patterns.

Conclusion

Cryptotrading with the right information is extremely important as it can save a whole lot of heartbreak. A basic piece of information that prompts a trade to engage is the candlestick pattern. The candle holder pattern has confirmed to be a useful tool for analysis. However these tools must be combined with different useful tools to produce a simple result.

Cc:-

@dilchamo

@dilchamo @steemcurator02